What Credit Score Do You Actually Need to Buy a Home in Nevada?

One of the most common questions buyers ask is also one of the most misunderstood:

“What credit score do I really need to buy a home?”

If you’re buying in Nevada, the answer isn’t a single number. It depends on the loan program, your overall financial profile, and how the lender structures your mortgage.

Let’s break it down clearly—without myths or scare tactics.

The Short Answer: You Don’t Need Perfect Credit

Many buyers assume they need a 740+ credit score to qualify. In reality, many Nevada buyers purchase homes with scores well below that.

What matters most is:

- The loan type

- Your income and debt

- Your down payment

- Your recent credit behavior

Credit score opens doors—but it’s only one piece of the approval puzzle.

Minimum Credit Scores by Loan Type

Here’s how the most common mortgage programs break down.

Conventional Loans

- Minimum score: 620

- Best pricing: 740+

- Down payment options: As low as 3%

Conventional loans reward higher credit scores with better interest rates, but many buyers qualify comfortably in the 620–700 range—especially with solid income and manageable debt.

FHA Loans

- Minimum score: 580 (with 3.5% down)

- Possible with lower scores: 500–579 (with larger down payment, lender-dependent)

FHA loans are popular with first-time buyers because they’re more forgiving of past credit issues. Recent payment history matters more than old mistakes.

VA Loans (for Eligible Veterans)

- No official minimum set by VA

- Most lenders prefer: 620+

- Down payment: 0%

VA loans are one of the most flexible options available. Many veterans qualify even after past credit challenges, as long as current finances are stable.

Jumbo Loans

- Typical minimum: 700–720

- Stronger reserves required

- Higher income verification

Jumbo loans are used for higher-priced homes and require stronger credit profiles—but even here, structure and assets matter.

Why Lenders Look Beyond the Score

A credit score is a snapshot, not the full story. Lenders also evaluate:

- Debt-to-income ratio (DTI)

- Payment history over the last 12–24 months

- Credit utilization

- Derogatory items (collections, late payments)

- Cash reserves after closing

A buyer with a 640 score and low debt may be a better borrower than someone with a 720 score and high monthly obligations.

Common Credit Myths That Hold Buyers Back

Let’s clear up a few misconceptions.

Myth #1: One late payment ruins your chances

Not true. Pattern matters more than one mistake.

Myth #2: You must pay off all collections

Often false. Many collections don’t need to be paid to qualify.

Myth #3: You should close old accounts

Closing accounts can hurt your score by reducing credit history and available credit.

Myth #4: You should wait until your score is “perfect”

Waiting can cost you more in rising prices than you save in rate improvements.

How Much Difference Does Credit Score Make in Your Rate?

Credit score impacts pricing—but not always as dramatically as buyers fear.

For example:

- A buyer at 680 may pay slightly more than a buyer at 740

- But seller credits, buydowns, or refinancing later can offset that difference

This is why many buyers choose to buy now and optimize later, instead of waiting indefinitely.

What If Your Score Isn’t Where You Want It Yet?

If you’re not quite ready today, that’s okay—but guessing isn’t the solution.

A short credit review can:

- Identify what’s helping or hurting your score

- Show which actions actually move the needle

- Prevent unnecessary credit changes

- Create a clear timeline to approval

At https://derekparentteam.com, we help buyers map out specific, realistic steps—not generic advice.

The Most Important Takeaway

The credit score you “need” isn’t a fixed number. It’s about:

- Choosing the right loan

- Structuring the deal correctly

- Understanding what lenders actually care about

Many buyers delay homeownership unnecessarily because of outdated or incorrect credit assumptions.

Final Thoughts

If you’re thinking about buying a home in Nevada, your credit score matters—but it doesn’t need to be perfect. With the right strategy, many buyers qualify sooner than they expect.

If you want an honest review of where you stand—and what’s possible—connect with The Derek Parent Team. We’ll break down your options clearly and help you move forward with confidence.

How Federal Reserve Policy Impacts Mortgage Rates

When mortgage rates rise or fall, most buyers and homeowners hear one phrase repeated over and over: “The Fed did it.”

But the truth is more nuanced.

The Federal Reserve plays a powerful role in shaping the mortgage market — without directly setting mortgage rates. Understanding how Fed policy actually works can help you make smarter decisions about buying, refinancing, or waiting.

Here’s a clear breakdown of how Federal Reserve policy influences mortgage rates and what that means for you as a Las Vegas buyer or homeowner.

1. The Federal Reserve Does Not Set Mortgage Rates

This is the most important point to understand upfront. The Federal Reserve does not directly control mortgage rates.

