Debt vs. Income: What You Need to Know

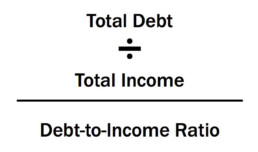

Income is a crucial component lenders consider when granting you a mortgage. However, income is not all that a lender will consider when determining how much you qualify for. They will also look at your debt to income ratio, in addition to other financial indicators.

If you make a lot of money but also have a lot of debt, this could be a red flag to lenders and reduce your borrowing capacity.

How debt & income affect your mortgage

Income and debt are yin and yang, opposites of each other. Debt is a liability, whereas the more income you have, the more power you have to make those liabilities go away. Having more income also gives more control of the following.

- It allows you to prepay your mortgage faster.

- It allows you to qualify for more when buying a home.

- It allows you to move into a shorter and more aggressive debt pay-down structure such as a 15-year fixed-rate mortgage.

- It allows you to pay off your credit cards in full every month, rather than paying unnecessary and pricey interest (assuming you’re making smart financial choices).

- It allows you to consume smart debt, such as purchasing a rental property that can generate even more income.

- It allows you to make investments, generating more income.

- It allows you to save and plan for the future.

Having this control over these and other financial choices is precisely why it is CRUCIAL to carry a debt-to-income ratio no bigger than 36% of your gross monthly income. The goal when borrowing mortgage money is to put yourself in a position where you can have a life beyond paying it off, while still saving and contributing to your retirement savings.

What you need to consider before you buy

Always remember it takes $2 of income to offset every $1 of debt for a 2:1 ratio for mortgage qualifying purposes.

If you want that fancy Mercedes at an $800 per month car payment, then you’ll need $19,200 a year in extra income or you’ll need to cut a current debt payment of $800 to balance your debt-to-income ratio.

If you want the dream house at $3,500 month, then aim your debt-to-income ratio at 36%—meaning you would ideally want income at $117,000 a year without carrying other consumer obligations in order to afford this mortgage.

When you are thinking about buying a home, also remember to consider what the future holds for your finances. For example, if your monthly expenses will likely increase in the future due to expenses like childcare costs or college tuition, this is something important to keep in mind. By keeping your debt to income ratio below 36% of your gross monthly income, you’ll put yourself in a position to enjoy your new home but also be able to continue saving for your future.

Unexpected Homebuying Roadblocks

Your offer has been accepted on your dream home and you have a down payment, good credit, and little debt. So the escrow process should be a breeze, right? WRONG! There are some surprising deal breakers that can quickly cause the transaction to go south. Here are a few of the most common ones.

Closing Lines of Credit

Maybe you’ve realized you have a few more credit cards than you’d like your lender to see. Time to shut ’em down before they check your credit, right? Not so fast. Closing down multiple accounts could actually ding your credit. Credit is composed of a few key components, the age of an opened account being one biggie. Shutting down multiple accounts will also lower your credit utilization rates, which can be yet another credit killer. Research the impact of any change to your credit before taking action.

Not Calculating the True Cost of your Mortgage Payment

The cost of homeownership goes far beyond a monthly mortgage check. There are HOA fees, maintenance costs, PMI, etc. Make sure you’ve calculated — and recalculated — whether the cumulative costs will be feasible. You don’t want a nasty surprise when you finally crunch your numbers and realize they don’t fit within your current financial circumstances.

Forgetting Maintenance Costs

Remember that you’ll have to spend much more time and money on the dream house with a pool in the backyard. If you simply don’t have the budget for a home with a pool, communicate this to your agent before you start looking at houses. The last thing you want is to end up falling in love with a home you simply can’t afford to maintain.

Assuming Fixtures are Part of the Deal

Make sure you and the seller agree on exactly what will be included — and what the seller will be taking to their new home sweet home. Things such as light fixtures are often assumed to be a part of the package, but if it’s an heirloom chandelier from the seller’s grandma, chances are they’ll consider it fair game to take when they go. Set out clear expectations of what’s staying and what’s going to avoid any confusion or upset.

Buying a home can be stressful, but with a little preparation (and the right lender and real estate agent) things can go relatively smoothly. No matter what happens, remember to stay flexible. Some things may arise that are out of your control. How you respond can ultimately sway the outcome — and hopefully get you the house of your dreams!

