Top 10 High-Rise Buildings in Las Vegas for Investors

Las Vegas is known for its energy, entertainment, and luxury lifestyle, but it’s also a city with one of the most dynamic real estate markets in the country. For investors, high-rise condominiums on or near the Strip represent a unique opportunity because they combine rental demand, prestige, and long-term appreciation.

Whether you’re looking for rental income, a vacation property, or long-term equity growth, Las Vegas high-rises can be a strong investment. Below, we’ve rounded up the top 10 high-rise buildings in Las Vegas for investors—each with its own appeal, amenities, and market potential.

1. Veer Towers

Located in the heart of CityCenter, Veer Towers are a favorite among investors because of their sleek architecture and prime location on the Strip. The units are modern and stylish, and short-term rental potential is high because of the walkability to casinos, dining, and shopping.

2. Waldorf Astoria Residences (Formerly Mandarin Oriental)

For investors seeking prestige, the Waldorf Astoria delivers. It offers five-star amenities, world-class service, and a central Strip location. While prices here are higher, the exclusivity and brand recognition attract luxury buyers and renters.

3. Panorama Towers

Just west of the Strip, Panorama Towers are popular with both residents and investors because of their spacious floorplans and Strip views. The proximity to Allegiant Stadium and the Raiders has also boosted demand, making it an appealing long-term investment.

4. Turnberry Place

Turnberry Place has long been one of the most established high-rise communities in Las Vegas. It offers large residences, resort-style amenities, and a private country club. Investors like it because it attracts long-term tenants who want space and security.

5. Sky Las Vegas

Sky Las Vegas sits directly on Las Vegas Boulevard, giving residents immediate access to the Strip. It features a wide range of amenities, from a resort pool to a spa and fitness center. Because of its central location, investors often find strong rental demand here.

6. Trump International Hotel Las Vegas

This non-gaming property offers hotel-condo style ownership. Investors appreciate the fully furnished units and optional hotel rental program, which makes management easy. Because it caters to travelers who want luxury without the casino environment, it’s a unique niche investment.

7. MGM Signature

For investors who want short-term rental flexibility, the MGM Signature is one of the most popular choices. Its condo-hotel model allows owners to rent their units on a nightly basis through MGM’s program or independently, making it one of the more versatile options.

8. One Las Vegas

Located on South Las Vegas Boulevard, One Las Vegas is ideal for long-term renters who prefer to be near the Strip but not in the middle of it. The larger floorplans and community atmosphere make it attractive to professionals and families.

9. Juhl

Juhl is in Downtown Las Vegas, which has seen major growth thanks to new restaurants, bars, and entertainment options. Investors like Juhl because it caters to young professionals and urban renters, plus it offers flexible leasing options.

10. Allure Las Vegas

Allure combines affordability with location. Situated near the north end of the Strip, it offers strong rental opportunities and a lower entry price point compared to ultra-luxury towers. For investors looking to get started in the high-rise market, Allure is a smart option.

Why High-Rises Work for Investors

High-rise condos in Las Vegas appeal to investors for several reasons:

- Rental Demand: Tourists, professionals, and second-home buyers drive consistent demand.

- Amenities: Pools, gyms, and 24-hour security make these properties attractive to tenants.

- Location: Being close to the Strip or Downtown ensures long-term value.

- Flexibility: Certain properties, like MGM Signature, allow nightly rentals, which can boost returns.

But like any investment, it’s important to evaluate financing, HOA fees, and rental rules before you buy.

Final Thoughts

Las Vegas continues to be one of the strongest real estate markets for investors, and high-rise condos offer a unique blend of lifestyle and income potential. From the exclusivity of Waldorf Astoria to the rental-friendly MGM Signature, there’s a tower to fit nearly every investment strategy.

If you’re ready to explore high-rise opportunities, connect with The Derek Parent Team. With decades of experience in financing high-rise properties, we’ll help you evaluate options, secure the right loan, and maximize your investment.

How a Cash-Out Refinance Can Eliminate Credit Card Debt

If you’re like many Americans, credit card balances have crept up over the past few years. With rising interest rates, carrying balances can feel like a never-ending cycle—minimum payments barely make a dent, and interest charges eat away at your paycheck.

But if you own a home, there’s a potential solution: a cash-out refinance. This strategy allows you to use your home’s equity to pay off high-interest debt, lower your monthly payments, and take control of your finances.

