What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

Who will owe?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

What's the Difference Between Getting Pre-approved & Pre-qualified?

Many people mistakenly believe that getting pre-approved for a mortgage is the same thing as getting pre-qualified. They are NOT the same! Here's the difference:

Getting Pre-qualified

Most sellers will require your pre-qualification letter before they’ll even consider your offer. Ask your lender for a prequalification letter. These are relatively simple to get and they just give a rough, unverified estimate of the loan size you may qualify to receive. Most lenders will give you a pre-qualification based on your verbal self-reporting of your income, assets, debts, and down payment size.

Estimated time: 2–3 days

Getting Pre-approved

The pre-approval stage is when lenders verify everything you’ve told them. You’ll need to supply proof of income, proof of assets, proof of employment, records of any debts you hold, and of course identification documents (such as your Social Security card) and a credit report (which the lender will run).

Once you’re pre-approved, you’ll receive a letter stating the exact amount of loan for which you’re approved.

Estimated time: 1 week to several months.

3 Things to Know about FHA Loans

FHA loans are popular with mortgage borrowers because of lower down payment requirements and less stringent lending standards.

Simply stated, an FHA loan is a mortgage insured by the Federal Housing Administration, a government agency within the U.S. Department of Housing and Urban Development. Borrowers with FHA loans pay for mortgage insurance, which protects the lender from a loss if the borrower defaults on the loan.

Less-than-perfect credit is OK

Minimum credit scores for FHA loans depend on the type of loan the borrower needs. People with credit scores under 500 generally are ineligible for FHA loans. The FHA will make allowances under certain circumstances for applicants who have what it calls "nontraditional credit history or insufficient credit" if they meet requirements. Ask your FHA lender or an FHA loan specialist if you qualify.

Lender must be FHA-approved

Because the FHA is not a lender, but rather an insurer, borrowers need to get their loan through an FHA-approved lender (as opposed to directly from the FHA). Not all FHA-approved lenders offer the same interest rate and costs -- even on the same FHA loan.

Costs, services and underwriting standards will vary among lenders or mortgage brokers, so it's important for borrowers to shop around.

Closing costs may be covered

The FHA allows home sellers, builders and lenders to pay some of the borrower's closing costs, such as an appraisal, credit report or title expenses. For example, a builder might offer to pay closing costs as an inducement for the borrower to buy a new home.

Borrowers can compare loan estimates from competing lenders to figure out which option makes the most sense.

Divorce? The 5 Worst Money Mistakes

Written by Guest blogger: Leslie Thompson

During a divorce, a spouse who hasn’t been involved in the family’s finances can often be at a disadvantage during settlement negotiations. That’s why it’s so important for both spouses in the process of dissolving their marriage to understand their post-divorce financial needs and their current financial situation.

The following five items are often overlooked as part of the settlement process, but they’re vital areas to address:

- Cash flow needs

Understanding your need for immediate cash flow is extremely important in determining which assets would be the most beneficial for you to receive in the divorce. If immediate cash flow is a concern, the most valuable assets for you are ones you could sell easily and quickly (so-called liquid accounts), such as stocks, bonds, mutual funds and possibly Roth retirement accounts.

If immediate cash flow is not an issue, a combination of assets with various degrees of liquidity (taxable and retirement plan accounts) will likely be more beneficial long-term.

- Joint liabilities

Just because you agree to split a liability does not mean that the lender will honor your property-settlement agreement. Mortgages will need to be refinanced (if possible), any outstanding tax liabilities on jointly-filed returns will need to be paid and jointly-held credit cards will need to be canceled.

It is important that all liabilities are settled before completing a divorce, either by paying them off or by transferring them to the spouse taking responsibility for the debt.

It is also a good idea to run a credit report to determine if there are any outstanding debts that need to be addressed before settlement.

By securing proof that all liabilities have been settled before the divorce finalization, you’ll avoid an unpleasant surprise when a creditor demands payment from you for a liability that you thought had been settled.

- Taxes on assets

It’s critical to review the tax impact of your investments when evaluating the division of your assets. While two assets or investment accounts may have equal dollar values, their economic value could be vastly different when taxes are factored in.

For example, Roth IRA and Roth 401(k) accounts are funded with after-tax dollars; their future growth and distributions are tax-free. On the other hand, traditional 401(k)s and deductible IRAs are funded with pretax dollars and when you withdraw money from them, taxes will be due on both the amount you contributed and the growth of the investments. As such, Roths have a higher economic value than non-Roth 401(k) or deductible IRAs because they won’t be reduced by future taxes.

If you are younger than 59 and a half, you will pay income tax on withdrawals from non-Roth retirement accounts and possibly a 10% tax penalty. But you can avoid the 10% penalty if the distribution occurs within 12 months following a divorce.

You’ll also want to think about any unrealized capital gains on your taxable investments, since taxes will be due someday. Keep in mind that the first $250,000 of gain from the sale of a principal residence is sheltered from tax.

- Past tax returns

It’s a good idea to review the past three to five years of the tax returns you filed as a married couple. Aside from showing you how much income you two had in a given year, you’ll see whether there are any assets on the settlement agreement or if there are what are known as “tax assets” that need to be considered in the negotiation — such as capital loss carry-forwards, charitable contribution carry-forwards or net-operating losses.

“Tax assets” provide the user a reduction in future taxes and should be considered an asset when splitting the marital estate. But left unresolved, they can cause confusion or errors when filing future tax returns.

- Division of retirement assets

Retirement assets typically represent a large portion of a couple’s net worth and there are special rules to allow for the transfer to be tax-free. You’ll want to make sure the intricacies of these transfers are handled with care.

The divorce decree should specify that any IRA is to be treated as a “transfer incident to divorce” to avoid having the transfer classified as a taxable distribution. Be sure to determine if any basis exists from after-tax contributions made to the IRA — an amount that will be tax-free when distributed. (Consult a tax adviser on this.)

