Debt vs. Income: What You Need to Know

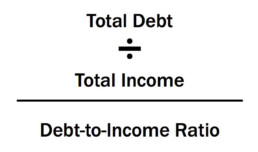

Income is a crucial component lenders consider when granting you a mortgage. However, income is not all that a lender will consider when determining how much you qualify for. They will also look at your debt to income ratio, in addition to other financial indicators.

If you make a lot of money but also have a lot of debt, this could be a red flag to lenders and reduce your borrowing capacity.

How debt & income affect your mortgage

Income and debt are yin and yang, opposites of each other. Debt is a liability, whereas the more income you have, the more power you have to make those liabilities go away. Having more income also gives more control of the following.

- It allows you to prepay your mortgage faster.

- It allows you to qualify for more when buying a home.

- It allows you to move into a shorter and more aggressive debt pay-down structure such as a 15-year fixed-rate mortgage.

- It allows you to pay off your credit cards in full every month, rather than paying unnecessary and pricey interest (assuming you’re making smart financial choices).

- It allows you to consume smart debt, such as purchasing a rental property that can generate even more income.

- It allows you to make investments, generating more income.

- It allows you to save and plan for the future.

Having this control over these and other financial choices is precisely why it is CRUCIAL to carry a debt-to-income ratio no bigger than 36% of your gross monthly income. The goal when borrowing mortgage money is to put yourself in a position where you can have a life beyond paying it off, while still saving and contributing to your retirement savings.

What you need to consider before you buy

Always remember it takes $2 of income to offset every $1 of debt for a 2:1 ratio for mortgage qualifying purposes.

If you want that fancy Mercedes at an $800 per month car payment, then you’ll need $19,200 a year in extra income or you’ll need to cut a current debt payment of $800 to balance your debt-to-income ratio.

If you want the dream house at $3,500 month, then aim your debt-to-income ratio at 36%—meaning you would ideally want income at $117,000 a year without carrying other consumer obligations in order to afford this mortgage.

When you are thinking about buying a home, also remember to consider what the future holds for your finances. For example, if your monthly expenses will likely increase in the future due to expenses like childcare costs or college tuition, this is something important to keep in mind. By keeping your debt to income ratio below 36% of your gross monthly income, you’ll put yourself in a position to enjoy your new home but also be able to continue saving for your future.

Why The Holidays are a Great Time to Refinance Your Mortgage

If you're a homeowner in Las Vegas and you want to lower your mortgage payment and/or consolidate your debt, then refinancing might be the right option for you!

So how does it Work?

Well, its not always that simple. There are many factors that determine if refinancing is right for you, such as interest rates and your current equity in your home. It also depends on what your current needs are. Do you want to lower your monthly payments and interest rate? Or do you want to cash out to consolidate your debt in time for the holiday season? There are different types of refinancing options to choose from.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The other option is a cash-out refinance - This is where you refinance your mortgage for more than you currently owe, then pocket the difference. Sounds great, right? Well, there are many factors that go into the process of cash-out refinancing. For example, you will need to apply and submit various documents, get an appraisal on your home, and have a good standing with your current mortgage for the past 12 months. However, if you qualify, cashing out is a great way to consolidate your debt and put more money in your pocket during the holiday season! Please note that when you do a cash out refinance, you are not eliminating your debt. You are consolidating it through your mortgage and will pay it off through your monthly loan payment.

The good news is that the Las Vegas real estate market is booming! Interest rates are competitive, and home values are increasing. That means that the majority of home owners have equity in their homes. You could take advantage of the our refinance options and lower your monthly payments, in addition to "cashing out" the difference.

If you are a homeowner in Las Vegas and you would like to take advantage of our refinance opportunities this holiday season, give us a call at 702-331-8185!

Unexpected Homebuying Roadblocks

Your offer has been accepted on your dream home and you have a down payment, good credit, and little debt. So the escrow process should be a breeze, right? WRONG! There are some surprising deal breakers that can quickly cause the transaction to go south. Here are a few of the most common ones.

