How to Analyze Cash Flow Before Buying a Rental Property

Investing in rental properties can be a powerful way to build long-term wealth, but one of the most important steps before making a purchase is analyzing cash flow. Understanding cash flow helps ensure that your investment will generate consistent income, cover expenses, and provide a return on your investment. Without proper analysis, even a property in a prime location could turn into a financial burden.

In this article, we’ll guide you step by step on how to analyze cash flow before buying a rental property, so you can make informed decisions and maximize your real estate profits.

What is Cash Flow in Real Estate?

Cash flow in real estate refers to the net income generated by a rental property after all expenses are paid. In other words, it’s the money left over each month or year after accounting for everything you spend to operate the property.

A simple way to calculate cash flow:

Cash Flow = Rental Income - Expenses

- Positive cash flow: The property earns more than it costs to maintain, which is ideal for investors.

- Negative cash flow: The property costs more than it earns, which can create financial strain.

Analyzing cash flow is essential for determining whether a rental property will be profitable.

Step 1: Calculate Gross Rental Income

The first step is to estimate the gross rental income, which is the total rent you expect to collect from tenants.

- Research similar properties in the area to determine market rent.

- Consider factors like location, property size, amenities, and condition.

- Be realistic with your estimates to avoid overestimating potential income.

For example, if you plan to rent a property for $1,500 per month, the annual gross rental income would be:

1500 x 12 = 18000

This figure is the starting point for your cash flow analysis.

Step 2: Estimate Operating Expenses

Next, calculate the operating expenses, which are the costs required to manage and maintain the property. Common expenses include:

- Mortgage payments (if the property is financed)

- Property taxes

- Insurance (landlord insurance)

- Maintenance and repairs (budget around 1% of property value annually)

- Property management fees (if hiring a management company, usually 8–10% of rent)

- Utilities (if the landlord covers them)

- Vacancy reserve (5–10% of rent to account for empty units)

Adding these costs together gives the total operating expenses, which you’ll subtract from your rental income.

Step 3: Calculate Net Operating Income (NOI)

Once you know the rental income and operating expenses, calculate the Net Operating Income (NOI):

NOI = Gross Rental Income - Operating Expenses

For example, if your annual rent is $18,000 and expenses are $10,000, the NOI would be:

18000 - 10000 = 8000

NOI shows how much money the property generates before accounting for mortgage payments or debt service. It’s a key metric for evaluating investment properties.

Step 4: Subtract Debt Service

If you are using a mortgage to finance the property, subtract the annual loan payments (principal + interest) to determine the cash flow after financing:

Cash Flow = NOI - Debt Service

Continuing the example, if the annual mortgage payments are $6,000:

8000 - 6000 = 2000

This means the property would generate $2,000 per year in positive cash flow.

Step 5: Account for One-Time and Unexpected Costs

Smart investors also include a buffer for unexpected expenses, such as:

- Major repairs (roof, HVAC, plumbing)

- Appliance replacements

- HOA special assessments

- Legal or eviction costs

A conservative approach is to set aside 5–10% of annual rental income to cover unexpected costs. This ensures your cash flow projections are realistic.

Step 6: Use Cash Flow Metrics

Two important metrics can help you evaluate a property’s profitability:

- Cash-on-Cash Return: Measures annual cash flow relative to your initial investment

Cash-on-Cash Return (%) = (Annual Cash Flow / Total Cash Invested) x 100

- Capitalization Rate (Cap Rate): Measures the property’s net income relative to its purchase price

Cap Rate (%) = (NOI / Purchase Price) x 100

Both metrics help compare properties and assess whether the investment meets your financial goals.

Step 7: Stress-Test Your Cash Flow

It’s important to evaluate how your cash flow holds up under different scenarios:

- What if rent drops by 10–15%?

- What if vacancy rates are higher than expected?

- What if maintenance costs rise?

Stress-testing helps you anticipate potential challenges and ensure the investment remains profitable under less-than-ideal conditions.

Step 8: Make an Informed Decision

After analyzing rental income, expenses, debt service, and potential risks, you should have a clear picture of whether the property is a good investment.

- Positive Cash Flow: Indicates the property can generate steady income and is likely a strong investment.

- Negative Cash Flow: May still work if property appreciation is expected, but it requires careful planning and reserves.

Cash flow analysis is just one piece of the puzzle. Also consider location, market trends, and long-term appreciation potential.

Tips for Maximizing Cash Flow

- Increase Rent Strategically – Make improvements that justify higher rent.

- Reduce Expenses – Compare insurance providers, perform energy-efficient upgrades, or self-manage the property.

- Screen Tenants Carefully – Reduce vacancies and late payments by selecting reliable tenants.

- Regular Maintenance – Prevent costly repairs by addressing minor issues early.

- Refinance When Possible – Lower interest rates reduce debt service and increase cash flow.

Active management of income and expenses is the key to maximizing cash flow and achieving long-term profitability.

Conclusion

Analyzing cash flow before buying a rental property is essential for real estate success. By calculating gross income, subtracting operating expenses and debt service, accounting for unexpected costs, and stress-testing your projections, you can make informed decisions that protect your investment and maximize returns.

For more guidance on rental property investments, cash flow analysis, and financing strategies, visit The Parent Team. Our team can help you identify profitable properties, analyze potential cash flow, and create a tailored investment plan to grow your real estate portfolio.

Remember, successful real estate investing begins with careful analysis. Understanding cash flow is the first step toward building a sustainable and profitable rental property business.

