Gifting a Home

Are you planning on gifting a home to someone this holiday season? For most people, a gift this generous is probably out of the question. But maybe you had a good year financially, and a family member needs the help. Whatever the case is, here are some guidelines when it comes to giving the gift of real estate.

Buying a new home outright

Instead of buying a new home outright, it may be wise to gift the cash for the home, NOT the home itself. Everyone has their own preferences when it comes to what they want in a home, so allowing the recipient of your generous gift to choose their home is probably a much safer idea.

We highly recommend running this by your accountant, as you may also need to file a gift tax return.

Gifting the down payment

Gifting money for a down payment works in pretty much the same way—except when it comes to the mortgage. If there’s even the slightest hint that the money is a loan rather than a gift, it can hinder the recipient’s ability to get a mortgage.

You’ll want to work closely with the recipient’s lender to file the appropriate paperwork, which will include a verified gift letter certifying the funds are a gift, not a loan. The lender will also likely need to examine your finances to determine if you’re able to gift. And remember, most lenders won’t permit gifts from nonfamily members.

Gifting an existing home

Would your children love to own the home they grew up in? Unfortunately this is a poor option, especially if both parents are still living.

One of the tricky struggles with gifting a home you own is the differential between the cost basis (what you first paid for the house) and the current fair market value—which could be hundreds of thousands of dollars, depending on how long you’ve owned it and the appreciation in the area.

This might not matter if your children plan to live in the home forever: The gift will be subject to your gift tax limit, and they’ll only pay capital gains tax if they sell. But if (and, likely, when) they sell, they’ll be stuck paying taxes on the difference.

If you’re determined to gift someone a home this holiday season, remember to keep these guidelines in mind. It IS possible, but of course it’s extremely important to consult your accountant and/or financial advisors to ensure it’s done in the right way.

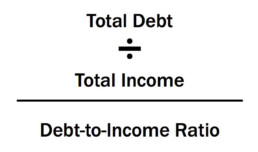

Debt vs. Income: What You Need to Know

Income is a crucial component lenders consider when granting you a mortgage. However, income is not all that a lender will consider when determining how much you qualify for. They will also look at your debt to income ratio, in addition to other financial indicators.

If you make a lot of money but also have a lot of debt, this could be a red flag to lenders and reduce your borrowing capacity.

How debt & income affect your mortgage

Income and debt are yin and yang, opposites of each other. Debt is a liability, whereas the more income you have, the more power you have to make those liabilities go away. Having more income also gives more control of the following.

- It allows you to prepay your mortgage faster.

- It allows you to qualify for more when buying a home.

- It allows you to move into a shorter and more aggressive debt pay-down structure such as a 15-year fixed-rate mortgage.

- It allows you to pay off your credit cards in full every month, rather than paying unnecessary and pricey interest (assuming you’re making smart financial choices).

- It allows you to consume smart debt, such as purchasing a rental property that can generate even more income.

- It allows you to make investments, generating more income.

- It allows you to save and plan for the future.

Having this control over these and other financial choices is precisely why it is CRUCIAL to carry a debt-to-income ratio no bigger than 36% of your gross monthly income. The goal when borrowing mortgage money is to put yourself in a position where you can have a life beyond paying it off, while still saving and contributing to your retirement savings.

What you need to consider before you buy

Always remember it takes $2 of income to offset every $1 of debt for a 2:1 ratio for mortgage qualifying purposes.

If you want that fancy Mercedes at an $800 per month car payment, then you’ll need $19,200 a year in extra income or you’ll need to cut a current debt payment of $800 to balance your debt-to-income ratio.

If you want the dream house at $3,500 month, then aim your debt-to-income ratio at 36%—meaning you would ideally want income at $117,000 a year without carrying other consumer obligations in order to afford this mortgage.

When you are thinking about buying a home, also remember to consider what the future holds for your finances. For example, if your monthly expenses will likely increase in the future due to expenses like childcare costs or college tuition, this is something important to keep in mind. By keeping your debt to income ratio below 36% of your gross monthly income, you’ll put yourself in a position to enjoy your new home but also be able to continue saving for your future.

5 Traits to Look for in a Realtor

Choosing the right real estate agent to help you buy or sell a home is no easy task! In fact, it can make all the difference in the world. The wrong agent can cost you time and money, and possibly even your potential dream home!

When you're interviewing potential agents, make sure they have these five qualities.

1. Remarkable Listener

The true to key to a good agent is how well they listen and retain what they heard. If you say your budget maximum is $250,000, then they should stick to within that price when providing properties to view. A good listener should quickly ascertain your needs and wants and have a plan of approach based on your criteria.

