What Happens if You Inherit a Mortgage?

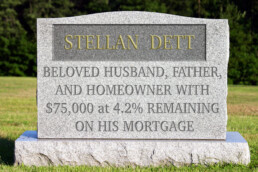

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Who will owe?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

What's the Difference Between Getting Pre-approved & Pre-qualified?

Many people mistakenly believe that getting pre-approved for a mortgage is the same thing as getting pre-qualified. They are NOT the same! Here's the difference:

Getting Pre-qualified

Most sellers will require your pre-qualification letter before they’ll even consider your offer. Ask your lender for a prequalification letter. These are relatively simple to get and they just give a rough, unverified estimate of the loan size you may qualify to receive. Most lenders will give you a pre-qualification based on your verbal self-reporting of your income, assets, debts, and down payment size.

Estimated time: 2–3 days

Getting Pre-approved

The pre-approval stage is when lenders verify everything you’ve told them. You’ll need to supply proof of income, proof of assets, proof of employment, records of any debts you hold, and of course identification documents (such as your Social Security card) and a credit report (which the lender will run).

Once you’re pre-approved, you’ll receive a letter stating the exact amount of loan for which you’re approved.

Estimated time: 1 week to several months.

Divorce? The 5 Worst Money Mistakes

Written by Guest blogger: Leslie Thompson

During a divorce, a spouse who hasn’t been involved in the family’s finances can often be at a disadvantage during settlement negotiations. That’s why it’s so important for both spouses in the process of dissolving their marriage to understand their post-divorce financial needs and their current financial situation.

The following five items are often overlooked as part of the settlement process, but they’re vital areas to address:

- Cash flow needs

Understanding your need for immediate cash flow is extremely important in determining which assets would be the most beneficial for you to receive in the divorce. If immediate cash flow is a concern, the most valuable assets for you are ones you could sell easily and quickly (so-called liquid accounts), such as stocks, bonds, mutual funds and possibly Roth retirement accounts.

If immediate cash flow is not an issue, a combination of assets with various degrees of liquidity (taxable and retirement plan accounts) will likely be more beneficial long-term.

- Joint liabilities

Just because you agree to split a liability does not mean that the lender will honor your property-settlement agreement. Mortgages will need to be refinanced (if possible), any outstanding tax liabilities on jointly-filed returns will need to be paid and jointly-held credit cards will need to be canceled.

It is important that all liabilities are settled before completing a divorce, either by paying them off or by transferring them to the spouse taking responsibility for the debt.

It is also a good idea to run a credit report to determine if there are any outstanding debts that need to be addressed before settlement.

By securing proof that all liabilities have been settled before the divorce finalization, you’ll avoid an unpleasant surprise when a creditor demands payment from you for a liability that you thought had been settled.

- Taxes on assets

It’s critical to review the tax impact of your investments when evaluating the division of your assets. While two assets or investment accounts may have equal dollar values, their economic value could be vastly different when taxes are factored in.

For example, Roth IRA and Roth 401(k) accounts are funded with after-tax dollars; their future growth and distributions are tax-free. On the other hand, traditional 401(k)s and deductible IRAs are funded with pretax dollars and when you withdraw money from them, taxes will be due on both the amount you contributed and the growth of the investments. As such, Roths have a higher economic value than non-Roth 401(k) or deductible IRAs because they won’t be reduced by future taxes.

If you are younger than 59 and a half, you will pay income tax on withdrawals from non-Roth retirement accounts and possibly a 10% tax penalty. But you can avoid the 10% penalty if the distribution occurs within 12 months following a divorce.

You’ll also want to think about any unrealized capital gains on your taxable investments, since taxes will be due someday. Keep in mind that the first $250,000 of gain from the sale of a principal residence is sheltered from tax.

- Past tax returns

It’s a good idea to review the past three to five years of the tax returns you filed as a married couple. Aside from showing you how much income you two had in a given year, you’ll see whether there are any assets on the settlement agreement or if there are what are known as “tax assets” that need to be considered in the negotiation — such as capital loss carry-forwards, charitable contribution carry-forwards or net-operating losses.

“Tax assets” provide the user a reduction in future taxes and should be considered an asset when splitting the marital estate. But left unresolved, they can cause confusion or errors when filing future tax returns.

- Division of retirement assets

Retirement assets typically represent a large portion of a couple’s net worth and there are special rules to allow for the transfer to be tax-free. You’ll want to make sure the intricacies of these transfers are handled with care.