Instead, it controls:

- The federal funds rate (the overnight rate banks charge each other)

- Monetary policy designed to manage inflation and economic growth

Mortgage rates are primarily influenced by:

- The bond market

- The 10-year Treasury yield

- Inflation expectations

- Investor demand for mortgage-backed securities

However, Fed decisions strongly influence all of these factors — which is why its actions matter so much.

2. Why the Fed Raises and Lowers Rates

The Federal Reserve’s main goals are:

- Control inflation

- Maintain employment stability

- Protect economic growth

When inflation is high, the Fed raises rates to slow spending.

When the economy slows too much, it lowers rates to stimulate growth.

These decisions ripple through financial markets, including housing.

3. How Fed Rate Hikes Push Mortgage Rates Higher

When the Fed raises the federal funds rate:

- Borrowing becomes more expensive for banks

- Investors demand higher returns

- Bond yields rise

- Mortgage-backed securities must offer higher yields to attract buyers

As a result, mortgage rates tend to increase, even though the Fed didn’t touch them directly.

This is exactly what happened during the recent inflation-fighting cycle, when aggressive Fed hikes led to the highest mortgage rates in over a decade.

4. Why Mortgage Rates Sometimes Fall Even When the Fed Holds Rates

This is where many buyers get confused.

Mortgage rates can drop before the Fed cuts rates — or even while the Fed pauses.

Why?

- Investors anticipate future economic slowing

- Inflation expectations ease

- Money flows into bonds as a safe haven

- Demand for mortgage-backed securities increases

Markets move on expectations, not just announcements. That’s why waiting for a Fed rate cut doesn’t always lead to the best mortgage pricing.

5. The Bond Market Matters More Than Headlines

Mortgage rates are closely tied to long-term bonds, especially the 10-year Treasury. When bond yields fall, mortgage rates usually follow.

Key factors that influence bond yields:

- Inflation data

- Employment reports

- Global economic uncertainty

- Federal Reserve guidance and projections

This is why some of the biggest mortgage rate drops happen on days when the Fed doesn’t even meet.

6. What This Means for Buyers

For buyers, Fed policy creates windows of opportunity — but they don’t always line up with news cycles.

Here’s what smart buyers focus on instead:

- Monthly payment affordability

- Purchase price vs. long-term value

- Seller concessions and incentives

- Refinance flexibility later

Trying to time the exact bottom of interest rates is risky. Buying when the numbers make sense — and refinancing later if rates improve — is often the stronger strategy.

7. What This Means for Homeowners

For homeowners, understanding Fed policy helps with:

- Refinance timing

- Cash-out decisions

- Debt consolidation planning

- Equity strategies

Even modest changes in market sentiment — not just Fed action — can create refinance opportunities. That’s why monitoring the bond market and rate trends matters more than waiting for a single Fed announcement.

8. Why Local Expertise Matters

National headlines talk about the Fed. Local experts talk about how Fed policy plays out in your market.

In Las Vegas, factors like:

- Population growth

- New construction incentives

- Investor demand

- High-rise financing conditions

can amplify or soften the impact of Federal Reserve decisions.

At https://derekparentteam.com, we help buyers and homeowners understand how national policy and local market dynamics intersect — so decisions are based on data, not fear.

Final Thoughts

The Federal Reserve sets the tone for the economy, but mortgage rates are driven by a broader mix of market forces. Understanding that relationship helps you stop reacting to headlines and start planning strategically.

Whether you’re buying, refinancing, or simply watching the market, the smartest move is understanding how policy affects real-world numbers, not just announcements.

If you want to see how today’s rate environment — and future Fed policy — impacts your options, connect with The Derek Parent Team. We’ll walk through real scenarios and help you build a plan that works in any market cycle.

What Fannie Mae and Freddie Mac Are Signaling About Mortgage Rates Today

When mortgage rates move, most people look to the Federal Reserve for answers. But inside the mortgage industry, two other institutions quietly provide some of the clearest forward-looking signals about where rates are heading: Fannie Mae and Freddie Mac.

These government-sponsored enterprises don’t set mortgage rates directly, but their forecasts, pricing models, and policy guidance heavily influence lending behavior nationwide. If you’re a buyer, homeowner, or investor trying to decide whether to act now or wait, their signals matter more than most headlines.

Here’s what they’re telling us right now.

Why Fannie Mae and Freddie Mac Matter So Much

Fannie Mae and Freddie Mac back the majority of conventional mortgages in the U.S. Because of that, they closely track economic data tied to housing affordability, inflation, employment, and consumer demand.

When they adjust forecasts or lending assumptions, lenders pay attention — because those changes affect:

- Mortgage pricing

- Loan availability

- Qualification guidelines

- Risk tolerance across the market

In short, they see what’s coming before it shows up in rate sheets.

