2026 Housing Market Outlook: What Las Vegas Homebuyers Should Know

As we look ahead to 2026, many buyers are asking the same question: What will the Las Vegas housing market really look like?After years of rapid appreciation, rising interest rates, and shifting buyer behavior, the market is entering a new phase—one that rewards preparation, patience, and smart strategy.

Here’s what homebuyers in Las Vegas should know as 2026 approaches.

1. The Market Is Moving Toward Balance, Not a Downturn

Contrary to some headlines, Las Vegas is not heading toward a housing crash. Instead, the market is stabilizing after years of extreme volatility. Price growth has slowed, inventory has improved modestly, and buyer behavior has become more deliberate.

This shift toward balance benefits buyers because:

- Prices are no longer jumping month over month

- Sellers are more open to negotiation

- Appraisals are more predictable

- Financing strategies matter more than speed

In short, 2026 is shaping up to be a market where informed buyers have real leverage.

2. Home Prices Are Expected to Rise Gradually

Most forecasts point to moderate appreciation, not explosive growth. In Las Vegas, that likely means 3–5% annual price increasesin most neighborhoods, with stronger performance in high-demand areas such as Summerlin, Henderson, and the Northwest Valley.

What’s supporting prices:

- Continued population growth

- Limited resale inventory

- Strong job creation

- Out-of-state migration

- Few distressed sellers

For buyers, this means waiting for prices to drop significantly may not be realistic. The better strategy is buying when the numbers work—and letting time build equity.

3. Mortgage Rates May Improve, But Timing Matters

Interest rates remain one of the biggest wild cards heading into 2026. While no one expects a return to 3% mortgages, many economists anticipate gradual rate improvementas inflation cools and economic policy stabilizes.

Even a modest rate drop can:

- Increase buying power

- Bring more buyers back into the market

- Reduce seller concessions

- Increase competition

This is why many buyers are choosing to buy beforerates improve—then refinance later—rather than waiting and competing with a larger buyer pool.

4. Inventory Will Improve, but Still Favor Sellers

New construction is expanding across Las Vegas, especially in:

- Summerlin West

- Henderson

- Skye Canyon

- North Las Vegas

However, many current homeowners are holding onto low-rate mortgages and choosing not to sell. That limits resale inventory and keeps supply tight.

What this means for buyers in 2026:

- More options than recent years

- Fewer bidding wars than peak markets

- Still strong demand for move-in-ready homes

This isn’t a buyer’s market—but it’s far more navigable than it was just a few years ago.

5. New Construction Will Play a Bigger Role

Builders are expected to remain aggressive heading into 2026, especially with incentives designed to offset affordability challenges.

Buyers may see:

- Closing cost credits

- Temporary rate buydowns

- Discounted upgrades

- Incentives on quick move-in homes

For many buyers, new construction may offer better overall value than resale—especially when incentives are factored into the total monthly payment.

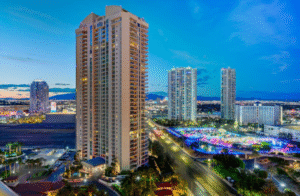

6. High-Rise and Condo Markets Are Strengthening

Las Vegas high-rise and condo markets are quietly improving. As litigation clears in some buildings and financing options expand, buyer confidence is returning.

By 2026, expect:

- More financing availability

- Continued demand from out-of-state buyers

- Stable pricing in premium towers

- Strong interest in low-maintenance living

This is especially relevant for professionals, retirees, and investors seeking convenience and long-term value.

7. Preparation Will Be the Biggest Advantage

The buyers who succeed in 2026 will not be the ones trying to time the market perfectly—they’ll be the ones who are prepared.

That means:

- Getting pre-approved early

- Understanding loan options

- Comparing scenarios (buy now vs. wait)

- Knowing which neighborhoods align with long-term goals

- Working with a local expert who understands Las Vegas market cycles

At The Parent Team, we help buyers analyze these factors clearly—so decisions are based on data, not headlines.

Final Thoughts

The 2026 Las Vegas housing market is shaping up to be one of the most strategic buying environments in years. Prices are stabilizing, inventory is improving slightly, and financing options are evolving. For prepared buyers, that combination creates opportunity.

If you’re thinking about buying in 2026—or want to position yourself early—connect with The Derek Parent Team. We’ll help you understand your buying power, evaluate timing, and build a plan that fits both today’s market and tomorrow’s goals.

What Today’s Interest Rates Really Mean for Las Vegas Buyers

Interest rates dominate real estate headlines, and for buyers in Las Vegas, the noise can feel overwhelming. One-week rates are “coming down,” the next week they’re “higher for longer.” The result? Many buyers are stuck waiting, unsure whether now is the right time to act.

But the reality is more nuanced. Today’s interest rates don’t automatically mean you should stop buying — they simply mean your strategy matters more than it used to.

Let’s break down what today’s rates actually mean for Las Vegas buyers and how to move forward with clarity instead of hesitation.

1. Rates Are Higher — But They’re No Longer Rising Fast

While today’s mortgage rates are higher than the historic lows of 2020–2021, the pace of increases has slowed significantly. That matters.

When rates rise rapidly, buyers freeze. But when rates stabilize — even at higher levels — the market begins to normalize. That’s exactly what we’re seeing now.

For buyers, this creates:

- More predictable monthly payments

- Less emotional decision-making

- Better ability to plan long-term

Stability doesn’t make headlines, but it creates opportunity.

2. Buying Power Has Shifted, Not Disappeared

Yes, higher rates affect affordability. A higher rate means a higher monthly payment on the same purchase price. But that doesn’t mean buying power is gone — it means buyers are adjusting how they buy.

