Why The Holidays are a Great Time to Refinance Your Mortgage

If you're a homeowner in Las Vegas and you want to lower your mortgage payment and/or consolidate your debt, then refinancing might be the right option for you!

So how does it Work?

Well, its not always that simple. There are many factors that determine if refinancing is right for you, such as interest rates and your current equity in your home. It also depends on what your current needs are. Do you want to lower your monthly payments and interest rate? Or do you want to cash out to consolidate your debt in time for the holiday season? There are different types of refinancing options to choose from.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The other option is a cash-out refinance - This is where you refinance your mortgage for more than you currently owe, then pocket the difference. Sounds great, right? Well, there are many factors that go into the process of cash-out refinancing. For example, you will need to apply and submit various documents, get an appraisal on your home, and have a good standing with your current mortgage for the past 12 months. However, if you qualify, cashing out is a great way to consolidate your debt and put more money in your pocket during the holiday season! Please note that when you do a cash out refinance, you are not eliminating your debt. You are consolidating it through your mortgage and will pay it off through your monthly loan payment.

The good news is that the Las Vegas real estate market is booming! Interest rates are competitive, and home values are increasing. That means that the majority of home owners have equity in their homes. You could take advantage of the our refinance options and lower your monthly payments, in addition to "cashing out" the difference.

If you are a homeowner in Las Vegas and you would like to take advantage of our refinance opportunities this holiday season, give us a call at 702-331-8185!

Why it is Good to Buy Now in Las Vegas

Are you wondering if now is the right time to buy in Las Vegas? Still on the fence or a bit unsure? Want

some more information before diving in? Here is some information to know before moving forward.

If you want to get in on the fun, now is a better time than ever. With today's shift towards a buyer's

market, buyers have more options to choose from and negotiate leverage. Because of this, you can find

your dream home without paying over market value, even less! Compared to previous situations of

bidding wars and over-asking, the moment is now to get in. Not to mention the constant increases in

value, you can find yourself making a substantial profit in the coming years.

Unlike renting, mortgage inflation doesn't go up, rent goes up, and the rent gets competitive. So, with less

competition than ever, you have a prime opportunity in your hands. The only question left is, to buy or

not to buy?

Derek Parent Q&A: High Rise Life

- Can you tell us a little bit about your background and how you got involved in the mortgage industry? I stepped into the mortgage industry in 1999 after running into an old friend at a boat show in Rhode Island. It had been a little while since I had seen him last, and there was just something about him that seemed different. We got to talking, and I found out that he was doing quite well for himself as a loan officer in the mortgage industry. I was so inspired, that every day for the following four weeks, I called into his office asking for an interview. I got the job, and just about a year later, I won a trip to Las Vegas based on my efforts. I was stunned. I went back home, grabbed my stuff, bought a one-way ticket back to Vegas and never looked back.

- What do you think has contributed to your success as an expert high-rise lender? Honestly, one of the reasons I became so intrigued with the high rise market was because of my own experience. When I purchased a condo for myself on the Las Vegas strip, I realized just how difficult it was to finance the high rise units. It was a nightmare, so when I closed, I made it my mission to solve the problem. It should not have been that difficult, and I wanted to make sure that I used every resource at my disposal to ensure that no one else had to go through the same thing.

- What do you love most about what you do? The one thing--beyond anything else--that has motivated me to be great at what I do is the satisfaction I get from helping my clients purchase their homes. Yes, there are other rewards in this business, but there is nothing that affects the way I sleep like knowing that I have a small hand in such a large part of my clients’ lives.

- What are some of the core values that the Parent Team carries? No business is sustainable without a strong foundation, and our core values are insanely important to the way we run our business and the way we treat our people. Specifically, we the core values that we live by: honesty, integrity, communication, client-focus and consistency. These qualities are what keep us motivated and grounded as we deal with our success and our frustrations, and they are the reason we have been able to maintain our quality of business over the years.

- You have a growing list of over 125 condo projects available for financing. Can you elaborate on this? The reason that growing list is so important is because our definition of ‘approval’ is so much deeper than most other sources. We do our due diligence in advance rather than during the transaction, which negates a lot of frustration and fall out with the client. One measure that we really look at is having a completed questionnaire and analysis of the condo project before we list it as ‘approved’. In the lending world, the condo questionnaire is a vital piece to knowing whether or not a condo can be financed, and because we do it in advance, the client is able to have full confidence in their purchase.

- What are some of the great promotional offers you currently have for those looking to purchase a high-rise condominium? The most important thing we have right now is that the buyer does not have to pay for their condo questionnaire, which is anywhere from about $200 to $500. Generally, it’s a cost that lenders require the buyer to pay for just to obtain information about the project for the lender. If for some reason the questionnaire details information that does not allow the lender to lend on the property, the buyer loses that money. We take that responsibility off of the buyer because we have already obtained the information from the condo project. Another great offer is that we allow buyers to purchase with only 5% down payment for their principal residence, and for second homes, we only require 10% down. We also provide an option for 10% down payment on jumbo loans.

- What are some essential points homebuyers should address when shopping for a loan? In the high-rise market, the number one thing that buyers should be aware of is if the lender requires them to pay for a condo questionnaire. If the lender is not confident enough to pay for it, there is a large possibility that they cannot finance the condo, and again, if that’s the case, the client will not be refunded and absorbs the cost. Other than that, I would say communication from your loan officer is the second most important factor. It not only makes the process easy, but it ensures your ability to get an offer accepted on the home you want because it gives the real estate agents confidence that the transaction will be smooth and close on time.

- Any exciting new developments with the Parent Team that you would like to share with us? For us, it really starts with our people; we bring on team members that not only bring a lot of value but also add amazing energy. Just recently, we brought on a business development specialist who is dedicated to growing our footprint and building new professional relationships, and we are extremely excited to see what it does for our growth. It has the potential to really extend our reach and allow us the opportunity to help more people accomplish the goal of home ownership.

