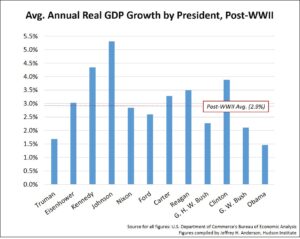

Real GDP Growth Trends: What Economic Cycles Tell Us About the Outlook

Understanding real GDP growth trends is one of the most reliable ways to evaluate the underlying strength of the economy. While short-term data often fluctuates, GDP provides a broader, more stable view of how economic activity evolves over time.

For homeowners, buyers, and investors, GDP trends matter because they directly influence employment, income growth, housing demand, and long-term real estate performance.

How Real GDP Growth Typically Evolves

Historically, real GDP growth tends to strengthen and peak during the middle phase of an economic cycle. This occurs as expansion gains traction through:

- Increased consumer spending

- Higher business investment

- Expanding employment and wage growth

GDP is considered a lagging but confirming indicator. Strong GDP readings often appear after economic momentum is already underway, which is why housing activity and buyer confidence often improve before GDP peaks.

Why GDP Growth Matters for Housing and Real Estate

Strong GDP growth is closely tied to real estate fundamentals. As economic activity expands:

- Job creation supports household formation

- Income growth improves affordability

- Demand for both owner-occupied and investment properties increases

Historically, periods of sustained GDP growth align with healthy housing demand, even if price growth moderates.

This is especially important for buyers evaluating timing, and for homeowners considering long-term equity planning.

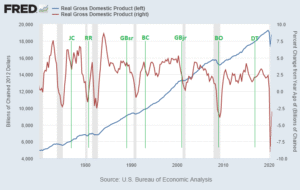

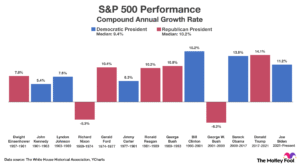

How GDP Growth and Financial Markets Differ

Financial markets are forward-looking, often pricing in expectations well before GDP data reflects them. As a result, market performance and GDP growth do not always peak at the same time.

This distinction matters in real estate because housing activity tends to follow real economic conditions, not short-term market sentiment. GDP growth provides confirmation that demand is supported by income and employment—not speculation alone.

GDP Growth and Mortgage Planning

GDP trends also influence mortgage strategy indirectly. Strong economic growth environments often coincide with:

- Increased loan demand

- Greater borrower confidence

- Strategic opportunities for refinancing or purchase planning

Understanding where the economy sits in the growth cycle can help borrowers make more informed mortgage decisions, particularly for long-term financing strategies.

Planning Takeaways for Buyers and Homeowners

For buyers, homeowners, and long-term investors, GDP growth trends help frame expectations around:

- Housing demand sustainability

- Income and employment stability

- Long-term property value support

Strong GDP growth environments tend to reward disciplined planning and thoughtful timing, rather than reactive decision-making.

Final Thoughts on GDP and Economic Cycles

While no single indicator tells the full story, real GDP growth remains one of the most dependable measures of economic health. Historical trends show that GDP often strengthens as economic cycles mature, even when markets appear uneven.

For those making housing or mortgage decisions, understanding GDP trends provides valuable context—helping align real estate strategy with the broader economic environment.

If you’d like to discuss how current GDP trends may relate to housing, real estate, or mortgage planning, I’m always happy to connect.

Why 2026 Is Quietly Becoming One of the Best Years to Buy in Las Vegas

While headlines tend to focus on rising home prices and fluctuating mortgage rates, something major is happening beneath the surface in the Las Vegas real estate market—something that could make 2026 one of the best years to buy a home in the last decade.

It’s not hype. It’s not speculation. It’s data, demand, inventory, and timing all shifting at once. And smart buyers who prepare early will be the ones who benefit.

Here’s what’s making 2026 a surprisingly strong buying opportunity.

1. Mortgage Rates Are Expected to Improve

No one expects a return to 2–3% mortgage rates, but nearly every major housing forecast agrees:

Rates should gradually ease into the mid-5% to low-6% range by late 2026.

Even a 0.5% to 1% decrease can dramatically improve:

- Monthly payment affordability

- Loan qualification amounts

- Buyer confidence

- Refinance potential

When rates improve even slightly, the buyer pool grows—meaning those who act early get ahead of the rush.

2. Inventory Will Increase — But Not Enough to Hurt Prices

Builders across Summerlin, Henderson, North Las Vegas, and Skye Canyon are expanding aggressively right now. New phases, new lots, and new communities are already underway.

But here’s the real story:

Inventory is improving just enough to create opportunity — but not enough to create a buyer’s market.