Today’s Las Vegas buyers are:

- Negotiating seller credits

- Using temporary rate buydowns

- Choosing different loan structures

- Being more selective with price and location

In many cases, buyers are paying less upfrontthan they would have during peak competition years, even if the rate is higher.

3. Prices in Las Vegas Are Holding — Not Collapsing

One of the biggest misconceptions is that higher rates automatically cause prices to drop. In Las Vegas, that hasn’t happened in a meaningful way.

Why?

- Continued out-of-state migration

- Strong job growth

- Limited resale inventory

- Homeowners holding low-rate mortgages

- Ongoing demand in Summerlin, Henderson, and the Northwest

Prices have stabilized, not crashed. That means waiting for a major price correction may not deliver the savings buyers expect.

4. Competition Is Lower — and That’s a Big Advantage

Higher rates have reduced buyer competition, and this is one of the most overlooked benefits of today’s market.

With fewer buyers competing, you’re more likely to:

- Avoid bidding wars

- Negotiate repairs and credits

- Secure seller-paid closing costs

- Take time to make informed decisions

In past years, buyers paid less interest but far more in overbids and waived protections. Today’s buyers often gain leverage instead.

5. Rates Are Temporary — Equity Is Not

Interest rates change. Home prices and equity compound over time.

If you buy today:

- You can refinance later if rates improve

- You lock in today’s price

- You start building equity immediately

- You protect yourself from rising rents

If you wait:

- Prices may rise while rates fall

- Competition may return

- Incentives may disappear

This is why many buyers are choosing to buy the home now and refinance the rate later.

6. New Construction Is Offering Real Value

Las Vegas new construction has become one of the most rate-friendly options for buyers.

Builders are currently offering:

- Rate buydowns

- Closing cost credits

- Discounted upgrades

- Quick move-in incentives

These incentives directly offset today’s interest rates and can dramatically reduce monthly payments in the early years of ownership.

7. The Right Loan Strategy Matters More Than the Rate

In today’s market, success isn’t about chasing the lowest advertised rate — it’s about choosing the right structure.

That may include:

- Temporary buydowns

- Adjustable-rate mortgages (for the right buyer)

- Shorter terms

- Strategic refinancing plans

- Equity-based strategies

This is where working with a local expert makes a measurable difference.

Final Thoughts

Today’s interest rates aren’t a stop sign — they’re a signal to slow down, be strategic, and buy smarter. For Las Vegas buyers, the combination of stabilizing rates, steady prices, reduced competition, and creative financing options creates real opportunity.

If you want to understand how today’s rates affect yourbuying power, your monthly payment, and your long-term plan, connect with The Derek Parent Team. We’ll help you evaluate real numbers, real scenarios, and real options — so you can move forward with confidence instead of waiting on headlines.

What Credit Score Do You Actually Need to Buy a Home in Nevada?

One of the most common questions buyers ask is also one of the most misunderstood:

“What credit score do I really need to buy a home?”

If you’re buying in Nevada, the answer isn’t a single number. It depends on the loan program, your overall financial profile, and how the lender structures your mortgage.

Let’s break it down clearly—without myths or scare tactics.

The Short Answer: You Don’t Need Perfect Credit

Many buyers assume they need a 740+ credit score to qualify. In reality, many Nevada buyers purchase homes with scores well below that.

What matters most is:

- The loan type

- Your income and debt

- Your down payment

- Your recent credit behavior

Credit score opens doors—but it’s only one piece of the approval puzzle.

Minimum Credit Scores by Loan Type

Here’s how the most common mortgage programs break down.

Conventional Loans

- Minimum score: 620

- Best pricing: 740+

- Down payment options: As low as 3%

Conventional loans reward higher credit scores with better interest rates, but many buyers qualify comfortably in the 620–700 range—especially with solid income and manageable debt.

FHA Loans

- Minimum score: 580(with 3.5% down)

- Possible with lower scores: 500–579(with larger down payment, lender-dependent)

FHA loans are popular with first-time buyers because they’re more forgiving of past credit issues. Recent payment history matters more than old mistakes.

VA Loans (for Eligible Veterans)

- No official minimum set by VA

- Most lenders prefer: 620+

- Down payment: 0%

VA loans are one of the most flexible options available. Many veterans qualify even after past credit challenges, as long as current finances are stable.

Jumbo Loans

- Typical minimum: 700–720

- Stronger reserves required

- Higher income verification

Jumbo loans are used for higher-priced homes and require stronger credit profiles—but even here, structure and assets matter.

Why Lenders Look Beyond the Score

A credit score is a snapshot, not the full story. Lenders also evaluate:

- Debt-to-income ratio (DTI)

- Payment history over the last 12–24 months

- Credit utilization

- Derogatory items (collections, late payments)

- Cash reserves after closing

A buyer with a 640 score and low debt may be a better borrower than someone with a 720 score and high monthly obligations.

Common Credit Myths That Hold Buyers Back

Let’s clear up a few misconceptions.

Myth #1: One late payment ruins your chances

Not true. Pattern matters more than one mistake.

Myth #2: You must pay off all collections

Often false. Many collections don’t need to be paid to qualify.

Myth #3: You should close old accounts

Closing accounts can hurt your score by reducing credit history and available credit.

Myth #4: You should wait until your score is “perfect”

Waiting can cost you more in rising prices than you save in rate improvements.

How Much Difference Does Credit Score Make in Your Rate?

Credit score impacts pricing—but not always as dramatically as buyers fear.

For example:

- A buyer at 680may pay slightly more than a buyer at 740

- But seller credits, buydowns, or refinancing later can offset that difference

This is why many buyers choose to buy now and optimize later, instead of waiting indefinitely.