Employer-sponsored retirement plans transfer through a qualified domestic relations order, which requires specific information and approval by the court and plan administrator to allow for a tax-free qualified transfer.

Leslie Thompson is Managing Principal of Spectrum Management Group in Indianapolis. With over 20 years of financial industry experience, she has holds the Chartered Financial Analyst, Certified Divorce Financial Analyst and Certified Public Accountant designations.

*This blog is for information purposes only. Derek Parent and NFM, Inc. accept no liability for its content. Please consult a tax adviser or legal counsel for more information.*

Trick Your Brain into Saving a Down Payment

Follow these 5 strategies to ensure you meet your long-term goals.

Why is it so difficult to stick with a long-term savings plan even when we truly consider our future goals to be just as important as — if not more than — our current desires? Chalk it up to our hardwiring: The rational side of the brain is often drowned out by the emotional side. Good news: It’s possible to outsmart those (very persuasive) instincts that encourage us to spend even when we know we should be saving.

Here’s how to save money for a down payment — or any other long-term savings goal — without letting those instincts get in the way.

Make it hard to spend

If your money is hard to get to, those impulse buys won’t be as easy to make. Put up some roadblocks by moving your savings from your checking account into a separate account that doesn’t have a debit card attached. Better yet, if you’ve got a separate emergency fund and you’re comfortable with not being able to access it immediately, move it into a money market account or other account with a higher interest rate and forget about it (unless you’re adding to the bottom line, of course).

Automate your savings

Take the task of saving out of your control and set up an automated account that diverts a certain amount of your income each month into a savings account. Because it removes the rationalization factor (“Should I save this month or skip it?”), it also removes the emotional act of negotiating with yourself.

Create specific goals and set reminders

Avoid settling for immediate gratification by forcing yourself to acknowledge your long-term goal regularly. Try posting a picture of your dream home in a highly visible area, pinning some money-saving quotes on your Pinterest board, or creating a clear savings timeline with specific number-based savings goals and saving it to your desktop to update with your daily progress.

Match impulse buys with an equal amount into your savings

Computers and smartphones make spending an ever-present option. Spending shouldn’t be forbidden. Instead, skew the act of spending to your favor. So you really want those new boots? Match that spending with an equal contribution to your down payment.

Sometimes the pain of doubling a cost is enough to deter a purchase. In the case you still choose to spend, the matched contribution ensures that at the very least you’re still taking measures to save.

Put away any unexpected savings

Can’t turn down a great sale? To piggyback a good habit onto any impulse purchase, take the sum that was discounted on your sale item and add it to your down payment savings account.

VA Loan Eligibility

The VA Loan program was created in 1944 to help veterans and active duty military become homeowners. The government backs portions of loans through approved lenders, allowing veterans to get mortgages with favorable terms.

If you’re interested in learning more about VA loans, here are the basics.

Eligibility

Both Veterans and active duty service members are eligible for VA loans on homes they will occupy. Members must have a good credit rating, sufficient income, a valid COE (certificate of eligibility) and meet specific service requirements.

Benefits

The biggest benefit of a VA Loan is the down payment, which is zero! That’s right, qualified borrowers can get 100% of the cost of a home financed if they haven’t been able to set aside a large sum of money for a down payment.

Another significant benefit is not having to pay private mortgage insurance monthly, which is a payment typically required to protect lenders against default when a buyer doesn’t put down 20%. However, there is an upfront PMI fee required on all VA loans. The lender doesn’t require monthly PMI or a down payment for VA loans because the portion backed by the government assumes the risk on behalf of the service member.

Process and Advice

The DD-214 is a form for veterans which outlines specifics about their active duty, including dates, assignment and rank, separation information, and any decorations, awards or medals received during service. The form is needed to acquire a Certificate of Eligibility (COE), which verifies to lenders that you are eligible for a VA loan. Active duty service members submit a current statement of service signed by the commander of their unit or personnel office in lieu of a DD-214.

Service members obtain VA Loans through typical lending institutions like banks and mortgage brokers who participate in the VA Home Loan Program. We highly recommend working with a lender that has experience in dealing with VA loans.

It’s a good idea to try to get pre-approved for a loan after gathering your COE. It lets buyers know you are serious, and will give you a realistic idea of how much you’ll be able to spend.

For more information on VA loans, visit the US Department of Veterans Affairs website at http://www.benefits.va.gov/.

5 Financial Perks of Being a First Time Homebuyer

A number of tax benefits come with being a homeowner — but you’ve got some work to do if you want to take full advantage.

All of those forms you filled out to buy your house were just the beginning. First-time homeowners have years of mortgage and insurance paperwork to look forward to, and, of course, taxes.

To sort through that pile of paperwork and make sure you’re saving as much money as possible, here are six tax benefits for new homeowners.

1. You can deduct the interest you pay on your mortgage

The home mortgage interest deduction is probably the best-known tax benefit for homeowners. It lets you deduct all the interest you pay toward your home mortgage with a few exceptions, including these big ones:

Your mortgage can’t be more than $1 million.

Your mortgage must be secured by your home (unsecured loans don’t count).

Your mortgage must be on a qualified home, meaning your main or second home (vacation homes count too).

Don’t assume that if you are married and file a joint tax return, you have to own your home together to claim the interest: For purposes of the deduction, the home can be owned by you, your spouse, or jointly. The deduction counts the same either way.

And don’t worry about keeping track of how much you’re paying in interest versus principal each month. At the end of the year, your lender should issue you a form 1098, which reports the amount of interest you’ve paid during the year.

Warning: Since, as a first-time homeowner, you pay more interest than principal in the first few years, that number can be fairly sobering.

2. You may be able to deduct points

Points are essentially prepaid interest that you offer upfront at closing to improve the rate on your mortgage. The more points you pay, the better deal you get.