Closing Lines of Credit

Maybe you’ve realized you have a few more credit cards than you’d like your lender to see. Time to shut ’em down before they check your credit, right? Not so fast. Closing down multiple accounts could actually ding your credit. Credit is composed of a few key components, the age of an opened account being one biggie. Shutting down multiple accounts will also lower your credit utilization rates, which can be yet another credit killer. Research the impact of any change to your credit before taking action.

Not Calculating the True Cost of your Mortgage Payment

The cost of homeownership goes far beyond a monthly mortgage check. There are HOA fees, maintenance costs, PMI, etc. Make sure you’ve calculated — and recalculated — whether the cumulative costs will be feasible. You don’t want a nasty surprise when you finally crunch your numbers and realize they don’t fit within your current financial circumstances.

Forgetting Maintenance Costs

Remember that you’ll have to spend much more time and money on the dream house with a pool in the backyard. If you simply don’t have the budget for a home with a pool, communicate this to your agent before you start looking at houses. The last thing you want is to end up falling in love with a home you simply can’t afford to maintain.

Assuming Fixtures are Part of the Deal

Make sure you and the seller agree on exactly what will be included — and what the seller will be taking to their new home sweet home. Things such as light fixtures are often assumed to be a part of the package, but if it’s an heirloom chandelier from the seller’s grandma, chances are they’ll consider it fair game to take when they go. Set out clear expectations of what’s staying and what’s going to avoid any confusion or upset.

Buying a home can be stressful, but with a little preparation (and the right lender and real estate agent) things can go relatively smoothly. No matter what happens, remember to stay flexible. Some things may arise that are out of your control. How you respond can ultimately sway the outcome — and hopefully get you the house of your dreams!

How Does Divorce Affect Mortgage Borrowing

Let’s face it: getting a mortgage can be a royal pain in the ass regardless of whether or not you’re recently divorced. Unfortunately, adding a divorce to the picture makes it even more difficult, although not impossible. Here are some things to consider:

What to plan for: By providing your mortgage company with the most accurate and true picture of your circumstances — starting with the loan application — you’re helping them to find the best way to structure your loan for a favorable credit decision. The lender will also look at your divorce decree for any other undisclosed/non-credit report financial obligations such as child support, alimony/spousal support paid or received.

If you receive income in the form of child support or alimony: This income can be used for qualifying for the mortgage, so long as there is a six-month history and the income will continue for the next three years, determined by child support or an alimony agreement detailing the terms of the obligation for the party paying the debt.

If you pay alimony or child support: This reduce your borrowing ability as debts reduce income, and income is needed to offset a mortgage payment.

If you are divorced even as long as 20 years ago: Unfortunately, there is no statute of limitations on mortgage loan underwriting. The full divorce decree will be required no matter how many years you have been divorced.

If you own a house and are on a mortgage with an ex-spouse: As long as the divorce decree awards the other party with the home, and the other party is willing to provide supporting evidence that they make the mortgage payments on that home — by providing 12 months of bank statements and/or canceled checks — the total mortgage payment on that home can be omitted from the decision-making process on your new mortgage, which can improve your ability to qualify.

If you and your ex make the mortgage payment from the same joint bank account and the divorce decree awarded the other party with the property: You are both 50-50 responsible because the money is “co-mingled” funds from the same place to pay the obligation. There is no way to support your position that one person is responsible for making the payment because it’s coming from a joint account.

If the ex-spouse is responsible for making the mortgage that you are also on: Explore the possibility of having the ex-spouse refinance you off the mortgage obligation.

If your ex-spouse is refinancing you off a mortgage loan: A final closing statement called an HUD could be required by the lender you’re working with for procuring your loan to omit the payment from the other house.

If you have a joint consumer credit such as credit cards, installment loans, auto loans or even student loans: Unless you can prove the other party is for responsible for the credit obligation (with 12 months of canceled checks or bank statements), those liabilities will be factored into your ability to qualify.

Tips If You’re Not Yet Divorced

It’s so important to create a marital settlement agreement prior to being divorced. This is a precursor to getting a divorce that could be a great asset in helping you qualify for home financing. Navigating the financial questions that inevitably come up during the separation or divorce can easily be taken care of by having a clear delineation in writing on whose property is whose.

