Las Vegas Housing Market Outlook: What Buyers Should Expect in 2026

With rapid population growth, major economic developments, and continued national attention, the Las Vegas housing market remains one of the most talked-about in the country. As 2026 approaches, buyers want to know: Will prices rise? Will rates fall? Will there be more inventory?

While no one can predict the future perfectly, current economic indicators, migration patterns, and housing trends give us a clear picture of what buyers should expect heading into the 2026 market.

Here’s your detailed, expert-backed outlook.

1. Home Prices Will Likely Continue to Rise — Slowly but Steadily

Las Vegas has seen strong appreciation over the last decade, driven by new residents, job growth, and limited inventory. While we’re not expecting the explosive price spikes seen during the 2021 boom, moderate appreciationis almost guaranteed.

What’s driving prices upward?

- Continued population growth (especially from California and the Pacific Northwest)

- Low turnover from homeowners locked into 3–4% mortgage rates

- Strong demand in markets like Henderson, Summerlin, and the Northwest

- Limited land availability for new construction in core areas

Expect 3–6% annual appreciationin most neighborhoods and higher in high-demand communities.

2. Inventory Will Improve — But Not Enough to Create a Buyer’s Market

Builders in Las Vegas are ramping up production, especially in Summerlin West, Skye Canyon, Inspirada, Cadence, and North Las Vegas. But new construction alone won’t solve the inventory shortage.

Why?

Because many existing homeowners won’t list their homes until mortgage rates drop significantly — which may not happen quickly.

What buyers can expect in 2026:

- Slightly more choices than the past few years

- Continued competition for well-priced properties

- Faster absorption of new listings

- High demand for move-in-ready homes

In short: 2026 won’t be a buyer’s market. But it may feel more balanced than recent years.

3. Mortgage Rates Could Decrease — But Not Dramatically

As inflation cools and economic policy stabilizes, analysts expect mortgage rates to gradually improve.

Most forecasts predict:

- Rates could settle in the mid-5% to low-6% rangeby late 2026

- No return to the historic 2–3% era

- Better affordability, but still above pandemic lows

A drop in rates—even a small one—will bring more buyers back into the market, pushing competition higher again.

Translation:Buy early if you can, then refinance when rates improve.

4. Migration Will Keep Driving Demand

Las Vegas continues to attract new residents for several reasons:

Key migration drivers:

- No state income tax

- Lower cost of living compared to coastal metros

- Expanding job opportunities

- 300+ days of sunshine

- Booming sports and entertainment scene

- Growing retiree population

Cities like Los Angeles, San Diego, San Francisco, Portland, and Seattle continue to feed a steady stream of new buyers into the Vegas market.

This migration is one of the strongest reasons home values are expected to remain stable — and rise — through 2026.

5. New Construction Will Offer Some of the Best Deals

With builders competing for buyers, expect incentives to remain strong through early 2026:

- Rate buydowns

- Closing cost credits

- Discounted upgrades

- Quick move-in price reductions

- Lot premiums waived in slower phases

However, once demand surges again—especially when rates improve—many of these incentives will shrink or disappear.

If you’re considering new construction, acting before the 2026 spring rush could save you thousands.

6. High-Rise and Condo Markets Will Continue Rebounding

Las Vegas high-rise condos are experiencing renewed demand thanks to:

- A surge in out-of-state buyers

- Expanding Strip entertainment options

- Strengthening rental demand

- Luxury buyers seeking lock-and-leave living

- Limited supply of new towers

As more buildings resolve litigation and financing options expand, 2026 could be one of the strongest years for high-rise sales in the last decade.

7. Investors Will Stay Active in 2026

Although short-term rental regulations remain tight, Las Vegas continues to attract:

- Long-term rental investors

- Mid-term rental investors (30–90 days)

- Cash buyers relocating from expensive states

- Equity-rich homeowners purchasing second homes

Strong rental demand and stable job growth ensure investors will continue seeing Vegas as a high-potential market.

Final Thoughts

The Las Vegas housing market in 2026 will be defined by stability, moderate appreciation, and renewed buyer activityas rates gradually improve. For buyers, the biggest advantage comes from preparing early, getting pre-approved, and understanding the market before competition heats up again.

If you want to explore your options, compare payments, or analyze neighborhoods, connect withThe Derek Parent Team. We’ll help you position yourself for success—whether you’re buying now, in early 2026, or refining your strategy ahead of time.

7 Mortgage Mistakes That Delay Closings — And How to Avoid All of Them

Nothing derails a home purchase faster than a preventable mortgage mistake. In a market like Las Vegas—where timing, inventory, and competition matter—one small misstep can delay your closing, cost you money, or even lose the home entirely.

Whether you’re a first-time buyer or a seasoned homeowner, understanding the common pitfalls can help your loan move quickly and smoothly. Here are seven mortgage mistakesthat slow down closings—and exactly how to avoid every one of them.

1. Not Getting Fully Pre-Approved

A pre-qualification is not enough. Sellers and agents want a full, underwritten pre-approval, not just a quick online estimate.