2. Great Communicator

No one wants an agent who lists a home and is rarely heard from again. You want an agent who is enthusiastically speaking to you often on what is happening in either the selling or buying process. Your agent should inform you about how she or he will deal with your transaction from start to finish. An agent who is in constant communication with you should also be in continual communication with all other parties in the transaction to keep you better apprised. The agent should return any texts, calls or emails as quickly as possible.

3. Amazingly Honest

Dishonesty breeds distrust. You want an agent whom you can always trust to be truthful and upfront throughout the entire sales process, even if the outcome is not easy to hear. An honest agent will price the property right at listing for a quick sale or inform the buyer of unseen issues with the home they are interested in. Having a trusted professional on your side means there is one less thing to worry about.

4. Incredibly Ethical

An agent who is also a Realtor suggests that a strict code of ethics will be adhered to throughout the transaction process. Abiding by the Realtor Code of Ethics means necessary transaction facts are not misrepresented or concealed, contract deals are completely spelled out in the writing, all people are treated equally and your best interests will be protected, among other code specifications.

5. Natural Negotiator

The best agents are natural negotiators, able to seal a deal with shrewd and aggressive bargaining skills. Excellent negotiators save you money and seal the deal faster. Ask a potential agent to describe their most difficult negotiation and what the outcome was or provide a difficult scenario and find out how that agent would handle it.

If you're buying or selling in the Las Vegas area and are looking for a good real estate agent, give me a call at 702.331.8185! I work with a lot of outstanding agents and will be happy to give you some referrals.

Unexpected Homebuying Roadblocks

Your offer has been accepted on your dream home and you have a down payment, good credit, and little debt. So the escrow process should be a breeze, right? WRONG! There are some surprising deal breakers that can quickly cause the transaction to go south. Here are a few of the most common ones.

Closing Lines of Credit

Maybe you’ve realized you have a few more credit cards than you’d like your lender to see. Time to shut ’em down before they check your credit, right? Not so fast. Closing down multiple accounts could actually ding your credit. Credit is composed of a few key components, the age of an opened account being one biggie. Shutting down multiple accounts will also lower your credit utilization rates, which can be yet another credit killer. Research the impact of any change to your credit before taking action.

Not Calculating the True Cost of your Mortgage Payment

The cost of homeownership goes far beyond a monthly mortgage check. There are HOA fees, maintenance costs, PMI, etc. Make sure you’ve calculated — and recalculated — whether the cumulative costs will be feasible. You don’t want a nasty surprise when you finally crunch your numbers and realize they don’t fit within your current financial circumstances.

Forgetting Maintenance Costs

Remember that you’ll have to spend much more time and money on the dream house with a pool in the backyard. If you simply don’t have the budget for a home with a pool, communicate this to your agent before you start looking at houses. The last thing you want is to end up falling in love with a home you simply can’t afford to maintain.

Assuming Fixtures are Part of the Deal

Make sure you and the seller agree on exactly what will be included — and what the seller will be taking to their new home sweet home. Things such as light fixtures are often assumed to be a part of the package, but if it’s an heirloom chandelier from the seller’s grandma, chances are they’ll consider it fair game to take when they go. Set out clear expectations of what’s staying and what’s going to avoid any confusion or upset.

Buying a home can be stressful, but with a little preparation (and the right lender and real estate agent) things can go relatively smoothly. No matter what happens, remember to stay flexible. Some things may arise that are out of your control. How you respond can ultimately sway the outcome — and hopefully get you the house of your dreams!

How to Choose Between a 30-Year & 15-Year Mortgage

Buying a home is a huge financial decision, and choosing the right mortgage can be difficult. If you're wondering whether to choose a 15-year mortgage or 30-year mortgage, here are 4 things to consider.

1) Can You Afford to Get a 15-Year Mortgage?

Although a 15-year mortgage offers a lower interest rate relative to a 30-year mortgage, thereby allowing borrowers to pay interest for only half as long, a 15-year mortgage comes with a higher total monthly payment. This is because the principal loan amount must be paid off faster, making each principal payment larger.

If you can afford the higher monthly payment associated with a 15-year mortgage, it might be worth considering.

2) Are You Buying Your First Home?

First-time home buyers often benefit from selecting a 30-year mortgage because the monthly payments are lower. A longer-term mortgage can make a more expensive home more affordable for a new buyer.

Of course, 15-year and 30-year mortgages are not the only options available to consumers. Borrowers can take an adjustable-rate mortgage, which offers a low initial rate that stays unchanged for some period, such as five years. When the period expires, borrowers could pay more if interest rates rise. But for buyers who are not looking to own their home for too long and who are confident that they will be able to resell the home, an adjustable rate mortgage may be a sensible option.