Consumers planning a divorce in the future would also benefit by separating their finances. This means having separate bank accounts, and paying any obligations from these separate accounts. If you are trying to get a mortgage, or will be trying to get a mortgage, consider having a conversation with mortgage professional upfront, who can guide you through the complexities in the underwriting process during a divorce.

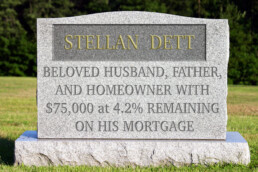

What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Who will owe?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

What's the Difference Between Getting Pre-approved & Pre-qualified?

Many people mistakenly believe that getting pre-approved for a mortgage is the same thing as getting pre-qualified. They are NOT the same! Here's the difference:

Getting Pre-qualified

Most sellers will require your pre-qualification letter before they’ll even consider your offer. Ask your lender for a prequalification letter. These are relatively simple to get and they just give a rough, unverified estimate of the loan size you may qualify to receive. Most lenders will give you a pre-qualification based on your verbal self-reporting of your income, assets, debts, and down payment size.

Estimated time: 2–3 days

Getting Pre-approved

The pre-approval stage is when lenders verify everything you’ve told them. You’ll need to supply proof of income, proof of assets, proof of employment, records of any debts you hold, and of course identification documents (such as your Social Security card) and a credit report (which the lender will run).

Once you’re pre-approved, you’ll receive a letter stating the exact amount of loan for which you’re approved.

Estimated time: 1 week to several months.

What Credit Score Do You Need to Qualify for a Mortgage?

If you’re thinking about purchasing a new home or refinancing your existing mortgage, you should know that your credit score is hugely important.

Banks and mortgage lenders use your credit score(s) to evaluate your creditworthiness, which translates to a higher or lower mortgage interest rate, and even determines eligibility.

Which Credit Score Do Mortgage Lenders Use?

First and foremost, you might be wondering which credit score mortgage lenders use, seeing that there’s no sense focusing on something they won’t actually look at to determine your creditworthiness.

The short answer is FICO scores, which are the industry standard and relied upon by just about everyone.

There are three FICO scores you need to be concerned with, including one from Equifax, one from Experian, and one from TransUnion, which are the three main credit bureaus.

Know Your Credit Scores Long Before Applying for a Mortgage

Before you actually head out to get a mortgage, it’s good practice to view your credit scores long before you apply. I’m talking several months in advance because any necessary credit score changes/improvements take time.

For example, any mistakes (or legitimate issues) holding your credit score down may take months to get cleared up. And you won’t want to leave anything to chance. Yes, the credit bureaus are bureaucratic, so nothing happens all that quickly.

Also, be sure to go with a service that allows you to see all 3 credit scores, as mortgage lenders typically pull a tri-merge credit report, which includes credit scores from all three bureaus.

The bureaus each report information a little differently, so knowing just one score won’t do you (or your lender) much good.

As far as lenders are concerned, it basically allows them to triple-check your credit before making the decision to hand over a large sum of money. They use the mid-score for pricing/qualification, so it’s imperative that all 3 credit scores are in tip-top shape.

For example, if your credit scores are 650, 680, and 720, a mortgage lender would use the 680 score, which is a decent but below-average credit score.

Lower Credit Score = Higher Mortgage Rate

Put simply, a lower credit score will lead to a higher mortgage rate, and vice versa. This all has to do with risk. The lower your credit score, the higher the chance you’ll default on your mortgage, at least that’s what the statistics say.

So if your credit score is too low, you probably won’t even get approved for a mortgage. Lenders simply won’t want your business. It’s just that risky.

Lately, banks and lenders have become even more stringent, requiring higher credit scores than they have in the past.

Credit Score Below 620 Considered Subprime

As far as conventional mortgage loans go, a credit score below 620 is typically considered subprime, meaning you’ll have a difficult time qualifying for a mortgage, and if you do, you’ll receive a subprime mortgage rate.

In general, you want a credit score above 720 to avoid any negative pricing adjustments, but a 760 credit score might be the new rule if you want the best possible terms and lowest rates. If you’ve got excellent credit, you can even get a reduced mortgage rate.