You can deduct points in the year you pay them if you meet certain criteria. Included in the list (and it’s a long one): Points must be paid on a loan secured by your main home, and that loan must be to purchase or build your main home.

3. For 2015, you can deduct PMI

Private mortgage insurance, or PMI, protects the bank in the event you default. PMI may be required as a condition of a mortgage for first-time homebuyers, especially if they can’t afford a large down payment.

For most years, PMI is not generally deductible. However, for 2015, qualifying homeowners who itemize may claim a tax deduction for the cost of PMI for both their primary home and any vacation homes.

4. Real estate taxes are deductible

Real estate taxes are imposed by state or local governments on the value of your property. Most banks or other mortgage lenders will factor the cost of your real estate taxes into your mortgage and put those amounts into an escrow account.

You can’t deduct the amounts paid into the escrow, but you can deduct the amounts paid out of it to cover the taxes (you’ll see this amount on a form 1098 issued by your lender at the end of the year).

If you don’t escrow for real estate taxes, you’ll deduct what you pay out of pocket directly to the tax authority.

And don’t forget about those taxes you paid at settlement. If you reimburse the seller for taxes already paid for the year, you get to deduct those too.

5. You’ll get capital gains tax relief down the road

Resale value is something you considered when you chose your home. And different from other investments for which you’re taxed on the full value of any gain, you can exclude some of the gain attributable to your home when you sell.

Under current law, you can avoid paying tax on up to $250,000 of gain ($500,000 for married filing jointly) so long as you have owned and lived in the property for two of the last five years (those years of owning and inhabiting don’t have to be consecutive).

Gain over that amount is taxed at capital gains rates, which are generally more favorable than ordinary income tax rates.

Corporate Benefits: Helping Employees Manage Their Financial Challenges

Reduce turnover and Boost Culture

The cost of employee turnover is exorbitant, and with statistics looming around every corner, taking a look at what employees are saying is no longer just a suggestion; it’s imperative to creating a culture that clearly represents its company.

HOW TO AVOID TURNOVER BY UNDERSTANDING THE JOURNEY

The decision to join a new organization is often accompanied by leaving another, and new hires are placing bets that their new role will be better than the last, fulfilling a need the previous employer was not. People ask for opinions from friends and family, search online for ratings and reviews and do what they can to find out if a company can help in achieving their personal goals. It is a decision that starts with rational considerations but is ultimately decided based on emotions and the connection that they feel with their new employer, and from the point they make the decision, all interactions build their perception about what it means to be an integral part of the organization. This is why on-boarding needs to be a refined process, offering employees the opportunity to truly feel at home. From a company’s perspective, it is a perfect opportunity to deliver on its value proposition and any other promises made during the hiring process—not only to meet expectations, but to exceed them. Our Corporate Benefits Program is designed to help Organization Name do that without having to subtract anything from its bottom line. There are not many things in life that have more of a correlation than work and home. Being able to play a role in helping employees—brand new or seasoned—establish themselves in their local communities is a crucial factor in earning their trust and giving them confidence in their employer.

“The benefits and perks that employees truly care about are those that offer them greater flexibility, autonomy and the ability to lead a better life… In general, employees are most likely to say they would change jobs for benefits and perks closely related to their quality of life. They are quite interested in jobs that offer them a way to balance work and home better, gain a deeper sense of autonomy and secure their financial future. (Gallup)”

In today’s uncertain economic climate, more businesses are seeking to create workplace environments that offer employees improved value and benefits.

That includes helping to manage personal finances and to prepare for retirement. In fact, two-thirds of North American employers now offer their workers financial education, according to a new report from the Wisconsin-based International Foundation of Employee Benefit Plans. Not only does this addition to employee benefits programs lead to happier and healthier workers, but it also can boost productivity as well as a company’s bottom line.

According to the recent survey Finding the Links Between Retirement, Stress and Health, financial stress can lead to decreased productivity

One-in-five workers reported feeling extremely stressed, mostly because of their job or finances. Those reporting high levels of stress were more than four times as likely to suffer from symptoms of fatigue, headaches, depression or other ailments. They also were twice as likely to report poor health overall, leading to more sick days, increased absenteeism and decreased productivity. Four-out-of-five employers reported that their employees’ personal financial issues were impacting their job performance somewhat, very much or to an extreme degree. This resulted in an increase in stress among employees (reported by 76 percent of employers); workers’ inability to focus at work (60 percent); and absenteeism and tardiness (34 percent). More than a quarter of employers also reported that a significant portion of their workers were challenged by both supporting their children (sometimes grown) and aiding elderly parents.

More companies are realizing that offering health-care and retirement plans is no longer enough and are beginning to look for ways to also help their employees with personal monetary challenges such as housing, home ownership and financial planning.

To help with this process, USA Mortgage is proud to offer its Corporate Benefits Program, a workplace-sponsored Financial Education & Resource Program for employers and organizations throughout Organization name.

PROVIDE YOUR EMPLOYEES WITH EVEN MORE ADDED VALUE

Including special home financing benefits—through the Corporate Mortgage Benefit Program. The program is quick and easy to set up, and once it’s ready to go, there’s nothing more you need to do. You’ll receive uncomplicated communication to share with your employees. Then, we’ll work directly with them to help them understand their home financing options and provide ongoing support every step of the way.

- Personalized support, education and tools your employees need to confidently plan for and move through the home financing process

- Competitive rates and fees on various home financing products and programs

- Employees interact with us where and how they like— in person, over the phone or on-the-go

BUYING OR REFINANCING A HOME

Through our Corporate Benefits Program, you’ll be able to easily locate financing that meets your needs and supports your homeownership goals. You’ll find competitive rates and fees on an array of loans and programs, with special options also available for those who are planning to build a new home or undergo home improvements. As an experienced home mortgage consultant, I can offer you personal guidance throughout the entire home financing process.