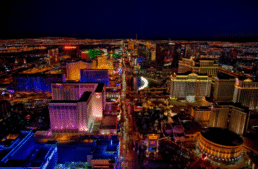

Las Vegas Real Estate Trends Every Buyer Should Watch This Year

The real estate market in Las Vegas continues to evolve, and this year is shaping up to be more strategic than sensational. Instead of dramatic swings, buyers are seeing steady trends that reward preparation, patience, and smart decision-making.

If you’re thinking about buying a home this year—whether it’s your first purchase, a move-up home, or an investment—these are the key Las Vegas real estate trends you should be paying attention to.

1. Prices Are Stabilizing, Not Falling

After years of rapid appreciation, Las Vegas home prices have entered a period of normalization. That doesn’t mean values are dropping across the board—it means growth has slowed to a healthier pace.

What buyers are seeing:

- Fewer extreme price jumps

- More realistic list prices

- Appraisals aligning more closely with contracts

- Less emotional pricing from sellers

For buyers, this creates predictability. You’re less likely to feel rushed, and more likely to make decisions based on numbers instead of pressure.

2. Inventory Is Improving—But Still Tight

Inventory has increased compared to the ultra-competitive years, but it remains limited in many desirable neighborhoods. A major reason is that many homeowners are holding onto low mortgage rates and choosing not to sell.

This creates a market where:

- Well-priced homes still move quickly

- Move-in-ready properties attract the most attention

- Buyers have slightly more choices—but not unlimited ones

The takeaway: being pre-approved and prepared still matters, especially in areas like Summerlin, Henderson, and the Northwest Valley.

3. Buyer Competition Is Lower Than Normal

One of the most buyer-friendly trends this year is reduced competition. Higher interest rates have pushed some buyers to the sidelines, which means fewer bidding wars and more negotiation power for those who remain active.

Buyers are now able to:

- Negotiate seller credits

- Ask for repairs

- Include contingencies

- Take more time with decisions

This is a sharp contrast to prior years, when buyers often waived protections just to win a deal.

4. Seller Concessions Are Back

Sellers are more flexible than they’ve been in years. Instead of focusing only on price, many are willing to help buyers manage affordability.

Common concessions include:

- Closing cost credits

- Temporary rate buydowns

- Price adjustments after inspections

- Credits toward repairs or upgrades

For buyers, these concessions can offset higher interest rates and lower upfront costs—sometimes significantly.

5. New Construction Is Playing a Bigger Role

New construction has become one of the most attractive options for buyers this year. Builders across Las Vegas are actively offering incentives to maintain sales momentum.

What buyers are seeing:

- Rate buydowns

- Closing cost assistance

- Upgrade credits

- Discounts on quick move-in homes

In many cases, new construction can offer a lower effective monthly payment than resale homes once incentives are factored in.

6. Mortgage Rates Are Steady, Not Spiking

While mortgage rates are higher than the historic lows of the past, they’ve become more stable. That stability is important—it allows buyers to plan rather than react.

Instead of trying to time the lowest rate, buyers are focusing on:

- Monthly payment comfort

- Loan structure flexibility

- Refinance opportunities later

- Long-term affordability

Many buyers are choosing to buy now and refinance later, rather than waiting for perfect conditions that may bring more competition.

7. Out-of-State Buyers Continue to Influence the Market

Las Vegas remains a top destination for buyers relocating from higher-cost states. This ongoing migration supports demand and helps keep prices resilient.

For local buyers, this means:

- Desirable neighborhoods remain competitive

- Long-term value remains strong

- Waiting for major price drops may not be realistic

Understanding where out-of-state demand is strongest can help buyers target areas with better long-term upside.

What This Means for Buyers

This year’s market isn’t about rushing or waiting blindly—it’s about strategy.

Smart buyers are:

- Getting pre-approved early

- Comparing buy-now vs. wait scenarios

- Using concessions to offset rates

- Staying flexible on property type and location

- Working with local experts who understand Las Vegas-specific trends

At The Parent Team, we help buyers break down these trends into clear numbers so decisions are based on data—not headlines.

Final Thoughts

The Las Vegas real estate market this year favors informed, prepared buyers. Prices are stable, competition is manageable, and opportunities exist for those who understand how today’s trends fit together.

If you’re thinking about buying—or want help deciding whether now is the right time—connect with The Derek Parent Team. We’ll help you evaluate your options, understand your buying power, and create a plan that makes sense in today’s market.

What Credit Score Do You Actually Need to Buy a Home in Nevada?

One of the most common questions buyers ask is also one of the most misunderstood:

“What credit score do I really need to buy a home?”

If you’re buying in Nevada, the answer isn’t a single number. It depends on the loan program, your overall financial profile, and how the lender structures your mortgage.

Let’s break it down clearly—without myths or scare tactics.

The Short Answer: You Don’t Need Perfect Credit

Many buyers assume they need a 740+ credit score to qualify. In reality, many Nevada buyers purchase homes with scores well below that.

What matters most is:

- The loan type

- Your income and debt

- Your down payment

- Your recent credit behavior

Credit score opens doors—but it’s only one piece of the approval puzzle.

Minimum Credit Scores by Loan Type

Here’s how the most common mortgage programs break down.

Conventional Loans

- Minimum score: 620

- Best pricing: 740+

- Down payment options: As low as 3%

Conventional loans reward higher credit scores with better interest rates, but many buyers qualify comfortably in the 620–700 range—especially with solid income and manageable debt.

FHA Loans

- Minimum score: 580(with 3.5% down)

- Possible with lower scores: 500–579(with larger down payment, lender-dependent)

FHA loans are popular with first-time buyers because they’re more forgiving of past credit issues. Recent payment history matters more than old mistakes.