Why it delays closings:

- Missing documents

- Unverified income

- Incorrect debt or credit calculations

How to avoid it:

Start with a full pre-approvalthrough a reputable lender like The Derek Parent Team, where your income, assets, and credit are verified upfront. This eliminates surprises once you’re under contract.

2. Making Big Purchases Before Closing

Furniture. Appliances. A new car. Even large holiday shopping can change your credit profile.

Why it delays closings:

- Higher debt-to-income ratio

- Lower credit score

- New inquiries flagged by underwriting

How to avoid it:

Avoid all major purchases until after you close—no new credit cards, no financing, no large charges.

3. Moving Money Between Accounts

Transferring funds between bank accounts looks suspicious to underwriters unless it’s fully documented.

Why it delays closings:

- Additional documentation needed

- Unexplained deposits

- Source-of-funds verification issues

How to avoid it:

Keep your money where it is. If you musttransfer funds, speak with your lender first so you know exactly what documentation will be required.

4. Not Providing Documents Quickly

Underwriting works on a timeline. Delayed paperwork can push your closing date back.

Common documents that slow buyers down:

- Bank statements

- Pay stubs

- Tax returns

- Divorce decrees

- Gift letters

- Business P&L statements (for self-employed buyers)

How to avoid it:

Have all financial documents ready in a labeled folder before you even go under contract. Quick responses = faster closings.

5. Switching Jobs During the Loan Process

Even a job change with higherincome can stall your mortgage.

Why it delays closings:

- New income can’t be verified

- Different job structure (salary to hourly, or W-2 to self-employed)

- Additional employment history required

How to avoid it:

If possible, wait until after closingto change jobs. If the switch is unavoidable, tell your lender immediately so documentation can be prepared early.

6. Not Being Honest About Finances

Even small omissions—side income, child support, past credit issues—will surface when underwriting runs verification.

Why it delays closings:

- Underwriters must re-calculate your loan

- Extra documentation required

- Conditions pile up instead of clearing

How to avoid it:

Be transparent from the beginning. A good lender can structure your loan properly—but only if they know everything up front.

7. Ignoring Lender Conditions

Many buyers assume that once they’re “approved,” the loan is done. But underwriters typically issue conditions that must be cleared for final approval.

Examples include:

- Verifying employment

- Providing updated bank statements

- Sourcing deposits

- Explaining credit inquiries

How to avoid it:

Respond to conditions within 24 hours. The faster you address them, the sooner you get your clear-to-close.

Bonus Tip: Work With a Lender Who Knows Las Vegas

High-rise condos, new construction, investor properties, VA loans—Las Vegas has unique lending challenges that national lenders often struggle with.

Working with an experienced local mortgage teamensures:

- Faster approvals

- Smoother underwriting

- Proper documentation from day one

- Clear communication between all parties

- Fewer last-minute surprises

AtThe Derek Parent Team, we specialize in navigating Las Vegas lending requirements so your closing stays on track.

Final Thoughts

Most closing delays are completely avoidable with the right preparation and the right lending partner. By staying organized, avoiding major financial changes, and communicating proactively, you can move from offer to keys with confidence.

If you want a stress-free mortgage experience—or want to review your pre-approval before shopping—connect with The Derek Parent Team. We’ll guide you step-by-step and help you avoid every mistake that slows down the closing process.

From Tourists to Homebuyers — How Vegas Migration Is Shaping Real Estate

For decades, people came to Las Vegas for entertainment, gaming, and world-class dining. But today, more visitors are deciding not to leave. What was once a tourist destination has become one of the fastest-growing housing marketsin the country, attracting families, professionals, and retirees from across the U.S.

So what’s driving this migration—and how is it shaping the local real estate market?

Let’s break it down.

1. From Visitors to Residents

Each year, millions of tourists visit Las Vegas. Many fall in love with the sunshine, affordability, and lifestyle—and decide to call it home. In fact, studies from the Las Vegas Global Economic Alliance (LVGEA)show that a significant percentage of new residents first experienced the city as visitors.

Unlike traditional resort towns, Vegas offers more than entertainment. It’s a city with growing job opportunities, new master-planned communities, and a surprisingly family-friendly culture.

2. Why People Are Moving to Las Vegas

Affordability Compared to Coastal Cities

Homebuyers relocating from California, Arizona, and the Pacific Northwest find that their money goes much further in Nevada. Even with rising prices, Las Vegas homes remain more affordable than those in Los Angeles or San Francisco—sometimes by 30–40%.

Tax Benefits

Nevada has no state income tax, which appeals to remote workers, entrepreneurs, and retirees looking to keep more of their earnings.

Remote Work Flexibility

The post-pandemic shift to remote and hybrid work allows professionals to live where they want, not just where their jobs are based. Las Vegas has become a hotspot for those seeking big-city amenities without big-city costs.

