How to Analyze Cash Flow Before Buying a Rental Property

Investing in rental properties can be a powerful way to build long-term wealth, but one of the most important steps before making a purchase is analyzing cash flow. Understanding cash flow helps ensure that your investment will generate consistent income, cover expenses, and provide a return on your investment. Without proper analysis, even a property in a prime location could turn into a financial burden.

In this article, we’ll guide you step by step on how to analyze cash flow before buying a rental property, so you can make informed decisions and maximize your real estate profits.

What is Cash Flow in Real Estate?

Cash flow in real estate refers to the net income generated by a rental property after all expenses are paid. In other words, it’s the money left over each month or year after accounting for everything you spend to operate the property.

A simple way to calculate cash flow:

Cash Flow = Rental Income - Expenses

- Positive cash flow: The property earns more than it costs to maintain, which is ideal for investors.

- Negative cash flow: The property costs more than it earns, which can create financial strain.

Analyzing cash flow is essential for determining whether a rental property will be profitable.

Step 1: Calculate Gross Rental Income

The first step is to estimate the gross rental income, which is the total rent you expect to collect from tenants.

- Research similar properties in the area to determine market rent.

- Consider factors like location, property size, amenities, and condition.

- Be realistic with your estimates to avoid overestimating potential income.

For example, if you plan to rent a property for $1,500 per month, the annual gross rental income would be:

1500 x 12 = 18000

This figure is the starting point for your cash flow analysis.

Step 2: Estimate Operating Expenses

Next, calculate the operating expenses, which are the costs required to manage and maintain the property. Common expenses include:

- Mortgage payments (if the property is financed)

- Property taxes

- Insurance (landlord insurance)

- Maintenance and repairs (budget around 1% of property value annually)

- Property management fees (if hiring a management company, usually 8–10% of rent)

- Utilities (if the landlord covers them)

- Vacancy reserve (5–10% of rent to account for empty units)

Adding these costs together gives the total operating expenses, which you’ll subtract from your rental income.

Step 3: Calculate Net Operating Income (NOI)

Once you know the rental income and operating expenses, calculate the Net Operating Income (NOI):

NOI = Gross Rental Income - Operating Expenses

For example, if your annual rent is $18,000 and expenses are $10,000, the NOI would be:

18000 - 10000 = 8000

NOI shows how much money the property generates before accounting for mortgage payments or debt service. It’s a key metric for evaluating investment properties.

Step 4: Subtract Debt Service

If you are using a mortgage to finance the property, subtract the annual loan payments (principal + interest) to determine the cash flow after financing:

Cash Flow = NOI - Debt Service

Continuing the example, if the annual mortgage payments are $6,000:

8000 - 6000 = 2000

This means the property would generate $2,000 per year in positive cash flow.

Step 5: Account for One-Time and Unexpected Costs

Smart investors also include a buffer for unexpected expenses, such as:

- Major repairs (roof, HVAC, plumbing)

- Appliance replacements

- HOA special assessments

- Legal or eviction costs

A conservative approach is to set aside 5–10% of annual rental income to cover unexpected costs. This ensures your cash flow projections are realistic.

Step 6: Use Cash Flow Metrics

Two important metrics can help you evaluate a property’s profitability:

- Cash-on-Cash Return: Measures annual cash flow relative to your initial investment

Cash-on-Cash Return (%) = (Annual Cash Flow / Total Cash Invested) x 100

- Capitalization Rate (Cap Rate): Measures the property’s net income relative to its purchase price

Cap Rate (%) = (NOI / Purchase Price) x 100

Both metrics help compare properties and assess whether the investment meets your financial goals.

Step 7: Stress-Test Your Cash Flow

It’s important to evaluate how your cash flow holds up under different scenarios:

- What if rent drops by 10–15%?

- What if vacancy rates are higher than expected?

- What if maintenance costs rise?

Stress-testing helps you anticipate potential challenges and ensure the investment remains profitable under less-than-ideal conditions.