What If Your Score Isn’t Where You Want It Yet?

If you’re not quite ready today, that’s okay—but guessing isn’t the solution.

A short credit review can:

- Identify what’s helping or hurting your score

- Show which actions actually move the needle

- Prevent unnecessary credit changes

- Create a clear timeline to approval

Athttps://derekparentteam.com, we help buyers map out specific, realistic steps—not generic advice.

The Most Important Takeaway

The credit score you “need” isn’t a fixed number. It’s about:

- Choosing the right loan

- Structuring the deal correctly

- Understanding what lenders actually care about

Many buyers delay homeownership unnecessarily because of outdated or incorrect credit assumptions.

Final Thoughts

If you’re thinking about buying a home in Nevada, your credit score matters—but it doesn’t need to be perfect. With the right strategy, many buyers qualify sooner than they expect.

If you want an honest review of where you stand—and what’s possible—connect with The Derek Parent Team. We’ll break down your options clearly and help you move forward with confidence.

Homeowners Are Sitting on Billions in Untapped Equity — Here’s How to Use Yours Wisely

Homeowners across the U.S. — especially in fast-growing markets like Las Vegas — are sitting on massive amounts of tappable equity. In fact, recent housing data shows Americans now have more than $16 trillionin home equity, with billions of that right here in Nevada.

But the big question is this:

What should you actually do with that equity?

Used wisely, your home equity can help you build wealth, eliminate debt, invest in your future, and strengthen your financial foundation. Used carelessly, it can create unnecessary risk.

Here’s how to use your equity strategically and responsibly.

1. Consolidate High-Interest Debt

Credit card interest rates are now averaging 20–30%, and many homeowners are feeling the pressure. If you’re carrying high-interest balances, a cash-out refinanceor HELOCcan dramatically reduce your monthly obligations.

Why this strategy works:

- Mortgage rates are significantly lower than credit card rates

- One consolidated payment is easier to manage

- Lower utilization often boosts your credit score

- Freeing up cash flow reduces financial stress

This is one of the smartest, most impactful uses of home equity — especially heading into 2026 with rising consumer debt.

2. Make High-ROI Home Improvements

Renovations can increase property value, improve your living space, and boost long-term equity. But not all upgrades are created equal.

High-return improvements include:

- Kitchen remodels

- Bathroom upgrades

- New flooring

- Exterior improvements for curb appeal

- Energy-efficient windows

- HVAC upgrades

A cash-out refinance or HELOC often makes more financial sense than personal loans or store financing, which carry higher rates.

3. Buy an Investment Property

If you’ve built strong equity and want to grow wealth, using that equity for a down payment on a rental or investment propertycan create long-term returns.

Benefits include:

- Additional monthly income

- Appreciation on multiple properties

- Tax benefits for investors

- A hedge against inflation

Many of your clients are leveraging their primary home equity to purchase:

- Long-term rentals

- Mid-term furnished units

- High-rise condos

- Second homes in Las Vegas communities

This is how homeowners move from paying a mortgage… to building a portfolio.

4. Refinance Into a Better Loan

Even if rates today aren’t at historic lows, refinancing can still make sense, especially if you can:

- Remove mortgage insurance (PMI)

- Switch from an ARM to a fixed-rate mortgage

- Shorten your term (30-year to 15-year)

- Reduce your interest rate

- Lower your monthly payment

If you bought in the mid-rate years and your equity has climbed, refinancing may open doors that weren’t available when you closed originally.

5. Build an Emergency or Opportunity Fund

Another smart equity move is pulling a conservative amount of cash for liquidity — not spending.

This gives homeowners:

- A financial safety net

- Funds for unexpected medical or family expenses

- Capital to jump on investment opportunities

- Flexibility during job changes or business transitions

A HELOC is especially useful for this because you only pay interest on what you use.

6. Prepare for Major Life Events

Your equity can help you navigate big moments with less financial strain.

Examples include:

- Paying for college tuition

- Funding a wedding

- Helping a family member buy a home

- Covering medical or caregiving expenses

- Preparing for retirement transitions

Instead of draining savings, homeowners can strategically tap equity to protect cash reserves.

7. Don’t Use Equity for “Lifestyle Debt”

Before leveraging your equity, it’s just as important to know what notto use it for.

Avoid spending equity on:

- Vacations

- Luxury purchases

- Vehicles

- Consumables

- Short-lived expenses

These reduce your net worth without creating long-term value.

How to Know Which Strategy Fits You Best

The right equity move depends on your goals:

- Want lower monthly expenses?

Debt consolidation or refi into a lower rate. - Want long-term wealth?

Invest in property or shorten your mortgage term. - Want flexibility?

Open a HELOC and keep funds available. - Want to upgrade your home?

Cash-out for renovations with strong ROI.

AtThe Derek Parent Team, we analyze your equity, credit, income, and goals to determine the smartest move — not just the easiest one.

Final Thoughts

Homeowners today have access to more equity than any time in history — but the real power lies in using it wisely. Whether you want to invest, reduce debt, protect your finances, or improve your home’s value, the right strategy can move you closer to your long-term financial goals.

If you’d like a customized equity analysis or want to explore cash-out, HELOC, or refinance options, connect with The Derek Parent Team. We’ll help you understand what’s possible and how to maximize your equity safely and strategically.

From Tourists to Homebuyers — How Vegas Migration Is Shaping Real Estate

For decades, people came to Las Vegas for entertainment, gaming, and world-class dining. But today, more visitors are deciding not to leave. What was once a tourist destination has become one of the fastest-growing housing marketsin the country, attracting families, professionals, and retirees from across the U.S.