Lifestyle and Climate

From golf courses and hiking trails to world-class restaurants and shows, Vegas offers year-round recreation. The warm climate also attracts “snowbirds” seeking to escape cold winters.

3. How Migration Is Transforming the Market

Rising Home Demand

New residents are fueling steady demand for housing, especially in areas like Summerlin, Henderson, and the Northwest Valley.Builders are racing to keep up with population growth, while resale inventory remains tight.

Shift in Buyer Demographics

Vegas buyers now include more young professionals and remote workers, not just retirees. This has increased demand for condos, townhomes, and single-family homes with home offices or flexible spaces.

Investment Opportunities

Out-of-state investors see Las Vegas as a high-potential market for long-term rentals and vacation properties. Even as short-term rental regulations evolve, investor interest remains strong.

High-Rise and Luxury Market Growth

Migration has reignited interest in high-rise livingalong the Strip and in suburban luxury communities like The Ridges and MacDonald Highlands. High-net-worth individuals are trading California luxury for Vegas lifestyle and tax savings.

4. Challenges That Come With Growth

While migration has energized the economy, it also brings challenges:

- Inventory Shortage:Demand continues to outpace supply, keeping prices elevated.

- Affordability Pressure:Wage growth hasn’t fully kept up with housing costs.

- Infrastructure Needs:The city is rapidly expanding roads, schools, and utilities to keep up with growth.

Still, compared to many U.S. metros, Las Vegas remains one of the most accessible and opportunity-rich housing marketsfor buyers.

5. What It Means for Homebuyers and Investors

If you’re considering buying in Las Vegas, now’s the time to get strategic.

- For Homebuyers:Rising migration means continued competition for desirable properties. Getting pre-approved early and working with a local lender gives you an edge.

- For Investors:The steady inflow of new residents supports long-term rental stability, especially in family-oriented communities and high-demand school zones.

- For Sellers:Continued in-migration means strong buyer interest and potential appreciation—especially in well-maintained or upgraded homes.

Final Thoughts

Las Vegas is evolving from a vacation destination into a vibrant, full-time community—and migration is at the heart of that transformation. As more people discover that Vegas offers both lifestyle and opportunity, the real estate market will continue to grow and diversify.

Whether you’re moving here, investing here, or already a homeowner, understanding how migration trends shape the market can help you make smarter real estate decisions.

If you’re ready to explore opportunities in Las Vegas real estate, connect withThe Derek Parent Team. With decades of experience helping homeowners, veterans, and investors, we’ll help you find the right move in this exciting market.

Rising Debt, Slowing Jobs: Why Now Might Be the Smartest Time to Buy

If you’ve been feeling the squeeze—higher prices at the store, more on the credit card, headlines about layoffs—you’re not imagining it. The latest Applied Analysis: Las Vegas Labor Market & Economic Outlook (October 2025)shows a clear picture: debt is rising, savings are thin, and job growth in Nevada has cooled off.

On the surface, that sounds like a reason to wait. But when you look deeper, this environment may actually be one of the smartest times to get out of high-interest debt and into an asset that can build wealth: a home.

Let’s break down why.

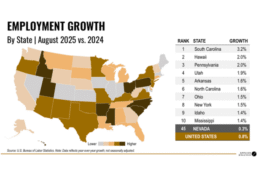

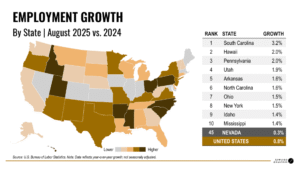

Slowing Job Growth, But a Stable Las Vegas

Nevada’s employment growth has slipped to about 0.3% year-over-year, ranking the state near the bottom nationally. At the same time, Southern Nevada’s unemployment rate sits above the U.S. average, signaling that the red-hot hiring boom we saw post-COVID has cooled.

That might feel scary, but in real estate terms it means something important:

- Less frenzied demand

- Fewer bidding wars

- More sellers willing to negotiate

In other words, when the job market cools, the housing market often shifts from “panic mode” to “negotiation mode.”That’s where smart buyers win.

Household Debt Is Up—Especially the Bad Kind

The national data in the report shows a clear trend: household debt continues to climb, and a growing share of that is credit card balances and short-term consumer debt.

We’re seeing:

- Rising credit card liabilitiescompared to prior decades

- Personal savings rates well belowthe 50-year average of 7.4%

- More families relying on debt to keep up with cost of living

Here’s the key problem: credit card and consumer debt compound against you.Every month you’re paying 18–25% interest, and at the end of the year you own nothing more than you started with.

A fixed mortgage, on the other hand, often comes with a much lower interest rate and is tied to a tangible asset that can appreciate over time.