What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Who will owe?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

What's the Difference Between Getting Pre-approved & Pre-qualified?

Many people mistakenly believe that getting pre-approved for a mortgage is the same thing as getting pre-qualified. They are NOT the same! Here's the difference:

Getting Pre-qualified

Most sellers will require your pre-qualification letter before they’ll even consider your offer. Ask your lender for a prequalification letter. These are relatively simple to get and they just give a rough, unverified estimate of the loan size you may qualify to receive. Most lenders will give you a pre-qualification based on your verbal self-reporting of your income, assets, debts, and down payment size.

Estimated time: 2–3 days

Getting Pre-approved

The pre-approval stage is when lenders verify everything you’ve told them. You’ll need to supply proof of income, proof of assets, proof of employment, records of any debts you hold, and of course identification documents (such as your Social Security card) and a credit report (which the lender will run).

Once you’re pre-approved, you’ll receive a letter stating the exact amount of loan for which you’re approved.

Estimated time: 1 week to several months.

3 Things to Know about FHA Loans

FHA loans are popular with mortgage borrowers because of lower down payment requirements and less stringent lending standards.

Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if the borrower defaults on the loan.

Less-than-perfect credit is OK

Minimum credit scores for FHA loans depend on the type of loan the borrower needs. People with credit scores under 500 generally are ineligible for FHA loans. The FHA will make allowances under certain circumstances for applicants who have what it calls "nontraditional credit history or insufficient credit" if they meet requirements. Ask your FHA lender or an FHA loan specialist if you qualify.

Lender must be FHA-approved

Because the FHA is not a lender, but rather an insurer, borrowers need to get their loan through an FHA-approved lender (as opposed to directly from the FHA). Not all FHA-approved lenders offer the same interest rate and costs -- even on the same FHA loan.

Costs, services and underwriting standards will vary among lenders or mortgage brokers, so it's important for borrowers to shop around.

Closing costs may be covered

The FHA allows home sellers, builders and lenders to pay some of the borrower's closing costs, such as an appraisal, credit report or title expenses. For example, a builder might offer to pay closing costs as an inducement for the borrower to buy a new home.

Borrowers can compare loan estimates from competing lenders to figure out which option makes the most sense.

Divorce? The 5 Worst Money Mistakes

Written by Guest blogger: Leslie Thompson

During a divorce, a spouse who hasn’t been involved in the family’s finances can often be at a disadvantage during settlement negotiations. That’s why it’s so important for both spouses in the process of dissolving their marriage to understand their post-divorce financial needs and their current financial situation.

The following five items are often overlooked as part of the settlement process, but they’re vital areas to address:

- Cash flow needs

Understanding your need for immediate cash flow is extremely important in determining which assets would be the most beneficial for you to receive in the divorce. If immediate cash flow is a concern, the most valuable assets for you are ones you could sell easily and quickly (so-called liquid accounts), such as stocks, bonds, mutual funds and possibly Roth retirement accounts.

If immediate cash flow is not an issue, a combination of assets with various degrees of liquidity (taxable and retirement plan accounts) will likely be more beneficial long-term.

- Joint liabilities

Just because you agree to split a liability does not mean that the lender will honor your property-settlement agreement. Mortgages will need to be refinanced (if possible), any outstanding tax liabilities on jointly-filed returns will need to be paid and jointly-held credit cards will need to be canceled.

It is important that all liabilities are settled before completing a divorce, either by paying them off or by transferring them to the spouse taking responsibility for the debt.

It is also a good idea to run a credit report to determine if there are any outstanding debts that need to be addressed before settlement.

By securing proof that all liabilities have been settled before the divorce finalization, you’ll avoid an unpleasant surprise when a creditor demands payment from you for a liability that you thought had been settled.

- Taxes on assets

It’s critical to review the tax impact of your investments when evaluating the division of your assets. While two assets or investment accounts may have equal dollar values, their economic value could be vastly different when taxes are factored in.

