Refinance in Vegas: Is It Worth It at Today’s Rates?

Interest rates have shifted dramatically over the past few years, leaving many Las Vegas homeowners wondering: “Is refinancing still worth it?”

The answer depends on your current rate, financial goals, and how long you plan to stay in your home. While today’s rates may not match the record lows of 2020–2021, refinancing can still make sense in the right situation. Let’s explore when it’s smart to refinance—and when it’s better to hold tight.

What Does It Mean to Refinance?

Refinancing replaces your existing mortgage with a new one—ideally with better terms. You can refinance to:

- Lower your interest rate

- Shorten your loan term (30 to 15 years)

- Tap into home equity for cash (cash-out refinance)

- Consolidate debt at a lower rate

- Remove a co-borrower or switch from an adjustable to a fixed rate

It’s essentially a reset button for your mortgage—one that can save money or unlock financial flexibility.

Why Homeowners Are Still Refinancing in 2025

Even though rates have risen from historic lows, there are still strong reasons to refinance:

1. To Consolidate High-Interest Debt

Many Las Vegas homeowners are carrying credit card balances at 20% or higher. A cash-out refinance at even 6–7% can save thousands in interest and simplify monthly payments.

2. To Fund Home Improvements

If your home’s value has appreciated, tapping into equity can help finance renovations that boost resale value or comfort—like kitchen upgrades, new HVAC, or solar.

3. To Switch to a Shorter Term

Refinancing from a 30-year to a 15- or 20-year term can help you build equity faster and reduce total interest over time.

4. To Remove Mortgage Insurance

If you bought your home with less than 20% down, you may be paying PMI. Refinancing once you’ve built enough equity can eliminate that cost.

When Refinancing Might NotBe Worth It

Refinancing doesn’t make sense for everyone. Here are times to think twice:

- You plan to sell soon.If you’ll move within the next 1–3 years, you may not recoup the closing costs.

- Your current rate is already competitive.If you’re locked in near the lows of 3–4%, refinancing could increase costs instead of reducing them.

- You lack sufficient equity.Most lenders require at least 10–20% equity for the best rates.

Before moving forward, ask your lender to calculate your breakeven point—how long it takes for monthly savings to outweigh the upfront costs.

What to Expect With Las Vegas Rates in 2025

Mortgage experts predict modest rate improvements through 2025 as inflation cools and the Federal Reserve gradually adjusts policy. However, no one expects a return to ultra-low pandemic levels soon.

Even so, Vegas homeowners with high equity and solid credit are finding competitive refinance opportunities—especially through specialized programs like cash-out or debt consolidation loans.

Example: When Refinancing Works

Let’s say you owe $400,000on a home valued at $550,000, with a current rate of 7.5%.

If you refinance to 6.5%, you could save roughly $260 per month—over $3,000 per year.

If closing costs are $4,500, your breakeven pointis under two years. Stay longer than that, and every month afterward is pure savings.

Local Tip: Vegas Home Values Are Holding Strong

Las Vegas real estate has shown remarkable stability. Homeowners who bought five or more years ago likely have strong equity positions, making it easier to refinance or cash out responsibly.

Even high-rise condo owners who weathered market fluctuations are now seeing renewed lender confidence as building litigation resolves and appraisals strengthen.

Final Thoughts

Refinancing in Las Vegas can still be worth it—if it aligns with your financial goals.Whether you want to lower payments, consolidate debt, or tap equity for upgrades, today’s rates can still make a meaningful difference.

The key is knowing your numbers. A quick analysis from a local expert can show you exactly what you’d save and how fast you’d recoup costs.

If you’re ready to find out whether refinancing makes sense for you, connect withThe Derek Parent Team. We’ll compare options, run your savings scenarios, and help you make a confident, informed decision.

Should You Refinance Before Selling Your Home?

If you’re planning to sell your home, you might be wondering: “Should I refinance first?”It sounds counterintuitive, but in some situations a quick refinance can lower costs, fix loan issues, or help you net more at closing. In other cases, it just adds fees and time you don’t need. Let’s break down when it makes sense—and when it doesn’t.

The Big Question: What Are You Trying to Solve?

Before you refinance, get clear on the why. Most sellers consider refinancing to:

- Lower a payment temporarilywhile prepping the home for sale

- Remove private mortgage insurance (PMI)to improve monthly cash flow

- Switch from an ARM to a fixed rateto avoid a payment jump during a longer selling timeline

- Cash out equityfor repairs/updates that could boost sale price

- Fix title/occupancy/loan quirksthat could spook buyers or delay closing

If none of these apply, refinancing purely out of habit usually isn’t worth it.