Why Buying Now Can Be a Smart Debt Strategy

When people think “buy a house,” they usually think about lifestyle—more space, a yard, a garage. That matters. But in this environment, owning a home is also a strategic financial move:

- Trade Bad Debt for Better Debt

If you’re carrying high-interest balances, a purchase or future cash-out refinance can be part of a plan to consolidate debt into lower-rate, fixed housing payments. You’re not just shifting debt—you’re tying it to an asset that can grow. - Lock In Today’s Prices Before the Next Run-Up

The report still shows strong fundamentals in Las Vegas: billions in visitor spending, healthy gaming revenue, and long-term population growth. When rates eventually come down, demand is likely to spike again and prices can move fast. Buying now positions you aheadof that. - Use the Market Softness to Your Advantage

In a slower job and housing market, buyers are seeing things we almost never saw in 2021–2022:- Seller credits toward closing costs

- Rate buydownspaid by the seller

- Room to negotiate on price and repairs

- Refinance When the Rate Cycle Shifts

Rates move in cycles. If you buy now, you:- Lock in the price

- Start building equity

- Keep the option to refinance laterinto a lower payment when rates ease

You can’t go back in time and buy at yesterday’s prices. But you canbuy today and improve the cost of money later.

Supporting Graph: Debt & Savings Pressure

You (or your marketing team) can turn this snapshot into a simple line or bar graph for the blog:

Household Financial Snapshot – U.S. (Selected Trends)

(Source: Applied Analysis, Oct 2025 – Federal Reserve & BEA data)

| Indicator | Long-Term / Prior Level | Most Recent Level | What It Signals |

| Personal Savings Rate | 50-year avg: 7.4% | Well below avg | Households saving less, leaning on credit |

| Credit Card Liabilities | Much lower in 1990s–2000s | Near record highs | More high-interest consumer debt |

| Total Household Wealth | Concentrated, Top 10% dominate | Still very skewed | Many families feel “behind” financially |

| Nevada Job Growth (YoY) | Higher in past expansions | 0.3% | Cooling, but not collapsing |

Takeaway:People are saving less, carrying more expensive debt, and feel pressure—yet homeownership remains one of the most reliable ways to get on the rightside of that equation.

What This Means for Las Vegas Buyers

If you’re in Las Vegas and you’re feeling the weight of rising debt and an uncertain job market, you’re not alone. But this is also a moment where a well-structured mortgagecan help you:

- Swap unsecured, high-interest debtfor a more stable, potentially lower-rate housing payment

- Lock in a home in a market that still has long-term growth drivers(tourism, entertainment, sports, tech, and inbound migration)

- Use seller contributions and smart product selection to get in the door with less upfront cash than you might think

This isn’t about stretching yourself thin. It’s about using the tools that exist—strategy, structure, and timing—to move from surviving to building.

The Bottom Line

Rising debt and slowing jobs are real. But they don’t just create risk—they create opportunity for buyers who move with a plan instead of fear.

The Parent Team, we specialize in looking at the whole picture—your income, your debt, your goals—and building a mortgage strategy that helps you move out of high-interest debt and into long-term stability and wealth through real estate.

If you’re carrying balances, renting, and wondering how to get ahead, this may be the perfect time to sit down, run the numbers, and see what’s possible.

Book your free mortgage strategy call todayand let’s turn today’s uncertainty into tomorrow’s opportunity.

How the 2025 Las Vegas Economy Is Shaping Opportunities for Homebuyers

If you’ve been watching the Las Vegas market, you’ve probably felt the tension — steady demand, high prices, and interest rates that just won’t seem to budge. But according to the latest Applied Analysis: Las Vegas Labor Market & Economic Outlook (October 2025)report, the tides may be turning.

Beneath the flashy Strip lights, the local economy is showing signs of cooling. And for homebuyers, that shift could actually be a major opportunity.

Job Growth Has Slowed — But That’s Not All Bad

Nevada’s job growth has dropped to just 0.3% year-over-year, ranking 45th in the nation. That’s a big slowdown from the post-pandemic hiring surge we saw in 2022 and 2023.

At first glance, this might sound concerning. But here’s the silver lining: when employment growth eases, it often takes some heat off the housing market. Fewer bidding wars, fewer cash investors driving up prices, and more room for real buyers to negotiate.

For context, Southern Nevada’s unemployment rate sits around 5.3%, slightly higher than the national average. It’s not a sign of crisis — it’s a return to balance.

Wages Are Holding Steady, Inflation Is Cooling

While job creation has slowed, paychecks have not. The average weekly wage in Nevada remains around $1,249, and inflation has cooled to roughly 3%. That means your purchasing power is finally stabilizingafter several years of runaway prices.

Even better, corporate profits and consumer spending are holding strong, which helps prevent a deep downturn. Retail sales are up nearly 4% year-over-year, and visitors are still spending over $55 billion annuallyin Las Vegas.

This mix — stable income, controlled inflation, and slower job growth — creates a sweet spot for mortgage planning. Buyers can take their time, shop strategically, and use temporary rate buydowns or seller credits to make their payment more manageable.

Builders Are Adjusting, Not Retreating

After years of nonstop construction, homebuilders in Southern Nevada are showing a little restraint. New housing starts and building permits are down more than 35%from their peak. That’s not a collapse — it’s a recalibration.