In summary, your credit score is probably the one thing you have complete control of, whereas things like job, income, and assets can be at the mercy of external forces. So do your best to strive for perfection in order to get the best deal on your mortgage.

Some Useful Credit Tips for Those Shopping for a Mortgage

- Credit scores are the single most important factor in determining your mortgage rate

- Aim for a 760+ credit score to get the best pricing and to avoid scrutiny

- Credit scores aren’t everything, what’s on your credit report matters as well!

- Know the contents of your credit report and what your scores are long before your lender does

- Any mistakes or missteps can be corrected, but take time, often several months!

- The FHA now requires a minimum credit score of 500, or 580 if you put less than 10% down

- Conventional loans generally require a minimum credit score of 620

- Credit scores below 620 are considered subprime and will be priced much higher

- Lenders pull all three of your credit scores and use the median score for qualification

- Low credit scores can also disqualify you for certain loan programs and/or limit your options

- Don’t mess with your credit before or during the loan application process!

Three Documents to Bring When Applying for a Conventional Loan

When you are planning to buy a home and need a mortgage, a conventional loan is one of the most common types of financing available. Make sure that you bring all of the necessary documentation when you apply for the loan.

Three Documents to Bring When Applying for a Conventional Loan

When you are considering the purchase of a home and are not paying cash for it, you will need a means of financing the purchase. Mortgage loans that are based on conventional loans in Las Vegas are a common way of financing the purchase of a house. When you head in to apply for the conventional loan, make sure that you bring these three pieces of documentation.

Proof of Income

You will need to bring proof of your income. This will include a pay stub and two of your most recent federal tax returns. If you work at more than one job, bring in a pay stub from each. If there is more than one adult applying for the loan, both people will need to bring these documents. These documents provide proof that your earnings will be enough to make the loan payments.

Social Security Card

Your social security number is used to run a credit check when you are applying for a mortgage backed by a conventional loan. A higher credit score means that you are a lower risk for defaulting. The higher your credit score, the lower the interest rate will be on your conventional loan.

Proof of Insurance

When you are applying for a conventional loan for the purchase of a home, the actual house is the collateral on the loan. In order to receive the mortgage, you are responsible for insuring the house. You will need to bring proof of homeowner's insurance from a legitimate insurance company. The proof will need to be on letterhead and contain the contact information of the agent offering the insurance policy. The insurance of the structure will ensure that the loan can be paid off in case of a catastrophic event such as a fire.

Looking for a seasoned mortgage professional?

Derek Parent and his team of professionals have the experience and passion you need to make purchasing your next home as stress-free as possible. We've had the opportunity to work with a wide diversity of clients, so we're ready for any situation!

Preparing in Advance for Your Home Purchase

The home buying process is a fulfilling and gratifying one that requires financial acumen and discipline.

Preparing for Financial Planning and Home Ownership

Purchasing a home is a big deal. Whether you are looking to buy a high rise, condo, or house in Las Vegas, it takes a lot of dedication and patience to turn a dream of home buying into a reality. Once some people hit a certain age, they automatically assume it's time to purchase a house. While it's good to own a home, it's wise to be fully prepared to own that home. This mainly depends on what your financial situation is like and how well you can be disciplined with what you have.

Financial Status

Your finances play a major role in this process. While it would be ideal, most people don't have the money to purchase their home with cash. In this case, many people get loans to cover the mortgage. There are so many options to choose from such as first-time home buyer options and lending mortgage options. No matter what route you choose, it's best to have the money to make the down payment on the home. Some programs will allow you to only have 3-5% down to pay for a home. Many finance educators and experts encourage 20% down payment. You'll also want to consider the expenses outside of the home purchase such as furnishings, repairs, closing costs and relocation fees. If you prepare for a home purchase the right way, you won't need to deplete your savings to make it happen.

Discipline

It takes a high level of financial discipline to purchase a home. When the mortgage lenders take a look at your credit score, they want to know that your chances of paying back the loan are very high. This boils down to how you handle money and what your money mindset is like. If you're mindful and intentional about your savings and investment accounts, you'll be in great shape to experience the beauty of being a homeowner.