Signal #1: Rates Are Expected to Ease — Not Collapse

Both agencies are projecting gradual improvement in mortgage rates, not a sudden drop. This is an important distinction.

Their recent outlooks suggest:

- Inflation is cooling, but not gone

- The economy is slowing, not breaking

- Rate volatility is decreasing

- Long-term rates are stabilizing

What this means for buyers is simple: the era of sharp rate spikes appears to be behind us, but the return to ultra-low rates is unlikely.

Translation: Rates may improve, but waiting for perfection could be costly.

Signal #2: Housing Demand Remains Strong

Despite higher rates, both Fannie Mae and Freddie Mac continue to report persistent housing demand, especially in growth markets like Las Vegas.

Key reasons:

- Ongoing population growth

- Limited resale inventory

- Homeowners holding low-rate mortgages

- Rising rents pushing renters toward ownership

This sustained demand is one reason neither agency expects meaningful home price declines in most markets. Instead, they’re forecasting moderate, steady appreciation.

Signal #3: Affordability Is Improving in Subtle Ways

While rates remain elevated compared to prior years, affordability is improving through other channels:

- Slower price appreciation

- More seller concessions

- Builder incentives

- Temporary rate buydowns

- Expanded loan strategies

Fannie Mae has noted that buyers are adapting rather than exiting the market. That adaptability is stabilizing housing activity — and reinforcing the idea that the market is normalizing, not weakening.

Signal #4: Refinance Activity Will Return — Slowly

Both agencies expect refinance volume to increase incrementally, not explosively. Homeowners with rates in the high-6% to 7% range may benefit from refinancing even with modest rate improvements.

What’s especially notable is the growing focus on:

- Cash-out refinances

- Debt consolidation

- Term restructuring (30-year to 20- or 15-year)

- Removing mortgage insurance

This tells us that homeowners are becoming more strategic — using refinancing as a financial tool, not just a rate play.

Signal #5: Lending Standards Are Holding Steady

One of the most important signals from Fannie Mae and Freddie Mac is what isn’t happening: lending standards are not tightening aggressively.

That suggests:

- No systemic housing risk

- No pullback from qualified borrowers

- Continued confidence in the housing market

For buyers, this is a strong indicator that the market is on solid footing — not headed toward instability.

What This Means for Las Vegas Buyers and Homeowners

In growth markets like Las Vegas, these signals matter even more. Continued in-migration, limited inventory, and strong employment trends are aligning with the broader national outlook.

For buyers:

- Waiting for dramatic rate drops may backfire if competition increases

- Buying now with flexibility to refinance later can be a smart strategy

For homeowners:

- Reviewing refinance and equity options sooner rather than later may unlock meaningful savings

- Strategic planning matters more than timing the absolute bottom

The Bigger Picture

Fannie Mae and Freddie Mac aren’t signaling fear. They’re signaling stability, moderation, and opportunity for prepared buyers.

Mortgage rates may not fall overnight, but the environment is becoming more predictable — and predictability creates opportunity for those who plan ahead instead of reacting late.

Final Thoughts

If you’re waiting for a clear sign from the market, this is it: the foundation is stabilizing, demand remains strong, and the smartest moves are happening quietly — before the next wave of buyers re-enters the market.

If you want to understand how today’s signals apply to your situation, connect with The Derek Parent Team at https://derekparentteam.com. We’ll walk you through real numbers, real options, and real strategies — not just headlines.

High-Rise vs. Single-Family Financing: What Buyers Need to Know

When buyers compare high-rise or condo financing to single-family home financing, many assume the loan terms are drastically different. In reality, the financing structure is very similar—but the process is not.

Understanding these differences upfront can save time, reduce stress, and prevent surprises once you’re under contract.

Down Payment Requirements: Very Similar

From a lending standpoint, high-rise and single-family properties generally follow the same down payment guidelines:

-

Primary Residence: 5% down

-

Second Home: 10% down

-

Investment Property: 20% down

These thresholds apply whether you are purchasing a single-family home or a condo in a high-rise building such as Veer Towers or ONE Las Vegas.

The Real Difference: Documentation and Project Approval

Where high-rise and condo purchases differ significantly is in documentation and upfront due diligence.

Condos and high-rise buildings require:

-

HOA certification

-

Condo project approval

-

Budget and reserve analysis

-

Owner-occupancy and rental ratio review

-

Insurance and litigation review (if applicable)

This process ensures the building meets lending guidelines before a loan can be finalized. Single-family homes do not require this level of project review, which is why they often move through underwriting faster.