So what’s driving this migration—and how is it shaping the local real estate market?

Let’s break it down.

1. From Visitors to Residents

Each year, millions of tourists visit Las Vegas. Many fall in love with the sunshine, affordability, and lifestyle—and decide to call it home. In fact, studies from the Las Vegas Global Economic Alliance (LVGEA)show that a significant percentage of new residents first experienced the city as visitors.

Unlike traditional resort towns, Vegas offers more than entertainment. It’s a city with growing job opportunities, new master-planned communities, and a surprisingly family-friendly culture.

2. Why People Are Moving to Las Vegas

Affordability Compared to Coastal Cities

Homebuyers relocating from California, Arizona, and the Pacific Northwest find that their money goes much further in Nevada. Even with rising prices, Las Vegas homes remain more affordable than those in Los Angeles or San Francisco—sometimes by 30–40%.

Tax Benefits

Nevada has no state income tax, which appeals to remote workers, entrepreneurs, and retirees looking to keep more of their earnings.

Remote Work Flexibility

The post-pandemic shift to remote and hybrid work allows professionals to live where they want, not just where their jobs are based. Las Vegas has become a hotspot for those seeking big-city amenities without big-city costs.

Lifestyle and Climate

From golf courses and hiking trails to world-class restaurants and shows, Vegas offers year-round recreation. The warm climate also attracts “snowbirds” seeking to escape cold winters.

3. How Migration Is Transforming the Market

Rising Home Demand

New residents are fueling steady demand for housing, especially in areas like Summerlin, Henderson, and the Northwest Valley.Builders are racing to keep up with population growth, while resale inventory remains tight.

Shift in Buyer Demographics

Vegas buyers now include more young professionals and remote workers, not just retirees. This has increased demand for condos, townhomes, and single-family homes with home offices or flexible spaces.

Investment Opportunities

Out-of-state investors see Las Vegas as a high-potential market for long-term rentals and vacation properties. Even as short-term rental regulations evolve, investor interest remains strong.

High-Rise and Luxury Market Growth

Migration has reignited interest in high-rise livingalong the Strip and in suburban luxury communities like The Ridges and MacDonald Highlands. High-net-worth individuals are trading California luxury for Vegas lifestyle and tax savings.

4. Challenges That Come With Growth

While migration has energized the economy, it also brings challenges:

- Inventory Shortage:Demand continues to outpace supply, keeping prices elevated.

- Affordability Pressure:Wage growth hasn’t fully kept up with housing costs.

- Infrastructure Needs:The city is rapidly expanding roads, schools, and utilities to keep up with growth.

Still, compared to many U.S. metros, Las Vegas remains one of the most accessible and opportunity-rich housing marketsfor buyers.

5. What It Means for Homebuyers and Investors

If you’re considering buying in Las Vegas, now’s the time to get strategic.

- For Homebuyers:Rising migration means continued competition for desirable properties. Getting pre-approved early and working with a local lender gives you an edge.

- For Investors:The steady inflow of new residents supports long-term rental stability, especially in family-oriented communities and high-demand school zones.

- For Sellers:Continued in-migration means strong buyer interest and potential appreciation—especially in well-maintained or upgraded homes.

Final Thoughts

Las Vegas is evolving from a vacation destination into a vibrant, full-time community—and migration is at the heart of that transformation. As more people discover that Vegas offers both lifestyle and opportunity, the real estate market will continue to grow and diversify.

Whether you’re moving here, investing here, or already a homeowner, understanding how migration trends shape the market can help you make smarter real estate decisions.

If you’re ready to explore opportunities in Las Vegas real estate, connect withThe Derek Parent Team. With decades of experience helping homeowners, veterans, and investors, we’ll help you find the right move in this exciting market.

Thinking About Selling? Here’s How to Stop Your Deal From Falling Apart After You Get an Offer

If you’re thinking about selling your home, you’ve probably spent a lot of time worrying about pricing, marketing, and timing.

But here’s the part most sellers never see coming:

Getting an offer is the easy part.

Getting all the way to closing is where deals fall apart.

Right now, roughly 15% of pending home sales are failing, and the #1 deal-killer isn’t usually the buyer’s loan.

It’s repairs and inspection surprises.

In other words: what happens afteryou accept the offer can make or break your sale.

The Silent Deal-Killer: Inspection & Repair Issues

Once your home is under contract, the buyer will usually order a home inspection. This is where hidden issues, deferred maintenance, and “I’ve been meaning to fix that” items all show up in writing.

When that inspection report lands, one of three things often happens:

- The buyer gets nervous and walks away

Big issues or long repair lists can scare buyers—especially in a cautious or shifting market. - They demand heavy credits or price cuts

Suddenly you’re giving back thousands at the closing table you thought you were keeping. - They try to renegotiate everything

You lose leverage, the timeline gets messy, and stress levels skyrocket.

The good news? You don’t have to be at the mercy of the inspection report.

You can get ahead of it.

The Smartest Move: Get a Pre-Listing Inspection

One of the most powerful tools you have as a seller is something most people never do:

A pre-listing inspection.

Instead of waiting for the buyer to hire an inspector and surprise you, you hire your own inspector beforeyour home goes on the market.

A pre-listing inspection helps you:

- Know exactly what buyers will find

No guessing. No surprises. You see the report first. - Handle repairs on your terms

You decide what to fix, when to fix it, and who does the work—withouta ticking clock. - Reduce renegotiations

When you’ve already addressed major issues or disclosed them upfront, buyers have less room to re-open negotiations. - Boost buyer confidence

A home that’s been inspected, repaired, and transparently presented feels safer and more trustworthy. - Dramatically lower the chances of a canceled contract

Fewer surprises = fewer freak-outs = fewer fallout deals.