When builders pause, inventory tightens in the short term, but it also means fewer speculative projects flooding the market later. For today’s buyers, that’s a chance to find real value before demand ticks back up.

Remember: Las Vegas is still adding new residents every month — especially from states like California and Arizona. Slower growth now doesn’t mean contraction; it means the market is catching its breath.

What This Means for You as a Homebuyer

The 2025 economy may not feel “perfect,” but it’s quietly working in favor of those ready to act. Here’s how you can use this moment to your advantage:

- Leverage Softened Competition– With job growth slowing and rates holding, fewer people are buying. That gives you more negotiating power and more time to find the right property.

- Ask for Seller Concessions– In 2021–2022, sellers wouldn’t budge. In 2025, they’re more willing to offer credits for closing costs, rate buydowns, or repairs.

- Focus on Payment, Not Rate– With creative mortgage tools like 2-1 buydowns or adjustable programs, your first-year payment can look dramatically better than expected.

- Plan to Refinance Later– Mortgage rates are cyclical. If you buy now and refinance when rates drop, you keep the lower purchase price and reduce your future payment.

- Think Long-Term– Despite short-term slowdowns, Las Vegas remains a high-growth metro area. Between population migration, tourism, and tech expansion, long-term appreciation is still in play.

Supporting Data: Employment Growth Snapshot

Source: U.S. Bureau of Labor Statistics (Applied Analysis, Oct 2025)

Nevada’s slower job growth signals moderation — a healthier, more balanced real estate environment.

While national headlines debate a possible slowdown, Las Vegas is quietly moving toward balance — and that’s exactly where smart homeowners win. Steady wages, easing inflation, and builder adjustments are creating rare breathing roomfor those ready to act.

The Parent Team, we’re helping buyers lock in opportunities while everyone else is waiting. From flexible loan programs to strategic rate buydowns and future refinance plans, our team helps you turn this uncertain market into an advantage.

Because the truth is simple: when rates drop, prices and competition rise. Don’t wait to be ready — be positioned now.

Book your free mortgage strategy call todayand find out what your buying power really looks like.

7 Creative Ways to Save for Your Down Payment

Saving for a down payment can feel like one of the biggest obstacles to buying a home. In a city like Las Vegas—where the market is competitive and prices continue to climb—having enough cash on hand matters. The good news? You don’t need to rely only on traditional savings. With a little creativity and discipline, you can reach your goal faster than you think.

Here are seven creative ways to save for your down payment.

1. Automate Your Savings

One of the simplest yet most effective strategies is to set up automatic transfers. Every payday, move a set amount into a separate “down payment” savings account. Because the money is tucked away before you see it, you won’t be tempted to spend it.

2. Cut Out Hidden Subscriptions

Streaming services, unused gym memberships, and auto-renewing apps add up. Review your bank statements and cancel what you don’t use. Even if you save $100 a month, that’s $1,200 a year toward your down payment.

3. Leverage Side Hustles

From rideshare driving to freelance work, side hustles can generate extra income dedicated exclusively to your savings goal. In Las Vegas, opportunities like event staffing or part-time hospitality jobs can be lucrative and flexible.

4. Bank Your Windfalls

Tax refunds, work bonuses, or even casino winnings (if you’re lucky!) should go straight into your down payment fund. These one-time boosts can shave months—or even years—off your timeline.

5. Sell Unused Items

Chances are, you’ve got valuable items collecting dust. Furniture, electronics, or collectibles can all be sold online. Not only does this free up space, but it also moves you closer to your down payment target.

6. Use Employer Programs or Grants

Some employers offer homebuyer assistance programs as part of their benefits package. In Nevada, state and local down payment assistance grants are also available. Working with a local lender likeThe Derek Parent Teamcan help you uncover programs you may qualify for.

7. Downsize Temporarily

If possible, consider downsizing your living situation for a short period—whether it’s moving in with family or finding a cheaper rental. The money you save on rent can go directly into your home savings account.

Bonus Tip: Know How Much You Really Need

You might not need as much as you think. Some loan programs require as little as 3% down(conventional), or even 0% down(VA loans for eligible veterans). Understanding your options with a trusted mortgage advisor can give you a clear and realistic target.

Final Thoughts

Saving for a down payment takes discipline, but it doesn’t have to feel impossible. By automating savings, cutting hidden expenses, taking on side hustles, and exploring assistance programs, you can reach your goal sooner than you think.

When you’re ready, theDerek Parent Teamcan guide you through loan options, down payment assistance, and strategies to make homeownership in Las Vegas a reality.

Cap Rate Explained: Is Your Las Vegas Property a Good Deal?

If you’re buying investment property in Las Vegas—whether a high-rise condo near the Strip or a single-family home in Henderson—one question matters most: “What’s the cap rate?”It’s a simple number with big implications, and it helps you compare deals quickly, apples to apples.

Below, we’ll break down what cap rate is, how to calculate it correctly (including HOA and management), what “good” looks like in Vegas, and how to improve it before you buy.

What Is Cap Rate?