For example, Roth IRA and Roth 401(k) accounts are funded with after-tax dollars; their future growth and distributions are tax-free. On the other hand, traditional 401(k)s and deductible IRAs are funded with pretax dollars and when you withdraw money from them, taxes will be due on both the amount you contributed and the growth of the investments. As such, Roths have a higher economic value than non-Roth 401(k) or deductible IRAs because they won’t be reduced by future taxes.

If you are younger than 59 and a half, you will pay income tax on withdrawals from non-Roth retirement accounts and possibly a 10% tax penalty. But you can avoid the 10% penalty if the distribution occurs within 12 months following a divorce.

You’ll also want to think about any unrealized capital gains on your taxable investments, since taxes will be due someday. Keep in mind that the first $250,000 of gain from the sale of a principal residence is sheltered from tax.

- Past tax returns

It’s a good idea to review the past three to five years of the tax returns you filed as a married couple. Aside from showing you how much income you two had in a given year, you’ll see whether there are any assets on the settlement agreement or if there are what are known as “tax assets” that need to be considered in the negotiation — such as capital loss carry-forwards, charitable contribution carry-forwards or net-operating losses.

“Tax assets” provide the user a reduction in future taxes and should be considered an asset when splitting the marital estate. But left unresolved, they can cause confusion or errors when filing future tax returns.

- Division of retirement assets

Retirement assets typically represent a large portion of a couple’s net worth and there are special rules to allow for the transfer to be tax-free. You’ll want to make sure the intricacies of these transfers are handled with care.

The divorce decree should specify that any IRA is to be treated as a “transfer incident to divorce” to avoid having the transfer classified as a taxable distribution. Be sure to determine if any basis exists from after-tax contributions made to the IRA — an amount that will be tax-free when distributed. (Consult a tax adviser on this.)

Employer-sponsored retirement plans transfer through a qualified domestic relations order, which requires specific information and approval by the court and plan administrator to allow for a tax-free qualified transfer.

Leslie Thompson is Managing Principal of Spectrum Management Group in Indianapolis. With over 20 years of financial industry experience, she has holds the Chartered Financial Analyst, Certified Divorce Financial Analyst and Certified Public Accountant designations.

*This blog is for information purposes only. Derek Parent and NFM, Inc. accept no liability for its content. Please consult a tax adviser or legal counsel for more information.*

Trick Your Brain into Saving a Down Payment

Follow these 5 strategies to ensure you meet your long-term goals.

Why is it so difficult to stick with a long-term savings plan even when we truly consider our future goals to be just as important as — if not more than — our current desires? Chalk it up to our hardwiring: The rational side of the brain is often drowned out by the emotional side. Good news: It’s possible to outsmart those (very persuasive) instincts that encourage us to spend even when we know we should be saving.

Here’s how to save money for a down payment — or any other long-term savings goal — without letting those instincts get in the way.

Make it hard to spend

If your money is hard to get to, those impulse buys won’t be as easy to make. Put up some roadblocks by moving your savings from your checking account into a separate account that doesn’t have a debit card attached. Better yet, if you’ve got a separate emergency fund and you’re comfortable with not being able to access it immediately, move it into a money market account or other account with a higher interest rate and forget about it (unless you’re adding to the bottom line, of course).

Automate your savings

Take the task of saving out of your control and set up an automated account that diverts a certain amount of your income each month into a savings account. Because it removes the rationalization factor (“Should I save this month or skip it?”), it also removes the emotional act of negotiating with yourself.

Create specific goals and set reminders

Avoid settling for immediate gratification by forcing yourself to acknowledge your long-term goal regularly. Try posting a picture of your dream home in a highly visible area, pinning some money-saving quotes on your Pinterest board, or creating a clear savings timeline with specific number-based savings goals and saving it to your desktop to update with your daily progress.

Match impulse buys with an equal amount into your savings

Computers and smartphones make spending an ever-present option. Spending shouldn’t be forbidden. Instead, skew the act of spending to your favor. So you really want those new boots? Match that spending with an equal contribution to your down payment.

Sometimes the pain of doubling a cost is enough to deter a purchase. In the case you still choose to spend, the matched contribution ensures that at the very least you’re still taking measures to save.

Put away any unexpected savings

Can’t turn down a great sale? To piggyback a good habit onto any impulse purchase, take the sum that was discounted on your sale item and add it to your down payment savings account.