In a market where buyers are cautious and picky, transparency is power.

Prepared homes make it to the closing table. Unprepared homes often don’t.

“But What If I Can’t Afford Repairs Right Now?”

This is one of the biggest fears sellers have:

“What if the house needs work, but I don’t have thousands of dollars to throw at repairs before I sell?”

If that’s you, you’re not alone—and you’re not stuck.

Many sellers today are using programs like RealVitalize(offered through select brokerages) or similar pay-at-closing improvement programs that allow you to:

- Do repairs, updates, or staging beforeyou list

- Pay nothing upfront

- Repay the costs at closing

That means you can potentially:

- Refresh paint and flooring

- Update lighting or fixtures

- Do necessary repairs flagged in a pre-listing inspection

- Improve curb appeal, kitchens, or baths…all without writing a big check before your home ever hits the market.

These updates don’t just help you sellyour home—they can help you:

- Attract more buyers

- Reduce lowball offers

- Improve your chances of getting top dollar

- Protect your deal once you’re under contract

In a world where buyers scroll through thousands of listing photos and expect homes to be “move-in ready,” this kind of program can be a game-changer.

Your Game Plan for a Smooth, Stress-Free Sale

If you’re even thinkingabout selling in the next 3–12 months, here’s a smart sequence to follow:

- Talk with a trusted real estate professional

Discuss your goals, timing, and rough pricing strategy. - Schedule a pre-listing inspection

Get clear on what’s really going on with your home behind the walls, under the roof, and in the systems. - Review the report together

Decide what must be fixed, what’s nice to fix, and what simply needs to be disclosed. - Explore pay-at-closing improvement options (like RealVitalize, if available)

See if you qualify to make impactful updates with no upfront payment. - Complete key repairs and cosmetic updates

Focus on items that will matter most to buyers and to an inspector. - List your home with confidence

You’re not guessing—you’ve already done the hard work upfront.

This approach keeps you in control—from the moment you list to the moment you sign at the closing table.

Thinking About Selling? Protect Your Deal Before It Starts.

If you’re planning to sell—or even just considering it—the best time to create a strategy is beforeyou put the sign in the yard.

A strong pre-listing plan can:

- Help you avoid last-minute drama

- Prevent needless price cuts

- Reduce buyer cancellations

- Put more money in your pocket at closing

If you’d like to talk through:

- Whether a pre-listing inspection makes sense for your situation

- Which repairs or upgrades will give you the most return

- How a program like RealVitalize (or similar) could help you do improvements with no upfront cost

…reach out and let’s set up a time to talk.

Ready to Sell With Confidence?

If you’re thinking about selling your home, don’t leave it to chance.

Get ahead of the inspection.

Protect your leverage.

Create a clear path from listing to closing.

Click here to schedule a no-pressure strategy sessionand learn how to prepare your home the right way—so you don’t just get an offer… You get to the finish line.

Reverse Mortgage Purchase: How Seniors Can Buy Bigger Homes

Many retirees dream of moving into a new home that better fits their lifestyle—maybe it’s a single-story home, a condo closer to family, or even a larger property with space for grandkids to visit. The challenge? Most seniors live on fixed incomes, and qualifying for a traditional mortgage payment can be difficult.

That’s where the Reverse Mortgage Purchaseprogram comes in. It allows homeowners 62 and older to buy a new home using a reverse mortgage, so they can move into the house they want without taking on a monthly mortgage payment.

What Is a Reverse Mortgage Purchase?

A Reverse Mortgage Purchase, officially known as a Home Equity Conversion Mortgage (HECM) for Purchase, is a government-insured loan program. It’s specifically designed to help seniors buy a new primary residence by combining a down payment with a reverse mortgage.

Instead of borrowing through a traditional mortgage with monthly payments, the reverse mortgage covers the balance. The loan is repaid later—when you sell, move out, or pass away.

How It Works

Here’s the simple breakdown:

- You Provide a Down Payment

Seniors typically put down 40–60% of the purchase price. The exact amount depends on your age, interest rates, and the home’s value. - The Reverse Mortgage Covers the Rest

The reverse mortgage fills the gap, eliminating the need for monthly mortgage payments. - You Live in the Home Without Payments

As long as you live in the property as your primary residence and pay property taxes, insurance, and upkeep, no payments are required.

Why Seniors Use Reverse Mortgage Purchase

- Buy More Home With Less Cash

Instead of paying 100% in cash, you can combine your funds with the reverse mortgage to buy a larger or better home. - No Monthly Mortgage Payment

Free up retirement income to cover living expenses, healthcare, or travel. - Right-Size Comfortably

Move into a home that matches your lifestyle today—whether that means downsizing for convenience or upgrading for family visits. - Preserve Cash Flow

Keep more of your retirement savings intact instead of tying it all into a home purchase.

Example Scenario

Imagine a couple, both 70 years old, selling their current home for $400,000.

- They want to buy a new home worth $600,000.

- With a Reverse Mortgage Purchase, they may only need a down payment of about $300,000.

- The reverse mortgage covers the remaining $300,000.

- Result: They get the new home they want and still have $100,000 left overfrom the sale of their old house for savings, emergencies, or lifestyle.

Important Considerations

- Primary Residence Only:The home must be your main residence, not a second home or investment property.

- Taxes & Insurance Still Apply:You’ll remain responsible for property taxes, homeowner’s insurance, and maintenance.

- Heirs & Estate Planning:The loan is repaid when you sell or leave the home. Heirs can keep the property by paying off the loan balance or sell it and keep any remaining equity.