Capitalization rate (cap rate)estimates an investment property’s annual return based on its net operating income (NOI) and purchase price—ignoring financing. It’s a clean way to compare different properties and neighborhoods.

Formula:

Cap Rate = NOI ÷ Purchase Price

- NOI (Net Operating Income)= Gross Annual Rent minusOperating Expenses

- Operating Expensesinclude: HOA dues, property taxes, insurance, repairs/maintenance, utilities (if owner-paid), property management, and reserves

- Exclude: Mortgage principal & interest, income taxes, and one-time acquisition costs

Quick Example (Single-Family in Henderson)

- Price: $400,000

- Monthly Rent: $2,600→ Annual Rent = $31,200

- Expenses (annual): Taxes $2,400, Insurance $1,200, Management (8%) $2,496, Repairs/Reserves $1,200 → $7,296total

- NOI= $31,200 – $7,296 = $23,904

- Cap Rate= 23,904 ÷ 400,000 = 5.98%(~6.0%)

High-Rise Twist: Don’t Forget HOA

High-rise condos can perform well, but HOA dues are the swing factor.Here’s a realistic look:

- Price: $350,000(Strip-adjacent high-rise)

- Monthly Rent: $2,300→ Annual Rent = $27,600

- HOA: $800/mo→ $9,600/yr

- Taxes $1,800, Insurance (HO-6 + contents/landlord) $500, Management (10%) $2,760, Repairs/Reserves $900

- Total Expenses = 9,600 + 1,800 + 500 + 2,760 + 900 = $15,560

- NOI= 27,600 – 15,560 = $12,040

- Cap Rate= 12,040 ÷ 350,000 = 3.44%

Takeaway:The same rent at a high-rise with a large HOA can cut cap rate significantly. Investors often accept a lower cap for prime location, amenities, and long-term appreciation.

What’s a “Good” Cap Rate in Las Vegas?

It depends on asset type, location, and risk:

- Single-Family (long-term rent):~4.75%–6.5%in established areas

- Townhome/Condo (non-high-rise):~4.25%–6.0%(HOA sensitive)

- High-Rise (long-term rent):~3.0%–5.0%(HOA + luxury amenities)

- Mid-term/Corporate rentals:Potentially higher effective returns, but more management and vacancy risk

- Short-term rentals (where permitted):Can outperform cap rate on paper, but legal limits, licensing, and building rules matter

Rule of thumb:Higher cap rate usually means higher risk (location, volatility, condition, tenant base). Prime buildings trade lower caps because of stability and exit liquidity.

Cap Rate vs. Cash-on-Cash vs. DSCR—Which Matters Most?

- Cap Rateignores financing; great for comparing properties.

- Cash-on-Cash Returnincludes your down payment and loan terms—the truest “what am I earning on my cash?” metric.

- DSCR (Debt Service Coverage Ratio)= NOI ÷ Annual Debt Payments; lenders use it (especially on investor and DSCR loans) to determine if the income supports the mortgage.

Smart approach:Use cap rate to shortlist, then underwrite cash-on-cash and DSCR with actual financing terms.

Common Cap Rate Mistakes (and Easy Fixes)

- Ignoring HOA/Management

- Fix:Always include full HOA dues and a realistic management fee (8–10%).

- Underestimating Vacancy

- Fix:Use a vacancy factor (3–8%) unless you have corporate/renewal history.

- No Reserves

- Fix:Budget at least 3–5% of rentfor repairs/turnover, more for older properties.

- Counting Principal & Interest in NOI

- Fix:Debt service is notpart of NOI. Keep cap rate “pure,” then run cash-on-cash.

- Using Pro Forma Rents

- Fix:Use actualleases or supported market comps and confirm rent-readiness.

How to Improve Cap Rate (Before You Buy)

- Negotiate price or creditsafter inspection (HVAC, windows, appliances).

- Target rent liftswith minor renovations (LED lighting, paint, durable LVP flooring, modern hardware).

- Optimize utilities(tenant-paid where possible).

- Shop insuranceannually and confirm correct landlord/HO-6 coverage.

- Right-size management(fee vs. service level), especially for mid-term rentals.

- Choose buildings with stable HOAs(healthy reserves, low delinquencies, no major litigation).

Cap Rate in Context: Appreciation & Exit Strategy

A slightly lower cap rate in A-locationassets (Summerlin, prime Henderson, sought-after high-rises) can be justified if you expect stronger long-term appreciationand easier resale. Meanwhile, “cash-flow kings” at higher caps may face softer exit liquidity or more volatility. Balance income todaywith equity growth tomorrow.

Vegas Investor Playbook (Quick Steps)

- Define the goal:Cash flow, appreciation, or a mix?

- Screen by cap rate:Use realistic NOI with HOA, management, and vacancy.

- Underwrite financing:Compare cash-on-cash and DSCR with actual rates, points, and reserves.

- Check rules:HOA rental limits, lease minimums, licensing, building warrantability.

- Offer with data:Inspection + rent comps + expense audit → negotiate from facts.