VA Loans (for Eligible Veterans)

- No official minimum set by VA

- Most lenders prefer: 620+

- Down payment: 0%

VA loans are one of the most flexible options available. Many veterans qualify even after past credit challenges, as long as current finances are stable.

Jumbo Loans

- Typical minimum: 700–720

- Stronger reserves required

- Higher income verification

Jumbo loans are used for higher-priced homes and require stronger credit profiles—but even here, structure and assets matter.

Why Lenders Look Beyond the Score

A credit score is a snapshot, not the full story. Lenders also evaluate:

- Debt-to-income ratio (DTI)

- Payment history over the last 12–24 months

- Credit utilization

- Derogatory items (collections, late payments)

- Cash reserves after closing

A buyer with a 640 score and low debt may be a better borrower than someone with a 720 score and high monthly obligations.

Common Credit Myths That Hold Buyers Back

Let’s clear up a few misconceptions.

Myth #1: One late payment ruins your chances

Not true. Pattern matters more than one mistake.

Myth #2: You must pay off all collections

Often false. Many collections don’t need to be paid to qualify.

Myth #3: You should close old accounts

Closing accounts can hurt your score by reducing credit history and available credit.

Myth #4: You should wait until your score is “perfect”

Waiting can cost you more in rising prices than you save in rate improvements.

How Much Difference Does Credit Score Make in Your Rate?

Credit score impacts pricing—but not always as dramatically as buyers fear.

For example:

- A buyer at 680may pay slightly more than a buyer at 740

- But seller credits, buydowns, or refinancing later can offset that difference

This is why many buyers choose to buy now and optimize later, instead of waiting indefinitely.

What If Your Score Isn’t Where You Want It Yet?

If you’re not quite ready today, that’s okay—but guessing isn’t the solution.

A short credit review can:

- Identify what’s helping or hurting your score

- Show which actions actually move the needle

- Prevent unnecessary credit changes

- Create a clear timeline to approval

At The Parent Team, we help buyers map out specific, realistic steps—not generic advice.

The Most Important Takeaway

The credit score you “need” isn’t a fixed number. It’s about:

- Choosing the right loan

- Structuring the deal correctly

- Understanding what lenders actually care about

Many buyers delay homeownership unnecessarily because of outdated or incorrect credit assumptions.

Final Thoughts

If you’re thinking about buying a home in Nevada, your credit score matters—but it doesn’t need to be perfect. With the right strategy, many buyers qualify sooner than they expect.

If you want an honest review of where you stand—and what’s possible—connect with The Derek Parent Team. We’ll break down your options clearly and help you move forward with confidence.

Hidden Costs of Buying a Home Most Buyers Don’t Budget For

Most buyers focus on the purchase price and down payment when planning to buy a home. But in reality, the true cost of homeownership goes beyond the sticker price. Failing to budget for the hidden expenses can turn an exciting purchase into a stressful experience.

In a market like Las Vegas — where HOAs, new construction, and high-rise living are common — understanding these costs upfront is critical. Here’s what many buyers overlook and how to prepare for them.

1. Closing Costs Add Up Faster Than Expected

Closing costs are often underestimated or misunderstood. Depending on your loan type and purchase price, closing costs typically range from 2% to 4% of the home price.

These may include:

- Loan origination and underwriting fees

- Appraisal and credit report fees

- Title insurance

- Escrow fees

- Recording fees

- Prepaid taxes and insurance

While seller credits can help offset these costs, buyers should still plan for them early in the process.

2. HOA Fees (A Big One in Las Vegas)

Many Las Vegas communities are governed by homeowners associations, and those monthly dues can vary significantly.

Typical HOA ranges:

- $50–$200/month in suburban communities

- $300–$600/month in condos or townhomes

- $600–$2,500+/month in high-rise buildings

HOA fees are part of your monthly housing costand can affect loan approval and affordability. They also increase annually in many communities.

3. Property Taxes May Be Higher Than Expected

Property taxes are often estimated, but the actual amount can change after purchase — especially in new construction or recently reassessed homes.

Buyers are sometimes surprised when:

- New construction taxes are reassessed at full value

- Supplemental tax bills arrive after closing

- Escrow payments increase in the second year

Budgeting conservatively for taxes helps avoid payment shock later.

4. Homeowners Insurance Isn’t One-Size-Fits-All

Insurance costs depend on:

- Property type

- Location

- Replacement cost

- HOA coverage (for condos and high-rises)

High-rise and condo buyers may also need HO-6 policies, while single-family homes often require higher coverage for roofs, pools, or detached structures.

Insurance premiums can rise annually, so planning for increases is smart.

5. Utilities and Seasonal Expenses

Las Vegas utility costs — especially electricity — can be significant during summer months.

Buyers often forget to budget for:

- Higher summer power bills

- Gas usage in winter

- Water and sewer fees

- Trash services (sometimes separate from HOA)

A larger home or older property can dramatically increase monthly utility expenses.

6. Maintenance and Repairs

Even brand-new homes come with maintenance costs. Older homes may need repairs sooner than expected.

Common ongoing expenses include:

- HVAC servicing

- Plumbing or electrical repairs

- Roof maintenance

- Appliance replacements

- Landscaping and irrigation upkeep

- Pool maintenance

A good rule of thumb is setting aside 1% of the home’s value annuallyfor maintenance.

7. New Construction Extras

Buyers purchasing new construction often assume everything is included — but many upgrades cost extra.

Common overlooked costs:

- Window coverings

- Backyard landscaping

- Appliances (in some communities)

- Garage finishes

- Smart home upgrades

These expenses often come shortly after closing, so they should be part of your upfront budget.