When Refinancing Before Selling CanMake Sense

1) You’ll Own the Home Long Enough to Break Even

Refinances have closing costs (often 2–5% of the loan amount). If you plan to hold the home for several months, a lower payment—or eliminating PMI—can offset those costs.

Rule of thumb:calculate the breakeven point(closing costs ÷ monthly savings). If you’ll keep the home longer than that, it may be worth it.

2) You Need Cash for High-ROI Repairs

Strategic upgrades (fresh paint, flooring, landscaping, lighting, minor kitchen/bath refresh) can increase your sale price and marketability. If a cash-out refinance funds improvements that comfortably exceed the cost of the refi, it’s a smart trade.

3) Your Current Loan Could Scare Buyers

If your ARM is about to reset or your loan terms complicate underwriting (rare, but it happens), moving to a clean, fixed-rate mortgage can reduce surprises—especially if you might sell to a buyer using financing that scrutinizes the seller’s situation.

4) You Want to Rent Instead of Sell (Plan B)

Markets change. If you might pivot to renting for 6–24 months, refinancing into a stable payment now can improve cash flow and give you time to let the market catch up.

When Refinancing Before Selling Doesn’t Make Sense

1) You’ll Sell Soon (60–120 Days)

There’s not enough time to recover the cost of a refi. Listing prep + days on market + closing timeline can already push your calendar; adding a new loan process rarely helps.

2) Your Rate Would Increase

If your existing mortgage rate is meaningfully lower than today’s market, replacing it only to sell shortly after is usually a net negative.

3) You’re Tapping Equity Without ROI

Pulling cash for non-essential spending (not tied to sale price or speed) just adds costs and risk. Save the equity for closing, a new purchase, or reserves.

4) You’ll Trigger a Prepayment Penalty

Not common for standard residential loans—but if yours has one, a new refi followed by a quick sale might stack fees. Verify first.

Cash-Out vs. No-Cash-Out: Which Fits Your Goal?

- No-Cash-Out Refi:Best for dropping PMI, improving the rate/term, or stabilizing a payment during a longer prep/list window.

- Cash-Out Refi:Best when you have a targeted renovation plan with clear comps showing the upgrade boosts value or days-on-market.

Tip:If you only need a small amount for repairs and your sale is near, a HELOC(interest on what you use) can be more flexible than a full refinance.

Quick Math: A Simple Breakeven Example

- Closing costs: $5,500

- Monthly savings (rate drop + PMI removal): $275

- Breakeven = 5,500 ÷ 275 = 20 months

If you’ll own the home longer than 20 months, it could pencil out. If not, consider skipping the refi or using smaller-ticket financing for prep.

Renovations That Typically Pay Off (and Those That Don’t)

Often worth it:

- Interior paint, deep clean, curb appeal, lighting, minor bath/kitchen refresh, flooring repairs, functional fixes (HVAC, roof patches)

Usually skip:

- Major kitchen/bath gut jobs, room additions, luxury customizations right before listing

Focus on first impressionand inspection-riskitems. Buyers love “move-in ready,” and appraisers reward clean, well-maintained homes.

Tax & Timing Considerations (High Level)

- Points/fees:Some costs may be deductible over time—ask your tax pro.

- Capital gains timing:If you’re close to the 2-out-of-5-year ownership/occupancy rule for the primary residence exclusion, don’t let a refi delay your sale past a key date.

- Appraisal timing:If values are rising, waiting a few weeks for stronger comps can help whether you refinance orsell.

(This isn’t tax advice—loop in your CPA for specifics.)

A Simple Decision Framework

- How soon will you sell?

- < 6 months: likely no refi

- 6–24 months: maybe(run breakeven)

- 24 months: considerif savings are real

- What’s the objective?

- Lower payment / remove PMI / stabilize term = no-cash-out refi

- High-ROI improvements = cash-out or HELOC

- Does the math work?

- Closing costs vs. monthly savings + projected value lift

- Any simpler path?

- HELOC, seller credits, smart staging instead of major reno

Final Thoughts

Refinancing before selling can be a smart move when it directly increases your net proceeds, reduces risk, or buys time—and when the savings outweigh the costs. But if your sale is around the corner, a refi often adds complexity without enough benefit.

Want a fast, honest read on your numbers? TheDerek Parent Teamcan run a refi vs. sell-as-isscenario: breakeven analysis, projected sale proceeds, and funding options for prep work—so you can move with confidence.