How Does Divorce Affect Mortgage Borrowing

Let’s face it: getting a mortgage can be a royal pain in the ass regardless of whether or not you’re recently divorced. Unfortunately, adding a divorce to the picture makes it even more difficult, although not impossible. Here are some things to consider:

What to plan for: By providing your mortgage company with the most accurate and true picture of your circumstances — starting with the loan application — you’re helping them to find the best way to structure your loan for a favorable credit decision. The lender will also look at your divorce decree for any other undisclosed/non-credit report financial obligations such as child support, alimony/spousal support paid or received.

If you receive income in the form of child support or alimony: This income can be used for qualifying for the mortgage, so long as there is a six-month history and the income will continue for the next three years, determined by child support or an alimony agreement detailing the terms of the obligation for the party paying the debt.

If you pay alimony or child support: This reduce your borrowing ability as debts reduce income, and income is needed to offset a mortgage payment.

If you are divorced even as long as 20 years ago: Unfortunately, there is no statute of limitations on mortgage loan underwriting. The full divorce decree will be required no matter how many years you have been divorced.

If you own a house and are on a mortgage with an ex-spouse: As long as the divorce decree awards the other party with the home, and the other party is willing to provide supporting evidence that they make the mortgage payments on that home — by providing 12 months of bank statements and/or canceled checks — the total mortgage payment on that home can be omitted from the decision-making process on your new mortgage, which can improve your ability to qualify.

If you and your ex make the mortgage payment from the same joint bank account and the divorce decree awarded the other party with the property: You are both 50-50 responsible because the money is “co-mingled” funds from the same place to pay the obligation. There is no way to support your position that one person is responsible for making the payment because it’s coming from a joint account.

If the ex-spouse is responsible for making the mortgage that you are also on: Explore the possibility of having the ex-spouse refinance you off the mortgage obligation.

If your ex-spouse is refinancing you off a mortgage loan: A final closing statement called an HUD could be required by the lender you’re working with for procuring your loan to omit the payment from the other house.

If you have a joint consumer credit such as credit cards, installment loans, auto loans or even student loans: Unless you can prove the other party is for responsible for the credit obligation (with 12 months of canceled checks or bank statements), those liabilities will be factored into your ability to qualify.

Tips If You’re Not Yet Divorced

It’s so important to create a marital settlement agreement prior to being divorced. This is a precursor to getting a divorce that could be a great asset in helping you qualify for home financing. Navigating the financial questions that inevitably come up during the separation or divorce can easily be taken care of by having a clear delineation in writing on whose property is whose.

Consumers planning a divorce in the future would also benefit by separating their finances. This means having separate bank accounts, and paying any obligations from these separate accounts. If you are trying to get a mortgage, or will be trying to get a mortgage, consider having a conversation with mortgage professional upfront, who can guide you through the complexities in the underwriting process during a divorce.

Tips For First Time Home Buyers

There’s probably hundreds of articles on the internet that are full of useful tips for first-time home buyers. Since our team has been exposed to thousands of loan transactions, we want to give you our expertise and personal advice. The more prepared you are, the smoother the process will be. We love helping our clients achieve their dreams of homeownership!

Check Your Credit Not only does your credit score matter, but your credit history is just as important. It’s not impossible to purchase a home with less-than-perfect credit, but it will be more expensive. In most cases, the lower your credit score is, the higher your mortgage interest rate will be. You also want to be mindful of your debt-to-income ratio, which is your total monthly debts divided by your gross monthly income. If you have substantial credit card debt, your debt-to-income ratio will likely be too high to qualify for a mortgage. Try to keep your debt-to-income ratio equal to or less than 43%.

Apply Now Before House Hunting Many hopeful buyers skip out on this crucial step and find themselves disappointed that they can’t qualify for a home that they fell in love with. Not to mention, you may qualify for more house than you think. You may be shopping for a house in the mid $200Ks range, when you can qualify for a home in the upper $300Ks.

Save Your Money! This seems like an obvious tip, but becoming a homeowner can get expensive. Don’t be discouraged! Just be sure to budget yourself and set enough money aside for your down payment, closing costs, and of course, furnishing your new home. Down payment options start as low as 3.5%, so you no longer have to make a 20% down payment to buy a house.

Corporate Benefits: Helping Employees Manage Their Financial Challenges

Reduce turnover and Boost Culture

The cost of employee turnover is exorbitant, and with statistics looming around every corner, taking a look at what employees are saying is no longer just a suggestion; it’s imperative to creating a culture that clearly represents its company.

HOW TO AVOID TURNOVER BY UNDERSTANDING THE JOURNEY

The decision to join a new organization is often accompanied by leaving another, and new hires are placing bets that their new role will be better than the last, fulfilling a need the previous employer was not. People ask for opinions from friends and family, search online for ratings and reviews and do what they can to find out if a company can help in achieving their personal goals. It is a decision that starts with rational considerations but is ultimately decided based on emotions and the connection that they feel with their new employer, and from the point they make the decision, all interactions build their perception about what it means to be an integral part of the organization. This is why on-boarding needs to be a refined process, offering employees the opportunity to truly feel at home. From a company’s perspective, it is a perfect opportunity to deliver on its value proposition and any other promises made during the hiring process—not only to meet expectations, but to exceed them. Our Corporate Benefits Program is designed to help Organization Name do that without having to subtract anything from its bottom line. There are not many things in life that have more of a correlation than work and home. Being able to play a role in helping employees—brand new or seasoned—establish themselves in their local communities is a crucial factor in earning their trust and giving them confidence in their employer.

“The benefits and perks that employees truly care about are those that offer them greater flexibility, autonomy and the ability to lead a better life… In general, employees are most likely to say they would change jobs for benefits and perks closely related to their quality of life. They are quite interested in jobs that offer them a way to balance work and home better, gain a deeper sense of autonomy and secure their financial future. (Gallup)”

In today’s uncertain economic climate, more businesses are seeking to create workplace environments that offer employees improved value and benefits.

That includes helping to manage personal finances and to prepare for retirement. In fact, two-thirds of North American employers now offer their workers financial education, according to a new report from the Wisconsin-based International Foundation of Employee Benefit Plans. Not only does this addition to employee benefits programs lead to happier and healthier workers, but it also can boost productivity as well as a company’s bottom line.