Step 8: Make an Informed Decision

After analyzing rental income, expenses, debt service, and potential risks, you should have a clear picture of whether the property is a good investment.

- Positive Cash Flow: Indicates the property can generate steady income and is likely a strong investment.

- Negative Cash Flow: May still work if property appreciation is expected, but it requires careful planning and reserves.

Cash flow analysis is just one piece of the puzzle. Also consider location, market trends, and long-term appreciation potential.

Tips for Maximizing Cash Flow

- Increase Rent Strategically – Make improvements that justify higher rent.

- Reduce Expenses – Compare insurance providers, perform energy-efficient upgrades, or self-manage the property.

- Screen Tenants Carefully – Reduce vacancies and late payments by selecting reliable tenants.

- Regular Maintenance – Prevent costly repairs by addressing minor issues early.

- Refinance When Possible – Lower interest rates reduce debt service and increase cash flow.

Active management of income and expenses is the key to maximizing cash flow and achieving long-term profitability.

Conclusion

Analyzing cash flow before buying a rental property is essential for real estate success. By calculating gross income, subtracting operating expenses and debt service, accounting for unexpected costs, and stress-testing your projections, you can make informed decisions that protect your investment and maximize returns.

For more guidance on rental property investments, cash flow analysis, and financing strategies, visit The Parent Team. Our team can help you identify profitable properties, analyze potential cash flow, and create a tailored investment plan to grow your real estate portfolio.

Remember, successful real estate investing begins with careful analysis. Understanding cash flow is the first step toward building a sustainable and profitable rental property business.

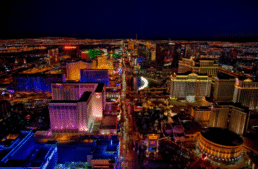

From Strip Views to Suburban Luxury: The Real Cost of Owning in Las Vegas

Las Vegas is one of the few cities in America where you can choose between two completely different lifestyles — the excitement of high-rise living on the Strip or the comfort and quiet of suburban luxury in communities like Summerlin, Henderson, and the Northwest. Both offer incredible benefits, but the real cost of ownership between them can be dramatically different.

Whether you’re relocating, upgrading, or investing, understanding the true monthly costs — not just the purchase price — can help you make the smartest decision for your budget and lifestyle.

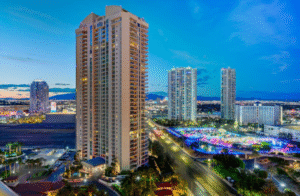

1. High-Rise Living: What You’re Really Paying For

High-rise condos offer unbeatable amenities and views, but ownership comes with expenses that are different from traditional homes.

Breakdown of typical costs for Strip-area high-rises:

- Mortgage payment (varies by loan type and tower)

- HOA fees: $600–$1,600 per month on average, and up to $2,500+ in ultra-luxury buildings

- Parking fees (in select towers)

- Special assessments (depending on building upgrades or repairs)

- Higher insurance requirements

What you’re getting:

- 24/7 concierge + security

- Resort-style pools

- Fitness centers, spas, lounges

- Valet parking

- Strip views and walkability

- Lock-and-leave convenience

The value: You’re buying a lifestyle, not just a unit. The all-inclusive amenities and prime location explain the premium.

Who it’s ideal for:

- Professionals

- Retirees wanting zero maintenance

- Frequent travelers

- Investors seeking mid-term rental opportunities

- Buyers who value views, security, and luxury amenities

2. Suburban Luxury: What Ownership Really Costs

Las Vegas suburbs are known for space, privacy, modern floor plans, and upscale communities. Costs are structured differently and usually more predictable.

Typical suburban ownership costs:

- Mortgage payment

- HOA fees: $50–$200 per month (higher for guard-gated communities)

- Utilities: Higher due to square footage

- Maintenance: Landscaping, pool upkeep, repairs

- Home insurance: Typically lower than high-rise insurance

What you’re getting:

- Larger square footage

- Private yards

- Family-friendly neighborhoods

- Community parks, trails, and recreation centers

- Stronger school zones (Henderson + Summerlin)

The value: More space, more privacy, and long-term appreciation potential.