Why This Matters Before You Write an Offer

High-rise financing is not more difficult—but it does require experience. Missing documentation or an unapproved condo project can delay closing or, in some cases, stop financing altogether.

When handled properly and early in the process, buyers still benefit from:

-

Competitive rates

-

Low down payment options

-

Standard loan programs

-

Smooth closings

The key is working with a lender who understands the condo approval process and can address these requirements before they become an issue.

Bottom Line

High-rise and single-family financing offer similar loan options, but high-rise purchases demand more upfront preparation. The earlier this work is done, the smoother the transaction will be.

If you’re considering a condo or weighing it against a single-family home, having the right guidance early can make all the difference. Let’s have that conversation before you write your offer.

2026 Economic Outlook: What History and Policy Suggest May Be Ahead

As we look ahead to 2026, a research partner recently published a report that does an excellent job framing what we may experience next—especially when viewed through the lens of historical presidential cycles.

While every economic cycle has unique variables, history provides useful context for planning. When paired with current fiscal and monetary policy, it helps explain both recent market performance and what may lie ahead.

The Policy Backdrop Heading Into 2026

When Congress passed the One Big Beautiful Bill, income taxes were not reduced to offset the economic impact of tariffs. As a result, a meaningful amount of stimulus is expected to

flow into the economy in early 2026, including:

- Approximately $150 billion in tax refunds

- Roughly $200 billion in business tax cuts

- Federal Reserve interest rate reductions

- Federal Reserve balance sheet expansion

In addition, the Federal Reserve is proposing to loosen certain bank capital regulations. If implemented, this could unlock an estimated $150–$200 billion of bank capital, much of which could flow into mortgages and the bond market, placing downward pressure on interest rates.

Taken together, these factors point to a highly stimulative economic environment as we move further into 2026.

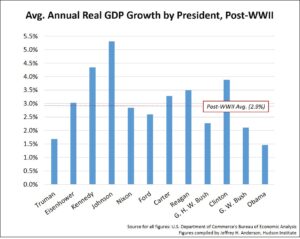

Real GDP Growth and the Presidential Cycle

Historically, real GDP growth has tended to peak during the second year of a presidential cycle. This reflects the delayed effect of fiscal and monetary policy as stimulus works its way into the real economy.

Economic activity often strengthens after policy measures are put in place, even if financial markets have already reacted well in advance.

Financial markets typically anticipate economic activity several calendar quarters ahead. This is why strong market performance often occurs before the real economy shows its full response.

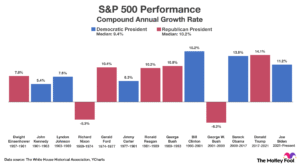

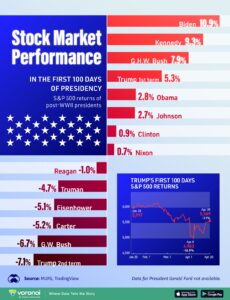

As the chart above illustrates, the S&P 500 has historically produced

strong returns early in a presidential cycle, followed by more muted or slower performance in Year 2, particularly as investors begin to focus on upcoming midterm elections.

This helps explain why recent market performance is no surprise, and why expectations remain for momentum to continue into early 2026. However, once stimulus is firmly embedded and the real economy is clearly responding, markets often pause or consolidate rather than continue moving straight up.

What This Means for Planning

Importantly, this pattern does not signal economic weakness. In many cases, it reflects the opposite:

- A strengthening real economy

- Improving liquidity conditions

- Financial markets that have already priced in much of the good news

For homeowners, buyers, and investors, these environments often create strategic opportunities, particularly around interest rates, refinancing windows, and long-term real estate planning.

Final Thoughts

While no forecast is perfect, understanding how policy, markets, and economic cycles interact can help with smarter decision-making. As we head into 2026, the combination of stimulus, regulatory changes, and historical precedent suggests an environment that rewards planning, patience, and proactive strategy.

If you’d like to discuss how this outlook may impact your personal situation, real estate decisions, or client planning for 2026, I’m always happy to connect.

Wishing you continued success and good health in the year ahead.

Is Now the Right Time to Refinance? A Data-Driven Look at Today’s Market

With interest rates shifting, home values rising, and consumer debt at all-time highs, many homeowners are asking the same question:

“Is now the right time to refinance?”

While the answer depends on your personal financial situation, the current market offers several compelling reasons to take a closer look. Here’s a data-backed breakdown of when refinancing makes sense—and when it might not.

1. Mortgage Rates Are Off Their Highs

After hitting multi-year highs, mortgage rates have begun to stabilize. While they haven’t returned to historic lows, they’ve dropped enough to create meaningful savings for many homeowners.