- Upfront Costs:Reverse mortgages have upfront costs and insurance premiums, so it’s important to review the numbers carefully.

Why This Matters in Las Vegas

Las Vegas is a top retirement destination, and many seniors here want to relocate to active-adult communities, single-story homes, or even larger homes for visiting family. A Reverse Mortgage Purchase allows you to make that move without draining retirement accounts or adding a monthly payment.

Final Thoughts

The Reverse Mortgage Purchase program is a powerful tool for seniors who want to buy their dream retirement home without financial stress. It allows you to leverage your home equity, preserve your savings, and live in a property that truly fits your golden years.

If you’d like to learn more about how this program works in Las Vegas, connect withThe Derek Parent Team. We’ll walk you through the details, run the numbers, and help you decide if this strategy is the right move for your retirement.

Relocating to Las Vegas: Complete Guide for New Homebuyers

Las Vegas is famous for its nightlife, entertainment, and energy, but it’s also one of the fastest-growing cities in the country for new residents. Every year, thousands of people relocate here for job opportunities, affordable living, and sunshine nearly 300 days a year.

If you’re considering a move to Las Vegas, you’re not alone—and having the right plan will make the transition smoother. In this guide, we’ll cover everything you need to know about relocating to Las Vegas as a new homebuyer.

Why Move to Las Vegas?

People relocate to Las Vegas for many reasons, and it’s not just about the Strip. Here’s why the city has become such a hot spot:

- No State Income Tax:Nevada is one of the most tax-friendly states in the U.S.

- Affordable Housing (Compared to Other Major Cities):While prices have risen, homes in Las Vegas are still more affordable than in Los Angeles, San Francisco, or Phoenix.

- Diverse Job Market:Beyond hospitality, industries like healthcare, tech, and logistics are growing.

- Year-Round Sunshine:With warm weather and outdoor activities, the quality of life is high.

- Variety of Communities:From suburban family-friendly neighborhoods to luxury high-rises on the Strip, there’s something for everyone.

Step 1: Decide Where to Live

Las Vegas isn’t one-size-fits-all. Choosing the right neighborhood will depend on your lifestyle, commute, and budget.

Popular Areas for New Homebuyers

- Summerlin:Master-planned luxury, great schools, and access to Red Rock Canyon.

- Henderson:Family-friendly with parks, schools, and Lake Mead nearby.

- North Las Vegas:Affordable homes and lots of new development.

- Downtown & Arts District:Perfect for professionals and those who love an urban vibe.

- High-Rises on the Strip:Great for investors or buyers seeking resort-style living.

Because each area has its own personality, it’s worth exploring different neighborhoods before deciding where to buy.

Step 2: Understand the Las Vegas Housing Market

The Las Vegas market can move quickly, so being prepared is essential.

- Median Home Prices:They are generally lower than coastal cities, but prices have been rising steadily.

- New Construction:Builders are offering incentives like closing cost credits, especially in Henderson and North Las Vegas.

- High-Rise Condos:These remain popular among investors and second-home buyers.

So whether you’re looking for a starter home, new build, or luxury property, there are options for every budget.

Step 3: Get Pre-Approved Before You Shop

If you’re relocating, one of the smartest moves you can make is getting pre-approvedfor a mortgage before you start house hunting.

- Why It Matters:Pre-approval shows sellers you’re serious, and it helps you understand your budget.

- Local Expertise:Working with a Las Vegas-based lender likeThe Derek Parent Teamensures you have someone who understands local market conditions.

- Loan Options:First-time buyers, veterans, and even investors can qualify for loan programs with low down payments or special benefits.

Because the market is competitive, pre-approval can give you an edge when making an offer.

Step 4: Plan for Moving Logistics

Relocating isn’t just about finding the right house—it’s also about making the move smooth.

- Hiring Movers:Decide whether you want a full-service mover or a DIY truck rental.

- Timing Your Move:Avoid peak summer heat if possible; spring and fall are easier months to relocate.

- Utilities and Services:Set up water, power, internet, and trash collection ahead of time so your home is ready when you arrive.

- Driver’s License & Registration:Nevada requires new residents to update their license and car registration within 30 days.

Step 5: Adjusting to Life in Las Vegas

Las Vegas offers more than just nightlife. Here’s what new residents quickly learn:

- Entertainment & Dining:From world-class shows to local food scenes, you’ll never run out of options.

- Outdoor Adventures:Red Rock Canyon, Lake Mead, and Mount Charleston are all within driving distance.

- Community Life:Many neighborhoods host farmers markets, festivals, and fitness events, making it easy to meet people.

- Weather:Summers are hot, but the dry climate and mild winters balance it out.

Because Las Vegas blends city living with outdoor beauty, it’s a place where you can shape the lifestyle you want.

Tips for New Homebuyers Relocating to Las Vegas

- Visit Before You Buy:If possible, spend time exploring neighborhoods to see where you feel most comfortable.

- Work With Local Experts:Realtors and lenders who know the market can save you time and money.

- Think About the Commute:Traffic is lighter than in many cities, but location still matters if you work near the Strip or Downtown.

- Budget for HOAs:Many communities in Las Vegas have homeowners’ associations, so factor those fees into your monthly costs.

- Stay Flexible:The perfect home may not check every box, but focus on your top priorities.

Final Thoughts

Relocating to Las Vegas is exciting because the city offers a mix of affordability, opportunity, and lifestyle you won’t find anywhere else. From Henderson’s family-friendly communities to Summerlin’s master-planned luxury, there’s a neighborhood that will feel like home.

The key is preparation: understanding the market, securing financing, and working with local experts who can guide you every step of the way.