CONVENIENT TOOLS AND RESOURCES

Online educational videos on my website can help you prepare to buy a home and learn about the home financing process.

- Find the ideal mortgage using our home loan shopping tools and calculators.

- Once you’ve applied, check your loans’ progress via a computer, smartphone or tablet with your LoanTracker.

- Manage your mortgage and other PERL accounts online.

REALIZE YOUR HOMEOWNERSHIP GOALS

You might be eligible to make a down payment as low as 3 percent on a fixed-rate loan for a single-family home with your first mortgage. You’ll have a chance to lower your interest rate through homebuyer education. To ensure eligibility, ask me about the loan amount, type of loan and type of property.

Benefits for Everyone

BENEFITS TO COMPANIES:

- Increased employee loyalty

- Reduced absenteeism.

- Improved financial well-being.

- Since buying a home is one of the top three stressful endeavors, less stress = more productive employees!

- Minimal administration required by your company; we do most of the work.

- Exclusive co-branded benefits website accessible to your employees and their families!

- No cost to your company or organization.

BENEFITS TO EMPLOYEES:

- All employees are eligible, and it’s completely voluntary.

- Educational materials are accessible through the co-branded benefits website.

- “Lunch & Learn” seminars are available.

- An exceptional team of real estate and financial experts are hand-picked and pre-screened for the benefit of participating members.

- A one-on-one relationship and a concierge experience working with a Mortgage Advisor and team.

- Professional advice and customized mortgage solutions for each borrower.

- Discounts on real estate commissions, home inspections, closing costs, moving expenses and more!

- Valuable savings when buying, selling and refinancing a home.

- Discounts on products and services in your area.

Homeownership for Future Employees

PROJECTED INCOME MORTGAGES

With a job offer letter mortgage, your future employees may qualify to buy a home with a non-contingent offer letter. A job offer letter must clearly outline employment terms – namely salary and start date. If that info is present and the income isn’t variable or commission-based, PERL may be able to approve and fund a loan with nothing more than the offer letter for income documentation for your future employees.

Subject to terms and conditions and credit qualification; not a commitment to lend, and not all borrowers may qualify.

PROGRAM REQUIREMENTS

- Income must begin within 90 Days of Closing (60 days for VA/FHA/USDA)

- Is non-contingent or provide documentation, such as a letter or e-mails from the future employer verifying all contingencies have been cleared, and

- Includes the terms of employment, including employment start date, position, and annual income based on salary (e.g., hourly earnings are not permitted)

- For a salary increase, documentation must indicate that the increase is fully approved and is explicitly granted to the employee

- Reserves are required covering 6 months principal, interest, taxes, and insurance

Open Doors, Unlock Opportunities: VA Home Loans

Program History

The VA program was created with the signing of the GI Bill by President Franklin D. Roosevelt on June 22, 1944. This law provided veterans with federally guaranteed home loans with no down payment.

This benefit was intended to stimulate jobs in the housing industry, as well as providing assistance for veterans and their families. The maximum loan amount at the time was $2,000, 50% of that guaranteed by the government.

VA Loans — Veteran’s Best Friend

- No down payment required up to county limits: http://www.loanlimits.org/va/

- No monthly Mortgage Insurance – helps to qualify for larger loan

- Seller contributions allowed up to 4% of value…above and beyond payment of standard closing costs

- Fees that can be paid by the veteran are limited

- 100% gift funds allowed

- No minimum reserve requirements (conforming limits)

- Make sense underwriting

- Veteran can use entitlement multiple times

- Fixed rate assumable loan (as approved by VA/servicer)

- Assistance/counseling to veterans in default due to temporary financial difficulty

- Vets qualify for home loan benefits after 2 years of service (less if served prior to 1980), or 90 days active duty during the Persian Gulf era; Reservists and National Guard eligible after 6 years (or 90 days active duty in Gulf)

- Unmarried surviving spouse of a veteran who died while in service or from a service connected disability may use benefits

To Recap...

- No Monthly Mortgage Insurance

- 100% LTV Purchase or Refinance

VA Financing is on the rise, but still under-utilized.

- Only an estimated 5% of U.S. Veterans and qualified military

personnel have used their home loan benefits.

What does this mean to you? Home financing made simple!