Most existing homeowners will not sell until rates drop significantly, which means new construction is carrying the load heading into 2026.

More options + less chaos = better buying conditions.

3. Price Growth Will Be Steady, Not Explosive

The rapid appreciation of 2021–2022 is behind us. In 2026, experts are predicting 3–6% steady annual growth—a much healthier and more predictable market.

This moderation creates two advantages:

- Homes won’t jump out of budget as quickly.

- Buyers will build equity consistently without taking on inflated pricing.

For long-term wealth building, slow and steady often beats fast and volatile.

4. Economic Momentum Is Accelerating

Las Vegas isn’t just reinventing itself—it’s expanding structurally.

Key drivers boosting the 2026 market include:

- Job growth in tech, logistics, medical, professional services, and hospitality

- Massive investment around the Strip and surrounding areas

- The incoming A’s baseball stadium

- Continued expansion of the Las Vegas Grand Prix

- Growth of the UNLV medical corridor

- Major expansions in distribution facilities across North Las Vegas

A strong economy increases incomes, migration, and demand… all while stabilizing home values.

5. Out-of-State Migration Is Not Slowing Down

People continue moving to Las Vegas for:

- Lower taxes

- Lower housing costs compared to coastal cities

- Better quality of life

- Climate and lifestyle

- Expanding job markets

California, Oregon, Arizona, and Washington remain the biggest feeder states—and this migration fuels demand and strengthens long-term property values.

More demand = more stability.

More stability = better long-term equity for early buyers.

6. High-Rise & Condo Markets Are Strengthening

After years of volatility, the high-rise market is experiencing a real resurgence. By 2026:

- More towers will resolve litigation

- Financing will expand

- Jumbo loan pricing will stay competitive

- Inventory will remain tight for premium units

This is especially important for investors and luxury buyers looking for Strip views or mid-term rental opportunities.

7. Buyer Competition Will Increase in Late 2026

Here’s the part most buyers don’t realize:

Once rates noticeably drop, competition will spike.

More buyers =

- Bidding wars

- Faster sales

- Less negotiation room

- Fewer seller credits and incentives

This is why preparing early is key. Those ready by early 2026 will have significantly more leverage than buyers who wait until late 2026 or 2027.

Final Thoughts

Las Vegas is entering a rare window of opportunity for buyers: rising inventory, improving rates, stable pricing, and strong long-term economic fundamentals. The market of 2026 won’t be a buyer’s market… but it will be one of the most balanced, strategic, and opportunity-filled years Las Vegas has seen in a long time.

If you want to get ahead of the next market wave, connect with The Derek Parent Team. We’ll help you evaluate payments, compare loan options, and position yourself to buy smart—before the competition returns.

Homeowners Are Sitting on Billions in Untapped Equity — Here’s How to Use Yours Wisely

Homeowners across the U.S. — especially in fast-growing markets like Las Vegas — are sitting on massive amounts of tappable equity. In fact, recent housing data shows Americans now have more than $16 trillion in home equity, with billions of that right here in Nevada.

But the big question is this:

What should you actually do with that equity?

Used wisely, your home equity can help you build wealth, eliminate debt, invest in your future, and strengthen your financial foundation. Used carelessly, it can create unnecessary risk.

Here’s how to use your equity strategically and responsibly.

1. Consolidate High-Interest Debt

Credit card interest rates are now averaging 20–30%, and many homeowners are feeling the pressure. If you’re carrying high-interest balances, a cash-out refinance or HELOC can dramatically reduce your monthly obligations.

Why this strategy works:

- Mortgage rates are significantly lower than credit card rates

- One consolidated payment is easier to manage

- Lower utilization often boosts your credit score

- Freeing up cash flow reduces financial stress

This is one of the smartest, most impactful uses of home equity — especially heading into 2026 with rising consumer debt.

2. Make High-ROI Home Improvements

Renovations can increase property value, improve your living space, and boost long-term equity. But not all upgrades are created equal.

High-return improvements include:

- Kitchen remodels

- Bathroom upgrades

- New flooring

- Exterior improvements for curb appeal

- Energy-efficient windows

- HVAC upgrades

A cash-out refinance or HELOC often makes more financial sense than personal loans or store financing, which carry higher rates.

3. Buy an Investment Property

If you’ve built strong equity and want to grow wealth, using that equity for a down payment on a rental or investment property can create long-term returns.