If you’re ready to make Las Vegas your new home, reach out to The Derek Parent Team. With decades of experience in the local mortgage industry, we’ll help you secure the right loan and make your relocation as smooth as possible.

First-Time Homebuyer Guide: Buying a Home in Las Vegas

Buying your first home is one of the biggest milestones of your life, and in a city like Las Vegas—where the real estate market moves quickly, neighborhoods each offer a unique lifestyle, and financing options can feel overwhelming—it’s important to have the right guidance.

This guide will walk you through everything you need to know as a first-time homebuyer in Las Vegas. From preparing your finances to choosing the right neighborhood, you’ll see the steps that make your purchase smoother and more successful.

Why Las Vegas is a Great Place for First-Time Buyers

Las Vegas isn’t just the “Entertainment Capital of the World.” Over the last decade, it has grown into a thriving city with family-friendly communities, expanding job opportunities, and a strong real estate market. Here’s why first-time buyers are drawn to Vegas:

- Affordability Compared to Other Major Cities:Prices have risen, but Las Vegas is still more affordable than many coastal markets like Los Angeles or San Francisco.

- No State Income Tax:Nevada has one of the most tax-friendly environments, so homeowners keep more of their income.

- Variety of Communities:You can choose a modern condo on the Strip, a new build in Summerlin, or a quiet neighborhood in Henderson—because the city has something for everyone.

- Strong Job Market:With tourism, technology, and logistics industries growing, the local economy provides stability for homeownership.

Step 1: Prepare Your Finances

Before you start shopping for homes, it’s important to take an honest look at your finances, because being prepared will make the process less stressful.

Check Your Credit Score

Your credit score plays a big role in determining what kind of mortgage you qualify for and the interest rate you’ll receive. Aim for a score of 620 or higher, but some loan programs can work with lower scores.

Save for a Down Payment

Traditionally, buyers put down 20%, but in today’s market, first-time homebuyers have more flexible options:

- FHA loans can require as little as 3.5% down.

- VA loans (for veterans and military families) often require no down payment.

- Conventional loans may allow for 3–5% down.

Get Pre-Approved for a Mortgage

Pre-approval not only shows sellers you’re serious, but it also gives you a clear picture of your budget. A local lender likeThe Derek Parent Teamcan walk you through the process and help you choose the right loan for your situation.

Step 2: Understand the Las Vegas Market

The Las Vegas housing market can be competitive, and prices vary depending on location, amenities, and demand.

- Entry-Level Homes:Many first-time buyers start with townhomes or smaller single-family houses.

- New Construction:Builders in Summerlin, North Las Vegas, and Henderson often offer incentives like closing cost assistance, so these can be a great option.

- High-Rise Condos:If you love city living, high-rises near the Strip offer luxury amenities but often come with HOA fees.

Because the market changes quickly, it’s smart to work with a professional who can help you set realistic expectations. You might face multiple-offer situations, so being prepared will give you an advantage.

Step 3: Choose the Right Neighborhood

Las Vegas is made up of diverse communities, and each has its own lifestyle. Here are a few popular areas for first-time buyers:

- Summerlin:Known for its master-planned communities, great schools, and parks. It’s perfect for families and professionals.

- Henderson:Offers a suburban feel with access to Lake Mead, shopping, and family-friendly neighborhoods.

- North Las Vegas:More affordable options with newer builds and expanding amenities, so it’s ideal if you’re looking for value.

- Southwest Las Vegas:Up-and-coming with plenty of new construction and easy access to the Strip.

Think about your lifestyle and priorities. Do you want to be close to work, or do you prefer quiet streets? Do you need great schools, or are amenities more important? Your answers will help narrow your search.

Step 4: Work with the Right Real Estate and Mortgage Professionals

Buying your first home can feel overwhelming, but you don’t have to do it alone. Having a trusted team by your side makes all the difference.

- Realtor:Helps you find properties, negotiate offers, and guide you through closing.

- Mortgage Lender:Assists with financing options, pre-approvals, and making sure your loan closes smoothly.

- Home Inspector:Ensures your home is in good condition before you buy.

AtThe Derek Parent Team, we specialize in helping first-time buyers navigate financing options in the Las Vegas market. Because we’ve been in the industry for decades, we know how to make the process simple and stress-free.

Step 5: Make an Offer

Once you’ve found the right home, it’s time to make an offer—and strategy is everything.

- Be Competitive:In a hot market, lowball offers often get rejected.

- Include a Strong Pre-Approval Letter:This reassures the seller you’re financially ready.

- Consider Seller Incentives:Builders and sellers sometimes offer credits toward closing costs, so ask your agent to negotiate these for you.

Step 6: Closing the Deal

The closing process typically takes 30–45 days. During this time, you’ll:

- Finalize your mortgage paperwork

- Complete inspections and appraisals

- Sign your closing documents

It can feel like a lot, but once you’re done, you’ll officially get the keys to your new home.

Tips for First-Time Homebuyers in Las Vegas

- Don’t Skip the Inspection:Even if the home looks perfect, inspections can reveal costly issues.

- Know Your Budget Beyond the Mortgage:Property taxes, HOA fees, and utilities all add up, so plan ahead.

- Think Long-Term:Buy a home you can grow into, not just one that works for right now.

- Stay Flexible:The right home might not check every single box, but it should meet your most important needs.

- Leverage First-Time Buyer Programs:Nevada offers down payment assistance and other incentives, so take advantage if you qualify.

Final Thoughts

Buying your first home in Las Vegas is an exciting step, and with the right preparation, it doesn’t have to feel overwhelming. The city has a strong economy, a wide range of neighborhoods, and flexible financing options—so there’s truly something for every type of buyer.