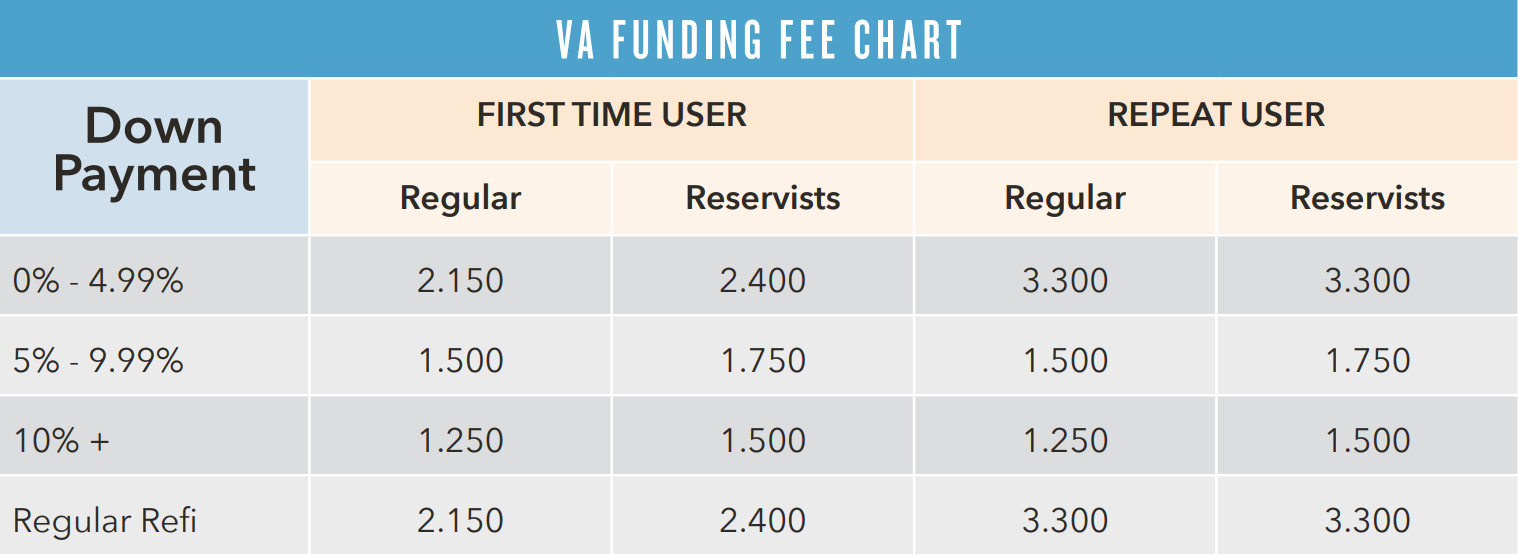

VA Funding Fee

- Although there is no monthly mortgage insurance on a VA loan, the veteran does have a onetime Funding Fee. On loans below county limit, this can be financed into the loan over and above the appraised value/sales price, or can be paid in cash (or a combination of both).

- The Funding Fee may be waived in the following instances (as evidenced on the “Certificate of Eligibility”):

- Veterans receiving VA compensation for service-connected disabilities

- Vets who would be entitled to receive compensation if not receiving military retirement pay

- Loans for surviving spouses of vets who died in service or from service-connected disabilities

- Funding Fee is calculated as a percentage of the loan amount. For example, on a $400,000 loan with a 2.15% VAFF = $8,600. Total loan amount = $408,600

TIP: Ask the Vet to put down 5% to reduce the Funding Fee!

Down Payments & Loan Amounts

Loan Programs: 30, 25 & 20 Yr. Fixed (PERL – conforming); High Bal, 15 Yr. & 5/1

The VA will guarantee 25% of the loan up to the county limit. Because of this, there is no down payment at or below the county limit: http://www.loanlimits.org/va/

Above county limits, the borrower is required to make a minimal down payment in the amount of 25% of the difference between the sales price and county limit (see example below).

Example

$458,850 - VA Loan Limit for Chesapeake County

$550,000 - Sales Price

$550,000 Sales Price - $458,850 County Limit = $91,150 difference

$91,150 difference x 25% required down = $22,787 down payment

$550,000 Sales Price - $22,787 down = $527,213 max VA loan (a 95.8% LTV in this case!)Hint: If the borrower has 5% to put down, the Funding Fee will be reduced to 1.5%!

The Advantage - Selling the Seller

Overcome the seller’s objections about dealing with a VA buyer! With PERL Residential Lending, the seller does not need to pay all the “non-allowable” fees!

- VA allows the non-allowable fees to be paid by the borrower up to 1% if an origination fee is not charged.

- These fees include lender fees (processing, underwriting etc.), escrow fee, termite inspection (depending on state), notary fee, messenger fee and any other non-allowable fee.

- It generally costs the borrower less than the one percent so all parties benefit.

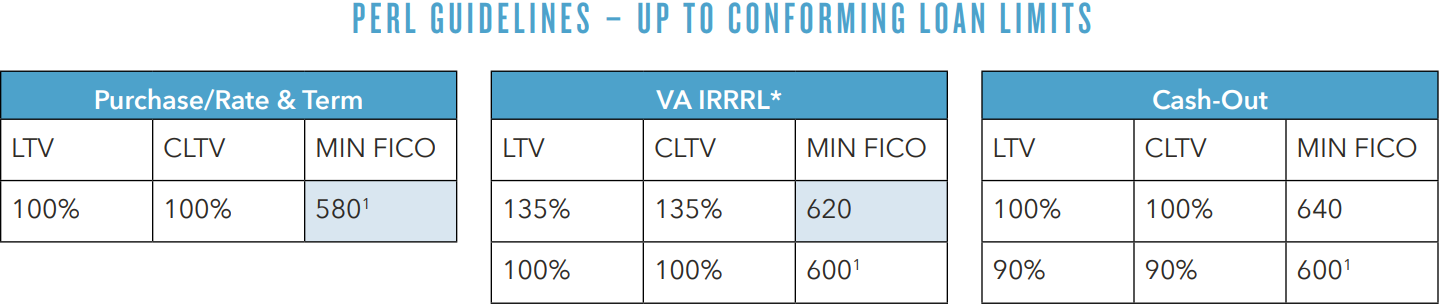

LTV/Credit

NOTE: The LTV/CLTV is exclusive of Financed VA Guaranty Funding Fees (Except for IRRRL)

1Minimum credit score for manufactured housing is 620

Underwriting — IRRRLs

A VA Interest Rate Reduction Refinance Loan (IRRRL) is a refi of an existing VA loan only. Rate and P&I must both be reduced, unless the existing loan is an ARM or the term is decreasing.

The new loan amount may include:

- Unpaid principal balance

- Prepaid expenses

- VA Funding Fee of .50%

- Allowable closing costs

- Max. 2 discount points

Perl IRRRL Guidelines

- Max 135% LTV w/ 620 credit; Max 100% LTV w/ 600 credit (based on total loan amount

- AVM from DataVerify determines LTV; if AVM not adequate, order conventional appraisal

- NEVER order a VA appraisal on a streamline!