Benefits include:

- Additional monthly income

- Appreciation on multiple properties

- Tax benefits for investors

- A hedge against inflation

Many of your clients are leveraging their primary home equity to purchase:

- Long-term rentals

- Mid-term furnished units

- High-rise condos

- Second homes in Las Vegas communities

This is how homeowners move from paying a mortgage… to building a portfolio.

4. Refinance Into a Better Loan

Even if rates today aren’t at historic lows, refinancing can still make sense, especially if you can:

- Remove mortgage insurance (PMI)

- Switch from an ARM to a fixed-rate mortgage

- Shorten your term (30-year to 15-year)

- Reduce your interest rate

- Lower your monthly payment

If you bought in the mid-rate years and your equity has climbed, refinancing may open doors that weren’t available when you closed originally.

5. Build an Emergency or Opportunity Fund

Another smart equity move is pulling a conservative amount of cash for liquidity — not spending.

This gives homeowners:

- A financial safety net

- Funds for unexpected medical or family expenses

- Capital to jump on investment opportunities

- Flexibility during job changes or business transitions

A HELOC is especially useful for this because you only pay interest on what you use.

6. Prepare for Major Life Events

Your equity can help you navigate big moments with less financial strain.

Examples include:

- Paying for college tuition

- Funding a wedding

- Helping a family member buy a home

- Covering medical or caregiving expenses

- Preparing for retirement transitions

Instead of draining savings, homeowners can strategically tap equity to protect cash reserves.

7. Don’t Use Equity for “Lifestyle Debt”

Before leveraging your equity, it’s just as important to know what not to use it for.

Avoid spending equity on:

- Vacations

- Luxury purchases

- Vehicles

- Consumables

- Short-lived expenses

These reduce your net worth without creating long-term value.

How to Know Which Strategy Fits You Best

The right equity move depends on your goals:

- Want lower monthly expenses?

Debt consolidation or refi into a lower rate. - Want long-term wealth?

Invest in property or shorten your mortgage term. - Want flexibility?

Open a HELOC and keep funds available. - Want to upgrade your home?

Cash-out for renovations with strong ROI.

At The Derek Parent Team, we analyze your equity, credit, income, and goals to determine the smartest move — not just the easiest one.

Final Thoughts

Homeowners today have access to more equity than any time in history — but the real power lies in using it wisely. Whether you want to invest, reduce debt, protect your finances, or improve your home’s value, the right strategy can move you closer to your long-term financial goals.

If you’d like a customized equity analysis or want to explore cash-out, HELOC, or refinance options, connect with The Derek Parent Team. We’ll help you understand what’s possible and how to maximize your equity safely and strategically.

Why Year-End Is the Smartest Time to Buy a Home in Las Vegas

While most people are focused on holidays, travel, and year-end planning, savvy buyers are doing something different — they’re taking advantage of one of the best times of year to buy real estate in Las Vegas.

If you’re serious about owning a home, the final months of the year offer unique advantages you won’t get in spring or summer. Here’s why year-end may be your smartest move.

1. Sellers Are More Motivated During the Holidays

By November and December, many sellers have had their homes on the market longer than expected. Whether they need to relocate, close before tax season, or simply don’t want to carry the home into the new year, seller motivation is significantly higher.

This often means:

- More price flexibility

- Faster negotiations

- Higher chance of seller-paid closing costs

- More willingness to accept contingencies

Less competition = more leverage for buyers.

2. Fewer Buyers in the Market

Most buyers pause their home search during the holidays. Kids are out of school, people travel, and money is tight — so buyer activity naturally slows down.

But that’s great news for you.

With fewer offers to compete against, you’re more likely to:

- Avoid bidding wars

- Get your first choice of home

- Negotiate better terms

- Lock in a property before demand surges in January and February

If you want less stress and more negotiating power, year-end is where it happens.

3. Builders Offer Huge Incentives Before December 31st

New construction communities LOVE closing out the year strong. Many builders — especially in Summerlin, Henderson, and the booming Northwest — offer massive incentives to hit their end-of-year sales goals.

These may include:

- Rate buydowns (including 2-1 buydowns)

- Closing cost credits worth $10K–$25K

- Free upgrades like flooring, appliances, or premium lots

- Discounts on quick-move-in homes

These incentives are often the best you’ll see all year.

4. You Get a Head Start Before the Spring Rush

Every January and February, buyers flood back into the market. Rates stabilize, tax refunds come in, and relocation season begins. By spring, competition spikes — and so do home prices.

Buying before the rush helps you:

- Lock in a home before demand increases

- Avoid rising list prices

- Close and move with fewer delays

- Refinance later if rates drop

You’re essentially buying low before everyone else wakes up.