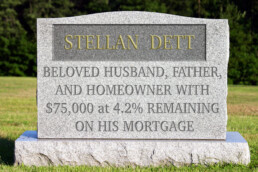

What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Inheriting a Mortgage: What Happens Next?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

5 Ways to Use a Mortgage Calculator

Whether you’re hoping to buy or planning to sell, a mortgage calculator can give you some valuable insights. Here are five questions a monthly mortgage calculator can help answer to make you more savvy about home buying.

Should you rent or buy?

There’s more to being a homeowner than just swapping a rent payment for a mortgage payment. You’ll have to consider additional costs like property taxes, and depending on your loan, you also may have to factor in fees like private mortgage insurance (PMI) — all of which can be estimated by a mortgage calculator. It’s a good way to compare the total cost of renting with the realistic costs of buying.

Is an adjustable-rate mortgage (ARM) right for you?

One way to keep a mortgage payment down and still get the house with all the bells and whistles is to choose an adjustable-rate mortgage with an interest rate lower than a fixed-rate loan’s. There are some risks involved, however: With an ARM, your payment could spike if the interest rate adjusts. With a mortgage calculator, you can see how interest rate assumptions can impact your monthly payment, and the total interest paid over the life of a loan with an ARM versus choosing a fixed-rate loan.

Can you cancel your PMI payments?

Private mortgage insurance is an additional cost for most buyers who don’t put down at least a 20% down payment. To stop paying this fee every month, you must owe less than 80% of the value of your home. You could qualify by either paying down your loan or seeing enough appreciation in your home to meet the threshold. A monthly mortgage calculator can help compare your home value with the loan amount and determine when you meet the requirements to request cancellation of your PMI payments.

Can you afford to pay off your mortgage early?

To find out, use a loan calculator to play around with the numbers. Plug in your original loan amount, interest rate, and date the loan was issued. Then include the amount you think you can add to your current monthly payment to determine how quickly you might be able to own your home outright.

Should you refinance?

A lower interest rate is usually a good thing, but depending on the amount you owe and the time remaining in the life of the loan, refinancing may end up costing you more than staying the course.

If you would like answers to these questions and more without using a mortgage calculator, contact my office at 702.331.8185.

Should You Combine Finances with Your Partner?

Depending on who you ask, combining finances with your significant other is either a positive step towards establishing a life together OR the worst idea ever. If you're considering it, here are some pros and cons to weigh.

Pros

Teamwork

If you’re on the same page and your financial priorities are fully aligned, you're likely looking beyond your own personal needs and wants and putting the needs of the relationship first. By combining all your assets and liabilities, you’re ultimately making the commitment to succeed or fail together, as a unit.

Simplicity

One of the benefits of joining accounts is that it makes bill paying and record keeping a whole lot easier (particularly if you’ve established a budget).

Furthermore, combining your loan accounts, such as credit cards, could help you get additional loans in the future.

And if you’re making consistent, timely payments, both of your credit scores will improve. If you had kept that credit account separate, only one of you would have the benefit of a higher score, which could hurt you down the road when you apply for additional credit.

Taxes

Sure, filing separate returns may be beneficial in some instances. (For example, if one spouse has large medical bills and can meet the deduction threshold by considering only his or her income.)

But joint filing saves time, and possibly money, too — particularly if you both work and one of you makes considerably more than the other. Combining incomes could bring the higher earnings into a lower tax bracket.

Also, some tax credits are only available to a married couple when they file jointly. Talk to your accountant for additional information about minimizing the tax bite.

Cons

Attitudes

Some couples may not agree on certain issues, like creating a spending/saving plan, setting retirement goals, or even how much debt they should carry. After all, opposites do attract, and in many relationships, there is, in fact, a spender and a saver.

If your financial philosophies don’t align, and you’re combining your financial life with someone who has vastly different expectations, goals, systems, ideals and habits, this could bring challenges and unwelcome relationship conflict.

Dependence

If you’ve been managing your money on your own for years, and have been relatively successful in doing so (from choosing your 401K funds to setting a budget to planning a vacation), you may not want to relinquish your financial autonomy.

Sure, there may be more bookkeeping for you to do if you keep your finances separate, and opt for more of a yours/mine/ours account type arrangement (commonly referred to as the “three pot system”), but it may ultimately provide you with the independence and comfort you desire.

Disentangling

You may be in la la land now, but what happens if the relationship doesn’t work out in the long run? Joint mortgages, credit cards, and bank accounts can be very difficult to separate, even with a formal court-ordered divorce decree.