8. Moving and Setup Costs

The move itself can be expensive.

Don’t forget to budget for:

- Moving services or trucks

- Utility deposits

- Internet and cable setup

- New furniture or appliances

- Minor cosmetic updates

These costs add up quickly, especially if you’re moving from out of state.

How to Avoid Budget Surprises

The best way to avoid surprises is planning early and working with professionals who understand the local market.

At The Parent Team, we help buyers:

- Review full monthly payment breakdowns

- Factor in HOA dues and taxes accurately

- Understand closing costs upfront

- Compare multiple scenarios

- Avoid “payment shock” after closing

A realistic budget leads to a much better homeownership experience.

Final Thoughts

Buying a home is one of the biggest financial decisions you’ll make. While hidden costs can’t always be eliminated, they canbe anticipated and planned for.

When buyers understand the full picture — not just the purchase price — they make smarter, more confident decisions and enjoy their home without financial stress.

If you’re preparing to buy and want a clear, honest breakdown of what to expect, connect with The Derek Parent Team. We’ll help you budget accurately and buy with confidence.

What Credit Score Do You Actually Need to Buy a Home in Nevada?

One of the most common questions buyers ask is also one of the most misunderstood:

“What credit score do I really need to buy a home?”

If you’re buying in Nevada, the answer isn’t a single number. It depends on the loan program, your overall financial profile, and how the lender structures your mortgage.

Let’s break it down clearly—without myths or scare tactics.

The Short Answer: You Don’t Need Perfect Credit

Many buyers assume they need a 740+ credit score to qualify. In reality, many Nevada buyers purchase homes with scores well below that.

What matters most is:

- The loan type

- Your income and debt

- Your down payment

- Your recent credit behavior

Credit score opens doors—but it’s only one piece of the approval puzzle.

Minimum Credit Scores by Loan Type

Here’s how the most common mortgage programs break down.

Conventional Loans

- Minimum score: 620

- Best pricing: 740+

- Down payment options: As low as 3%

Conventional loans reward higher credit scores with better interest rates, but many buyers qualify comfortably in the 620–700 range—especially with solid income and manageable debt.

FHA Loans

- Minimum score: 580(with 3.5% down)

- Possible with lower scores: 500–579(with larger down payment, lender-dependent)

FHA loans are popular with first-time buyers because they’re more forgiving of past credit issues. Recent payment history matters more than old mistakes.

VA Loans (for Eligible Veterans)

- No official minimum set by VA

- Most lenders prefer: 620+

- Down payment: 0%

VA loans are one of the most flexible options available. Many veterans qualify even after past credit challenges, as long as current finances are stable.

Jumbo Loans

- Typical minimum: 700–720

- Stronger reserves required

- Higher income verification

Jumbo loans are used for higher-priced homes and require stronger credit profiles—but even here, structure and assets matter.

Why Lenders Look Beyond the Score

A credit score is a snapshot, not the full story. Lenders also evaluate:

- Debt-to-income ratio (DTI)

- Payment history over the last 12–24 months

- Credit utilization

- Derogatory items (collections, late payments)

- Cash reserves after closing

A buyer with a 640 score and low debt may be a better borrower than someone with a 720 score and high monthly obligations.

Common Credit Myths That Hold Buyers Back

Let’s clear up a few misconceptions.

Myth #1: One late payment ruins your chances

Not true. Pattern matters more than one mistake.

Myth #2: You must pay off all collections

Often false. Many collections don’t need to be paid to qualify.

Myth #3: You should close old accounts

Closing accounts can hurt your score by reducing credit history and available credit.

Myth #4: You should wait until your score is “perfect”

Waiting can cost you more in rising prices than you save in rate improvements.

How Much Difference Does Credit Score Make in Your Rate?

Credit score impacts pricing—but not always as dramatically as buyers fear.

For example:

- A buyer at 680may pay slightly more than a buyer at 740

- But seller credits, buydowns, or refinancing later can offset that difference

This is why many buyers choose to buy now and optimize later, instead of waiting indefinitely.

What If Your Score Isn’t Where You Want It Yet?

If you’re not quite ready today, that’s okay—but guessing isn’t the solution.

A short credit review can:

- Identify what’s helping or hurting your score

- Show which actions actually move the needle

- Prevent unnecessary credit changes

- Create a clear timeline to approval

Athttps://derekparentteam.com, we help buyers map out specific, realistic steps—not generic advice.

The Most Important Takeaway

The credit score you “need” isn’t a fixed number. It’s about:

- Choosing the right loan

- Structuring the deal correctly

- Understanding what lenders actually care about

Many buyers delay homeownership unnecessarily because of outdated or incorrect credit assumptions.

Final Thoughts

If you’re thinking about buying a home in Nevada, your credit score matters—but it doesn’t need to be perfect. With the right strategy, many buyers qualify sooner than they expect.

If you want an honest review of where you stand—and what’s possible—connect with The Derek Parent Team. We’ll break down your options clearly and help you move forward with confidence.

How Federal Reserve Policy Impacts Mortgage Rates

When mortgage rates rise or fall, most buyers and homeowners hear one phrase repeated over and over: “The Fed did it.”

But the truth is more nuanced.

The Federal Reserve plays a powerful role in shaping the mortgage market — without directly setting mortgage rates. Understanding how Fed policy actually works can help you make smarter decisions about buying, refinancing, or waiting.

Here’s a clear breakdown of how Federal Reserve policy influences mortgage rates and what that means for you as a Las Vegas buyer or homeowner.