According to the recent survey Finding the Links Between Retirement, Stress and Health, financial stress can lead to decreased productivity

One-in-five workers reported feeling extremely stressed, mostly because of their job or finances. Those reporting high levels of stress were more than four times as likely to suffer from symptoms of fatigue, headaches, depression or other ailments. They also were twice as likely to report poor health overall, leading to more sick days, increased absenteeism and decreased productivity. Four-out-of-five employers reported that their employees’ personal financial issues were impacting their job performance somewhat, very much or to an extreme degree. This resulted in an increase in stress among employees (reported by 76 percent of employers); workers’ inability to focus at work (60 percent); and absenteeism and tardiness (34 percent). More than a quarter of employers also reported that a significant portion of their workers were challenged by both supporting their children (sometimes grown) and aiding elderly parents.

More companies are realizing that offering health-care and retirement plans is no longer enough and are beginning to look for ways to also help their employees with personal monetary challenges such as housing, home ownership and financial planning.

To help with this process, USA Mortgage is proud to offer its Corporate Benefits Program, a workplace-sponsored Financial Education & Resource Program for employers and organizations throughout Organization name.

PROVIDE YOUR EMPLOYEES WITH EVEN MORE ADDED VALUE

Including special home financing benefits—through the Corporate Mortgage Benefit Program. The program is quick and easy to set up, and once it’s ready to go, there’s nothing more you need to do. You’ll receive uncomplicated communication to share with your employees. Then, we’ll work directly with them to help them understand their home financing options and provide ongoing support every step of the way.

- Personalized support, education and tools your employees need to confidently plan for and move through the home financing process

- Competitive rates and fees on various home financing products and programs

- Employees interact with us where and how they like— in person, over the phone or on-the-go

BUYING OR REFINANCING A HOME

Through our Corporate Benefits Program, you’ll be able to easily locate financing that meets your needs and supports your homeownership goals. You’ll find competitive rates and fees on an array of loans and programs, with special options also available for those who are planning to build a new home or undergo home improvements. As an experienced home mortgage consultant, I can offer you personal guidance throughout the entire home financing process.

CONVENIENT TOOLS AND RESOURCES

Online educational videos on my website can help you prepare to buy a home and learn about the home financing process.

- Find the ideal mortgage using our home loan shopping tools and calculators.

- Once you’ve applied, check your loans’ progress via a computer, smartphone or tablet with your LoanTracker.

- Manage your mortgage and other PERL accounts online.

REALIZE YOUR HOMEOWNERSHIP GOALS

You might be eligible to make a down payment as low as 3 percent on a fixed-rate loan for a single-family home with your first mortgage. You’ll have a chance to lower your interest rate through homebuyer education. To ensure eligibility, ask me about the loan amount, type of loan and type of property.

Benefits for Everyone

BENEFITS TO COMPANIES:

- Increased employee loyalty

- Reduced absenteeism.

- Improved financial well-being.

- Since buying a home is one of the top three stressful endeavors, less stress = more productive employees!

- Minimal administration required by your company; we do most of the work.

- Exclusive co-branded benefits website accessible to your employees and their families!

- No cost to your company or organization.

BENEFITS TO EMPLOYEES:

- All employees are eligible, and it’s completely voluntary.

- Educational materials are accessible through the co-branded benefits website.

- “Lunch & Learn” seminars are available.

- An exceptional team of real estate and financial experts are hand-picked and pre-screened for the benefit of participating members.

- A one-on-one relationship and a concierge experience working with a Mortgage Advisor and team.

- Professional advice and customized mortgage solutions for each borrower.

- Discounts on real estate commissions, home inspections, closing costs, moving expenses and more!

- Valuable savings when buying, selling and refinancing a home.

- Discounts on products and services in your area.

Homeownership for Future Employees

PROJECTED INCOME MORTGAGES

With a job offer letter mortgage, your future employees may qualify to buy a home with a non-contingent offer letter. A job offer letter must clearly outline employment terms – namely salary and start date. If that info is present and the income isn’t variable or commission-based, PERL may be able to approve and fund a loan with nothing more than the offer letter for income documentation for your future employees.

Subject to terms and conditions and credit qualification; not a commitment to lend, and not all borrowers may qualify.

PROGRAM REQUIREMENTS

- Income must begin within 90 Days of Closing (60 days for VA/FHA/USDA)

- Is non-contingent or provide documentation, such as a letter or e-mails from the future employer verifying all contingencies have been cleared, and

- Includes the terms of employment, including employment start date, position, and annual income based on salary (e.g., hourly earnings are not permitted)

- For a salary increase, documentation must indicate that the increase is fully approved and is explicitly granted to the employee

- Reserves are required covering 6 months principal, interest, taxes, and insurance

Open Doors, Unlock Opportunities: VA Home Loans

Program History

The VA program was created with the signing of the GI Bill by President Franklin D. Roosevelt on June 22, 1944. This law provided veterans with federally guaranteed home loans with no down payment.

This benefit was intended to stimulate jobs in the housing industry, as well as providing assistance for veterans and their families. The maximum loan amount at the time was $2,000, 50% of that guaranteed by the government.

VA Loans — Veteran’s Best Friend

- No down payment required up to county limits: http://www.loanlimits.org/va/

- No monthly Mortgage Insurance – helps to qualify for larger loan

- Seller contributions allowed up to 4% of value…above and beyond payment of standard closing costs

- Fees that can be paid by the veteran are limited

- 100% gift funds allowed

- No minimum reserve requirements (conforming limits)

- Make sense underwriting

- Veteran can use entitlement multiple times

- Fixed rate assumable loan (as approved by VA/servicer)

- Assistance/counseling to veterans in default due to temporary financial difficulty

- Vets qualify for home loan benefits after 2 years of service (less if served prior to 1980), or 90 days active duty during the Persian Gulf era; Reservists and National Guard eligible after 6 years (or 90 days active duty in Gulf)

- Unmarried surviving spouse of a veteran who died while in service or from a service connected disability may use benefits

To Recap...

- No Monthly Mortgage Insurance

- 100% LTV Purchase or Refinance

VA Financing is on the rise, but still under-utilized.

- Only an estimated 5% of U.S. Veterans and qualified military

personnel have used their home loan benefits.

What does this mean to you? Home financing made simple!