Who it’s ideal for:

- Families

- Remote workers

- Buyers wanting long-term equity growth

- Investors seeking rental demand

- Anyone valuing space over amenities

3. Price Comparison: High-Rise vs. Suburban Luxury

Here’s a realistic snapshot of today’s pricing:

High-Rise (Strip + near-Strip)

- Entry-level: $300,000–$450,000

- Mid-luxury towers: $450,000–$850,000

- Luxury Strip towers: $900,000–$3M+

- HOA fees: $600–$2,500+/mo

Suburban Luxury (Summerlin, Henderson, NW)

- Entry-level single-family: $430,000–$550,000

- Modern, upgraded homes: $650,000–$950,000

- Luxury homes: $1M–$4M+

- HOA fees: $50–$200/mo

- Larger maintenance expenses

Key takeaway:

High-rise condos often have a lower purchase price but higher monthly carrying costs.

Suburban homes often cost more upfront but offer lower ongoing fees.

4. Appreciation & Investment Potential

Both segments appreciate differently.

High-Rise Appreciation:

- More sensitive to interest rates

- Influenced by building litigation, reserves, and HOA strength

- Strong rental potential for 30+ day leases

- High demand from out-of-state buyers

Suburban Home Appreciation:

- Historically stronger, more stable

- Driven by population growth and job expansion

- Higher resale demand

- Less volatility

If your goal is long-term wealth building, suburban homes typically outperform high-rise units. If your goal is lifestyle or mid-term rental potential, high-rises shine.

5. Lifestyle Differences That Affect Cost

The biggest financial difference often comes down to how you live.

High-Rise Pros:

- Zero maintenance

- No yard work

- Security + concierge

- Walkability

- Resort amenities

- Downsize-friendly

Suburban Pros:

- Privacy

- Outdoor space

- Better for pets

- Family-friendly communities

- Garage parking and storage

- More flexibility for renovations

Which lifestyle matches your daily life and long-term goals?

6. Which Option Is More Affordable in the Long Run?

If you prefer lower monthly expenses and long-term equity:

Suburban homes win.

If you want luxury living with no maintenance and don’t mind higher monthly fees:

High-rises are unbeatable.

If you’re an investor looking for mid-term rentals:

High-rises can perform extremely well in corporate + travel-nurse markets.

If you’re planning to raise a family or want a backyard:

Suburbs dominate.

Final Thoughts

Las Vegas offers two incredible lifestyles:

Strip-facing high-rise excitement or suburban luxury comfort.

The real cost of ownership comes down to HOA fees, maintenance, and the lifestyle you’re choosing — not just the home price.

If you want to compare payments, HOA structures, loan types, and long-term affordability, connect with The Derek Parent Team. We specialize in both high-rise and suburban financing, and we’ll help you make the smartest financial decision for your next move.

Homeowners Are Sitting on Billions in Untapped Equity — Here’s How to Use Yours Wisely

Homeowners across the U.S. — especially in fast-growing markets like Las Vegas — are sitting on massive amounts of tappable equity. In fact, recent housing data shows Americans now have more than $16 trillion in home equity, with billions of that right here in Nevada.

But the big question is this:

What should you actually do with that equity?

Used wisely, your home equity can help you build wealth, eliminate debt, invest in your future, and strengthen your financial foundation. Used carelessly, it can create unnecessary risk.

Here’s how to use your equity strategically and responsibly.

1. Consolidate High-Interest Debt

Credit card interest rates are now averaging 20–30%, and many homeowners are feeling the pressure. If you’re carrying high-interest balances, a cash-out refinance or HELOC can dramatically reduce your monthly obligations.

Why this strategy works:

- Mortgage rates are significantly lower than credit card rates

- One consolidated payment is easier to manage

- Lower utilization often boosts your credit score

- Freeing up cash flow reduces financial stress

This is one of the smartest, most impactful uses of home equity — especially heading into 2026 with rising consumer debt.