The divorce decree should specify that any IRA is to be treated as a “transfer incident to divorce” to avoid having the transfer classified as a taxable distribution. Be sure to determine if any basis exists from after-tax contributions made to the IRA — an amount that will be tax-free when distributed. (Consult a tax adviser on this.)

Employer-sponsored retirement plans transfer through a qualified domestic relations order, which requires specific information and approval by the court and plan administrator to allow for a tax-free qualified transfer.

Leslie Thompson is Managing Principal of Spectrum Management Group in Indianapolis. With over 20 years of financial industry experience, she has holds the Chartered Financial Analyst, Certified Divorce Financial Analyst and Certified Public Accountant designations.

*This blog is for information purposes only. Derek Parent and NFM, Inc. accept no liability for its content. Please consult a tax adviser or legal counsel for more information.*

VA Loan Eligibility

The VA Loan program was created in 1944 to help veterans and active duty military become homeowners. The government backs portions of loans through approved lenders, allowing veterans to get mortgages with favorable terms.

If you’re interested in learning more about VA loans, here are the basics.

Eligibility

Both Veterans and active duty service members are eligible for VA loans on homes they will occupy. Members must have a good credit rating, sufficient income, a valid COE (certificate of eligibility) and meet specific service requirements.

Benefits

The biggest benefit of a VA Loan is the down payment, which is zero! That’s right, qualified borrowers can get 100% of the cost of a home financed if they haven’t been able to set aside a large sum of money for a down payment.

Another significant benefit is not having to pay private mortgage insurance monthly, which is a payment typically required to protect lenders against default when a buyer doesn’t put down 20%. However, there is an upfront PMI fee required on all VA loans. The lender doesn’t require monthly PMI or a down payment for VA loans because the portion backed by the government assumes the risk on behalf of the service member.

Process and Advice

The DD-214 is a form for veterans which outlines specifics about their active duty, including dates, assignment and rank, separation information, and any decorations, awards or medals received during service. The form is needed to acquire a Certificate of Eligibility (COE), which verifies to lenders that you are eligible for a VA loan. Active duty service members submit a current statement of service signed by the commander of their unit or personnel office in lieu of a DD-214.

Service members obtain VA Loans through typical lending institutions like banks and mortgage brokers who participate in the VA Home Loan Program. We highly recommend working with a lender that has experience in dealing with VA loans.

It’s a good idea to try to get pre-approved for a loan after gathering your COE. It lets buyers know you are serious, and will give you a realistic idea of how much you’ll be able to spend.

For more information on VA loans, visit the US Department of Veterans Affairs website at http://www.benefits.va.gov/.

4 Misconceptions about Real Estate & Capital Gains Tax

Walking away with a profit on your home sale is an exciting proposition. But there’s one thing that can suck the excitement right out of such a positive financial move:the threat of taxes on your investment gain — otherwise known as the dreaded capital gains tax.

Luckily, the Taxpayer Relief Act of 1997 helps many homeowners hold on to the gains earned on their home sale. Pre-1997, homeowners could only use a once-in-a-lifetime tax exemption of up to $125,000 on a home sale, or they would need to roll their earnings into the purchase of another home. Today the rules aren’t quite so stringent. As with all tax-related things, there are plenty of exceptions and loopholes to be aware of. So let’s break down a few misconceptions about capital gains and home sales.

Tax treatment: House flippers vs. homeowners

One common misconception when it comes to capital gains tax on real estate is that all home sales are treated equally. Unfortunately for house flippers, that’s simply not the case. To receive the best tax treatment on your gains, you must have used the home as your primary residence for two out of the five years preceding the sale. If the home was not used as a primary residence for the required time, profit on the sale is taxed as capital gains. However, for those who flip houses on an ongoing basis, homes are considered inventory instead of capital assets, and the profit earned is taxed as income. Long-term capital gains tax is 15% for most people, 20% for those in the top tax brackets. However, if the gains are taxed as income, rates could range from 10% to 39.6% depending on the rest of your income. In addition, house flippers aren’t allowed to simply avoid the tax by rolling profits over into their next home purchase.

Exemption limits: Filing married vs. single

While the Taxpayer Relief Act did away with the once-in-a-lifetime tax exemption of $125,000, exemption limits haven’t completely fallen by the wayside. Now you can pocket up to $500,000 of each home sale profit tax-free if you’re married, or up to $250,000 if you’re single. But for some newly married couples, claiming this exemption can be a little tricky. If one person owned the house for the past two years, but their partner wasn’t added to the title until, say, the last two months, that’s OK. However, both parties must have lived in the residence for two years prior to the sale — even if only one was on the title before they were married. In addition, if one person sold a previous home within the last two years and cashed in on an exemption, the couple will have to wait until they are both out of that two-year window before pocketing any gains from their shared home.