5. Tax Advantages for Buying Before Year-End

Depending on your financial situation, buying before December 31st may give you access to tax benefits including:

- Mortgage interest deduction

- Property tax deduction

- Possible points or buydown deductions

- First-time buyer incentives (depending on program)

Always consult with a CPA, but many homeowners enjoy meaningful tax advantages simply by closing before January 1st.

6. More Flexible Scheduling for Showings & Closings

The holiday slowdown benefits buyers beyond pricing — it also makes logistics easier.

You’ll often find:

- Faster appraisal scheduling

- Quicker underwriting

- Easier coordination with title companies

- More availability for inspections

Everything moves smoother because fewer people are buying at the same time.

7. You Can Set Yourself Up for a Strong Financial Start to 2026

Buying a home before year-end positions you to:

- Start building equity immediately

- Lock in monthly housing stability

- Avoid rising rents in the new year

- Begin 2026 with a major financial win

Instead of waiting and paying more later, you enter the new year already ahead.

Final Thoughts

Year-end might not be the most obvious time to buy a home, but in Las Vegas, it’s often the smartest. With motivated sellers, reduced competition, better builder incentives, and faster closing timelines, the final months of the year give buyers advantages they simply won’t find in spring or summer.

If you’re ready to take advantage of these benefits and explore your options, connect with The Derek Parent Team. We’ll walk you through payments, programs, incentives, and strategies to help you buy smart — before the rest of the market jumps back in.

Credit Score Tune-Up: 7 Fixes That Strengthen Your Mortgage Approval in 2026

If you’re planning to buy a home in 2026, your credit score will be one of the biggest factors determining your loan approval, interest rate, and monthly payment. Even small improvements can save you thousands of dollars over the life of your mortgage.

The good news? You don’t need a perfect score to qualify — but a stronger score means better options, lower rates, and more negotiating power. Here are seven smart credit fixes to tune up your score before you apply for a mortgage in 2026.

1. Pay Down Credit Card Balances Strategically

Your credit utilization ratio — the percentage of available credit you’re using — makes up 30% of your credit score. Lowering that percentage is one of the fastest ways to see a score increase.

Tips that work:

- Keep balances below 30%, and ideally under 10%.

- Pay down cards with the highest utilization first.

- Avoid using your cards heavily 2–3 months before your mortgage application.

This single fix can raise scores 20–60 points in a short period.

2. Check Your Credit Reports for Errors

Mistakes happen more often than most people realize — and even a small error can impact your approval.

Request your free annual reports and look for:

- Accounts that don’t belong to you

- Incorrect balances

- Duplicate accounts

- Outdated collections

- Late payments you can prove were on-time

Disputing errors early gives the bureaus enough time to correct the issue before your mortgage lender pulls your credit.

3. Avoid Opening New Credit Accounts

Opening new accounts can temporarily lower your score because:

- Hard inquiries reduce points

- New accounts reduce your average age of credit

If you’re preparing for a mortgage, avoid:

- New credit cards

- Auto loans

- Furniture or appliance financing

- Buy-now-pay-later accounts

Remember: No major credit changes within 6–12 months of buying.

4. Set Up Automatic Payments to Prevent Late Marks

Payment history is 35% of your entire credit score — the largest factor. One late payment can drop your score 50–100 points.

If you struggle to remember due dates:

- Set up autopay for minimum payments

- Create reminders on your calendar

- Align due dates after your paycheck

Protecting your on-time history is one of the most valuable things you can do.

5. Negotiate Old Collections or Charge-Offs

Collections don’t always need to be paid off to qualify for a mortgage, but resolving them can help your score move faster.

What to do:

- Contact the creditor

- Request a “pay for delete” (they remove the account when you pay)

- Get agreements in writing

Collections older than 24 months may not impact your score as much, but paying off newer ones can create an instant bump.

6. Ask for a Credit Limit Increase

If your utilization is high but you don’t have cash to pay down balances, asking for a credit limit increase can improve your score without spending money.

For example:

- A $1,500 balance on a $3,000 limit = 50% utilization

- A $1,500 balance on a $6,000 limit = 25% utilization

Just make sure you don’t add new charges once your limit increases.

7. Keep Old Accounts Open

Your credit score rewards you for long-standing accounts. Closing old credit cards can:

- Shorten your credit history

- Increase your utilization

- Reduce your total available credit

Even if you don’t use them often, keep old accounts open — especially those with a long positive history.

Bonus Tip: Talk to a Lender Early

Many buyers wait too long to review their credit, only to discover issues right before they want to submit an offer. The truth is, the earlier you start the process, the more options you have.