The key is preparation: understanding your finances, working with trusted professionals, and knowing what to expect in the market.

If you’re ready to take the next step, connect withThe Derek Parent Team. We’ll guide you through the process, answer your questions, and help you secure the right loan for your first home in Las Vegas.

How Rising Interest Rates Affect Home Buyers in Las Vegas

Buying a home in Las Vegas is an exciting step. From new builds in Summerlin to family-friendly communities in Henderson, the real estate market here offers something for everyone. But one factor shaping the decisions of home buyers right now is rising interest rates. Mortgage rates play a big role in how affordable a home really is, and many buyers wonder what higher rates mean for their budget, loan options, and long-term financial stability.

In this article, we’ll break down how rising interest rates affect home buyers in Las Vegas, what it means for affordability, and what strategies you can use to still achieve your dream of homeownership.

Why Do Interest Rates Matter for Home Buyers?

When you buy a home, chances are you’ll need a mortgage. Your interest rate determines how much you’ll pay the lender over time. Even a small increase can make a noticeable difference in your monthly payment.

For example:

- A $350,000 home with a 5% interest rate might cost around $1,880 a month (principal and interest).

- At 7%, that same loan jumps to about $2,330 a month.

That’s nearly $450 more each month—money that could otherwise go toward savings, upgrades, or day-to-day expenses.

In a city like Las Vegas, where the housing market is competitive, rising interest rates can affect not only what you can afford but also how quickly homes sell.

The Las Vegas Housing Market and Rising Rates

Las Vegas has long been an attractive market for buyers moving from other states, especially California, because of relatively affordable housing and no state income tax. However, with interest rates rising, buyers are noticing:

- Reduced purchasing power– Many buyers now qualify for smaller loan amounts than they did a year or two ago.

- Slower price growth– Home prices may level out as higher rates cool demand.

- Increased competition for affordable homes– Entry-level homes are in even greater demand since higher rates make luxury properties less attainable.

For local buyers, this means adjusting expectations. For out-of-state buyers, it could mean comparing Las Vegas homes not only to prices in their former city but also to their new borrowing costs.

How Higher Rates Affect Loan Programs

Not all mortgages react the same way to rising rates. Depending on your financial situation, you may still find options that keep homeownership within reach.

FHA Loans

For many first-time buyers, FHA loan programs in Las Vegas remain a strong option. FHA loans often come with lower down payment requirements and more flexible credit standards. While interest rates affect FHA loans just like conventional ones, the lower barriers to entry can make them a practical choice even in a higher-rate environment.

Adjustable-Rate Mortgages (ARMs)

Some buyers turn to ARMs, which typically start with a lower rate than fixed-rate mortgages. This can help lower initial payments, though rates may rise later.

Refinancing Options

If you buy at a higher rate today, you’re not locked in forever. Down the road, you can explore options to refinance your mortgage if rates drop again, potentially lowering your monthly payment.

Budgeting and Affordability in a Higher Rate Environment

When interest rates rise, it’s essential to revisit your budget. Homeownership involves more than just the mortgage—it also includes property taxes, insurance, utilities, and HOA fees (common in Las Vegas communities).

Here are a few strategies:

- Get pre-approved early– This helps you understand exactly what you can afford at current rates.

- Consider a slightly smaller home or different neighborhood– Expanding your search beyond the Strip-adjacent areas can uncover more affordable options.

- Look at debt management– If high-interest debts are weighing on your ability to qualify, exploring debt consolidation solutions could improve your financial standing and increase your mortgage options.

What Rising Rates Mean for Sellers—and Buyers

While higher interest rates create challenges, they also open opportunities.

- For buyers: Slower price growth and reduced competition from investors may give you more negotiating power.

- For sellers: Homes may take longer to sell, and pricing competitively becomes more important.

In Las Vegas, where the market has been fast-moving for years, rising rates may create a more balanced environment. Buyers who were once outbid may now have a better shot at securing the home they want.

Long-Term Perspective: Why Buying Still Makes Sense in Las Vegas

Even with rising rates, buying a home in Las Vegas can still be a wise investment. Consider:

- Rent vs. Buy– Rental prices in Las Vegas continue to rise, and monthly rents can rival or exceed mortgage payments.

- Equity Building– Owning a home allows you to build equity, which is not possible when renting.

- Future Refinancing– Today’s rates might seem high compared to a few years ago, but historically they’re still within normal ranges. Buying now means you can refinance later if rates decline.

For buyers planning to stay in their home for several years, the benefits of ownership often outweigh the temporary challenges of higher interest rates.

Tips for Navigating the Current Market

- Work with an experienced local team– Navigating the Las Vegas housing market requires insight into neighborhoods, builders, and financing programs.

- Stay flexible– Have a list of must-haves and nice-to-haves to widen your options.

- Focus on long-term value– Don’t just buy for today’s rate; think about how the home fits your lifestyle and goals over the next 5–10 years.

- Lean on mortgage solutions– Explore FHA, conventional, and refinance options to find the right fit for your budget.

Final Thoughts

Rising interest rates are changing the landscape for home buyers in Las Vegas, but they don’t have to put their homeownership dreams on hold. By understanding how rates affect your budget, exploring flexible loan programs, and planning for the long term, you can still find the right home in this vibrant city.

At Derek Parent Team, we help buyers navigate today’s market with personalized mortgage solutions, whether it’s through FHA loan programs in Las Vegas, refinancing options, or debt consolidation solutions to strengthen your financial foundation.

Las Vegas remains a city of opportunity, and with the right guidance, you can make smart moves—even in a higher interest rate environment.