1. The Federal Reserve Does Not Set Mortgage Rates

This is the most important point to understand upfront. The Federal Reserve does not directly control mortgage rates.

Instead, it controls:

- The federal funds rate(the overnight rate banks charge each other)

- Monetary policy designed to manage inflation and economic growth

Mortgage rates are primarily influenced by:

- The bond market

- The 10-year Treasury yield

- Inflation expectations

- Investor demand for mortgage-backed securities

However, Fed decisions strongly influence all of these factors — which is why its actions matter so much.

2. Why the Fed Raises and Lowers Rates

The Federal Reserve’s main goals are:

- Control inflation

- Maintain employment stability

- Protect economic growth

When inflation is high, the Fed raises rates to slow spending.

When the economy slows too much, it lowers rates to stimulate growth.

These decisions ripple through financial markets, including housing.

3. How Fed Rate Hikes Push Mortgage Rates Higher

When the Fed raises the federal funds rate:

- Borrowing becomes more expensive for banks

- Investors demand higher returns

- Bond yields rise

- Mortgage-backed securities must offer higher yields to attract buyers

As a result, mortgage rates tend to increase, even though the Fed didn’t touch them directly.

This is exactly what happened during the recent inflation-fighting cycle, when aggressive Fed hikes led to the highest mortgage rates in over a decade.

4. Why Mortgage Rates Sometimes Fall Even When the Fed Holds Rates

This is where many buyers get confused.

Mortgage rates can drop beforethe Fed cuts rates — or even while the Fed pauses.

Why?

- Investors anticipate future economic slowing

- Inflation expectations ease

- Money flows into bonds as a safe haven

- Demand for mortgage-backed securities increases

Markets move on expectations, not just announcements. That’s why waiting for a Fed rate cut doesn’t always lead to the best mortgage pricing.

5. The Bond Market Matters More Than Headlines

Mortgage rates are closely tied to long-term bonds, especially the 10-year Treasury. When bond yields fall, mortgage rates usually follow.

Key factors that influence bond yields:

- Inflation data

- Employment reports

- Global economic uncertainty

- Federal Reserve guidance and projections

This is why some of the biggest mortgage rate drops happen on days when the Fed doesn’t even meet.

6. What This Means for Buyers

For buyers, Fed policy creates windows of opportunity— but they don’t always line up with news cycles.

Here’s what smart buyers focus on instead:

- Monthly payment affordability

- Purchase price vs. long-term value

- Seller concessions and incentives

- Refinance flexibility later

Trying to time the exact bottom of interest rates is risky. Buying when the numbers make sense — and refinancing later if rates improve — is often the stronger strategy.

7. What This Means for Homeowners

For homeowners, understanding Fed policy helps with:

- Refinance timing

- Cash-out decisions

- Debt consolidation planning

- Equity strategies

Even modest changes in market sentiment — not just Fed action — can create refinance opportunities. That’s why monitoring the bond market and rate trends matters more than waiting for a single Fed announcement.

8. Why Local Expertise Matters

National headlines talk about the Fed. Local experts talk about how Fed policy plays out in your market.

In Las Vegas, factors like:

- Population growth

- New construction incentives

- Investor demand

- High-rise financing conditions

can amplify or soften the impact of Federal Reserve decisions.

Athttps://derekparentteam.com, we help buyers and homeowners understand how national policy and local market dynamics intersect — so decisions are based on data, not fear.

Final Thoughts

The Federal Reserve sets the tone for the economy, but mortgage rates are driven by a broader mix of market forces. Understanding that relationship helps you stop reacting to headlines and start planning strategically.

Whether you’re buying, refinancing, or simply watching the market, the smartest move is understanding how policy affects real-world numbers, not just announcements.

If you want to see how today’s rate environment — and future Fed policy — impacts youroptions, connect with The Derek Parent Team. We’ll walk through real scenarios and help you build a plan that works in any market cycle.

What Fannie Mae and Freddie Mac Are Signaling About Mortgage Rates Today

When mortgage rates move, most people look to the Federal Reserve for answers. But inside the mortgage industry, two other institutions quietly provide some of the clearest forward-looking signalsabout where rates are heading: Fannie Mae and Freddie Mac.

These government-sponsored enterprises don’t set mortgage rates directly, but their forecasts, pricing models, and policy guidance heavily influence lending behavior nationwide. If you’re a buyer, homeowner, or investor trying to decide whether to act now or wait, their signals matter more than most headlines.

Here’s what they’re telling us right now.

Why Fannie Mae and Freddie Mac Matter So Much

Fannie Mae and Freddie Mac back the majority of conventional mortgages in the U.S. Because of that, they closely track economic data tied to housing affordability, inflation, employment, and consumer demand.

When they adjust forecasts or lending assumptions, lenders pay attention — because those changes affect:

- Mortgage pricing

- Loan availability

- Qualification guidelines

- Risk tolerance across the market

In short, they see what’s coming beforeit shows up in rate sheets.

Signal #1: Rates Are Expected to Ease — Not Collapse

Both agencies are projecting gradual improvement in mortgage rates, not a sudden drop. This is an important distinction.

Their recent outlooks suggest:

- Inflation is cooling, but not gone

- The economy is slowing, not breaking

- Rate volatility is decreasing

- Long-term rates are stabilizing

What this means for buyers is simple: the era of sharp rate spikes appears to be behind us, but the return to ultra-low rates is unlikely.

Translation: Rates may improve, but waiting for perfection could be costly.

Signal #2: Housing Demand Remains Strong

Despite higher rates, both Fannie Mae and Freddie Mac continue to report persistent housing demand, especially in growth markets like Las Vegas.