VA Loan Eligibility

The VA Loan program was created in 1944 to help veterans and active duty military become homeowners. The government backs portions of loans through approved lenders, allowing veterans to get mortgages with favorable terms.

If you’re interested in learning more about VA loans, here are the basics.

Eligibility

Both Veterans and active duty service members are eligible for VA loans on homes they will occupy. Members must have a good credit rating, sufficient income, a valid COE (certificate of eligibility) and meet specific service requirements.

Benefits

The biggest benefit of a VA Loan is the down payment, which is zero! That’s right, qualified borrowers can get 100% of the cost of a home financed if they haven’t been able to set aside a large sum of money for a down payment.

Another significant benefit is not having to pay private mortgage insurance monthly, which is a payment typically required to protect lenders against default when a buyer doesn’t put down 20%. However, there is an upfront PMI fee required on all VA loans. The lender doesn’t require monthly PMI or a down payment for VA loans because the portion backed by the government assumes the risk on behalf of the service member.

Process and Advice

The DD-214 is a form for veterans which outlines specifics about their active duty, including dates, assignment and rank, separation information, and any decorations, awards or medals received during service. The form is needed to acquire a Certificate of Eligibility (COE), which verifies to lenders that you are eligible for a VA loan. Active duty service members submit a current statement of service signed by the commander of their unit or personnel office in lieu of a DD-214.

Service members obtain VA Loans through typical lending institutions like banks and mortgage brokers who participate in the VA Home Loan Program. We highly recommend working with a lender that has experience in dealing with VA loans.

It’s a good idea to try to get pre-approved for a loan after gathering your COE. It lets buyers know you are serious, and will give you a realistic idea of how much you’ll be able to spend.

For more information on VA loans, visit the US Department of Veterans Affairs website at http://www.benefits.va.gov/.

5 Financial Perks of Being a First Time Homebuyer

A number of tax benefits come with being a homeowner — but you’ve got some work to do if you want to take full advantage.

All of those forms you filled out to buy your house were just the beginning. First-time homeowners have years of mortgage and insurance paperwork to look forward to, and, of course, taxes.

To sort through that pile of paperwork and make sure you’re saving as much money as possible, here are six tax benefits for new homeowners.

1. You can deduct the interest you pay on your mortgage

The home mortgage interest deduction is probably the best-known tax benefit for homeowners. It lets you deduct all the interest you pay toward your home mortgage with a few exceptions, including these big ones:

Your mortgage can’t be more than $1 million.

Your mortgage must be secured by your home (unsecured loans don’t count).

Your mortgage must be on a qualified home, meaning your main or second home (vacation homes count too).

Don’t assume that if you are married and file a joint tax return, you have to own your home together to claim the interest: For purposes of the deduction, the home can be owned by you, your spouse, or jointly. The deduction counts the same either way.

And don’t worry about keeping track of how much you’re paying in interest versus principal each month. At the end of the year, your lender should issue you a form 1098, which reports the amount of interest you’ve paid during the year.

Warning: Since, as a first-time homeowner, you pay more interest than principal in the first few years, that number can be fairly sobering.

2. You may be able to deduct points

Points are essentially prepaid interest that you offer upfront at closing to improve the rate on your mortgage. The more points you pay, the better deal you get.

You can deduct points in the year you pay them if you meet certain criteria. Included in the list (and it’s a long one): Points must be paid on a loan secured by your main home, and that loan must be to purchase or build your main home.

3. For 2015, you can deduct PMI

Private mortgage insurance, or PMI, protects the bank in the event you default. PMI may be required as a condition of a mortgage for first-time homebuyers, especially if they can’t afford a large down payment.

For most years, PMI is not generally deductible. However, for 2015, qualifying homeowners who itemize may claim a tax deduction for the cost of PMI for both their primary home and any vacation homes.

4. Real estate taxes are deductible

Real estate taxes are imposed by state or local governments on the value of your property. Most banks or other mortgage lenders will factor the cost of your real estate taxes into your mortgage and put those amounts into an escrow account.

You can’t deduct the amounts paid into the escrow, but you can deduct the amounts paid out of it to cover the taxes (you’ll see this amount on a form 1098 issued by your lender at the end of the year).