- DTI is not calculated – no AUS

- The P&I on the IRRRL must be less than the loan being refinanced (unless going from fixed to ARM or reducing term)

- 0x30x12 on all mortgages

- Max $500 incidental cash back

Underwriting Basics - Credit

Bankruptcy:

- Chapter 7 – generally 2+ years is acceptable; possibly 1-2 years with extenuating circumstances

- Chapter 13 – all payments satisfied OK; possibly OK after 12 months of satisfactory payments with court approval

- VA Jumbos – no BK within past 7 years

Foreclosures:

- Follow same rules as Chapter 7 BK (VA Jumbos – no history of foreclosure within past 7 years)

- Ensure that borrower’s entitlement has been restored (or determine if there’s bonus entitlement)

- Develop complete information on the facts and circumstances of the foreclosure

Other Adverse Credit Items:

- Collections - Aggregate balance of $1,000 or greater must be paid (excluding medical)

- Judgments – Must be paid in full at or prior to closing

Underwriting Basics - Property

Conversion of primary Residence to Rental

- If the veteran is converting a current principal residence to an investment property:

- Evidences of cash reserves totaling 3 months PITI for each rental property must be provided.

- The borrower may qualify using 75% of the gross rental income to offset the mortgage payment.

- Borrower may use entitlement multiple times – Veteran must occupy the property as his/her primary residence

when purchased. - Income from existing rental properties claimed on the borrower’s Schedule E may be used. With 2 years, positive

net rents may be used as income. Less than 2 years, can be used to offset mortgage. - Unlike FHA, the VA has no “flip” rule or restrictions. Sales price appreciation simply must make sense.

Underwriting Basics - Liabilities

Need a boost? VA Underwriting makes sense!

VA Recommended Compensating Factors include (but are not limited to):

- Excellent Credit History

- Conservative use of consumer credit

- Minimal consumer debt

- Long-term employment

- Significant liquid assets

- Sizeable down payment (purchases)

- Significant equity (refi’s)

- Little or no payment shock

- High residual income (more info on next slide)

- Low DTI

- Tax benefits for home ownership

Compensating factors can be used to justify expanded DTI or payment shock, but CANNOT be

used to offset unsatisfactory credit.

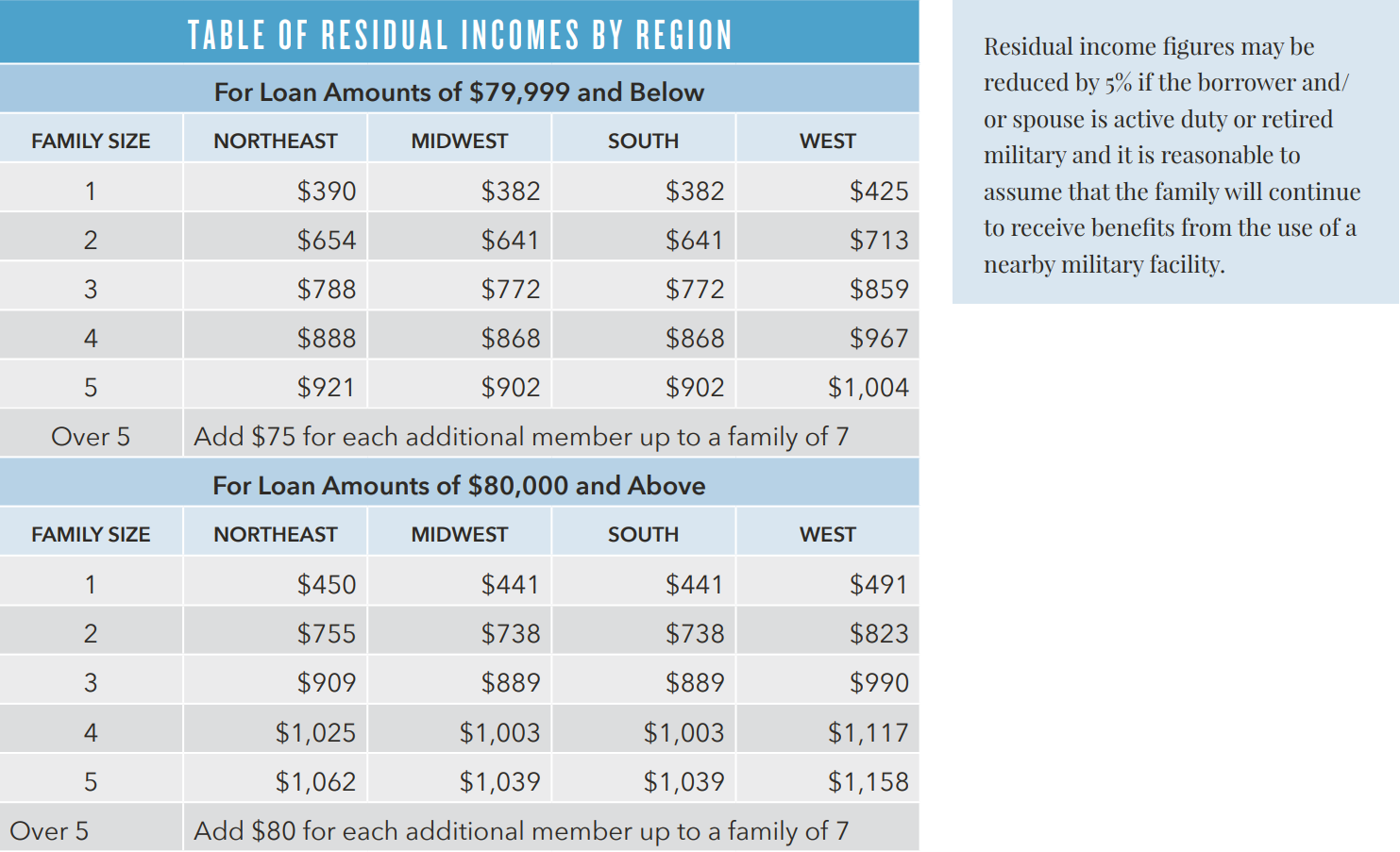

Underwriting — Residual Income

Residual income is the amount of net income remaining to cover family living expenses (food, health care, clothing, etc.). All household members are included in family size, with the exception of: a) a non-borrowing spouse who has a stable, reliable income sufficient to support expenses, or b) a child for whom sufficient foster care or child support payments are received regularly.