A quick credit review with a mortgage professional can:

- Identify what’s hurting your score

- Give you a personalized improvement plan

- Tell you exactly what you need for approval

- Help you qualify for the best interest rate

At The Derek Parent Team, we walk buyers through credit improvement steps every day — and even small tweaks can create big results when it’s time to buy.

Final Thoughts

Improving your credit doesn’t have to be stressful or overwhelming. With the right strategy and a few consistent habits, you can strengthen your mortgage approval, lower your future interest rate, and put yourself in the best position possible for buying a home in 2026.

Whether your score needs a small tune-up or a major boost, the earlier you start, the better your results will be.

If you want a personalized credit roadmap and mortgage analysis, connect with The Derek Parent Team today. We’ll help you understand your numbers and get mortgage-ready with confidence.

Tax Advantages Every Homeowner Should Maximize Before January 1st

As the year winds down, most homeowners start thinking about holiday plans, travel schedules, and finishing the year strong. But one of the most important things you can do before December 31st is make sure you’re taking full advantage of the tax benefits that come with homeownership.

Many homeowners miss out on deductions simply because they forget what’s available — or they wait until it’s too late. Here’s a simple breakdown of the top tax moves you should consider before the new year.

1. Check Your Mortgage Interest Deduction

If you itemize your taxes, you may be able to deduct the mortgage interest you paid this year. This often applies to:

- Primary residences

- Second homes

- Some investment properties

Because mortgage interest is front-loaded (you pay more interest early in your loan), this deduction can be substantial.

Year-end tip:

Download your year-to-date mortgage statement and make sure it aligns with your tax plan. If you’re close to the itemization threshold, this deduction may push you over.

2. Deduct Property Taxes Paid This Year

Homeowners can typically deduct up to $10,000 of state and local taxes combined (SALT cap). This includes:

- Property taxes

- State income taxes

- Local sales taxes

Year-end tip:

If your county allows it, consider paying your next property tax installment before December 31st to maximize this year’s deduction.

3. Energy-Efficient Improvements May Qualify for Credits

If you upgraded your home this year — especially for energy efficiency — you may qualify for federal tax credits worth hundreds or even thousands of dollars.

Eligible improvements include:

- Solar panels

- Energy-efficient windows

- New HVAC systems

- Insulation upgrades

- Energy-efficient water heaters

Why this matters:

Credits reduce your tax bill dollar for dollar, which is even better than a deduction.

4. Track Home Office Deductions

If you’re a remote worker, self-employed, or operate a business from home, you may qualify for the home office deduction.

This can include a portion of:

- Utilities

- Internet

- Maintenance

- Depreciation

- Mortgage interest

- Home insurance

The key is that your home office must be used regularly and exclusively for work.

Year-end tip:

Gather receipts and calculate your office percentage now so you’re not scrambling during tax season.

5. Review Capital Gains Rules if You Sold a Home in 2024

If you sold your primary residence this year, you may qualify for the capital gains exclusion:

- Up to $250,000 tax-free profit for single filers

- Up to $500,000 for married couples

To qualify, you must have lived in the home for at least two of the last five years.

Year-end reminder:

Make sure you track improvements you made during ownership, as these increase your cost basis and reduce taxable gain.

6. Consider Making an Extra Mortgage Payment

Homeowners who itemize can sometimes benefit from making one additional mortgage payment before December 31st. Doing so may increase your deductible mortgage interest for the year.

This strategy works best when:

- You itemize

- You’re close to the deduction threshold

- You want to reduce taxable income before January 1st

Always consult a tax professional to see if this move benefits you.

7. Document Home Improvements for Future Tax Savings

Even if you don’t get a deduction this year, keeping a record of upgrades helps you later when you sell the property.

Why?

Because improvements increase your home’s cost basis, reducing your taxable capital gains.

Start building a folder with:

- Contractor invoices

- Receipts

- Permit fees

- Material costs

Your future self will thank you.

Final Thoughts

Homeownership comes with incredible financial advantages — but only if you use them. Reviewing your deductions, credits, and home-related expenses before January 1st can save you money and set you up for a stronger financial year ahead.

If you want to explore refinancing opportunities, cash-out options, or strategies to maximize your equity and tax benefits, connect with The Derek Parent Team. We’ll help you understand your numbers and make smart year-end decisions.

Las Vegas High-Rise Report: Pricing, Inventory & What’s Coming in 2026

As Las Vegas continues expanding its skyline, high-rise condos remain one of the most unique—and misunderstood—segments of the real estate market. From Strip-facing luxury towers to modern residential buildings off Las Vegas Blvd., high-rise living is gaining momentum again as the city evolves into a true sports and entertainment hub.