Key reasons:

- Ongoing population growth

- Limited resale inventory

- Homeowners holding low-rate mortgages

- Rising rents pushing renters toward ownership

This sustained demand is one reason neither agency expects meaningful home price declines in most markets. Instead, they’re forecasting moderate, steady appreciation.

Signal #3: Affordability Is Improving in Subtle Ways

While rates remain elevated compared to prior years, affordability is improving through other channels:

- Slower price appreciation

- More seller concessions

- Builder incentives

- Temporary rate buydowns

- Expanded loan strategies

Fannie Mae has noted that buyers are adapting rather than exiting the market. That adaptability is stabilizing housing activity — and reinforcing the idea that the market is normalizing, not weakening.

Signal #4: Refinance Activity Will Return — Slowly

Both agencies expect refinance volume to increase incrementally, not explosively. Homeowners with rates in the high-6% to 7% range may benefit from refinancing even with modest rate improvements.

What’s especially notable is the growing focus on:

- Cash-out refinances

- Debt consolidation

- Term restructuring (30-year to 20- or 15-year)

- Removing mortgage insurance

This tells us that homeowners are becoming more strategic — using refinancing as a financial tool, not just a rate play.

Signal #5: Lending Standards Are Holding Steady

One of the most important signals from Fannie Mae and Freddie Mac is what isn’thappening: lending standards are not tightening aggressively.

That suggests:

- No systemic housing risk

- No pullback from qualified borrowers

- Continued confidence in the housing market

For buyers, this is a strong indicator that the market is on solid footing — not headed toward instability.

What This Means for Las Vegas Buyers and Homeowners

In growth markets like Las Vegas, these signals matter even more. Continued in-migration, limited inventory, and strong employment trends are aligning with the broader national outlook.

For buyers:

- Waiting for dramatic rate drops may backfire if competition increases

- Buying now with flexibility to refinance later can be a smart strategy

For homeowners:

- Reviewing refinance and equity options sooner rather than later may unlock meaningful savings

- Strategic planning matters more than timing the absolute bottom

The Bigger Picture

Fannie Mae and Freddie Mac aren’t signaling fear. They’re signaling stability, moderation, and opportunity for prepared buyers.

Mortgage rates may not fall overnight, but the environment is becoming more predictable — and predictability creates opportunity for those who plan ahead instead of reacting late.

Final Thoughts

If you’re waiting for a clear sign from the market, this is it: the foundation is stabilizing, demand remains strong, and the smartest moves are happening quietly — before the next wave of buyers re-enters the market.

If you want to understand how today’s signals apply to yoursituation, connect with The Derek Parent Teamathttps://derekparentteam.com. We’ll walk you through real numbers, real options, and real strategies — not just headlines.

From Strip Views to Suburban Luxury: The Real Cost of Owning in Las Vegas

Las Vegas is one of the few cities in America where you can choose between two completely different lifestyles — the excitement of high-rise living on the Strip or the comfort and quiet of suburban luxury in communities like Summerlin, Henderson, and the Northwest. Both offer incredible benefits, but the real cost of ownershipbetween them can be dramatically different.

Whether you’re relocating, upgrading, or investing, understanding the true monthly costs — not just the purchase price — can help you make the smartest decision for your budget and lifestyle.

1. High-Rise Living: What You’re Really Paying For

High-rise condos offer unbeatable amenities and views, but ownership comes with expenses that are different from traditional homes.

Breakdown of typical costs for Strip-area high-rises:

- Mortgage payment(varies by loan type and tower)

- HOA fees:$600–$1,600 per month on average, and up to $2,500+ in ultra-luxury buildings

- Parking fees(in select towers)

- Special assessments(depending on building upgrades or repairs)

- Higher insurance requirements

What you’re getting:

- 24/7 concierge + security

- Resort-style pools

- Fitness centers, spas, lounges

- Valet parking

- Strip views and walkability

- Lock-and-leave convenience

The value:You’re buying a lifestyle, not just a unit. The all-inclusive amenities and prime location explain the premium.

Who it’s ideal for:

- Professionals

- Retirees wanting zero maintenance

- Frequent travelers

- Investors seeking mid-term rental opportunities

- Buyers who value views, security, and luxury amenities

2. Suburban Luxury: What Ownership Really Costs

Las Vegas suburbs are known for space, privacy, modern floor plans, and upscale communities. Costs are structured differently and usually more predictable.

Typical suburban ownership costs:

- Mortgage payment

- HOA fees:$50–$200 per month (higher for guard-gated communities)

- Utilities:Higher due to square footage

- Maintenance:Landscaping, pool upkeep, repairs

- Home insurance:Typically lower than high-rise insurance

What you’re getting:

- Larger square footage

- Private yards

- Family-friendly neighborhoods

- Community parks, trails, and recreation centers

- Stronger school zones (Henderson + Summerlin)

The value:More space, more privacy, and long-term appreciation potential.

Who it’s ideal for:

- Families

- Remote workers

- Buyers wanting long-term equity growth

- Investors seeking rental demand

- Anyone valuing space over amenities

3. Price Comparison: High-Rise vs. Suburban Luxury

Here’s a realistic snapshot of today’s pricing:

High-Rise (Strip + near-Strip)

- Entry-level: $300,000–$450,000

- Mid-luxury towers: $450,000–$850,000

- Luxury Strip towers: $900,000–$3M+

- HOA fees: $600–$2,500+/mo

Suburban Luxury (Summerlin, Henderson, NW)

- Entry-level single-family: $430,000–$550,000

- Modern, upgraded homes: $650,000–$950,000

- Luxury homes: $1M–$4M+

- HOA fees: $50–$200/mo

- Larger maintenance expenses

Key takeaway:

High-rise condos often have a lower purchase price but higher monthly carrying costs.