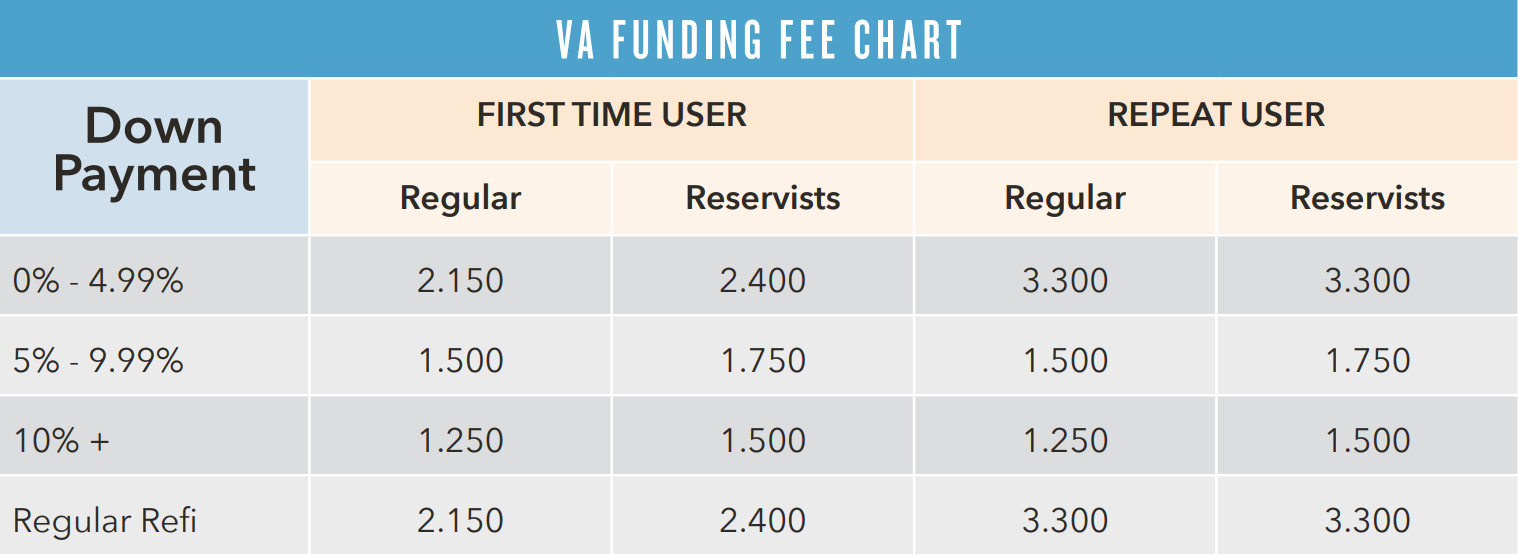

VA Funding Fee

- Although there is no monthly mortgage insurance on a VA loan, the veteran does have a onetime Funding Fee. On loans below county limit, this can be financed into the loan over and above the appraised value/sales price, or can be paid in cash (or a combination of both).

- The Funding Fee may be waived in the following instances (as evidenced on the “Certificate of Eligibility”):

- Veterans receiving VA compensation for service-connected disabilities

- Vets who would be entitled to receive compensation if not receiving military retirement pay

- Loans for surviving spouses of vets who died in service or from service-connected disabilities

- Funding Fee is calculated as a percentage of the loan amount. For example, on a $400,000 loan with a 2.15% VAFF = $8,600. Total loan amount = $408,600

TIP: Ask the Vet to put down 5% to reduce the Funding Fee!

Down Payments & Loan Amounts

Loan Programs: 30, 25 & 20 Yr. Fixed (PERL – conforming); High Bal, 15 Yr. & 5/1

The VA will guarantee 25% of the loan up to the county limit. Because of this, there is no down payment at or below the county limit: http://www.loanlimits.org/va/

Above county limits, the borrower is required to make a minimal down payment in the amount of 25% of the difference between the sales price and county limit (see example below).

Example

$458,850 - VA Loan Limit for Chesapeake County

$550,000 - Sales Price

$550,000 Sales Price - $458,850 County Limit = $91,150 difference

$91,150 difference x 25% required down = $22,787 down payment

$550,000 Sales Price - $22,787 down = $527,213 max VA loan (a 95.8% LTV in this case!)Hint: If the borrower has 5% to put down, the Funding Fee will be reduced to 1.5%!

The Advantage - Selling the Seller

Overcome the seller’s objections about dealing with a VA buyer! With PERL Residential Lending, the seller does not need to pay all the “non-allowable” fees!

- VA allows the non-allowable fees to be paid by the borrower up to 1% if an origination fee is not charged.

- These fees include lender fees (processing, underwriting etc.), escrow fee, termite inspection (depending on state), notary fee, messenger fee and any other non-allowable fee.

- It generally costs the borrower less than the one percent so all parties benefit.

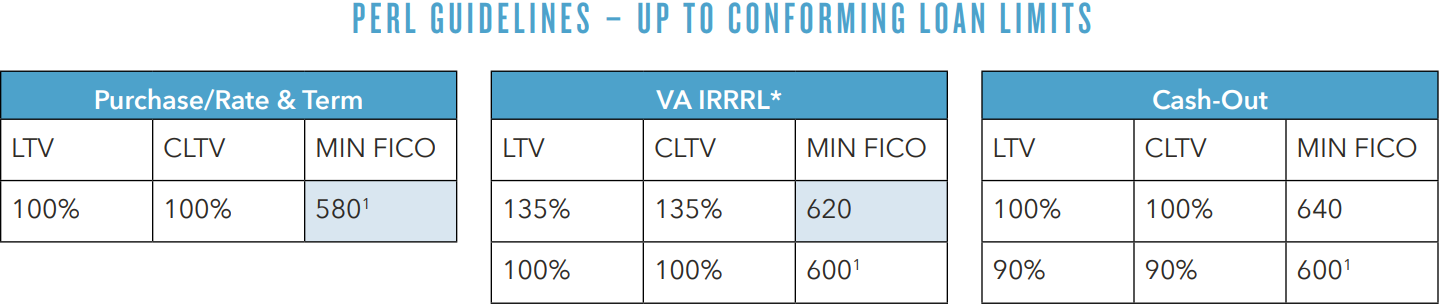

LTV/Credit

NOTE: The LTV/CLTV is exclusive of Financed VA Guaranty Funding Fees (Except for IRRRL)

1Minimum credit score for manufactured housing is 620

Underwriting — IRRRLs

A VA Interest Rate Reduction Refinance Loan (IRRRL) is a refi of an existing VA loan only. Rate and P&I must both be reduced, unless the existing loan is an ARM or the term is decreasing.