If you don’t escrow for real estate taxes, you’ll deduct what you pay out of pocket directly to the tax authority.

And don’t forget about those taxes you paid at settlement. If you reimburse the seller for taxes already paid for the year, you get to deduct those too.

5. You’ll get capital gains tax relief down the road

Resale value is something you considered when you chose your home. And different from other investments for which you’re taxed on the full value of any gain, you can exclude some of the gain attributable to your home when you sell.

Under current law, you can avoid paying tax on up to $250,000 of gain ($500,000 for married filing jointly) so long as you have owned and lived in the property for two of the last five years (those years of owning and inhabiting don’t have to be consecutive).

Gain over that amount is taxed at capital gains rates, which are generally more favorable than ordinary income tax rates.

Buying a Home When Your Partner Has Bad Credit

You pay all your bills on time and you work hard to earn more — so you can save more. Your credit score reflects your savvy money management skills, and you can proudly boast that you’re a member of the 730-and-up club.

Your partner? Not so much. Whether due to past actions or financial mistakes they’re currently working to correct, your love’s credit score is not something to write home about.

What’s a committed couple ready to settle down into a place of their own to do?

Before giving up on dreams of home ownership, take a look at the following options and determine what path makes the most sense for the two of you.

Ask why your partner’s credit score is low

Before trying to beg and plead with a lender to just give you the loan, ask why your partner’s credit score is less than stellar. If in the end you can chalk a bad credit score up to a mountain of consumer debt, you both might need to take a step back.

Buying a home isn’t a requirement — it’s an important decision, but it’s a big one — and trying to force the situation while one of you faces dire financial straits is a recipe for monetary disaster.

Step one: develop a debt repayment plan. Step two: look into home ownership later, when you each carry smaller liabilities.

If your partner has “bad” credit due to long-past transgressions, you each may benefit by taking action to improve their score before applying for a home loan. Start with these tips to boost a credit score (and score a better interest rate on that mortgage):

- Check credit reports, look for mistakes, and correct errors if necessary

- Make all future payments on time and in full

- Keep your credit utilization ratio low (which means don’t run up a balance of $499 on a card with a $500 credit limit, even if you pay off that balance in full every month!)

- Leave old accounts open, but don’t use them

Make the mortgage your own

Ready to buy a house now? It may make more sense to apply for a loan on your own instead of going in jointly with your partner.

Keep in mind that lenders look at your entire financial picture to determine whether you qualify. That means your own income, assets, and credit-worthiness need to meet the lender’s requirements without any help from other sources.

Before running down this road, ensure the monthly payments and other costs associated with home ownership are ones you can shoulder with your income alone.

While no one wants to think about worst-case scenarios, it’s your name on the dotted line — and you’re the one responsible for paying the mortgage if the two of you ever split up.

Plead your case

Although mortgage lenders may seem like faceless entities incapable of deviating from their set processes, there is room for you to explain your situation and provide all the facts.

If you can show your partner’s bad credit is due to factors that will not impact your reasonable ability to repay the home loan, the lender may approve a joint application despite a low score on one end.

Ask if you can write a letter of explanation for a low credit score. If the lender says it will consider your explanation, provide as much documentation to back up your reasons as possible. Consider including explanations and documents to show how, together, you and your love can reasonably make your monthly payments on your potential loan.

Consider a co-signer

If none of the above solutions works for your situation, you can consider asking someone to co-sign the home loan with you. Another person with a good credit score, sufficient income, and low debt-to-income ratio can help you qualify for the mortgage you want.

But you shouldn’t consider this option lightly. That other person will be financially responsible for the loan if you default.

To put it simply, co-signing can come with a lot of baggage. If co-signing makes sense for you, it’s an option — though you might want to think about other options first.

Love is blind, but mortgage lenders may not be so forgiving (or, well, blind to the realities of your financial situation). That doesn’t mean buying a home is out of the question, but do your research first.

If you can find a workable solution, take action and make your home-owning dreams a reality.

And if you both need to take some time to repair that bad credit score? Do that, and rest easier knowing your financial ducks will be in a row before you take on a mortgage.