Suburban homes often cost more upfront but offer lower ongoing fees.

4. Appreciation & Investment Potential

Both segments appreciate differently.

High-Rise Appreciation:

- More sensitive to interest rates

- Influenced by building litigation, reserves, and HOA strength

- Strong rental potential for 30+ day leases

- High demand from out-of-state buyers

Suburban Home Appreciation:

- Historically stronger, more stable

- Driven by population growth and job expansion

- Higher resale demand

- Less volatility

If your goal is long-term wealth building, suburban homes typically outperform high-rise units. If your goal is lifestyle or mid-term rental potential, high-rises shine.

5. Lifestyle Differences That Affect Cost

The biggest financial difference often comes down to how you live.

High-Rise Pros:

- Zero maintenance

- No yard work

- Security + concierge

- Walkability

- Resort amenities

- Downsize-friendly

Suburban Pros:

- Privacy

- Outdoor space

- Better for pets

- Family-friendly communities

- Garage parking and storage

- More flexibility for renovations

Which lifestyle matches your daily life and long-term goals?

6. Which Option Is More Affordable in the Long Run?

If you prefer lower monthly expenses and long-term equity:

Suburban homes win.

If you want luxury living with no maintenance and don’t mind higher monthly fees:

High-rises are unbeatable.

If you’re an investor looking for mid-term rentals:

High-rises can perform extremely wellin corporate + travel-nurse markets.

If you’re planning to raise a family or want a backyard:

Suburbs dominate.

Final Thoughts

Las Vegas offers two incredible lifestyles:

Strip-facing high-rise excitementor suburban luxury comfort.

The real cost of ownership comes down to HOA fees, maintenance, and the lifestyle you’re choosing — not just the home price.

If you want to compare payments, HOA structures, loan types, and long-term affordability, connect withThe Derek Parent Team. We specialize in both high-rise and suburban financing, and we’ll help you make the smartest financial decision for your next move.

Homeowners Are Sitting on Billions in Untapped Equity — Here’s How to Use Yours Wisely

Homeowners across the U.S. — especially in fast-growing markets like Las Vegas — are sitting on massive amounts of tappable equity. In fact, recent housing data shows Americans now have more than $16 trillionin home equity, with billions of that right here in Nevada.

But the big question is this:

What should you actually do with that equity?

Used wisely, your home equity can help you build wealth, eliminate debt, invest in your future, and strengthen your financial foundation. Used carelessly, it can create unnecessary risk.

Here’s how to use your equity strategically and responsibly.

1. Consolidate High-Interest Debt

Credit card interest rates are now averaging 20–30%, and many homeowners are feeling the pressure. If you’re carrying high-interest balances, a cash-out refinanceor HELOCcan dramatically reduce your monthly obligations.

Why this strategy works:

- Mortgage rates are significantly lower than credit card rates

- One consolidated payment is easier to manage

- Lower utilization often boosts your credit score

- Freeing up cash flow reduces financial stress

This is one of the smartest, most impactful uses of home equity — especially heading into 2026 with rising consumer debt.

2. Make High-ROI Home Improvements

Renovations can increase property value, improve your living space, and boost long-term equity. But not all upgrades are created equal.

High-return improvements include:

- Kitchen remodels

- Bathroom upgrades

- New flooring

- Exterior improvements for curb appeal

- Energy-efficient windows

- HVAC upgrades

A cash-out refinance or HELOC often makes more financial sense than personal loans or store financing, which carry higher rates.

3. Buy an Investment Property

If you’ve built strong equity and want to grow wealth, using that equity for a down payment on a rental or investment propertycan create long-term returns.

Benefits include:

- Additional monthly income

- Appreciation on multiple properties

- Tax benefits for investors

- A hedge against inflation

Many of your clients are leveraging their primary home equity to purchase:

- Long-term rentals

- Mid-term furnished units

- High-rise condos

- Second homes in Las Vegas communities

This is how homeowners move from paying a mortgage… to building a portfolio.

4. Refinance Into a Better Loan

Even if rates today aren’t at historic lows, refinancing can still make sense, especially if you can:

- Remove mortgage insurance (PMI)

- Switch from an ARM to a fixed-rate mortgage

- Shorten your term (30-year to 15-year)

- Reduce your interest rate

- Lower your monthly payment

If you bought in the mid-rate years and your equity has climbed, refinancing may open doors that weren’t available when you closed originally.

5. Build an Emergency or Opportunity Fund

Another smart equity move is pulling a conservative amount of cash for liquidity — not spending.

This gives homeowners:

- A financial safety net

- Funds for unexpected medical or family expenses

- Capital to jump on investment opportunities

- Flexibility during job changes or business transitions

A HELOC is especially useful for this because you only pay interest on what you use.

6. Prepare for Major Life Events

Your equity can help you navigate big moments with less financial strain.

Examples include:

- Paying for college tuition

- Funding a wedding

- Helping a family member buy a home

- Covering medical or caregiving expenses

- Preparing for retirement transitions

Instead of draining savings, homeowners can strategically tap equity to protect cash reserves.

7. Don’t Use Equity for “Lifestyle Debt”

Before leveraging your equity, it’s just as important to know what notto use it for.

Avoid spending equity on:

- Vacations

- Luxury purchases

- Vehicles

- Consumables

- Short-lived expenses

These reduce your net worth without creating long-term value.