Type of home: Primary residence vs. vacation home or rental property

If you aren’t flipping homes, but you do have a second home or a rental property you’d like to sell after living there for the required two years, it won’t be treated as a primary residence for tax purposes. Second homes and rental homes no longer receive the same tax shelter they did before a 2008 shift in the tax code — even if the home becomes your primary residence for a time. Instead, when tax time comes around, you will owe a prorated amount based on the number of years the property was rented out or used as a second home after 2008. If, for instance, you used your vacation home as your primary residence for five years starting in 2010, but you used it as a vacation home for 15 years before that, only 10% of the gains would be taxed: The two years post-2008 when it was used as a vacation home equals 10% of the total 20 years of homeownership. The rest of the profit wouldn’t be taxed as long as it fell within the exemption limits.

Profit: Large sale price vs. small sale price

Another common misconception is that the more a home sells for, the larger the tax bill will be. However, for tax purposes, what you owe doesn’t depend on the sale price — it’s based on how much profit you make from the sale. In fact, you could sell your home for $5 million and not owe a penny in taxes — as long as you didn’t make more than the allowed exemption amount on the sale.

Another important thing to note: Capital gains tax on real estate isn’t necessarily an all-or-nothing proposition. If you’re nearing the cap on exemptions, you could still qualify for a partial exemption — just be sure to consult a tax professional before you make any big moves.

10 Questions to Ask Your Mortgage Lender

One of THE MOST important stages in the home-buying process is finding a reputable lender or mortgage broker to handle your transaction. A good lender will respect that you work hard for your money — and you want to spend it wisely.

After running a credit check, your lender will present you with options for what you may qualify to borrow. The mortgage amount can be different depending on two things: the product and interest rate. Since the interest rate determines what you’ll owe every month on that balance, understanding how different mortgage products work is key. Here are 10 questions to ask to make sure you’re getting the best rate (and the best deal).

- What is the interest rate?

Your lender will offer you an interest rate based on the loan and your credit. The interest rate, along with the mortgage balance and loan term, will determine your real monthly payment. A loan with a lower balance or a lower interest rate will make for a smaller monthly payment. If you’re not satisfied with the interest rates offered, work to clean up your credit so you can qualify for a lower interest rate.

- What is the monthly mortgage payment?

As you develop a budget for your new home, make sure you can afford this monthly mortgage payment — and be sure to include insurance and taxes in your monthly payment calculations. And don’t forget about short-term financial goals — say, saving up for a vacation or buying a new computer — and long-term retirement goals to consider. Your monthly mortgage payment shouldn’t be so high that your money can’t work toward your other financial goals.

- Is the mortgage fixed rate or an ARM?

Fixed-rate loans keep the same rate for the life of the loan, which can range between 10 and 30 years. Adjustable-rate mortgages, or ARMs, have interest rates that change after an initial period at regular intervals. If you don’t plan to stay in your home long-term, a hybrid ARM with an initial fixed-rate period may be a better choice, since this type of loan tends to have lower interest rates than fixed-rate mortgages.

If you do consider an ARM, make sure you ask (and understand!) when the rate will change and by how much. Ask how often the rate will change after the initial interest rate change, the index that it’s tied to, and the loan’s margin. There are usually caps to how much the interest rate can increase during one period and over the life of the loan, so recalculate the monthly payment to make sure you can afford that higher rate.

- What fees do I have to pay?

One-time fees, typically called “points,” are due at closing. For every point you pay, your lender will decrease your interest rate by 1%. You can also inquire about whether you might have the option of paying zero closing fees in exchange for a higher interest rate.

- Does the loan have any prepayment penalties?

If you’re saving up to make some extra mortgage payments to pay off your mortgage principal early, you may have to pay a fee. Don’t forget to ask this important question.

- When can I lock in the interest rate and points, and how much does this cost?

Your lender may be able to lock in your interest rate for a time, and for a fee. If rates go up, you’ll still be able to benefit from a lower rate on your mortgage.

- What are the qualifying guidelines for this loan?

The underwriting guidelines are different for every loan, as are income and reserve requirements. Along with requiring you to have sufficient funds for the down payment and closing costs, most mortgages require proof of income and reserves of up to six months of mortgage payments.

- What is the minimum down payment required for this loan?

Different loan products have different down payment requirements. Most mortgages require a 20% down payment, but if you qualify for an FHA loan, for example, your down payment could be as low as 3.5%. In general, loans with lower down payments cost more.

- Do I have to pay for mortgage insurance, and how much will this cost?