The new loan amount may include:

- Unpaid principal balance

- Prepaid expenses

- VA Funding Fee of .50%

- Allowable closing costs

- Max. 2 discount points

Perl IRRRL Guidelines

- Max 135% LTV w/ 620 credit; Max 100% LTV w/ 600 credit (based on total loan amount

- AVM from DataVerify determines LTV; if AVM not adequate, order conventional appraisal

- NEVER order a VA appraisal on a streamline!

- DTI is not calculated – no AUS

- The P&I on the IRRRL must be less than the loan being refinanced (unless going from fixed to ARM or reducing term)

- 0x30x12 on all mortgages

- Max $500 incidental cash back

Underwriting Basics - Credit

Bankruptcy:

- Chapter 7 – generally 2+ years is acceptable; possibly 1-2 years with extenuating circumstances

- Chapter 13 – all payments satisfied OK; possibly OK after 12 months of satisfactory payments with court approval

- VA Jumbos – no BK within past 7 years

Foreclosures:

- Follow same rules as Chapter 7 BK (VA Jumbos – no history of foreclosure within past 7 years)

- Ensure that borrower’s entitlement has been restored (or determine if there’s bonus entitlement)

- Develop complete information on the facts and circumstances of the foreclosure

Other Adverse Credit Items:

- Collections - Aggregate balance of $1,000 or greater must be paid (excluding medical)

- Judgments – Must be paid in full at or prior to closing

Underwriting Basics - Property

Conversion of primary Residence to Rental

- If the veteran is converting a current principal residence to an investment property:

- Evidences of cash reserves totaling 3 months PITI for each rental property must be provided.

- The borrower may qualify using 75% of the gross rental income to offset the mortgage payment.

- Borrower may use entitlement multiple times – Veteran must occupy the property as his/her primary residence

when purchased. - Income from existing rental properties claimed on the borrower’s Schedule E may be used. With 2 years, positive

net rents may be used as income. Less than 2 years, can be used to offset mortgage. - Unlike FHA, the VA has no “flip” rule or restrictions. Sales price appreciation simply must make sense.

Underwriting Basics - Liabilities

Need a boost? VA Underwriting makes sense!

VA Recommended Compensating Factors include (but are not limited to):

- Excellent Credit History

- Conservative use of consumer credit

- Minimal consumer debt

- Long-term employment

- Significant liquid assets

- Sizeable down payment (purchases)

- Significant equity (refi’s)

- Little or no payment shock

- High residual income (more info on next slide)

- Low DTI

- Tax benefits for home ownership

Compensating factors can be used to justify expanded DTI or payment shock, but CANNOT be

used to offset unsatisfactory credit.