2. Make High-ROI Home Improvements

Renovations can increase property value, improve your living space, and boost long-term equity. But not all upgrades are created equal.

High-return improvements include:

- Kitchen remodels

- Bathroom upgrades

- New flooring

- Exterior improvements for curb appeal

- Energy-efficient windows

- HVAC upgrades

A cash-out refinance or HELOC often makes more financial sense than personal loans or store financing, which carry higher rates.

3. Buy an Investment Property

If you’ve built strong equity and want to grow wealth, using that equity for a down payment on a rental or investment property can create long-term returns.

Benefits include:

- Additional monthly income

- Appreciation on multiple properties

- Tax benefits for investors

- A hedge against inflation

Many of your clients are leveraging their primary home equity to purchase:

- Long-term rentals

- Mid-term furnished units

- High-rise condos

- Second homes in Las Vegas communities

This is how homeowners move from paying a mortgage… to building a portfolio.

4. Refinance Into a Better Loan

Even if rates today aren’t at historic lows, refinancing can still make sense, especially if you can:

- Remove mortgage insurance (PMI)

- Switch from an ARM to a fixed-rate mortgage

- Shorten your term (30-year to 15-year)

- Reduce your interest rate

- Lower your monthly payment

If you bought in the mid-rate years and your equity has climbed, refinancing may open doors that weren’t available when you closed originally.

5. Build an Emergency or Opportunity Fund

Another smart equity move is pulling a conservative amount of cash for liquidity — not spending.

This gives homeowners:

- A financial safety net

- Funds for unexpected medical or family expenses

- Capital to jump on investment opportunities

- Flexibility during job changes or business transitions

A HELOC is especially useful for this because you only pay interest on what you use.

6. Prepare for Major Life Events

Your equity can help you navigate big moments with less financial strain.

Examples include:

- Paying for college tuition

- Funding a wedding

- Helping a family member buy a home

- Covering medical or caregiving expenses

- Preparing for retirement transitions

Instead of draining savings, homeowners can strategically tap equity to protect cash reserves.

7. Don’t Use Equity for “Lifestyle Debt”

Before leveraging your equity, it’s just as important to know what not to use it for.

Avoid spending equity on:

- Vacations

- Luxury purchases

- Vehicles

- Consumables

- Short-lived expenses

These reduce your net worth without creating long-term value.

How to Know Which Strategy Fits You Best

The right equity move depends on your goals:

- Want lower monthly expenses?

Debt consolidation or refi into a lower rate. - Want long-term wealth?

Invest in property or shorten your mortgage term. - Want flexibility?

Open a HELOC and keep funds available. - Want to upgrade your home?

Cash-out for renovations with strong ROI.

At The Derek Parent Team, we analyze your equity, credit, income, and goals to determine the smartest move — not just the easiest one.

Final Thoughts

Homeowners today have access to more equity than any time in history — but the real power lies in using it wisely. Whether you want to invest, reduce debt, protect your finances, or improve your home’s value, the right strategy can move you closer to your long-term financial goals.

If you’d like a customized equity analysis or want to explore cash-out, HELOC, or refinance options, connect with The Derek Parent Team. We’ll help you understand what’s possible and how to maximize your equity safely and strategically.

Las Vegas Housing Market Outlook: What Buyers Should Expect in 2026

With rapid population growth, major economic developments, and continued national attention, the Las Vegas housing market remains one of the most talked-about in the country. As 2026 approaches, buyers want to know: Will prices rise? Will rates fall? Will there be more inventory?

While no one can predict the future perfectly, current economic indicators, migration patterns, and housing trends give us a clear picture of what buyers should expect heading into the 2026 market.

Here’s your detailed, expert-backed outlook.

1. Home Prices Will Likely Continue to Rise — Slowly but Steadily

Las Vegas has seen strong appreciation over the last decade, driven by new residents, job growth, and limited inventory. While we’re not expecting the explosive price spikes seen during the 2021 boom, moderate appreciation is almost guaranteed.