What the data shows:

- Rates have eased from their peak levels in recent years

- Experts project continued gradual improvement through 2025

- Even a 0.50% to 1.00% improvement can create thousands in long-term savings

If your current mortgage rate is above the market by even half a point, a refinance may help reduce your payment.

2. Home Values in Las Vegas Continue to Rise

Las Vegas remains one of the most stable and desirable real estate markets in the country. Rising home values mean more tappable equity—equity you can use to:

- Consolidate high-interest credit card debt

- Pay for home improvements

- Invest in another property

- Lower your overall financial stress

Many homeowners don’t realize how much equity they’ve gained since 2020. A quick valuation review can reveal whether a refinance or cash-out refinance is a smart move.

3. Debt Levels Are Higher Than Ever

The average credit card interest rate now exceeds 20–30%, and personal loan rates continue to climb. Millions of homeowners are carrying high-interest balances while paying much lower interest on their mortgage.

A cash-out refinance allows you to roll high-interest revolving debt into one low-rate payment—improving cash flow and helping pay off debt faster.

Data point to consider:

Replacing $20,000 in credit card debt at 25% interest with a refinance at 6–7% interest can save thousands per year.

4. Refinancing to Shorter Terms Can Save Big

Many homeowners don’t consider a refinance unless the payment goes down—but refinancing into a shorter term can dramatically reduce interest paid over the life of the loan.

For example:

- A 30-year loan refinanced into a 20- or 15-year loan

- A slightly higher payment but tens of thousands saved in interest

This is a powerful strategy for homeowners planning early retirement or building wealth aggressively.

5. When Refinancing Might NOT Make Sense

A refinance isn’t right for everyone. You may want to hold off if:

- You plan to sell your home within the next 1–2 years

- Your current interest rate is already competitive

- You lack enough equity to qualify for the loan you want

- Closing costs outweigh long-term savings

Your lender should analyze your breakeven point—how long it takes for your monthly savings to outweigh upfront costs.

6. How Long You Plan to Stay Matters

If you plan to keep your home long-term, even modest rate improvement can create significant savings. But if you’re moving soon, short-term benefits may not justify the closing costs.

A quick consultation can determine whether refinancing offers meaningful value based on your goals.

7. Refinancing Is Easier Than Most People Think

Many homeowners worry refinancing will be stressful or time-consuming, but today’s digital process makes it more streamlined than ever.

Most refinances require:

- Income verification

- Home valuation

- Bank statements

- Standard loan disclosures

With a good lending team, the process is often completed in 20–30 days or less.

Final Thoughts

There is no one-size-fits-all answer to refinancing—but today’s market offers strong opportunities for many homeowners. With rates easing, equity rising, and consumer debt increasing, now may be the perfect time to evaluate your numbers.

A data-driven refinance strategy can help you:

- Lower your payment

- Eliminate high-interest debt

- Strengthen your financial profile

- Build long-term wealth

If you want to explore whether refinancing makes sense based on your current rate, equity, and goals, connect with The Derek Parent Team. We’ll run a custom analysis and show you exactly what you could save in today’s market.

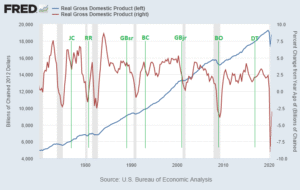

Real GDP Growth Trends: What Economic Cycles Tell Us About the Outlook

Understanding real GDP growth trends is one of the most reliable ways to evaluate the underlying strength of the economy. While short-term data often fluctuates, GDP provides a broader, more stable view of how economic activity evolves over time.

For homeowners, buyers, and investors, GDP trends matter because they directly influence employment, income growth, housing demand, and long-term real estate performance.

How Real GDP Growth Typically Evolves

Historically, real GDP growth tends to strengthen and peak during the middle phase of an economic cycle. This occurs as expansion gains traction through:

- Increased consumer spending

- Higher business investment

- Expanding employment and wage growth

GDP is considered a lagging but confirming indicator. Strong GDP readings often appear after economic momentum is already underway, which is why housing activity and buyer confidence often improve before GDP peaks.

Why GDP Growth Matters for Housing and Real Estate

Strong GDP growth is closely tied to real estate fundamentals. As economic activity expands:

- Job creation supports household formation

- Income growth improves affordability

- Demand for both owner-occupied and investment properties increases

Historically, periods of sustained GDP growth align with healthy housing demand, even if price growth moderates.

This is especially important for buyers evaluating timing, and for homeowners considering long-term equity planning.

How GDP Growth and Financial Markets Differ

Financial markets are forward-looking, often pricing in expectations well before GDP data reflects them. As a result, market performance and GDP growth do not always peak at the same time.