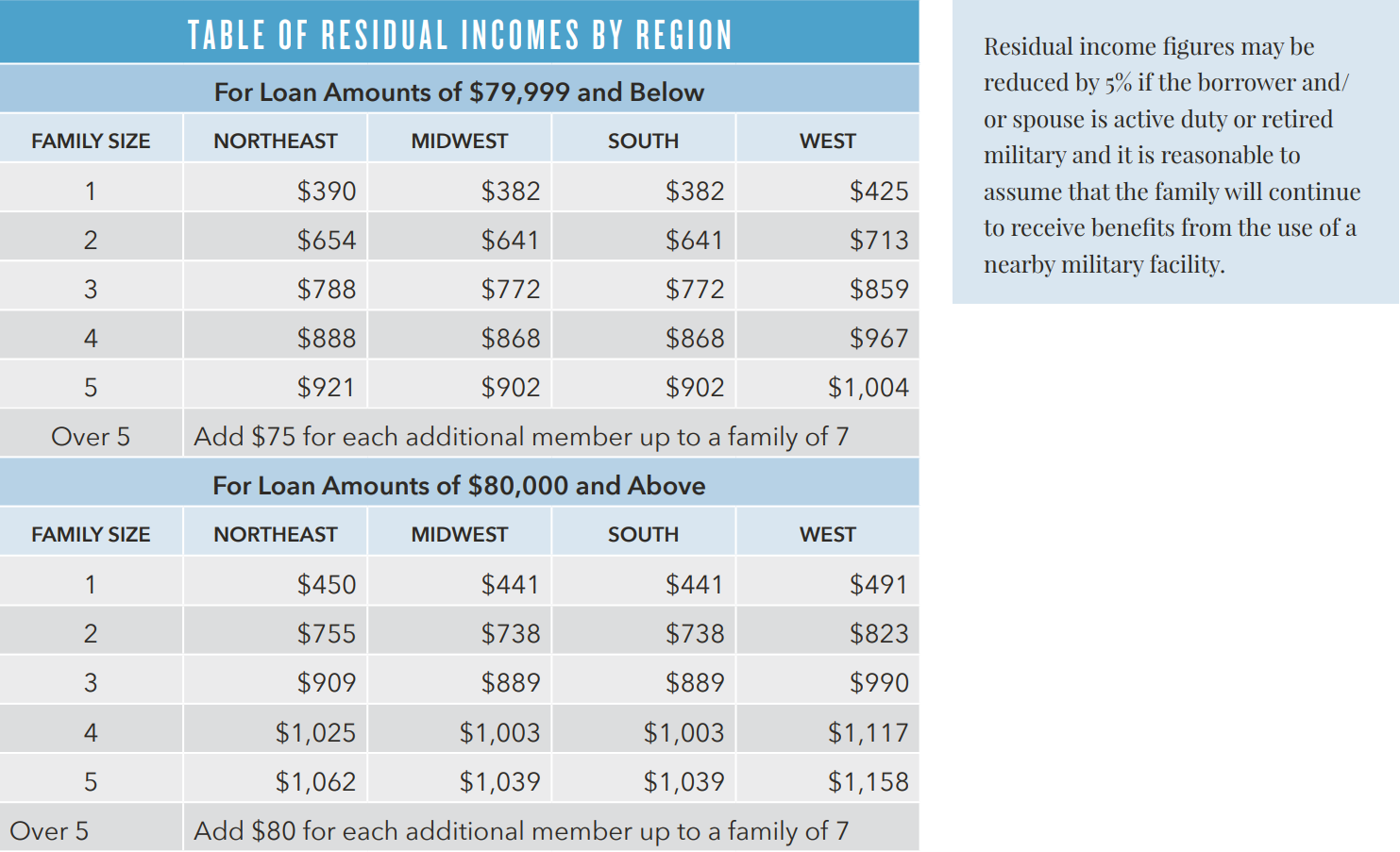

Underwriting — Residual Income

Residual income is the amount of net income remaining to cover family living expenses (food, health care, clothing, etc.). All household members are included in family size, with the exception of: a) a non-borrowing spouse who has a stable, reliable income sufficient to support expenses, or b) a child for whom sufficient foster care or child support payments are received regularly.

Appraisals & Collateral

- Appraisals are ordered through the Veteran’s Information Portal and assigned by the VA.

- The subject property must meet VA Minimum Property Requirements prior to loan funding. This will affect properties being sold “as is.” Repairs noted on the appraisal must inspect the repairs and issue a clear inspection report prior to funding.

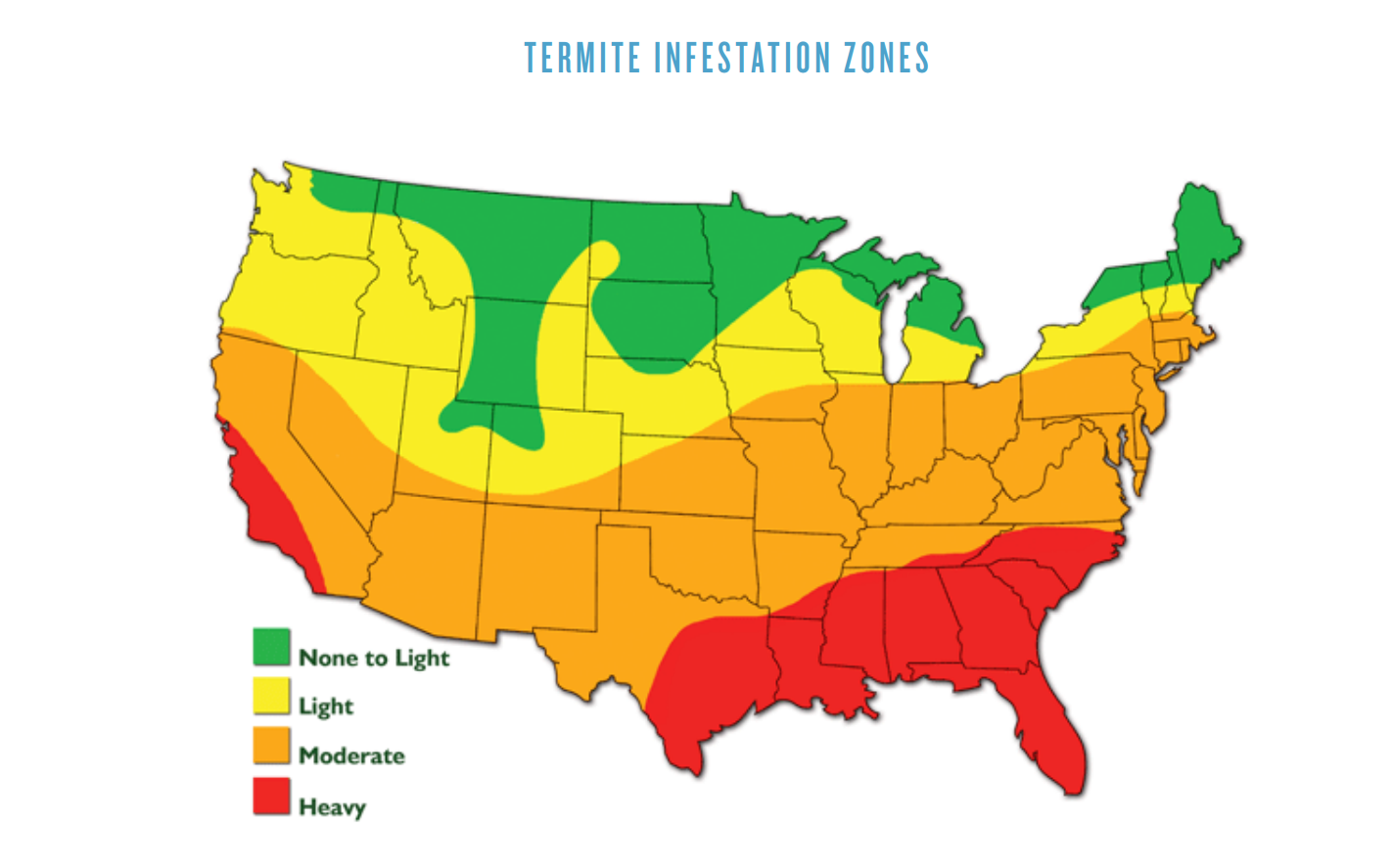

- All VA Purchases requires a clear termite report, excluding condos on the 2nd story or higher.

- Any required repair items or deficiencies will be noted on the appraisal report.

Most VA appraisals do not require repair work!

What Else Do I Need To Know?

- Borrowers must occupy the property. No Investment or 2nd Home purchases allowed (IRRRL OK).

- VA borrowers may own other property, as long as the subject property will be owner occupied.

- Non-occupant co-borrowers are not permitted to help qualify.

- Non-traditional credit is allowed on a case by case basis.

- Condos must be on the VA approved condo list. There are no “spot approvals.”

- Termite report and clearance is required (except IRRRL’s) on existing properties in areas where the probability of infestation has been defined as “very heavy” or “moderate to heavy” by the IRC. Check with VA Regional Loan Center for final determination.

- Clear CAIVRS is required for all borrowers.

- VA is often confused as a “First Time Homebuyer” program, but this is not the case.