If you’re considering buying, selling, or investing in a Vegas condo, here’s your 2025–2026 High-Rise Market Report breaking down pricing, inventory, and what’s ahead.

1. High-Rise Pricing Trends Heading Into 2026

Over the past few years, high-rise values have rebounded steadily after temporary price dips caused by interest rates and building-specific restrictions. Today, pricing is stabilizing—and in some towers, quietly creeping upward.

Current Price Ranges (2025 Market Snapshot)

- Luxury Towers (Waldorf Astoria, The Martin, Veer Towers):

$600–$1,800+ per sq. ft. - Mid-Luxury Towers (Turnberry, Panorama, Sky Las Vegas):

$375–$650 per sq. ft. - Entry-Level High-Rises (SOHO, Juhl, Allure):

$300–$450 per sq. ft.

What’s Driving Pricing?

- Strong demand from out-of-state buyers

- Limited resale inventory due to low turnover

- Major events boosting desirability (Formula 1, A’s Stadium, Sphere expansion)

- Investors seeking low-maintenance, lock-and-leave assets

Bottom line: Prices are not falling. They’re stabilizing—and poised for gradual appreciation in 2026.

2. Inventory Remains Tight (but Improving Slightly)

High-rise inventory in Las Vegas is still far below historical norms. Many homeowners who purchased during low-rate years are holding onto their units, and new luxury towers are not being built at the pace seen in cities like Miami or New York.

Current Inventory Breakdown

- Luxury properties: Low inventory; highly competitive

- Mid-tier towers: Moderate turnover, especially in Panorama & Sky

- Older buildings: More options, but many need upgrades

Because new construction is rare in the high-rise segment, resale units remain the primary source of opportunity.

What this means for buyers:

If you have your eye on a specific tower or floor plan, be ready to move quickly—especially for Strip-view or corner units. Pre-approval from a high-rise–experienced lender gives you a major advantage.

3. What’s Fueling Demand Going Into 2026?

Migration, lifestyle, and Nevada’s tax benefits continue to push demand upward. But several new catalysts are accelerating interest in high-rise ownership:

The Sports Boom

- Raiders, Golden Knights, Aces

- Formula 1

- A’s Stadium opening soon

- Major events boosting tourism and executive relocations

The Entertainment Expansion

- Sphere expansion phase

- New resorts and hospitality developments

- Strengthening convention calendar

The Remote Work Shift

Professionals relocating from the West Coast are choosing high-rise condos for their amenities, security, and convenience.

Translation: Lifestyle + location = strong and lasting demand.

4. What to Expect in 2026: The High-Rise Outlook

Looking ahead, several trends are likely to shape the 2026 market:

1. Gradual Price Appreciation

Experts expect 3–5% appreciation annually in prime towers as demand stays strong.

2. More Renovations in Older Buildings

Buyers want turnkey units. Expect increased remodeling, modernizing, and amenity upgrades.

3. A Rise in Investor Activity

Especially in buildings with mid-term and corporate rental flexibility.

4. Stronger Financing Options

As litigation clears in some towers and guidelines loosen, lenders may approve more units for conventional and jumbo financing.

5. Increased Focus on HOAs

Buyers will continue scrutinizing reserves, budgets, insurance, and upcoming assessments.

5. Should You Buy Now or Wait for 2026?

Waiting for the “perfect moment” in real estate usually costs more in the long run. Here’s why acting sooner may be smarter:

- Inventory is still tight, so good units don’t stay available long.

- If rates drop, competition will surge.

- Prices in luxury buildings rarely go backwards.

- Rental demand (especially mid-term) remains strong for investors.

If you find a great unit now, securing it and refinancing later (if rates improve) is the winning strategy.

Final Thoughts

The Las Vegas high-rise market is healthy, stable, and positioned for real growth heading into 2026. For buyers, that means more opportunity—and for investors, it means strong long-term upside in a segment with limited supply and rising demand.

Whether you’re comparing towers, exploring investment options, or looking for a Strip-view dream home, the key is working with a lender who understands high-rise financing inside and out.

For expert guidance and custom scenarios, connect with The Derek Parent Team — the leaders in Las Vegas high-rise mortgage lending.

5 Equity Moves Every Homeowner Should Make Before the New Year

As the year comes to a close, many homeowners start thinking about goals, finances, and what they want the next year to look like. But there’s one area that often gets overlooked—your home equity.

Your home is likely one of your biggest assets, and the equity inside it can become a powerful tool if you know how to use it. Before the new year arrives, here are five smart equity moves every homeowner should consider.