This distinction matters in real estate because housing activity tends to follow real economic conditions, not short-term market sentiment. GDP growth provides confirmation that demand is supported by income and employment—not speculation alone.

GDP Growth and Mortgage Planning

GDP trends also influence mortgage strategy indirectly. Strong economic growth environments often coincide with:

- Increased loan demand

- Greater borrower confidence

- Strategic opportunities for refinancing or purchase planning

Understanding where the economy sits in the growth cycle can help borrowers make more informed mortgage decisions, particularly for long-term financing strategies.

Planning Takeaways for Buyers and Homeowners

For buyers, homeowners, and long-term investors, GDP growth trends help frame expectations around:

- Housing demand sustainability

- Income and employment stability

- Long-term property value support

Strong GDP growth environments tend to reward disciplined planning and thoughtful timing, rather than reactive decision-making.

Final Thoughts on GDP and Economic Cycles

While no single indicator tells the full story, real GDP growth remains one of the most dependable measures of economic health. Historical trends show that GDP often strengthens as economic cycles mature, even when markets appear uneven.

For those making housing or mortgage decisions, understanding GDP trends provides valuable context—helping align real estate strategy with the broader economic environment.

If you’d like to discuss how current GDP trends may relate to housing, real estate, or mortgage planning, I’m always happy to connect.

Why 2026 Is Quietly Becoming One of the Best Years to Buy in Las Vegas

While headlines tend to focus on rising home prices and fluctuating mortgage rates, something major is happening beneath the surface in the Las Vegas real estate market—something that could make 2026 one of the best years to buy a home in the last decade.

It’s not hype. It’s not speculation. It’s data, demand, inventory, and timing all shifting at once. And smart buyers who prepare early will be the ones who benefit.

Here’s what’s making 2026 a surprisingly strong buying opportunity.

1. Mortgage Rates Are Expected to Improve

No one expects a return to 2–3% mortgage rates, but nearly every major housing forecast agrees:

Rates should gradually ease into the mid-5% to low-6% range by late 2026.

Even a 0.5% to 1% decrease can dramatically improve:

- Monthly payment affordability

- Loan qualification amounts

- Buyer confidence

- Refinance potential

When rates improve even slightly, the buyer pool grows—meaning those who act early get ahead of the rush.

2. Inventory Will Increase — But Not Enough to Hurt Prices

Builders across Summerlin, Henderson, North Las Vegas, and Skye Canyon are expanding aggressively right now. New phases, new lots, and new communities are already underway.

But here’s the real story:

Inventory is improving just enough to create opportunity — but not enough to create a buyer’s market.

Most existing homeowners will not sell until rates drop significantly, which means new construction is carrying the load heading into 2026.

More options + less chaos = better buying conditions.

3. Price Growth Will Be Steady, Not Explosive

The rapid appreciation of 2021–2022 is behind us. In 2026, experts are predicting 3–6% steady annual growth—a much healthier and more predictable market.

This moderation creates two advantages:

- Homes won’t jump out of budget as quickly.

- Buyers will build equity consistently without taking on inflated pricing.

For long-term wealth building, slow and steady often beats fast and volatile.

4. Economic Momentum Is Accelerating

Las Vegas isn’t just reinventing itself—it’s expanding structurally.

Key drivers boosting the 2026 market include:

- Job growth in tech, logistics, medical, professional services, and hospitality

- Massive investment around the Strip and surrounding areas

- The incoming A’s baseball stadium

- Continued expansion of the Las Vegas Grand Prix

- Growth of the UNLV medical corridor

- Major expansions in distribution facilities across North Las Vegas

A strong economy increases incomes, migration, and demand… all while stabilizing home values.

5. Out-of-State Migration Is Not Slowing Down

People continue moving to Las Vegas for:

- Lower taxes

- Lower housing costs compared to coastal cities

- Better quality of life

- Climate and lifestyle

- Expanding job markets

California, Oregon, Arizona, and Washington remain the biggest feeder states—and this migration fuels demand and strengthens long-term property values.

More demand = more stability.

More stability = better long-term equity for early buyers.

6. High-Rise & Condo Markets Are Strengthening

After years of volatility, the high-rise market is experiencing a real resurgence. By 2026:

- More towers will resolve litigation

- Financing will expand

- Jumbo loan pricing will stay competitive

- Inventory will remain tight for premium units

This is especially important for investors and luxury buyers looking for Strip views or mid-term rental opportunities.

7. Buyer Competition Will Increase in Late 2026

Here’s the part most buyers don’t realize:

Once rates noticeably drop, competition will spike.