Here’s how it works—and why it might be the reset you need.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your current mortgage with a new, larger loan. The difference between your old loan balance and the new loan is paid out to you in cash. You can then use that money however you’d like—many homeowners use it to pay off credit cards, student loans, or medical debt.

For example:

- Current mortgage balance: $250,000

- New mortgage balance: $300,000

- Cash to you: $50,000 (before closing costs)

That $50,000 could be used to wipe out high-interest credit cards in one move.

Why Credit Card Debt Is So Costly

Credit card debt is one of the most expensive types of borrowing because:

- Average rates exceed 20% in today’s market.

- Making only minimum payments can keep you in debt for decades.

- Interest compounds quickly, so balances grow even if you’re making payments.

Compare that to a mortgage rate—even at 6–7%, it’s still dramatically lower than what you’re paying on most credit cards.

How a Cash-Out Refinance Helps

A cash-out refinance can give you financial breathing room because:

- You Swap High Interest for Lower Interest

Instead of paying 20%+ on multiple cards, you consolidate that debt into your mortgage at a much lower rate. - You Simplify Payments

One mortgage payment is easier to manage than juggling five or six credit card bills every month. - You Improve Cash Flow

Because your interest rate is lower, your monthly payment may drop significantly—even after refinancing. - You Can Rebuild Your Credit

Paying off revolving credit balances reduces your credit utilization ratio, which is a big factor in your credit score.

A Simple Example

Imagine you have $40,000 in credit card debt with an average interest rate of 22%. Your minimum payments might be over $1,200 per month, and most of that is going toward interest, not principal.

Now imagine rolling that $40,000 into a cash-out refinance at 6.5%. Your monthly payment on that debt could shrink to less than half of what you’re paying now—plus you’re paying down principal right away, not just interest.

That kind of change can free up money for savings, emergencies, or simply breathing easier each month.

Things to Consider Before Refinancing

While a cash-out refinance can be a powerful tool, it’s not right for everyone. Here are a few things to weigh:

- Closing Costs: Like any refinance, you’ll pay closing costs, which are usually 2–5% of the loan amount.

- New Loan Term: Extending your loan term can lower your payment, but it also means paying interest over a longer period.

- Discipline Matters: A cash-out refinance won’t help long term if you run credit cards back up again. It’s best paired with a plan to stay out of debt.

- Equity Requirements: You’ll need enough equity in your home—typically at least 20%—to qualify.

Is It Worth It?

Here’s the bottom line: if you’re drowning in credit card debt, a cash-out refinance could be a game-changer because it lets you:

- Consolidate debt into one manageable payment

- Save thousands in interest

- Improve your financial stability

But the best way to know is to run the numbers for your specific situation.

Final Thoughts

Credit card debt doesn’t have to control your life. With home equity on your side, a cash-out refinance can be the tool that finally helps you break free from high-interest balances and move toward financial freedom.

If you’re ready to see whether this strategy makes sense for you, connect with The Derek Parent Team. We’ll review your mortgage, run scenarios based on today’s rates, and help you decide if a cash-out refinance can eliminate your credit card debt once and for all.

Should You Wait for Lower Rates or Buy a Home Now

If you’ve been thinking about buying a home, you’ve probably asked yourself the big question: “Should I wait for lower interest rates, or should I buy now?”

It’s a tough decision, and with so much talk about rate cuts, inflation, and housing supply, it can feel overwhelming. The truth is, there’s no one-size-fits-all answer, because the right move depends on your financial goals, your timeline, and the local market.

Let’s break down the pros and cons so you can make the smartest decision for your situation.

Why Some Buyers Are Waiting

It’s no secret that interest rates are higher today than they were just a few years ago. Buyers who wait often hope that:

- Rates Will Drop Soon: If rates fall by even 1%, monthly payments can become significantly more affordable.

- Lower Payments Mean More Buying Power: A lower rate lets you qualify for a higher loan amount.

- Less Risk of Overpaying: If rates drop and home prices stabilize, some buyers feel they’ll avoid buying at the “peak.”

Waiting can pay off if rates fall quickly, but the risk is that no one can predict the market with certainty.

Why Buying Now Could Be Smarter

On the flip side, many experts argue that buying now can still be the better long-term move, because:

- You Can Always Refinance Later: As the saying goes, “Marry the house, date the rate.” If rates drop, you can refinance into a lower rate.