- This program is open to all Veterans, active duty military, qualified reservists/National Guard, and un-remarried surviving spouses of service-connected death.

Summary of VA Advantages

- No down payment required. See County List for limits.

- Maximum seller contributions 4%+

- 100% gift funds allowed

- No minimum reserve requirements

- Make sense underwriting

- Citizenship is not required

- Veteran can use entitlement many times

- Not limited to First Time Homebuyers

- Fixed rate assumable loan

- Reservists/National Guard qualify for VA benefits

- Manufactured homes OK

- Quick closings

- Underwritten at PERL

Why PERL?

Experienced Realtors and Veterans trust and choose PERL!

- Purchase and Refinance specialists in VA, FHA and Conventional loans.

- We understand the demands and pressures of a Realtor driven purchase market.

- We know the importance of closing on time to the buyer, seller, and Realtor.

- Experienced, quality Mortgage Loan Originators who provide individual service.

- Dedicated Government Lending department and senior management team with decades of experience.

Resources

- VA Loan Guaranty Homepage

- General Rules for Eligibility

- Lender’s Handbook

- 2016 County Limits

- Appraisal Fee Schedules

- VA Regional Loan Centers

- VA Condo Search

- VIP (Veterans Information Portal)

- VA Forms

- Veterans Association of Real Estate Professionals

Derek Parent Helping Homeowners Realize Their Dreams

Cementing his place as a seasoned mortgage professional, Derek Parent and The Parent Team of USA Mortgage is leaving a mark as one of the top mortgage origination teams in the country.

via High Rise Life Magazine - July/August 2018

Over the years, Derek Parent and his team have gained the trust of the community at large with experience working with an array of clients, including first-time homebuyers, high net-worth individuals, veterans, teachers, and medical workers.

One of Parent’s biggest priorities is staying on top of market trends to protect, service and educate his clients to the best of his ability. Derek Parent alongside his team of experts have set out a mission to help clients realize their dreams. In our interview, Parent discusses everything from getting the perfect loan, first time buyer home tips, purchasing and financing a home in 2018, getting approved for high-rise condominium with little as 5% down, why refinancing may be good option, and everything in between. Here is what he had to say.

Q: Can you tell us a little about yourself and The Parent Team of USA Mortgage?

The Parent Team is built around a couple of very basic principles, and they don’t have nearly as much to do with the actual work environment as they do the people. I truly believe that–like a home–if you implement great habits and amazing people in your everyday life, you will build a foundation that can withstand any storm or capacity. From day one, I’ve always attempted to surround myself with people who represent those qualities. Personally, I am a strong believer in elevation, and what I embrace most about the mortgage industry is that it allows me to grow–not only in my career, but also in my personal development. It’s enabled me to do what I love; it’s given me the opportunity to be a stepping stone–and sometimes, a guide–for those looking to achieve something.

When you pair that with over 20 years of industry experience, there is very little that seems daunting. I’ve seen all different types of markets and needs, and it’s allowed me to work with clients from every side of the spectrum. We work in an extremely dynamic industry, and I believe that my duty is to always keep an adaptive perspective, and it’s this same mindset that has been the foundation of how my team and I have been able to fulfill a desperate need for mortgage options in Las Vegas. Whether someone is planning to purchase a single-family home, condominium, primary residence or investment, these wins–the difficult ones–are the scores that count and setting ourselves apart in a world where most are intimidated is something in which I continue to pursue daily, understanding that it will give my clients more opportunity, less stress and most importantly, trust in their mortgage advisor to always have their backs.

Q: What are some of the types of programs you offer or specialize in?

Depending on the type of property, we offer several different options, including Jumbo, Conventional, FHA and VA throughout Nevada, California, Texas, and Florida. One specialty is being able to provide traditional financing for high-rise condominium projects in Las Vegas with as little as 5% down payment.

Q: As an expert high-rise lender, is it difficult to get approved for high-rise loan?

Not at all. It is simple. We generally can tell very quickly whether someone can qualify or not. We analyze a few things like the applicant’s credit and income and the property’s value to determine whether the loan is possible now or in the future.

Q: What are some great options available for buyers currently looking to buy a high-rise condominium?

We have expanded our options to provide financing on condominiums ranging from $70,000 to $3 million, and a down payment can be as little 5% down. We want to help everybody. Some of the condominiums that are listed include: Veer Towers, Turnberry Towers, Turnberry Place, One Las Vegas, Metropolis, The Ogden, Park Towers,

and more.

Q: What are some core values that The Parent Team carries?

All our decisions and choices are based on the foundation of integrity, honesty, compassion and always keeping the client’s best interest in mind. Our clients are far more than just clients; they are friends and taking care of them is our #1 priority.

Q: What are your thoughts on housing market and recent developments in Las Vegas? Do you think it is a good time to buy?

I’m a strong believer that NOW is always the best time to buy. Why wait? Tomorrow is never promised.

Q: Can you give us insight into current interest rates and market projection?

With being an active Sponsor of the Las Vegas Global Economic Alliance group, The Parent Team is always up to date with what’s going on in today’s market. As the housing market is steadily growing, so will the rates.

Q: Why do you think refinancing is a good option for some clients?

There are several reasons why refinancing is beneficial to clients. Some of the benefits are paying off credit cards, financing a business, covering college tuition, managing unexpected expenses, making improvements to your home or taking advantage of potential tax-deduction benefits from interest paid on the loan. Refinancing overall gives our clients an opportunity to put more cash into their pockets rather than leaving it tied to a piece of property.

Q: What are some tips you recommend for new home buyers when shopping for a loan?

My recommendation is to work with someone of a high-caliber professional who you trust. Becoming a homeowner is one of the biggest purchases in someone’s life, so it’s important to go through this process with someone you know has your back.

Q: What makes The Parent Team different compared to other lenders?

Our mission is to help our community achieve homeownership, helping the maximum number of people in our community. One of the reasons why we invested in creating opportunities for homeowners that can purchase in any price range is to be able to provide options for every type of homebuyer. This process of purchasing a home, refinancing, and dealing with money can be sensitive, so our mission is to make sure every single one of our clients experiences a smooth transaction and an uplifting process.

Derek J. Parent NMLS# 182283

Is it Better to Pay Off Your Mortgage or Invest?