More buyers =

- Bidding wars

- Faster sales

- Less negotiation room

- Fewer seller credits and incentives

This is why preparing early is key. Those ready by early 2026 will have significantly more leverage than buyers who wait until late 2026 or 2027.

Final Thoughts

Las Vegas is entering a rare window of opportunity for buyers: rising inventory, improving rates, stable pricing, and strong long-term economic fundamentals. The market of 2026 won’t be a buyer’s market… but it will be one of the most balanced, strategic, and opportunity-filled years Las Vegas has seen in a long time.

If you want to get ahead of the next market wave, connect with The Derek Parent Team. We’ll help you evaluate payments, compare loan options, and position yourself to buy smart—before the competition returns.

The Ultimate Guide to Financing a High-Rise Condo in Las Vegas

Financing a high-rise condo isn’t the same as financing a traditional single-family home. In Las Vegas—where the high-rise market includes iconic towers like Veer Towers, The Martin, Turnberry, Panorama, and Sky—buyers often run into unique lending requirements that many lenders simply don’t understand.

Whether you're buying a primary residence, second home, or investment unit, this guide breaks down everything you need to know to successfully finance a high-rise condo in Las Vegas.

1. Understanding High-Rise Condo Financing (and Why It’s Different)

High-rise loans come with additional layers of review because lenders must evaluate both your financials and the building’s financial health.

This includes:

- HOA financials

- Budget and reserves

- Litigation

- Insurance coverage

- Owner-occupancy ratios

- Single-entity ownership percentages

One issue in the building can limit financing options—even if you are fully qualified.

That’s why buyers should work with a lender who knows the high-rise landscape inside and out.

2. Warrantable vs. Non-Warrantable Condos

The biggest factor in high-rise financing is determining whether the building is warrantable or non-warrantable.

Warrantable Condos

These meet Fannie Mae/Freddie Mac guidelines, meaning you can use:

- Conventional loans

- Lower down payments

- Competitive interest rates

Most major towers are warrantable, but this can change if the HOA is dealing with litigation or low reserves.

Non-Warrantable Condos

These do not meet agency guidelines and require:

- Portfolio loans

- Higher down payments (usually 20–30%)

- Slightly higher rates

- More documentation

Some of Vegas’ most popular luxury towers periodically fall into this category depending on the building’s condition or legal status.

3. Down Payment Requirements for High-Rise Condos

Your down payment depends on whether the building is warrantable and what type of loan you’re using.

Typical requirements:

- Primary residence (warrantable): 5–10% down

- Second home: 10% down

- Investment property: 20–25% down

- Non-warrantable building: 20–30% down

Jumbo high-rise units may require additional reserves or stricter qualification guidelines.

4. Understanding HOA Requirements and Fees

High-rise HOA fees are typically higher than traditional condos because they cover:

- Concierge services

- Valet

- Security

- Amenities (gym, pool, spa, lounge)

- Maintenance

- Utilities in some buildings (water, internet, trash, etc.)

Lenders must verify HOA stability. Low reserves or pending assessments can directly impact loan approval.

Pro tip: Before making an offer, ask your lender whether the building is already approved. The Derek Parent Team keeps an updated high-rise building approval list.

5. Jumbo Loans for Luxury High-Rise Units

Many Strip-facing high-rise units exceed conforming loan limits, requiring a jumbo loan.

Jumbo loans typically require:

- 700+ credit scores

- Strong income documentation

- 6–12 months of reserves

- 10–20% down minimum

The good news? Jumbo rates have become more competitive and often closely match conventional pricing.

6. Investment Property Financing

Las Vegas high-rises are popular for:

- Corporate rentals

- Traveling nurse housing

- Longer-term furnished rentals

- Second homes

While most high-rises restrict nightly rentals, many allow 30-day minimum leases, making them attractive for mid-term investors.

To finance an investment high-rise, expect:

- 20–25% down

- Higher debt-to-income scrutiny

- DSCR loan options for certain buildings

Your lender must confirm rental restrictions upfront.

7. Common Issues That Can Delay High-Rise Approval

High-rise loans require extra due diligence, so delays can happen—especially with inexperienced lenders.

Common issues include:

- HOA insurance policy gaps

- Pending litigation

- Low building reserves

- Too many investors in the building

- One owner holding too many units

- Incomplete condo questionnaires

Working with a lender familiar with each building significantly reduces delays.

8. Why You Need a High-Rise Specialist

High-rise lending is a niche inside the mortgage industry. Most big-box lenders and online mortgage companies struggle with:

- Warrantability reviews

- HOA document analysis

- Non-warrantable programs

- Jumbo portfolio approvals

- Building-specific nuances

As the original in-house lender for Veer Towers, Derek Parent is one of the most experienced high-rise lenders in the city, with decades of experience financing units across the Strip and beyond.