Appraisals & Collateral

- Appraisals are ordered through the Veteran’s Information Portal and assigned by the VA.

- The subject property must meet VA Minimum Property Requirements prior to loan funding. This will affect properties being sold “as is.” Repairs noted on the appraisal must inspect the repairs and issue a clear inspection report prior to funding.

- All VA Purchases requires a clear termite report, excluding condos on the 2nd story or higher.

- Any required repair items or deficiencies will be noted on the appraisal report.

Most VA appraisals do not require repair work!

What Else Do I Need To Know?

- Borrowers must occupy the property. No Investment or 2nd Home purchases allowed (IRRRL OK).

- VA borrowers may own other property, as long as the subject property will be owner occupied.

- Non-occupant co-borrowers are not permitted to help qualify.

- Non-traditional credit is allowed on a case by case basis.

- Condos must be on the VA approved condo list. There are no “spot approvals.”

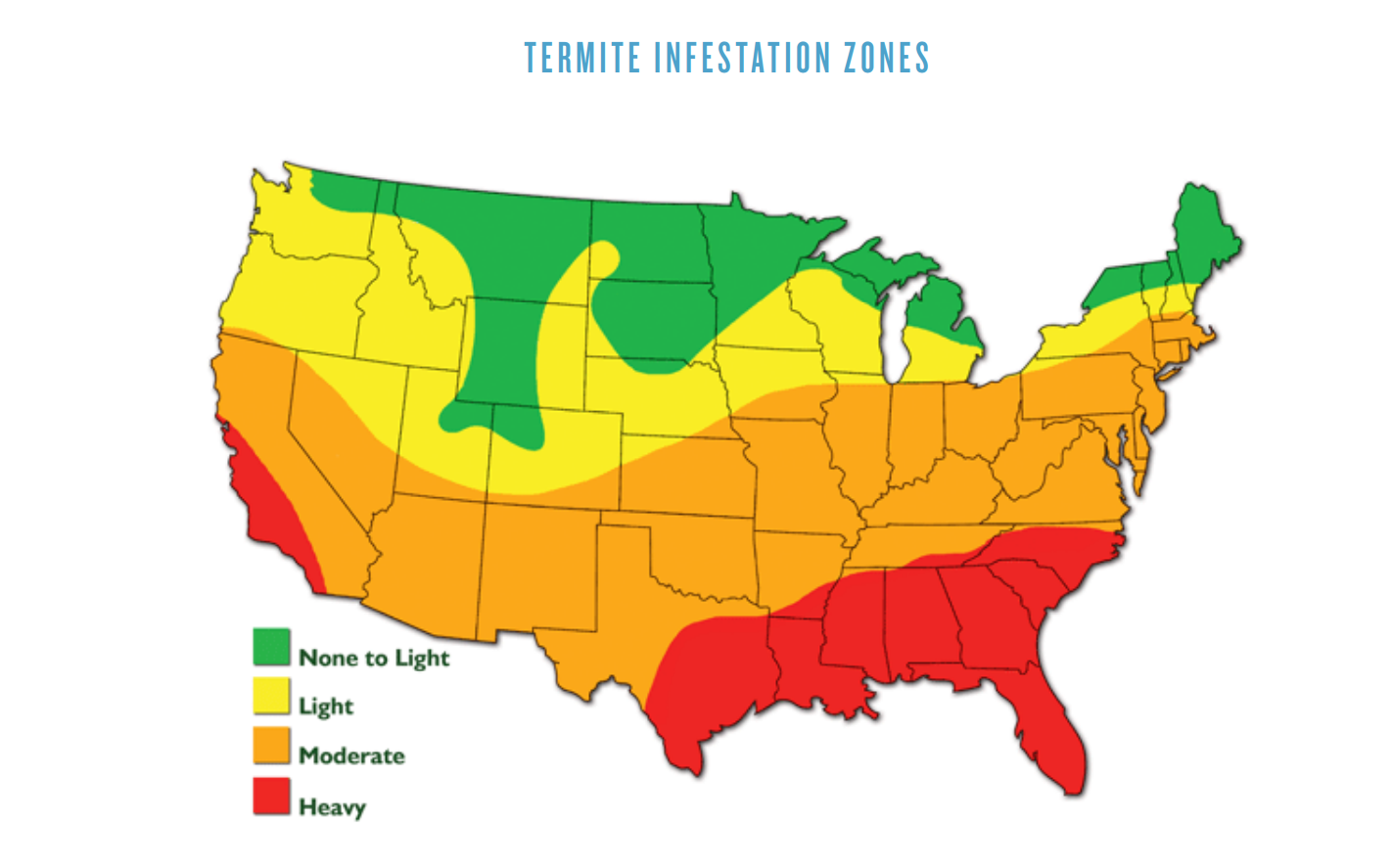

- Termite report and clearance is required (except IRRRL’s) on existing properties in areas where the probability of infestation has been defined as “very heavy” or “moderate to heavy” by the IRC. Check with VA Regional Loan Center for final determination.

- Clear CAIVRS is required for all borrowers.

- VA is often confused as a “First Time Homebuyer” program, but this is not the case.

- This program is open to all Veterans, active duty military, qualified reservists/National Guard, and un-remarried surviving spouses of service-connected death.

Summary of VA Advantages

- No down payment required. See County List for limits.