What’s driving prices upward?

- Continued population growth (especially from California and the Pacific Northwest)

- Low turnover from homeowners locked into 3–4% mortgage rates

- Strong demand in markets like Henderson, Summerlin, and the Northwest

- Limited land availability for new construction in core areas

Expect 3–6% annual appreciation in most neighborhoods and higher in high-demand communities.

2. Inventory Will Improve — But Not Enough to Create a Buyer’s Market

Builders in Las Vegas are ramping up production, especially in Summerlin West, Skye Canyon, Inspirada, Cadence, and North Las Vegas. But new construction alone won’t solve the inventory shortage.

Why?

Because many existing homeowners won’t list their homes until mortgage rates drop significantly — which may not happen quickly.

What buyers can expect in 2026:

- Slightly more choices than the past few years

- Continued competition for well-priced properties

- Faster absorption of new listings

- High demand for move-in-ready homes

In short: 2026 won’t be a buyer’s market. But it may feel more balanced than recent years.

3. Mortgage Rates Could Decrease — But Not Dramatically

As inflation cools and economic policy stabilizes, analysts expect mortgage rates to gradually improve.

Most forecasts predict:

- Rates could settle in the mid-5% to low-6% range by late 2026

- No return to the historic 2–3% era

- Better affordability, but still above pandemic lows

A drop in rates—even a small one—will bring more buyers back into the market, pushing competition higher again.

Translation: Buy early if you can, then refinance when rates improve.

4. Migration Will Keep Driving Demand

Las Vegas continues to attract new residents for several reasons:

Key migration drivers:

- No state income tax

- Lower cost of living compared to coastal metros

- Expanding job opportunities

- 300+ days of sunshine

- Booming sports and entertainment scene

- Growing retiree population

Cities like Los Angeles, San Diego, San Francisco, Portland, and Seattle continue to feed a steady stream of new buyers into the Vegas market.

This migration is one of the strongest reasons home values are expected to remain stable — and rise — through 2026.

5. New Construction Will Offer Some of the Best Deals

With builders competing for buyers, expect incentives to remain strong through early 2026:

- Rate buydowns

- Closing cost credits

- Discounted upgrades

- Quick move-in price reductions

- Lot premiums waived in slower phases

However, once demand surges again—especially when rates improve—many of these incentives will shrink or disappear.

If you’re considering new construction, acting before the 2026 spring rush could save you thousands.

6. High-Rise and Condo Markets Will Continue Rebounding

Las Vegas high-rise condos are experiencing renewed demand thanks to:

- A surge in out-of-state buyers

- Expanding Strip entertainment options

- Strengthening rental demand

- Luxury buyers seeking lock-and-leave living

- Limited supply of new towers

As more buildings resolve litigation and financing options expand, 2026 could be one of the strongest years for high-rise sales in the last decade.

7. Investors Will Stay Active in 2026

Although short-term rental regulations remain tight, Las Vegas continues to attract:

- Long-term rental investors

- Mid-term rental investors (30–90 days)

- Cash buyers relocating from expensive states

- Equity-rich homeowners purchasing second homes

Strong rental demand and stable job growth ensure investors will continue seeing Vegas as a high-potential market.

Final Thoughts

The Las Vegas housing market in 2026 will be defined by stability, moderate appreciation, and renewed buyer activity as rates gradually improve. For buyers, the biggest advantage comes from preparing early, getting pre-approved, and understanding the market before competition heats up again.

If you want to explore your options, compare payments, or analyze neighborhoods, connect with The Derek Parent Team. We’ll help you position yourself for success—whether you’re buying now, in early 2026, or refining your strategy ahead of time.

5 Equity Moves Every Homeowner Should Make Before the New Year

As the year comes to a close, many homeowners start thinking about goals, finances, and what they want the next year to look like. But there’s one area that often gets overlooked—your home equity.

