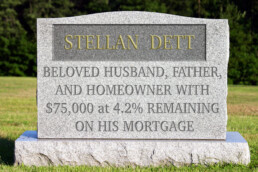

What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Who will owe?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

5 Ways to Use a Mortgage Calculator

Whether you’re hoping to buy or planning to sell, a mortgage calculator can give you some valuable insights. Here are five questions a monthly mortgage calculator can help answer to make you more savvy about home buying.

Should you rent or buy?

There’s more to being a homeowner than just swapping a rent payment for a mortgage payment. You’ll have to consider additional costs like property taxes, and depending on your loan, you also may have to factor in fees like private mortgage insurance (PMI) — all of which can be estimated by a mortgage calculator. It’s a good way to compare the total cost of renting with the realistic costs of buying.

Is an adjustable-rate mortgage (ARM) right for you?

One way to keep a mortgage payment down and still get the house with all the bells and whistles is to choose an adjustable-rate mortgage with an interest rate lower than a fixed-rate loan’s. There are some risks involved, however: With an ARM, your payment could spike if the interest rate adjusts. With a mortgage calculator, you can see how interest rate assumptions can impact your monthly payment, and the total interest paid over the life of a loan with an ARM versus choosing a fixed-rate loan.

Can you cancel your PMI payments?

Private mortgage insurance is an additional cost for most buyers who don’t put down at least a 20% down payment. To stop paying this fee every month, you must owe less than 80% of the value of your home. You could qualify by either paying down your loan or seeing enough appreciation in your home to meet the threshold. A monthly mortgage calculator can help compare your home value with the loan amount and determine when you meet the requirements to request cancellation of your PMI payments.

Can you afford to pay off your mortgage early?

To find out, use a loan calculator to play around with the numbers. Plug in your original loan amount, interest rate, and date the loan was issued. Then include the amount you think you can add to your current monthly payment to determine how quickly you might be able to own your home outright.

Should you refinance?

A lower interest rate is usually a good thing, but depending on the amount you owe and the time remaining in the life of the loan, refinancing may end up costing you more than staying the course.

If you would like answers to these questions and more without using a mortgage calculator, contact my office at 702.331.8185.

Should You Combine Finances with Your Partner?

Depending on who you ask, combining finances with your significant other is either a positive step towards establishing a life together OR the worst idea ever. If you're considering it, here are some pros and cons to weigh.

Pros

Teamwork

If you’re on the same page and your financial priorities are fully aligned, you're likely looking beyond your own personal needs and wants and putting the needs of the relationship first. By combining all your assets and liabilities, you’re ultimately making the commitment to succeed or fail together, as a unit.

Simplicity

One of the benefits of joining accounts is that it makes bill paying and record keeping a whole lot easier (particularly if you’ve established a budget).

Furthermore, combining your loan accounts, such as credit cards, could help you get additional loans in the future.

And if you’re making consistent, timely payments, both of your credit scores will improve. If you had kept that credit account separate, only one of you would have the benefit of a higher score, which could hurt you down the road when you apply for additional credit.

Taxes

Sure, filing separate returns may be beneficial in some instances. (For example, if one spouse has large medical bills and can meet the deduction threshold by considering only his or her income.)

But joint filing saves time, and possibly money, too — particularly if you both work and one of you makes considerably more than the other. Combining incomes could bring the higher earnings into a lower tax bracket.

Also, some tax credits are only available to a married couple when they file jointly. Talk to your accountant for additional information about minimizing the tax bite.

Cons

Attitudes

Some couples may not agree on certain issues, like creating a spending/saving plan, setting retirement goals, or even how much debt they should carry. After all, opposites do attract, and in many relationships, there is, in fact, a spender and a saver.

If your financial philosophies don’t align, and you’re combining your financial life with someone who has vastly different expectations, goals, systems, ideals and habits, this could bring challenges and unwelcome relationship conflict.

Dependence

If you’ve been managing your money on your own for years, and have been relatively successful in doing so (from choosing your 401K funds to setting a budget to planning a vacation), you may not want to relinquish your financial autonomy.

Sure, there may be more bookkeeping for you to do if you keep your finances separate, and opt for more of a yours/mine/ours account type arrangement (commonly referred to as the “three pot system”), but it may ultimately provide you with the independence and comfort you desire.

Disentangling

You may be in la la land now, but what happens if the relationship doesn’t work out in the long run? Joint mortgages, credit cards, and bank accounts can be very difficult to separate, even with a formal court-ordered divorce decree.