1. Check Your Current Equity Position

Most homeowners don’t know how much equity they’ve built over the years. Between appreciation and your mortgage payments, you may have more than you think.

To calculate quickly:

Home Value – Mortgage Balance = Your Equity

Why it matters:

- You may have enough equity to eliminate PMI.

- You may qualify for better refinance terms.

- You may unlock equity for renovations or investments.

A quick review with a trusted lender like The Derek Parent Team can give you an accurate, updated number.

2. Review Your Mortgage Rate and Terms

Even if you’re not in a rush to refinance, it’s worth evaluating whether your current mortgage still fits your financial goals.

Consider reviewing:

- Your current interest rate vs. today’s options

- Whether refinancing to a shorter term could save interest

- If you have PMI you could remove

- Whether switching from an ARM to fixed could protect you long-term

Many homeowners discover they can improve their monthly payment or long-term savings just by reviewing the numbers.

3. Use Equity Strategically for High-ROI Upgrades

Not all home improvements are equal. Some upgrades add value, while others don’t.

High-ROI improvements include:

- Kitchen updates

- Bathroom upgrades

- New flooring or paint

- Exterior curb appeal

- Energy-efficient enhancements (HVAC, windows, insulation)

If you’re sitting on solid equity, using a cash-out refinance or HELOC for strategic improvements can increase your home’s value heading into the new year.

4. Consolidate High-Interest Debt Into Lower-Rate Equity

Credit card interest rates are now averaging 20–30%. If you're carrying balances, the interest alone may be draining your cash flow.

A cash-out refinance can:

- Replace high-interest revolving debt with a lower-interest fixed mortgage

- Lower your total monthly payments

- Improve your credit score by reducing utilization

- Free up cash flow as you enter the new year

This move alone can save homeowners thousands annually.

5. Plan Ahead for Major Purchases or Life Changes

Equity can serve as a financial cushion during major life events, including:

- College tuition

- Medical expenses

- Home renovations

- Investment opportunities

- Expanding or downsizing your home

- Funding a second property or rental investment

Reviewing your equity before the new year helps you prepare for these moments with clarity and confidence.

Bonus Tip: Set Your 2025 Equity Strategy Now

Don’t wait until January to decide your financial goals. Use this time to:

- Update your budget

- Plan your mortgage strategy

- Explore refinance or HELOC options

- Map out home improvements and timelines

- Strengthen your equity position for future wealth-building

Your home equity is a major part of your net worth—make sure it’s working for you, not sitting idle.

Final Thoughts

A strong equity plan can help you reduce debt, increase home value, improve cash flow, and prepare for life’s big opportunities. Instead of waiting until the new year, reviewing everything now gives you a head start on 2025.

If you want a personalized home equity review or want to explore refinance, HELOC, or cash-out options, connect with The Parent Team. We’ll help you understand your numbers, compare scenarios, and make smart equity moves for the year ahead.

7 Creative Ways to Save for Your Down Payment

Saving for a down payment can feel like one of the biggest obstacles to buying a home. In a city like Las Vegas—where the market is competitive and prices continue to climb—having enough cash on hand matters. The good news? You don’t need to rely only on traditional savings. With a little creativity and discipline, you can reach your goal faster than you think.

Here are seven creative ways to save for your down payment.

1. Automate Your Savings

One of the simplest yet most effective strategies is to set up automatic transfers. Every payday, move a set amount into a separate “down payment” savings account. Because the money is tucked away before you see it, you won’t be tempted to spend it.

2. Cut Out Hidden Subscriptions

Streaming services, unused gym memberships, and auto-renewing apps add up. Review your bank statements and cancel what you don’t use. Even if you save $100 a month, that’s $1,200 a year toward your down payment.

3. Leverage Side Hustles

From rideshare driving to freelance work, side hustles can generate extra income dedicated exclusively to your savings goal. In Las Vegas, opportunities like event staffing or part-time hospitality jobs can be lucrative and flexible.

4. Bank Your Windfalls

Tax refunds, work bonuses, or even casino winnings (if you’re lucky!) should go straight into your down payment fund. These one-time boosts can shave months—or even years—off your timeline.

5. Sell Unused Items

Chances are, you’ve got valuable items collecting dust. Furniture, electronics, or collectibles can all be sold online. Not only does this free up space, but it also moves you closer to your down payment target.

6. Use Employer Programs or Grants

Some employers offer homebuyer assistance programs as part of their benefits package. In Nevada, state and local down payment assistance grants are also available. Working with a local lender like The Derek Parent Team can help you uncover programs you may qualify for.