- Home Prices Are Rising: While rates have slowed the market, Las Vegas home values continue to trend upward. Waiting could mean paying more for the same property later.

- Build Equity Sooner: Buying now means you start building wealth through equity right away, instead of sitting on the sidelines.

- Less Competition (For Now): With some buyers waiting, the current market may give you more negotiating power than in a frenzy of lower rates.

The Las Vegas Market Factor

In Las Vegas, the decision feels even more important because of how competitive the market can get.

- Inventory is Tight: There aren’t enough homes for the demand, and when rates drop, more buyers will jump back in.

- Builders Are Offering Incentives: In places like Henderson and Summerlin, builders are helping with closing costs or even rate buy-downs.

- High-Rises and Investment Properties Are Attractive: Investors are waiting too, so buying before the rush could give you a better deal.

So while waiting for rates to drop sounds appealing, local conditions suggest buying sooner could position you ahead of the competition.

A Simple Example

Imagine you buy a $400,000 home today at a 6.5% interest rate. Your monthly payment might feel higher than you’d like, but you’ve locked in the price.

Now imagine waiting a year. Rates drop to 5.5%, but demand skyrockets and that same home costs $440,000. Even with the lower rate, your payment could be similar—or higher—because prices increased.

This is why timing the market is tricky.

Questions to Ask Yourself

Before you decide whether to wait or buy, ask:

- How long do I plan to live in the home? If it’s long-term, short-term rate fluctuations matter less.

- Am I financially prepared? Do you have savings for a down payment, closing costs, and emergency funds?

- What’s more important right now—stability or savings? If stability is the goal, buying sooner may be better.

- Can I afford the payment today? Never stretch beyond your comfort zone just for the sake of timing.

Final Thoughts

There’s no perfect time to buy a home—but there’s a right time for you.

If you wait for lower rates, you could end up competing with more buyers and paying higher prices. If you buy now, you can secure a home, start building equity, and refinance later if rates drop.

At the end of the day, the best decision comes down to your personal goals, not just headlines.

If you’re ready to explore your options, connect with The Derek Parent Team. We’ll review your situation, run the numbers, and help you decide whether it makes more sense to buy now or wait.

What Is a Non-QM Loan? Mortgage Options for Self-Employed & Investors

If you’re self-employed, a real estate investor, or someone with unique income sources, you may have run into challenges getting approved for a traditional mortgage. That’s because most loans fall under Qualified Mortgage (QM) guidelines, which have strict requirements around income verification, debt-to-income ratios, and credit history.

But what if your income doesn’t fit into those boxes? That’s where Non-QM loans come in.

What Is a Non-QM Loan?

A Non-Qualified Mortgage (Non-QM) is any home loan that doesn’t meet the standard guidelines set by the Consumer Financial Protection Bureau (CFPB) for Qualified Mortgages.

That doesn’t mean they’re risky or bad—it simply means lenders use alternative methods to verify income and assess risk.

Non-QM loans are designed for borrowers who are financially strong but don’t meet traditional documentation rules.

Who Are Non-QM Loans Designed For?

Non-QM loans are popular with:

- Self-Employed Borrowers: Instead of W-2s, lenders may use bank statements, 1099s, or profit-and-loss statements to verify income.

- Real Estate Investors: Programs like DSCR loans (Debt Service Coverage Ratio) allow approval based on rental income instead of personal income.

- High-Net-Worth Individuals: Asset depletion loans let you qualify by using your investment or savings accounts.

- Borrowers with Credit Challenges: Some Non-QM lenders work with recent credit events like bankruptcy or foreclosure, provided you show financial stability.

Benefits of a Non-QM Loan

- Flexible Income Verification

Instead of W-2s, you can use alternative documents like bank statements or rental income. - Access to More Loan Programs

DSCR, bank statement, and interest-only loans give borrowers creative options that traditional lenders don’t offer. - Opportunity to Scale Investments

Investors can leverage Non-QM programs to grow rental portfolios without the limitations of conventional underwriting. - Credit Flexibility

You may qualify even if you’ve had a credit event in the recent past.

Things to Consider

While Non-QM loans can be a powerful tool, it’s important to understand the trade-offs:

- Higher Interest Rates: Non-QM loans often come with slightly higher rates than conventional mortgages.