Consistency

It's one thing to gain all the information. It's another thing to make sure you remain consistent with the information you gain. If you make those baby steps with building discipline and apply those lessons you learn about handling your finances, you'll be in a dynamic position to purchase a home and handle all that comes along with it.

Derek Parent Team

Looking for a new condo or high rise to be your Las Vegas home? Contact us today! Derek is the only person in Las Vegas that offers down payment assistance and mortgage lending towards the purchase of high rise condos in Las Vegas.

10 Questions to Ask Your Mortgage Lender

One of THE MOST important stages in the home-buying process is finding a reputable lender or mortgage broker to handle your transaction. A good lender will respect that you work hard for your money — and you want to spend it wisely.

After running a credit check, your lender will present you with options for what you may qualify to borrow. The mortgage amount can be different depending on two things: the product and interest rate. Since the interest rate determines what you’ll owe every month on that balance, understanding how different mortgage products work is key. Here are 10 questions to ask to make sure you’re getting the best rate (and the best deal).

- What is the interest rate?

Your lender will offer you an interest rate based on the loan and your credit. The interest rate, along with the mortgage balance and loan term, will determine your real monthly payment. A loan with a lower balance or a lower interest rate will make for a smaller monthly payment. If you’re not satisfied with the interest rates offered, work to clean up your credit so you can qualify for a lower interest rate.

- What is the monthly mortgage payment?

As you develop a budget for your new home, make sure you can afford this monthly mortgage payment — and be sure to include insurance and taxes in your monthly payment calculations. And don’t forget about short-term financial goals — say, saving up for a vacation or buying a new computer — and long-term retirement goals to consider. Your monthly mortgage payment shouldn’t be so high that your money can’t work toward your other financial goals.

- Is the mortgage fixed rate or an ARM?

Fixed-rate loans keep the same rate for the life of the loan, which can range between 10 and 30 years. Adjustable-rate mortgages, or ARMs, have interest rates that change after an initial period at regular intervals. If you don’t plan to stay in your home long-term, a hybrid ARM with an initial fixed-rate period may be a better choice, since this type of loan tends to have lower interest rates than fixed-rate mortgages.

If you do consider an ARM, make sure you ask (and understand!) when the rate will change and by how much. Ask how often the rate will change after the initial interest rate change, the index that it’s tied to, and the loan’s margin. There are usually caps to how much the interest rate can increase during one period and over the life of the loan, so recalculate the monthly payment to make sure you can afford that higher rate.

- What fees do I have to pay?

One-time fees, typically called “points,” are due at closing. For every point you pay, your lender will decrease your interest rate by 1%. You can also inquire about whether you might have the option of paying zero closing fees in exchange for a higher interest rate.

- Does the loan have any prepayment penalties?

If you’re saving up to make some extra mortgage payments to pay off your mortgage principal early, you may have to pay a fee. Don’t forget to ask this important question.

- When can I lock in the interest rate and points, and how much does this cost?

Your lender may be able to lock in your interest rate for a time, and for a fee. If rates go up, you’ll still be able to benefit from a lower rate on your mortgage.

- What are the qualifying guidelines for this loan?

The underwriting guidelines are different for every loan, as are income and reserve requirements. Along with requiring you to have sufficient funds for the down payment and closing costs, most mortgages require proof of income and reserves of up to six months of mortgage payments.

- What is the minimum down payment required for this loan?

Different loan products have different down payment requirements. Most mortgages require a 20% down payment, but if you qualify for an FHA loan, for example, your down payment could be as low as 3.5%. In general, loans with lower down payments cost more.

- Do I have to pay for mortgage insurance, and how much will this cost?

Putting down less than 20% on your purchase requires paying mortgage insurance until your loan-to-value, or LTV, ratio falls below 80%. Mortgage insurance premiums can be expensive, sometimes costing up to $100 per month for every $100,000 borrowed.

- Do you have other mortgage products with lower rates that I qualify for?

The best way to comparison-shop is to start with your current lender. They probably offer more than one type of loan, and these may have terms better suited to your financial situation.