7. Downsize Temporarily

If possible, consider downsizing your living situation for a short period—whether it’s moving in with family or finding a cheaper rental. The money you save on rent can go directly into your home savings account.

Bonus Tip: Know How Much You Really Need

You might not need as much as you think. Some loan programs require as little as 3% down (conventional), or even 0% down (VA loans for eligible veterans). Understanding your options with a trusted mortgage advisor can give you a clear and realistic target.

Final Thoughts

Saving for a down payment takes discipline, but it doesn’t have to feel impossible. By automating savings, cutting hidden expenses, taking on side hustles, and exploring assistance programs, you can reach your goal sooner than you think.

When you’re ready, the Derek Parent Team can guide you through loan options, down payment assistance, and strategies to make homeownership in Las Vegas a reality.

Refinance in Vegas: Is It Worth It at Today’s Rates?

Interest rates have shifted dramatically over the past few years, leaving many Las Vegas homeowners wondering: “Is refinancing still worth it?”

The answer depends on your current rate, financial goals, and how long you plan to stay in your home. While today’s rates may not match the record lows of 2020–2021, refinancing can still make sense in the right situation. Let’s explore when it’s smart to refinance—and when it’s better to hold tight.

What Does It Mean to Refinance?

Refinancing replaces your existing mortgage with a new one—ideally with better terms. You can refinance to:

- Lower your interest rate

- Shorten your loan term (30 to 15 years)

- Tap into home equity for cash (cash-out refinance)

- Consolidate debt at a lower rate

- Remove a co-borrower or switch from an adjustable to a fixed rate

It’s essentially a reset button for your mortgage—one that can save money or unlock financial flexibility.

Why Homeowners Are Still Refinancing in 2025

Even though rates have risen from historic lows, there are still strong reasons to refinance:

1. To Consolidate High-Interest Debt

Many Las Vegas homeowners are carrying credit card balances at 20% or higher. A cash-out refinance at even 6–7% can save thousands in interest and simplify monthly payments.

2. To Fund Home Improvements

If your home’s value has appreciated, tapping into equity can help finance renovations that boost resale value or comfort—like kitchen upgrades, new HVAC, or solar.

3. To Switch to a Shorter Term

Refinancing from a 30-year to a 15- or 20-year term can help you build equity faster and reduce total interest over time.

4. To Remove Mortgage Insurance

If you bought your home with less than 20% down, you may be paying PMI. Refinancing once you’ve built enough equity can eliminate that cost.

When Refinancing Might Not Be Worth It

Refinancing doesn’t make sense for everyone. Here are times to think twice:

- You plan to sell soon. If you’ll move within the next 1–3 years, you may not recoup the closing costs.

- Your current rate is already competitive. If you’re locked in near the lows of 3–4%, refinancing could increase costs instead of reducing them.

- You lack sufficient equity. Most lenders require at least 10–20% equity for the best rates.

Before moving forward, ask your lender to calculate your breakeven point—how long it takes for monthly savings to outweigh the upfront costs.

What to Expect With Las Vegas Rates in 2025

Mortgage experts predict modest rate improvements through 2025 as inflation cools and the Federal Reserve gradually adjusts policy. However, no one expects a return to ultra-low pandemic levels soon.

Even so, Vegas homeowners with high equity and solid credit are finding competitive refinance opportunities—especially through specialized programs like cash-out or debt consolidation loans.

Example: When Refinancing Works

Let’s say you owe $400,000 on a home valued at $550,000, with a current rate of 7.5%.

If you refinance to 6.5%, you could save roughly $260 per month—over $3,000 per year.

If closing costs are $4,500, your breakeven point is under two years. Stay longer than that, and every month afterward is pure savings.

Local Tip: Vegas Home Values Are Holding Strong

Las Vegas real estate has shown remarkable stability. Homeowners who bought five or more years ago likely have strong equity positions, making it easier to refinance or cash out responsibly.

Even high-rise condo owners who weathered market fluctuations are now seeing renewed lender confidence as building litigation resolves and appraisals strengthen.

Final Thoughts

Refinancing in Las Vegas can still be worth it—if it aligns with your financial goals. Whether you want to lower payments, consolidate debt, or tap equity for upgrades, today’s rates can still make a meaningful difference.

The key is knowing your numbers. A quick analysis from a local expert can show you exactly what you’d save and how fast you’d recoup costs.

If you’re ready to find out whether refinancing makes sense for you, connect with The Derek Parent Team. We’ll compare options, run your savings scenarios, and help you make a confident, informed decision.