- Larger Down Payments: Some programs may require 10–20% down or more, depending on the loan type.

- Lender Variety: Not all lenders offer Non-QM loans, so working with an experienced mortgage professional matters.

The Las Vegas Factor

In a city like Las Vegas, Non-QM loans are especially valuable. With so many self-employed professionals, entrepreneurs, and real estate investors, these programs allow buyers to qualify who might otherwise be turned away by traditional banks.

Whether you’re an Uber driver with fluctuating income, a casino worker earning tips, or an investor buying a short-term rental property, Non-QM programs can provide the financing you need.

Final Thoughts

Non-QM loans open the door for self-employed buyers, investors, and anyone who doesn’t fit the traditional lending mold. They’re flexible, creative, and designed for real-world borrowers.

If you’re in Las Vegas and want to explore your mortgage options, reach out to The Derek Parent Team. With years of experience in Non-QM lending, we’ll help you find the right program—whether it’s a bank statement loan, DSCR loan, or another Non-QM option.

Reverse Mortgages Explained: A Retirement Strategy for Homeowners 62+

For many homeowners, their house is their biggest asset. But when retirement comes around, savings may not stretch as far as expected, and fixed incomes can feel tight. That’s why more and more seniors are exploring reverse mortgages as a retirement strategy.

If you’re 62 or older, a reverse mortgage can allow you to tap into your home equity without selling your home or making monthly mortgage payments. Here’s how it works—and why it could be the financial solution you’ve been looking for.

What Is a Reverse Mortgage?

A reverse mortgage is a special type of loan available to homeowners 62 and older. Instead of you making payments to the lender, the lender pays you.

You can receive funds as:

- A lump sum

- Monthly payments

- A line of credit you draw from when needed

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is federally insured.

How It Works

With a reverse mortgage:

- You must continue to live in the home as your primary residence.

- You’re still responsible for property taxes, insurance, and maintenance.

- The loan balance grows over time, and is repaid when you sell, move out, or pass away.

Because no monthly mortgage payments are required, it frees up cash flow during retirement.

Benefits of a Reverse Mortgage

- Supplement Retirement Income

Use your home equity to cover living expenses, medical costs, or even travel. - Stay in Your Home

You don’t need to sell or downsize to access your equity—you can stay right where you are. - Flexibility

Choose how you receive the funds—lump sum, line of credit, or monthly income. - Non-Recourse Protection

You or your heirs will never owe more than the home’s value, even if the loan balance grows larger. - No Monthly Mortgage Payments

This can dramatically reduce financial stress in retirement.

Things to Consider

A reverse mortgage isn’t the right fit for everyone. Here are a few important considerations:

- Home Equity Requirements: The more equity you have, the more you can access.

- Costs & Fees: Like any loan, reverse mortgages have upfront costs.

- Impact on Inheritance: Since the loan is repaid when the home is sold, heirs may receive less.

- Staying in the Home: If you plan to move soon, a reverse mortgage may not make sense.

Who Can Benefit Most?

Reverse mortgages work best for:

- Seniors on fixed incomes who want extra financial flexibility

- Homeowners who plan to stay in their home long-term

- Retirees who want to eliminate existing mortgage payments

- Families who want to preserve other retirement assets by leveraging home equity first

Reverse Mortgage in Las Vegas

In Las Vegas, where home values have appreciated significantly, many retirees have built up substantial equity. Instead of selling, a reverse mortgage lets you enjoy the lifestyle you’ve worked hard for—whether that means helping family, traveling, or simply covering monthly expenses comfortably.

Final Thoughts

A reverse mortgage can be a powerful retirement strategy for homeowners 62 and older. It allows you to convert home equity into usable income while staying in your home and eliminating monthly mortgage payments.

Like any financial decision, it’s important to weigh the pros and cons and talk with a trusted advisor.

If you’d like to explore whether a reverse mortgage is right for you, connect with The Derek Parent Team. We’ll walk you through your options and help you decide if this strategy fits your retirement goals.

First-Time Homebuyer Guide: Buying a Home in Las Vegas

Buying your first home is one of the biggest milestones of your life, and in a city like Las Vegas—where the real estate market moves quickly, neighborhoods each offer a unique lifestyle, and financing options can feel overwhelming—it’s important to have the right guidance.