When it comes down to it, this is not a simple or straightforward question.

There are so many variables that you really need to whip out a calculator, talk to your CPA, visit a financial planner and/or retirement specialist, and so on and so forth.

It also depends on your mortgage rate, your tax bracket, how much you owe on your mortgage, what type of mortgage you’ve got, the term, how long it will take to pay it off, etc.

Does your employer provide a 401k match? Is your money better off in another type of retirement account? Do you have other high-APR debt? How much do you need to set aside for a rainy day?

Mortgages have a lot of desirable qualities that make them the best debt to carry. For example, very few loans come with extremely low fixed interest rates that are tax deductible and amortized over a long period of time.

So if there was ever a loan to hold onto, a mortgage would be it, especially with rates where they’re at now.

If we assume inflation picks up in coming years, your existing mortgage becomes even more attractive to hang onto, as opposed to paying down, seeing that the debt will be paid back in cheaper dollars from the future.

If rates happen to go down, you have the option to refinance to a lower rate, which also provides flexibility. And if you invest money early on instead of paying down your mortgage, your gains can be exponentially better.

Finally, there’s also the emotional element. Some folks like the idea of being debt-free, for better or worse, financially. Not everyone likes to invest in complicated securities or even seemingly benign blue chip stocks, so their goal might be to eliminate the debt overhang as quickly as possible.

In either case, it’s always smart to set aside some readily accessible funds in the case of an emergency, or even to replace your roof or handle some other household repairs.

The key is really finding a balance. There’s no rule for how much you need to pay other than your payment due. You can make an extra payment here and there or look into biweekly mortgage payments, or just pay on schedule and spread your money around as needed/desired.

Here are some pros of both options:

Pros of Paying Off the Mortgage

- Pay less interest

- Own your home free and clear faster

- Get rid of mortgage insurance

- Gain more home equity

- If rates fall and you refinance, lower LTV = lower interest rate

- You can sell your home more easily

- Less risk of losing money in the stock market or elsewhere

- Less work

- No debt at retirement

- Peace of mind

Pros of Investing Instead

- Mortgage rates will never be this low again

- Long-term low fixed rate a great deal

- Mortgage interest deductible

- Money remains liquid

- Investment gains can exceed return on mortgage

- Investing early can make for greater long-term returns

- Ability to diversify your investments

- Contributions to retirement account may be more beneficial

- Inflation makes mortgage balance cheaper in the future

- Home could lose value

- Avoid throwing good money after bad if underwater on your mortgage

If you're interested in refinancing or applying for a new mortgage, contact my office at 702.331.8185.

What Credit Score Do You Need to Qualify for a Mortgage?

If you’re thinking about purchasing a new home or refinancing your existing mortgage, you should know that your credit score is hugely important.

Banks and mortgage lenders use your credit score(s) to evaluate your creditworthiness, which translates to a higher or lower mortgage interest rate, and even determines eligibility.

Which Credit Score Do Mortgage Lenders Use?

First and foremost, you might be wondering which credit score mortgage lenders use, seeing that there’s no sense focusing on something they won’t actually look at to determine your creditworthiness.

The short answer is FICO scores, which are the industry standard and relied upon by just about everyone.

There are three FICO scores you need to be concerned with, including one from Equifax, one from Experian, and one from TransUnion, which are the three main credit bureaus.

Know Your Credit Scores Long Before Applying for a Mortgage

Before you actually head out to get a mortgage, it’s good practice to view your credit scores long before you apply. I’m talking several months in advance because any necessary credit score changes/improvements take time.

For example, any mistakes (or legitimate issues) holding your credit score down may take months to get cleared up. And you won’t want to leave anything to chance. Yes, the credit bureaus are bureaucratic, so nothing happens all that quickly.

Also, be sure to go with a service that allows you to see all 3 credit scores, as mortgage lenders typically pull a tri-merge credit report, which includes credit scores from all three bureaus.

The bureaus each report information a little differently, so knowing just one score won’t do you (or your lender) much good.

As far as lenders are concerned, it basically allows them to triple-check your credit before making the decision to hand over a large sum of money. They use the mid-score for pricing/qualification, so it’s imperative that all 3 credit scores are in tip-top shape.

For example, if your credit scores are 650, 680, and 720, a mortgage lender would use the 680 score, which is a decent but below-average credit score.

Lower Credit Score = Higher Mortgage Rate

Put simply, a lower credit score will lead to a higher mortgage rate, and vice versa. This all has to do with risk. The lower your credit score, the higher the chance you’ll default on your mortgage, at least that’s what the statistics say.

So if your credit score is too low, you probably won’t even get approved for a mortgage. Lenders simply won’t want your business. It’s just that risky.

Lately, banks and lenders have become even more stringent, requiring higher credit scores than they have in the past.

Credit Score Below 620 Considered Subprime

As far as conventional mortgage loans go, a credit score below 620 is typically considered subprime, meaning you’ll have a difficult time qualifying for a mortgage, and if you do, you’ll receive a subprime mortgage rate.

In general, you want a credit score above 720 to avoid any negative pricing adjustments, but a 760 credit score might be the new rule if you want the best possible terms and lowest rates. If you’ve got excellent credit, you can even get a reduced mortgage rate.

In summary, your credit score is probably the one thing you have complete control of, whereas things like job, income, and assets can be at the mercy of external forces. So do your best to strive for perfection in order to get the best deal on your mortgage.

Some Useful Credit Tips for Those Shopping for a Mortgage

- Credit scores are the single most important factor in determining your mortgage rate

- Aim for a 760+ credit score to get the best pricing and to avoid scrutiny

- Credit scores aren’t everything, what’s on your credit report matters as well!

- Know the contents of your credit report and what your scores are long before your lender does

- Any mistakes or missteps can be corrected, but take time, often several months!

- The FHA now requires a minimum credit score of 500, or 580 if you put less than 10% down

- Conventional loans generally require a minimum credit score of 620

- Credit scores below 620 are considered subprime and will be priced much higher

- Lenders pull all three of your credit scores and use the median score for qualification

- Low credit scores can also disqualify you for certain loan programs and/or limit your options

- Don’t mess with your credit before or during the loan application process!