How to Know Which Strategy Fits You Best

The right equity move depends on your goals:

- Want lower monthly expenses?

Debt consolidation or refi into a lower rate. - Want long-term wealth?

Invest in property or shorten your mortgage term. - Want flexibility?

Open a HELOC and keep funds available. - Want to upgrade your home?

Cash-out for renovations with strong ROI.

AtThe Derek Parent Team, we analyze your equity, credit, income, and goals to determine the smartest move — not just the easiest one.

Final Thoughts

Homeowners today have access to more equity than any time in history — but the real power lies in using it wisely. Whether you want to invest, reduce debt, protect your finances, or improve your home’s value, the right strategy can move you closer to your long-term financial goals.

If you’d like a customized equity analysis or want to explore cash-out, HELOC, or refinance options, connect with The Derek Parent Team. We’ll help you understand what’s possible and how to maximize your equity safely and strategically.

The Ultimate Guide to Financing a High-Rise Condo in Las Vegas

Financing a high-rise condo isn’t the same as financing a traditional single-family home. In Las Vegas—where the high-rise market includes iconic towers like Veer Towers, The Martin, Turnberry, Panorama, and Sky—buyers often run into unique lending requirements that many lenders simply don’t understand.

Whether you're buying a primary residence, second home, or investment unit, this guide breaks down everything you need to know to successfully finance a high-rise condo in Las Vegas.

1. Understanding High-Rise Condo Financing (and Why It’s Different)

High-rise loans come with additional layers of review because lenders must evaluate both your financialsand the building’s financial health.

This includes:

- HOA financials

- Budget and reserves

- Litigation

- Insurance coverage

- Owner-occupancy ratios

- Single-entity ownership percentages

One issue in the building can limit financing options—even if youare fully qualified.

That’s why buyers should work with a lender who knows the high-rise landscape inside and out.

2. Warrantable vs. Non-Warrantable Condos

The biggest factor in high-rise financing is determining whether the building is warrantableor non-warrantable.

Warrantable Condos

These meet Fannie Mae/Freddie Mac guidelines, meaning you can use:

- Conventional loans

- Lower down payments

- Competitive interest rates

Most major towers are warrantable, but this can change if the HOA is dealing with litigation or low reserves.

Non-Warrantable Condos

These do notmeet agency guidelines and require:

- Portfolio loans

- Higher down payments (usually 20–30%)

- Slightly higher rates

- More documentation

Some of Vegas’ most popular luxury towers periodically fall into this category depending on the building’s condition or legal status.

3. Down Payment Requirements for High-Rise Condos

Your down payment depends on whether the building is warrantable and what type of loan you’re using.

Typical requirements:

- Primary residence (warrantable):5–10% down

- Second home:10% down

- Investment property:20–25% down

- Non-warrantable building:20–30% down

Jumbo high-rise units may require additional reserves or stricter qualification guidelines.

4. Understanding HOA Requirements and Fees

High-rise HOA fees are typically higher than traditional condos because they cover:

- Concierge services

- Valet

- Security

- Amenities (gym, pool, spa, lounge)

- Maintenance

- Utilities in some buildings (water, internet, trash, etc.)

Lenders must verify HOA stability. Low reserves or pending assessments can directly impact loan approval.

Pro tip:Before making an offer, ask your lender whether the building is already approved. The Derek Parent Team keeps an updated high-rise building approval list.

5. Jumbo Loans for Luxury High-Rise Units

Many Strip-facing high-rise units exceed conforming loan limits, requiring a jumbo loan.

Jumbo loans typically require:

- 700+ credit scores

- Strong income documentation

- 6–12 months of reserves

- 10–20% down minimum

The good news? Jumbo rates have become more competitive and often closely match conventional pricing.

6. Investment Property Financing

Las Vegas high-rises are popular for:

- Corporate rentals

- Traveling nurse housing

- Longer-term furnished rentals

- Second homes

While most high-rises restrict nightly rentals, many allow 30-day minimum leases, making them attractive for mid-term investors.

To finance an investment high-rise, expect:

- 20–25% down

- Higher debt-to-income scrutiny

- DSCR loan options for certain buildings

Your lender must confirm rental restrictions upfront.

7. Common Issues That Can Delay High-Rise Approval

High-rise loans require extra due diligence, so delays can happen—especially with inexperienced lenders.

Common issues include:

- HOA insurance policy gaps

- Pending litigation

- Low building reserves

- Too many investors in the building

- One owner holding too many units

- Incomplete condo questionnaires

Working with a lender familiar with each building significantly reduces delays.

8. Why You Need a High-Rise Specialist

High-rise lending is a niche inside the mortgage industry. Most big-box lenders and online mortgage companies struggle with:

- Warrantability reviews

- HOA document analysis

- Non-warrantable programs

- Jumbo portfolio approvals

- Building-specific nuances

As the original in-house lender for Veer Towers, Derek Parent is one of the most experienced high-rise lenders in the city, with decades of experience financing units across the Strip and beyond.

When you work with a specialist, you get:

- Faster approvals

- Access to warrantable + non-warrantable programs

- Accurate building information

- No last-minute surprises

- Smoother closings

Final Thoughts

Financing a high-rise condo in Las Vegas is incredibly doable—but only when you work with the right team and know what to expect. From warrantability to HOA reviews to jumbo financing, the process requires local expertise and a lender who understands each tower’s unique requirements.

If you’re considering buying a Las Vegas high-rise, connect withThe Derek Parent Team. We’ll help you navigate financing options, compare buildings, and secure the right loan for your goals.