This guide will walk you through everything you need to know as a first-time homebuyer in Las Vegas. From preparing your finances to choosing the right neighborhood, you’ll see the steps that make your purchase smoother and more successful.

Why Las Vegas is a Great Place for First-Time Buyers

Las Vegas isn’t just the “Entertainment Capital of the World.” Over the last decade, it has grown into a thriving city with family-friendly communities, expanding job opportunities, and a strong real estate market. Here’s why first-time buyers are drawn to Vegas:

- Affordability Compared to Other Major Cities: Prices have risen, but Las Vegas is still more affordable than many coastal markets like Los Angeles or San Francisco.

- No State Income Tax: Nevada has one of the most tax-friendly environments, so homeowners keep more of their income.

- Variety of Communities: You can choose a modern condo on the Strip, a new build in Summerlin, or a quiet neighborhood in Henderson—because the city has something for everyone.

- Strong Job Market: With tourism, technology, and logistics industries growing, the local economy provides stability for homeownership.

Step 1: Prepare Your Finances

Before you start shopping for homes, it’s important to take an honest look at your finances, because being prepared will make the process less stressful.

Check Your Credit Score

Your credit score plays a big role in determining what kind of mortgage you qualify for and the interest rate you’ll receive. Aim for a score of 620 or higher, but some loan programs can work with lower scores.

Save for a Down Payment

Traditionally, buyers put down 20%, but in today’s market, first-time homebuyers have more flexible options:

- FHA loans can require as little as 3.5% down.

- VA loans (for veterans and military families) often require no down payment.

- Conventional loans may allow for 3–5% down.

Get Pre-Approved for a Mortgage

Pre-approval not only shows sellers you’re serious, but it also gives you a clear picture of your budget. A local lender like The Derek Parent Team can walk you through the process and help you choose the right loan for your situation.

Step 2: Understand the Las Vegas Market

The Las Vegas housing market can be competitive, and prices vary depending on location, amenities, and demand.

- Entry-Level Homes: Many first-time buyers start with townhomes or smaller single-family houses.

- New Construction: Builders in Summerlin, North Las Vegas, and Henderson often offer incentives like closing cost assistance, so these can be a great option.

- High-Rise Condos: If you love city living, high-rises near the Strip offer luxury amenities but often come with HOA fees.

Because the market changes quickly, it’s smart to work with a professional who can help you set realistic expectations. You might face multiple-offer situations, so being prepared will give you an advantage.

Step 3: Choose the Right Neighborhood

Las Vegas is made up of diverse communities, and each has its own lifestyle. Here are a few popular areas for first-time buyers:

- Summerlin: Known for its master-planned communities, great schools, and parks. It’s perfect for families and professionals.

- Henderson: Offers a suburban feel with access to Lake Mead, shopping, and family-friendly neighborhoods.

- North Las Vegas: More affordable options with newer builds and expanding amenities, so it’s ideal if you’re looking for value.

- Southwest Las Vegas: Up-and-coming with plenty of new construction and easy access to the Strip.

Think about your lifestyle and priorities. Do you want to be close to work, or do you prefer quiet streets? Do you need great schools, or are amenities more important? Your answers will help narrow your search.

Step 4: Work with the Right Real Estate and Mortgage Professionals

Buying your first home can feel overwhelming, but you don’t have to do it alone. Having a trusted team by your side makes all the difference.

- Realtor: Helps you find properties, negotiate offers, and guide you through closing.

- Mortgage Lender: Assists with financing options, pre-approvals, and making sure your loan closes smoothly.

- Home Inspector: Ensures your home is in good condition before you buy.

At The Derek Parent Team, we specialize in helping first-time buyers navigate financing options in the Las Vegas market. Because we’ve been in the industry for decades, we know how to make the process simple and stress-free.

Step 5: Make an Offer

Once you’ve found the right home, it’s time to make an offer—and strategy is everything.

- Be Competitive: In a hot market, lowball offers often get rejected.

- Include a Strong Pre-Approval Letter: This reassures the seller you’re financially ready.

- Consider Seller Incentives: Builders and sellers sometimes offer credits toward closing costs, so ask your agent to negotiate these for you.

Step 6: Closing the Deal

The closing process typically takes 30–45 days. During this time, you’ll:

- Finalize your mortgage paperwork

- Complete inspections and appraisals

- Sign your closing documents

It can feel like a lot, but once you’re done, you’ll officially get the keys to your new home.