- Maximum seller contributions 4%+

- 100% gift funds allowed

- No minimum reserve requirements

- Make sense underwriting

- Citizenship is not required

- Veteran can use entitlement many times

- Not limited to First Time Homebuyers

- Fixed rate assumable loan

- Reservists/National Guard qualify for VA benefits

- Manufactured homes OK

- Quick closings

- Underwritten at PERL

Why PERL?

Experienced Realtors and Veterans trust and choose PERL!

- Purchase and Refinance specialists in VA, FHA and Conventional loans.

- We understand the demands and pressures of a Realtor driven purchase market.

- We know the importance of closing on time to the buyer, seller, and Realtor.

- Experienced, quality Mortgage Loan Originators who provide individual service.

- Dedicated Government Lending department and senior management team with decades of experience.

Resources

- VA Loan Guaranty Homepage

- General Rules for Eligibility

- Lender’s Handbook

- 2016 County Limits

- Appraisal Fee Schedules

- VA Regional Loan Centers

- VA Condo Search

- VIP (Veterans Information Portal)

- VA Forms

- Veterans Association of Real Estate Professionals

Derek Parent Helping Homeowners Realize Their Dreams

Cementing his place as a seasoned mortgage professional, Derek Parent and The Parent Team of USA Mortgage is leaving a mark as one of the top mortgage origination teams in the country.

via High Rise Life Magazine - July/August 2018

Over the years, Derek Parent and his team have gained the trust of the community at large with experience working with an array of clients, including first-time homebuyers, high net-worth individuals, veterans, teachers, and medical workers.

One of Parent’s biggest priorities is staying on top of market trends to protect, service and educate his clients to the best of his ability. Derek Parent alongside his team of experts have set out a mission to help clients realize their dreams. In our interview, Parent discusses everything from getting the perfect loan, first time buyer home tips, purchasing and financing a home in 2018, getting approved for high-rise condominium with little as 5% down, why refinancing may be good option, and everything in between. Here is what he had to say.

Q: Can you tell us a little about yourself and The Parent Team of USA Mortgage?

The Parent Team is built around a couple of very basic principles, and they don’t have nearly as much to do with the actual work environment as they do the people. I truly believe that–like a home–if you implement great habits and amazing people in your everyday life, you will build a foundation that can withstand any storm or capacity. From day one, I’ve always attempted to surround myself with people who represent those qualities. Personally, I am a strong believer in elevation, and what I embrace most about the mortgage industry is that it allows me to grow–not only in my career, but also in my personal development. It’s enabled me to do what I love; it’s given me the opportunity to be a stepping stone–and sometimes, a guide–for those looking to achieve something.

When you pair that with over 20 years of industry experience, there is very little that seems daunting. I’ve seen all different types of markets and needs, and it’s allowed me to work with clients from every side of the spectrum. We work in an extremely dynamic industry, and I believe that my duty is to always keep an adaptive perspective, and it’s this same mindset that has been the foundation of how my team and I have been able to fulfill a desperate need for mortgage options in Las Vegas. Whether someone is planning to purchase a single-family home, condominium, primary residence or investment, these wins–the difficult ones–are the scores that count and setting ourselves apart in a world where most are intimidated is something in which I continue to pursue daily, understanding that it will give my clients more opportunity, less stress and most importantly, trust in their mortgage advisor to always have their backs.

Q: What are some of the types of programs you offer or specialize in?

Depending on the type of property, we offer several different options, including Jumbo, Conventional, FHA and VA throughout Nevada, California, Texas, and Florida. One specialty is being able to provide traditional financing for high-rise condominium projects in Las Vegas with as little as 5% down payment.

Q: As an expert high-rise lender, is it difficult to get approved for high-rise loan?

Not at all. It is simple. We generally can tell very quickly whether someone can qualify or not. We analyze a few things like the applicant’s credit and income and the property’s value to determine whether the loan is possible now or in the future.

Q: What are some great options available for buyers currently looking to buy a high-rise condominium?

We have expanded our options to provide financing on condominiums ranging from $70,000 to $3 million, and a down payment can be as little 5% down. We want to help everybody. Some of the condominiums that are listed include: Veer Towers, Turnberry Towers, Turnberry Place, One Las Vegas, Metropolis, The Ogden, Park Towers,

and more.

Q: What are some core values that The Parent Team carries?

All our decisions and choices are based on the foundation of integrity, honesty, compassion and always keeping the client’s best interest in mind. Our clients are far more than just clients; they are friends and taking care of them is our #1 priority.

Q: What are your thoughts on housing market and recent developments in Las Vegas? Do you think it is a good time to buy?

I’m a strong believer that NOW is always the best time to buy. Why wait? Tomorrow is never promised.

Q: Can you give us insight into current interest rates and market projection?

With being an active Sponsor of the Las Vegas Global Economic Alliance group, The Parent Team is always up to date with what’s going on in today’s market. As the housing market is steadily growing, so will the rates.

Q: Why do you think refinancing is a good option for some clients?

There are several reasons why refinancing is beneficial to clients. Some of the benefits are paying off credit cards, financing a business, covering college tuition, managing unexpected expenses, making improvements to your home or taking advantage of potential tax-deduction benefits from interest paid on the loan. Refinancing overall gives our clients an opportunity to put more cash into their pockets rather than leaving it tied to a piece of property.

Q: What are some tips you recommend for new home buyers when shopping for a loan?

My recommendation is to work with someone of a high-caliber professional who you trust. Becoming a homeowner is one of the biggest purchases in someone’s life, so it’s important to go through this process with someone you know has your back.

Q: What makes The Parent Team different compared to other lenders?

Our mission is to help our community achieve homeownership, helping the maximum number of people in our community. One of the reasons why we invested in creating opportunities for homeowners that can purchase in any price range is to be able to provide options for every type of homebuyer. This process of purchasing a home, refinancing, and dealing with money can be sensitive, so our mission is to make sure every single one of our clients experiences a smooth transaction and an uplifting process.

Derek J. Parent NMLS# 182283