3) Are You Planning on Retiring Soon?

How close a borrower is to retiring plays a major role in whether to take out a 15-year mortgage. Typically, borrowers who take 15-year mortgages are at least 40 years old. These borrowers are often willing to pay off the balance on their mortgages faster in order to retire with little or no outstanding debt on their homes. However, many older homeowners also must weigh prepayment — making early payments on their mortgage — against the need to save for retirement.

4) Do You Have a Strict Savings Plan?

Choosing a 15-year mortgage over a 30-year mortgage also may be a worthwhile choice if you are not a disciplined saver. But many people may lack the discipline needed to save long-term, especially in amounts that would offset what they would save by switching to a 15-year mortgage.

If you're wondering which is right for you, contact my office at 702.331.8185 and one of my team members will be happy to assist you.

What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Who will owe?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

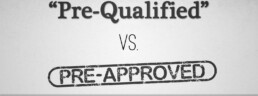

What's the Difference Between Getting Pre-approved & Pre-qualified?

Many people mistakenly believe that getting pre-approved for a mortgage is the same thing as getting pre-qualified. They are NOT the same! Here's the difference:

Getting Pre-qualified

Most sellers will require your pre-qualification letter before they’ll even consider your offer. Ask your lender for a prequalification letter. These are relatively simple to get and they just give a rough, unverified estimate of the loan size you may qualify to receive. Most lenders will give you a pre-qualification based on your verbal self-reporting of your income, assets, debts, and down payment size.

Estimated time: 2–3 days

Getting Pre-approved

The pre-approval stage is when lenders verify everything you’ve told them. You’ll need to supply proof of income, proof of assets, proof of employment, records of any debts you hold, and of course identification documents (such as your Social Security card) and a credit report (which the lender will run).

Once you’re pre-approved, you’ll receive a letter stating the exact amount of loan for which you’re approved.

Estimated time: 1 week to several months.

3 Things to Know about FHA Loans

FHA loans are popular with mortgage borrowers because of lower down payment requirements and less stringent lending standards.

Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if the borrower defaults on the loan.

Less-than-perfect credit is OK

Minimum credit scores for FHA loans depend on the type of loan the borrower needs. People with credit scores under 500 generally are ineligible for FHA loans. The FHA will make allowances under certain circumstances for applicants who have what it calls "nontraditional credit history or insufficient credit" if they meet requirements. Ask your FHA lender or an FHA loan specialist if you qualify.

Lender must be FHA-approved

Because the FHA is not a lender, but rather an insurer, borrowers need to get their loan through an FHA-approved lender (as opposed to directly from the FHA). Not all FHA-approved lenders offer the same interest rate and costs -- even on the same FHA loan.

Costs, services and underwriting standards will vary among lenders or mortgage brokers, so it's important for borrowers to shop around.

Closing costs may be covered

The FHA allows home sellers, builders and lenders to pay some of the borrower's closing costs, such as an appraisal, credit report or title expenses. For example, a builder might offer to pay closing costs as an inducement for the borrower to buy a new home.

Borrowers can compare loan estimates from competing lenders to figure out which option makes the most sense.

Divorce? The 5 Worst Money Mistakes

Written by Guest blogger: Leslie Thompson

During a divorce, a spouse who hasn’t been involved in the family’s finances can often be at a disadvantage during settlement negotiations. That’s why it’s so important for both spouses in the process of dissolving their marriage to understand their post-divorce financial needs and their current financial situation.

The following five items are often overlooked as part of the settlement process, but they’re vital areas to address:

- Cash flow needs

Understanding your need for immediate cash flow is extremely important in determining which assets would be the most beneficial for you to receive in the divorce. If immediate cash flow is a concern, the most valuable assets for you are ones you could sell easily and quickly (so-called liquid accounts), such as stocks, bonds, mutual funds and possibly Roth retirement accounts.

If immediate cash flow is not an issue, a combination of assets with various degrees of liquidity (taxable and retirement plan accounts) will likely be more beneficial long-term.

- Joint liabilities

Just because you agree to split a liability does not mean that the lender will honor your property-settlement agreement. Mortgages will need to be refinanced (if possible), any outstanding tax liabilities on jointly-filed returns will need to be paid and jointly-held credit cards will need to be canceled.

It is important that all liabilities are settled before completing a divorce, either by paying them off or by transferring them to the spouse taking responsibility for the debt.

It is also a good idea to run a credit report to determine if there are any outstanding debts that need to be addressed before settlement.

By securing proof that all liabilities have been settled before the divorce finalization, you’ll avoid an unpleasant surprise when a creditor demands payment from you for a liability that you thought had been settled.