Putting down less than 20% on your purchase requires paying mortgage insurance until your loan-to-value, or LTV, ratio falls below 80%. Mortgage insurance premiums can be expensive, sometimes costing up to $100 per month for every $100,000 borrowed.

- Do you have other mortgage products with lower rates that I qualify for?

The best way to comparison-shop is to start with your current lender. They probably offer more than one type of loan, and these may have terms better suited to your financial situation.

5 Ways to Use a Mortgage Calculator

Whether you’re hoping to buy or planning to sell, a mortgage calculator can give you some valuable insights. Here are five questions a monthly mortgage calculator can help answer to make you more savvy about home buying.

Should you rent or buy?

There’s more to being a homeowner than just swapping a rent payment for a mortgage payment. You’ll have to consider additional costs like property taxes, and depending on your loan, you also may have to factor in fees like private mortgage insurance (PMI) — all of which can be estimated by a mortgage calculator. It’s a good way to compare the total cost of renting with the realistic costs of buying.

Is an adjustable-rate mortgage (ARM) right for you?

One way to keep a mortgage payment down and still get the house with all the bells and whistles is to choose an adjustable-rate mortgage with an interest rate lower than a fixed-rate loan’s. There are some risks involved, however: With an ARM, your payment could spike if the interest rate adjusts. With a mortgage calculator, you can see how interest rate assumptions can impact your monthly payment, and the total interest paid over the life of a loan with an ARM versus choosing a fixed-rate loan.

Can you cancel your PMI payments?

Private mortgage insurance is an additional cost for most buyers who don’t put down at least a 20% down payment. To stop paying this fee every month, you must owe less than 80% of the value of your home. You could qualify by either paying down your loan or seeing enough appreciation in your home to meet the threshold. A monthly mortgage calculator can help compare your home value with the loan amount and determine when you meet the requirements to request cancellation of your PMI payments.

Can you afford to pay off your mortgage early?

To find out, use a loan calculator to play around with the numbers. Plug in your original loan amount, interest rate, and date the loan was issued. Then include the amount you think you can add to your current monthly payment to determine how quickly you might be able to own your home outright.

Should you refinance?

A lower interest rate is usually a good thing, but depending on the amount you owe and the time remaining in the life of the loan, refinancing may end up costing you more than staying the course.

If you would like answers to these questions and more without using a mortgage calculator, contact my office at 702.331.8185.

Will a New Bill in Congress Help You Qualify for a Mortgage?

A new bill in Congress could significantly impact your ability to secure a mortgage by changing the way lenders look at credit scores.

Known as the Credit Score Competition Act, the bill is in its first stage of the legislative process. Although it’s a long way from becoming a law, future homebuyers have good reason to keep an eye on this bill. The bill would push for a new credit-scoring system, one that could potentially allow more buyers to secure funding. This is a big deal for those who have a low FICO credit score but are otherwise good home-loan candidates.

People with credit scores that do not meet FICO’s standards of “good” or “excellent” could be evaluated under different credit-score systems and therefore have their credit rated differently. In theory, this could help those buyers receive approval for a mortgage they might otherwise have missed out on. Because Fannie Mae and Freddie Mac own about 90% of the secondary mortgage market, and they’re allowed to consider only FICO scores, there’s no room for competition in the credit-scoring industry.

With such low competition, there’s no reason for companies to innovate.

This matters because not everyone has access to traditional forms of credit that beef up your FICO credit score (think steady income, bank accounts, assets, and months of credit-building history). Proponents who argue Fannie Mae and Freddie Mac should be allowed to look at new credit-scoring systems say FICO’s way of formulating credit scores is unfair to a number of groups, including first-time homebuyers, lower-income families, and minorities. The model currently used to score borrowers is based on data from nearly 20 years ago and excludes millions of people that companies like Experian say are creditworthy but whose scores don’t reflect that under the system in place today.

Credit-scoring models currently used in the residential mortgage process judge someone’s creditworthiness on a strict set of criteria but leave out factors that may indicate financial responsibility. For example, right now, FICO generally doesn’t take into account factors such as whether you pay your rent on time. Sometimes, that’s the only way first-time homebuyers can demonstrate they’re capable of handling a monthly mortgage payment. The current credit-scoring model also effectively punishes borrowers who don’t have much of a credit history; a short or nonexistent credit history can drag down overall scores. With this system, if you’re financially responsible, a diligent saver, and debt-free, you could still miss out on a mortgage because you don’t utilize credit in your day-to-day life.

Stay tuned to Credit Score Competition Act's journey through the legislative process!