Tips for First-Time Homebuyers in Las Vegas

- Don’t Skip the Inspection: Even if the home looks perfect, inspections can reveal costly issues.

- Know Your Budget Beyond the Mortgage: Property taxes, HOA fees, and utilities all add up, so plan ahead.

- Think Long-Term: Buy a home you can grow into, not just one that works for right now.

- Stay Flexible: The right home might not check every single box, but it should meet your most important needs.

- Leverage First-Time Buyer Programs: Nevada offers down payment assistance and other incentives, so take advantage if you qualify.

Final Thoughts

Buying your first home in Las Vegas is an exciting step, and with the right preparation, it doesn’t have to feel overwhelming. The city has a strong economy, a wide range of neighborhoods, and flexible financing options—so there’s truly something for every type of buyer.

The key is preparation: understanding your finances, working with trusted professionals, and knowing what to expect in the market.

If you’re ready to take the next step, connect with The Derek Parent Team. We’ll guide you through the process, answer your questions, and help you secure the right loan for your first home in Las Vegas.

Gifting a Home

Are you planning on gifting a home to someone this holiday season? For most people, a gift this generous is probably out of the question. But maybe you had a good year financially, and a family member needs the help. Whatever the case is, here are some guidelines when it comes to giving the gift of real estate.

Buying a new home outright

Instead of buying a new home outright, it may be wise to gift the cash for the home, NOT the home itself. Everyone has their own preferences when it comes to what they want in a home, so allowing the recipient of your generous gift to choose their home is probably a much safer idea.

We highly recommend running this by your accountant, as you may also need to file a gift tax return.

Gifting the down payment

Gifting money for a down payment works in pretty much the same way—except when it comes to the mortgage. If there’s even the slightest hint that the money is a loan rather than a gift, it can hinder the recipient’s ability to get a mortgage.

You’ll want to work closely with the recipient’s lender to file the appropriate paperwork, which will include a verified gift letter certifying the funds are a gift, not a loan. The lender will also likely need to examine your finances to determine if you’re able to gift. And remember, most lenders won’t permit gifts from nonfamily members.

Gifting an existing home

Would your children love to own the home they grew up in? Unfortunately this is a poor option, especially if both parents are still living.

One of the tricky struggles with gifting a home you own is the differential between the cost basis (what you first paid for the house) and the current fair market value—which could be hundreds of thousands of dollars, depending on how long you’ve owned it and the appreciation in the area.

This might not matter if your children plan to live in the home forever: The gift will be subject to your gift tax limit, and they’ll only pay capital gains tax if they sell. But if (and, likely, when) they sell, they’ll be stuck paying taxes on the difference.

If you’re determined to gift someone a home this holiday season, remember to keep these guidelines in mind. It IS possible, but of course it’s extremely important to consult your accountant and/or financial advisors to ensure it’s done in the right way.

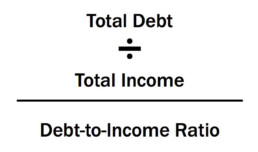

Debt vs. Income: What You Need to Know

Income is a crucial component lenders consider when granting you a mortgage. However, income is not all that a lender will consider when determining how much you qualify for. They will also look at your debt to income ratio, in addition to other financial indicators.

If you make a lot of money but also have a lot of debt, this could be a red flag to lenders and reduce your borrowing capacity.

How debt & income affect your mortgage

Income and debt are yin and yang, opposites of each other. Debt is a liability, whereas the more income you have, the more power you have to make those liabilities go away. Having more income also gives more control of the following.

- It allows you to prepay your mortgage faster.

- It allows you to qualify for more when buying a home.

- It allows you to move into a shorter and more aggressive debt pay-down structure such as a 15-year fixed-rate mortgage.

- It allows you to pay off your credit cards in full every month, rather than paying unnecessary and pricey interest (assuming you’re making smart financial choices).

- It allows you to consume smart debt, such as purchasing a rental property that can generate even more income.

- It allows you to make investments, generating more income.

- It allows you to save and plan for the future.

Having this control over these and other financial choices is precisely why it is CRUCIAL to carry a debt-to-income ratio no bigger than 36% of your gross monthly income. The goal when borrowing mortgage money is to put yourself in a position where you can have a life beyond paying it off, while still saving and contributing to your retirement savings.