- Taxes on assets

It’s critical to review the tax impact of your investments when evaluating the division of your assets. While two assets or investment accounts may have equal dollar values, their economic value could be vastly different when taxes are factored in.

For example, Roth IRA and Roth 401(k) accounts are funded with after-tax dollars; their future growth and distributions are tax-free. On the other hand, traditional 401(k)s and deductible IRAs are funded with pretax dollars and when you withdraw money from them, taxes will be due on both the amount you contributed and the growth of the investments. As such, Roths have a higher economic value than non-Roth 401(k) or deductible IRAs because they won’t be reduced by future taxes.

If you are younger than 59 and a half, you will pay income tax on withdrawals from non-Roth retirement accounts and possibly a 10% tax penalty. But you can avoid the 10% penalty if the distribution occurs within 12 months following a divorce.

You’ll also want to think about any unrealized capital gains on your taxable investments, since taxes will be due someday. Keep in mind that the first $250,000 of gain from the sale of a principal residence is sheltered from tax.

- Past tax returns

It’s a good idea to review the past three to five years of the tax returns you filed as a married couple. Aside from showing you how much income you two had in a given year, you’ll see whether there are any assets on the settlement agreement or if there are what are known as “tax assets” that need to be considered in the negotiation — such as capital loss carry-forwards, charitable contribution carry-forwards or net-operating losses.

“Tax assets” provide the user a reduction in future taxes and should be considered an asset when splitting the marital estate. But left unresolved, they can cause confusion or errors when filing future tax returns.

- Division of retirement assets

Retirement assets typically represent a large portion of a couple’s net worth and there are special rules to allow for the transfer to be tax-free. You’ll want to make sure the intricacies of these transfers are handled with care.

The divorce decree should specify that any IRA is to be treated as a “transfer incident to divorce” to avoid having the transfer classified as a taxable distribution. Be sure to determine if any basis exists from after-tax contributions made to the IRA — an amount that will be tax-free when distributed. (Consult a tax adviser on this.)

Employer-sponsored retirement plans transfer through a qualified domestic relations order, which requires specific information and approval by the court and plan administrator to allow for a tax-free qualified transfer.

Leslie Thompson is Managing Principal of Spectrum Management Group in Indianapolis. With over 20 years of financial industry experience, she has holds the Chartered Financial Analyst, Certified Divorce Financial Analyst and Certified Public Accountant designations.

*This blog is for information purposes only. Derek Parent and NFM, Inc. accept no liability for its content. Please consult a tax adviser or legal counsel for more information.*

Trick Your Brain into Saving a Down Payment

Follow these 5 strategies to ensure you meet your long-term goals.

Why is it so difficult to stick with a long-term savings plan even when we truly consider our future goals to be just as important as — if not more than — our current desires? Chalk it up to our hardwiring: The rational side of the brain is often drowned out by the emotional side. Good news: It’s possible to outsmart those (very persuasive) instincts that encourage us to spend even when we know we should be saving.

Here’s how to save money for a down payment — or any other long-term savings goal — without letting those instincts get in the way.

Make it hard to spend

If your money is hard to get to, those impulse buys won’t be as easy to make. Put up some roadblocks by moving your savings from your checking account into a separate account that doesn’t have a debit card attached. Better yet, if you’ve got a separate emergency fund and you’re comfortable with not being able to access it immediately, move it into a money market account or other account with a higher interest rate and forget about it (unless you’re adding to the bottom line, of course).

Automate your savings

Take the task of saving out of your control and set up an automated account that diverts a certain amount of your income each month into a savings account. Because it removes the rationalization factor (“Should I save this month or skip it?”), it also removes the emotional act of negotiating with yourself.

Create specific goals and set reminders

Avoid settling for immediate gratification by forcing yourself to acknowledge your long-term goal regularly. Try posting a picture of your dream home in a highly visible area, pinning some money-saving quotes on your Pinterest board, or creating a clear savings timeline with specific number-based savings goals and saving it to your desktop to update with your daily progress.

Match impulse buys with an equal amount into your savings

Computers and smartphones make spending an ever-present option. Spending shouldn’t be forbidden. Instead, skew the act of spending to your favor. So you really want those new boots? Match that spending with an equal contribution to your down payment.

Sometimes the pain of doubling a cost is enough to deter a purchase. In the case you still choose to spend, the matched contribution ensures that at the very least you’re still taking measures to save.

Put away any unexpected savings

Can’t turn down a great sale? To piggyback a good habit onto any impulse purchase, take the sum that was discounted on your sale item and add it to your down payment savings account.