When you work with a specialist, you get:

- Faster approvals

- Access to warrantable + non-warrantable programs

- Accurate building information

- No last-minute surprises

- Smoother closings

Final Thoughts

Financing a high-rise condo in Las Vegas is incredibly doable—but only when you work with the right team and know what to expect. From warrantability to HOA reviews to jumbo financing, the process requires local expertise and a lender who understands each tower’s unique requirements.

If you’re considering buying a Las Vegas high-rise, connect with The Derek Parent Team. We’ll help you navigate financing options, compare buildings, and secure the right loan for your goals.

7 Mortgage Mistakes That Delay Closings — And How to Avoid All of Them

Nothing derails a home purchase faster than a preventable mortgage mistake. In a market like Las Vegas—where timing, inventory, and competition matter—one small misstep can delay your closing, cost you money, or even lose the home entirely.

Whether you’re a first-time buyer or a seasoned homeowner, understanding the common pitfalls can help your loan move quickly and smoothly. Here are seven mortgage mistakes that slow down closings—and exactly how to avoid every one of them.

1. Not Getting Fully Pre-Approved

A pre-qualification is not enough. Sellers and agents want a full, underwritten pre-approval, not just a quick online estimate.

Why it delays closings:

- Missing documents

- Unverified income

- Incorrect debt or credit calculations

How to avoid it:

Start with a full pre-approval through a reputable lender like The Derek Parent Team, where your income, assets, and credit are verified upfront. This eliminates surprises once you’re under contract.

2. Making Big Purchases Before Closing

Furniture. Appliances. A new car. Even large holiday shopping can change your credit profile.

Why it delays closings:

- Higher debt-to-income ratio

- Lower credit score

- New inquiries flagged by underwriting

How to avoid it:

Avoid all major purchases until after you close—no new credit cards, no financing, no large charges.

3. Moving Money Between Accounts

Transferring funds between bank accounts looks suspicious to underwriters unless it’s fully documented.

Why it delays closings:

- Additional documentation needed

- Unexplained deposits

- Source-of-funds verification issues

How to avoid it:

Keep your money where it is. If you must transfer funds, speak with your lender first so you know exactly what documentation will be required.

4. Not Providing Documents Quickly

Underwriting works on a timeline. Delayed paperwork can push your closing date back.

Common documents that slow buyers down:

- Bank statements

- Pay stubs

- Tax returns

- Divorce decrees

- Gift letters

- Business P&L statements (for self-employed buyers)

How to avoid it:

Have all financial documents ready in a labeled folder before you even go under contract. Quick responses = faster closings.

5. Switching Jobs During the Loan Process

Even a job change with higher income can stall your mortgage.

Why it delays closings:

- New income can’t be verified

- Different job structure (salary to hourly, or W-2 to self-employed)

- Additional employment history required

How to avoid it:

If possible, wait until after closing to change jobs. If the switch is unavoidable, tell your lender immediately so documentation can be prepared early.

6. Not Being Honest About Finances

Even small omissions—side income, child support, past credit issues—will surface when underwriting runs verification.

Why it delays closings:

- Underwriters must re-calculate your loan

- Extra documentation required

- Conditions pile up instead of clearing

How to avoid it:

Be transparent from the beginning. A good lender can structure your loan properly—but only if they know everything up front.

7. Ignoring Lender Conditions

Many buyers assume that once they’re “approved,” the loan is done. But underwriters typically issue conditions that must be cleared for final approval.

Examples include:

- Verifying employment

- Providing updated bank statements

- Sourcing deposits

- Explaining credit inquiries

How to avoid it:

Respond to conditions within 24 hours. The faster you address them, the sooner you get your clear-to-close.

Bonus Tip: Work With a Lender Who Knows Las Vegas

High-rise condos, new construction, investor properties, VA loans—Las Vegas has unique lending challenges that national lenders often struggle with.

Working with an experienced local mortgage team ensures:

- Faster approvals

- Smoother underwriting

- Proper documentation from day one

- Clear communication between all parties

- Fewer last-minute surprises

At The Derek Parent Team, we specialize in navigating Las Vegas lending requirements so your closing stays on track.

Final Thoughts

Most closing delays are completely avoidable with the right preparation and the right lending partner. By staying organized, avoiding major financial changes, and communicating proactively, you can move from offer to keys with confidence.

If you want a stress-free mortgage experience—or want to review your pre-approval before shopping—connect with The Derek Parent Team. We’ll guide you step-by-step and help you avoid every mistake that slows down the closing process.