What you need to consider before you buy

Always remember it takes $2 of income to offset every $1 of debt for a 2:1 ratio for mortgage qualifying purposes.

If you want that fancy Mercedes at an $800 per month car payment, then you’ll need $19,200 a year in extra income or you’ll need to cut a current debt payment of $800 to balance your debt-to-income ratio.

If you want the dream house at $3,500 month, then aim your debt-to-income ratio at 36%—meaning you would ideally want income at $117,000 a year without carrying other consumer obligations in order to afford this mortgage.

When you are thinking about buying a home, also remember to consider what the future holds for your finances. For example, if your monthly expenses will likely increase in the future due to expenses like childcare costs or college tuition, this is something important to keep in mind. By keeping your debt to income ratio below 36% of your gross monthly income, you’ll put yourself in a position to enjoy your new home but also be able to continue saving for your future.

Why The Holidays are a Great Time to Refinance Your Mortgage

If you're a homeowner in Las Vegas and you want to lower your mortgage payment and/or consolidate your debt, then refinancing might be the right option for you!

So how does it Work?

Well, its not always that simple. There are many factors that determine if refinancing is right for you, such as interest rates and your current equity in your home. It also depends on what your current needs are. Do you want to lower your monthly payments and interest rate? Or do you want to cash out to consolidate your debt in time for the holiday season? There are different types of refinancing options to choose from.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The other option is a cash-out refinance - This is where you refinance your mortgage for more than you currently owe, then pocket the difference. Sounds great, right? Well, there are many factors that go into the process of cash-out refinancing. For example, you will need to apply and submit various documents, get an appraisal on your home, and have a good standing with your current mortgage for the past 12 months. However, if you qualify, cashing out is a great way to consolidate your debt and put more money in your pocket during the holiday season! Please note that when you do a cash out refinance, you are not eliminating your debt. You are consolidating it through your mortgage and will pay it off through your monthly loan payment.

The good news is that the Las Vegas real estate market is booming! Interest rates are competitive, and home values are increasing. That means that the majority of home owners have equity in their homes. You could take advantage of the our refinance options and lower your monthly payments, in addition to "cashing out" the difference.

If you are a homeowner in Las Vegas and you would like to take advantage of our refinance opportunities this holiday season, give us a call at 702-331-8185!

5 Traits to Look for in a Realtor

Choosing the right real estate agent to help you buy or sell a home is no easy task! In fact, it can make all the difference in the world. The wrong agent can cost you time and money, and possibly even your potential dream home!

When you're interviewing potential agents, make sure they have these five qualities.

1. Remarkable Listener

The true to key to a good agent is how well they listen and retain what they heard. If you say your budget maximum is $250,000, then they should stick to within that price when providing properties to view. A good listener should quickly ascertain your needs and wants and have a plan of approach based on your criteria.

2. Great Communicator

No one wants an agent who lists a home and is rarely heard from again. You want an agent who is enthusiastically speaking to you often on what is happening in either the selling or buying process. Your agent should inform you about how she or he will deal with your transaction from start to finish. An agent who is in constant communication with you should also be in continual communication with all other parties in the transaction to keep you better apprised. The agent should return any texts, calls or emails as quickly as possible.

3. Amazingly Honest

Dishonesty breeds distrust. You want an agent whom you can always trust to be truthful and upfront throughout the entire sales process, even if the outcome is not easy to hear. An honest agent will price the property right at listing for a quick sale or inform the buyer of unseen issues with the home they are interested in. Having a trusted professional on your side means there is one less thing to worry about.

4. Incredibly Ethical

An agent who is also a Realtor suggests that a strict code of ethics will be adhered to throughout the transaction process. Abiding by the Realtor Code of Ethics means necessary transaction facts are not misrepresented or concealed, contract deals are completely spelled out in the writing, all people are treated equally and your best interests will be protected, among other code specifications.

5. Natural Negotiator

The best agents are natural negotiators, able to seal a deal with shrewd and aggressive bargaining skills. Excellent negotiators save you money and seal the deal faster. Ask a potential agent to describe their most difficult negotiation and what the outcome was or provide a difficult scenario and find out how that agent would handle it.

If you're buying or selling in the Las Vegas area and are looking for a good real estate agent, give me a call at 702.331.8185! I work with a lot of outstanding agents and will be happy to give you some referrals.