Final Thoughts

Cap rate is the fastest way to compare deals, but it’s not the only way to judge a winner.In Las Vegas, cap rate, cash-on-cash, DSCR, HOA health, and exit strategy all work together. When you underwrite with real numbers—and pick the right financing—you make smarter offers and close with confidence.

Want a side-by-side analysis on properties you’re considering? TheDerek Parent Teamcan run cap rate + cash-on-cash + DSCRwith today’s lending options (conventional, jumbo, DSCR, and Non-QM) so you know exactly what’s a good deal—and what to pass on.

Jumbo Loans in Las Vegas: What Buyers Should Expect

Las Vegas is known for luxury living—from custom estates in Summerlin and Henderson to sleek high-rise condos on the Strip. But with higher price tags often comes the need for jumbo financing.

If you’re looking at homes above conventional loan limits, you’ll likely need a jumbo loan. Here’s what buyers in Las Vegas should know before applying.

What Is a Jumbo Loan?

A jumbo loan is any mortgage that exceeds the conforming loan limitsset by Fannie Mae and Freddie Mac. For 2025, the conforming limit in most parts of the country is around $766,550for a single-family home.

If your purchase price requires financing above that number, you’re in jumbo territory.

Why Jumbo Loans Matter in Las Vegas

In markets like Las Vegas, where luxury homes and high-rise condos often exceed conforming limits, jumbo loans are common. Buyers use them to:

- Finance luxury single-family homes in areas like Summerlin, The Ridges, and Henderson.

- Purchase high-rise condos on the Strip, such as Veer Towers or Waldorf Astoria.

- Secure vacation or second homes in golf course or guard-gated communities.

Key Differences From Conventional Loans

Jumbo loans don’t follow Fannie Mae or Freddie Mac guidelines, so lenders set their own requirements. Expect:

- Higher Credit Standards

Most lenders look for a minimum 700+ credit score, though some programs allow slightly lower with strong reserves. - Larger Down Payments

While some jumbo lenders offer 10% down, 20% or more is common for the best terms. - Stronger Income Documentation

Lenders typically require full tax returns, W-2s, or—if you’re self-employed—profit-and-loss statements and bank records. - Reserve Requirements

Expect to show 6–12 months of mortgage paymentsin reserves, sometimes more for larger loans. - Tighter Debt-to-Income Ratios

Many jumbo programs cap DTI at around 43%, though some lenders are more flexible.

Interest Rates and Terms

Jumbo loans traditionally had higher rates than conventional loans, but in today’s market, the gap is often much smaller. In some cases, jumbo rates may even be competitive with conventional programs.

Borrowers can choose from:

- Fixed-Rate Jumbo Loans:Predictable payments over the life of the loan.

- ARM (Adjustable-Rate) Jumbos:Lower initial rates with adjustments later—popular with buyers who don’t plan to stay long-term.

Common Uses of Jumbo Loans in Las Vegas

- Luxury Estates:Large properties in The Ridges, Anthem, or MacDonald Highlands.

- High-Rise Condos:Units in buildings like Panorama, The Martin, or Turnberry Place often require jumbo financing.

- Second Homes:Many buyers use jumbo loans to purchase vacation homes in golf or resort communities.

Tips for Getting Approved

- Check Your Credit Early

Clean up any errors and reduce balances before applying. - Gather Documentation

Jumbo underwriting is detailed—have tax returns, bank statements, and proof of assets ready. - Work With a Specialist

Not all lenders are comfortable with high-rise condos or luxury properties. TheDerek Parent Teamhas decades of experience navigating jumbo financing in Las Vegas. - Consider Your Reserves

The more liquidity you can show, the stronger your application. - Know Your Loan Options

Some lenders offer jumbo loans tailored for self-employed borrowers, investors, or those with unique income streams.

Final Thoughts

Jumbo loans open the door to some of the most desirable properties in Las Vegas. While they require stronger financials and more documentation than conventional loans, they also provide flexibility and access to luxury real estate opportunities.

If you’re ready to explore jumbo financing for a home in Las Vegas, connect withThe Derek Parent Team. We’ll help you understand your options, prepare your application, and secure the right jumbo loan for your needs.

What Every Veteran Needs to Know About VA Loans in Las Vegas

If you’ve served our country, you’ve earned one of the most powerful benefits available to homebuyers: the VA loan.Backed by the U.S. Department of Veterans Affairs, VA loans give veterans, active-duty service members, and eligible spouses the opportunity to buy a home with incredible advantages.

But how do they actually work in Las Vegas? And what should you know before using one? Let’s break it down.

What Is a VA Loan?

A VA loan is a mortgage program created in 1944 to help veterans achieve homeownership. Unlike conventional or FHA loans, VA loans are guaranteed by the government, which makes lenders more willing to offer favorable terms.

The best part? VA loans are designed to make homeownership easier and more affordable.

Key Benefits of VA Loans

- No Down Payment

Qualified veterans can finance up to 100% of the home’s value. - No Private Mortgage Insurance (PMI)

Unlike FHA or conventional loans with less than 20% down, VA loans eliminate monthly PMI, saving you money. - Competitive Interest Rates

Because the VA guarantees part of the loan, lenders typically offer lower rates than other loan types. - Flexible Credit Guidelines

VA loans often allow more leniency with credit scores compared to conventional financing. - One-Time Funding Fee (with Waivers Available)

A funding fee helps sustain the program, but it can be rolled into the loan. Disabled veterans may qualify for an exemption.

VA Loans in the Las Vegas Market

Las Vegas is a military-friendly citywith Nellis Air Force Base and Creech Air Force Base nearby. Because of that, VA loans are widely used by service members and veterans relocating to or retiring in the area.

Here’s what makes them especially powerful in Las Vegas:

- Rising Home Prices:VA’s no-down-payment feature helps veterans compete in a market where saving 20% down is tough.

- High Loan Limits:VA loans have no official cap, but lenders set guidelines. Many Las Vegas veterans use VA Jumbo Loans for higher-priced homes.

- Flexible Property Options:VA loans can be used for single-family homes, townhomes, and certain condos (if the project is VA-approved).

What VA Loans Can’tDo

While VA loans are flexible, they do have some limits:

- They’re for primary residences only, not investment properties or vacation homes.

- The property must meet VA appraisal standards (safe, sound, and sanitary).

- Some high-rise condos in Las Vegas may not be VA-approved, so always check before making an offer.

Tips for Using a VA Loan Successfully

- Get Pre-Approved First

A VA pre-approval shows sellers you’re serious, which is critical in a competitive Las Vegas market. - Work With a VA-Experienced Lender

Not all lenders specialize in VA loans. At The Derek Parent Team, we’ve helped countless veterans navigate the process. - Check Condo Approvals Early

If you’re looking at condos or high-rises, verify VA approval status before writing an offer. - Plan Ahead for the Funding Fee

Factor it into your budget unless you qualify for an exemption.

Final Thoughts

For veterans and service members, VA loans are one of the most powerful financial tools available. They remove barriers like down payments and PMI, offer competitive rates, and provide flexibility that other loan types can’t match.

If you’re a veteran considering buying a home in Las Vegas, don’t leave this benefit on the table. Connect withThe Derek Parent Teamtoday—we’ll guide you through the VA loan process and help you secure the home you’ve earned.

Mortgage Pre-Approval vs. Pre-Qualification: What’s the Difference?

If you’re thinking about buying a home, you’ve probably heard the terms pre-qualificationand pre-approval.They sound similar, but in the mortgage world, they mean very different things. Knowing the difference can save you time, reduce stress, and even give you an edge in a competitive market like Las Vegas.

What Is Pre-Qualification?

Pre-qualification is often the first stepin the homebuying process. It’s a quick evaluation of your financial situation based on information you provide to a lender.

- Usually done online or over the phone

- Based on self-reported income, assets, and debts

- Doesn’t always include a credit check

- Gives you a general idea of how much you mightqualify for

Think of it as a ballpark estimate.Pre-qualification can be useful early on when you’re just exploring your options, but it’s not a guarantee of approval.

What Is Pre-Approval?

Pre-approval is a much deeper diveinto your finances. It’s when a lender actually verifies your information to determine how much you can borrow.

- Requires documentation like pay stubs, tax returns, and bank statements

- Includes a credit check

- Provides a conditional commitment for a specific loan amount

- Carries more weight with sellers and real estate agents

Think of pre-approval as the green light.It shows you’re a serious buyer and ready to move forward.

Why the Difference Matters

In a competitive market like Las Vegas, the distinction between pre-qualification and pre-approval can be the difference between getting your offer accepted or losing out.

- Sellers prefer pre-approved buyers.They know the financing is more solid.

- Real estate agents take you more seriously.With a pre-approval in hand, they know you’re ready to shop.

- You shop with confidence.You know exactly how much home you can afford, which prevents heartbreak later.

When to Get Pre-Qualified vs. Pre-Approved

- Pre-Qualification:Use this step if you’re just starting to plan, want to see your potential budget, or are comparing loan options.

- Pre-Approval:Get this done before you start touring homes or making offers. It will give you an advantage in today’s market.

Pre-Approval in Las Vegas

The Las Vegas housing market can be fast-paced. Homes in desirable neighborhoods often attract multiple offers. Being pre-approved helps you:

- Compete with cash buyers

- Strengthen your negotiating power

- Move quickly when you find the right property

In short: if you’re serious about buying in Las Vegas, pre-approval isn’t optional—it’s essential.

Final Thoughts

Pre-qualification is a helpful starting point, but pre-approval is the real deal.It shows sellers you’re prepared, gives you confidence, and positions you to succeed in a competitive housing market.

If you’re ready to get pre-approved, connect withThe Derek Parent Team. We’ll guide you through the process, explain your options, and put you in the strongest position to buy your next home in Las Vegas.