Your home is likely one of your biggest assets, and the equity inside it can become a powerful tool if you know how to use it. Before the new year arrives, here are five smart equity moves every homeowner should consider.

1. Check Your Current Equity Position

Most homeowners don’t know how much equity they’ve built over the years. Between appreciation and your mortgage payments, you may have more than you think.

To calculate quickly:

Home Value – Mortgage Balance = Your Equity

Why it matters:

- You may have enough equity to eliminate PMI.

- You may qualify for better refinance terms.

- You may unlock equity for renovations or investments.

A quick review with a trusted lender like The Derek Parent Team can give you an accurate, updated number.

2. Review Your Mortgage Rate and Terms

Even if you’re not in a rush to refinance, it’s worth evaluating whether your current mortgage still fits your financial goals.

Consider reviewing:

- Your current interest rate vs. today’s options

- Whether refinancing to a shorter term could save interest

- If you have PMI you could remove

- Whether switching from an ARM to fixed could protect you long-term

Many homeowners discover they can improve their monthly payment or long-term savings just by reviewing the numbers.

3. Use Equity Strategically for High-ROI Upgrades

Not all home improvements are equal. Some upgrades add value, while others don’t.

High-ROI improvements include:

- Kitchen updates

- Bathroom upgrades

- New flooring or paint

- Exterior curb appeal

- Energy-efficient enhancements (HVAC, windows, insulation)

If you’re sitting on solid equity, using a cash-out refinance or HELOC for strategic improvements can increase your home’s value heading into the new year.

4. Consolidate High-Interest Debt Into Lower-Rate Equity

Credit card interest rates are now averaging 20–30%. If you're carrying balances, the interest alone may be draining your cash flow.

A cash-out refinance can:

- Replace high-interest revolving debt with a lower-interest fixed mortgage

- Lower your total monthly payments

- Improve your credit score by reducing utilization

- Free up cash flow as you enter the new year

This move alone can save homeowners thousands annually.

5. Plan Ahead for Major Purchases or Life Changes

Equity can serve as a financial cushion during major life events, including:

- College tuition

- Medical expenses

- Home renovations

- Investment opportunities

- Expanding or downsizing your home

- Funding a second property or rental investment

Reviewing your equity before the new year helps you prepare for these moments with clarity and confidence.

Bonus Tip: Set Your 2025 Equity Strategy Now

Don’t wait until January to decide your financial goals. Use this time to:

- Update your budget

- Plan your mortgage strategy

- Explore refinance or HELOC options

- Map out home improvements and timelines

- Strengthen your equity position for future wealth-building

Your home equity is a major part of your net worth—make sure it’s working for you, not sitting idle.

Final Thoughts

A strong equity plan can help you reduce debt, increase home value, improve cash flow, and prepare for life’s big opportunities. Instead of waiting until the new year, reviewing everything now gives you a head start on 2025.

If you want a personalized home equity review or want to explore refinance, HELOC, or cash-out options, connect with The Parent Team. We’ll help you understand your numbers, compare scenarios, and make smart equity moves for the year ahead.

Mortgage Myths That Could Be Costing You Thousands

When it comes to home loans, misinformation is everywhere. Friends, family, and even outdated articles online can spread half-truths that confuse buyers. Unfortunately, believing these myths could cost you serious money—or even prevent you from buying a home.

Let’s clear the air by debunking some of the most common mortgage myths that might be holding you back.

Myth #1: You Need 20% Down to Buy a Home

This is one of the biggest misconceptions in real estate. While putting 20% down avoids private mortgage insurance (PMI), it’s not required.

- FHA loans allow as little as 3.5% down.

- Conventional loans can go as low as 3% down for qualified buyers.

- VA loans (for veterans) and USDA loans (in rural areas) can require 0% down.

Truth: You don’t need to wait years to save 20%. Waiting could cost you more in rising home prices.

Myth #2: The Lowest Interest Rate Is Always the Best Deal

A rock-bottom rate looks appealing, but if it comes with high fees or points, you may not save money in the long run.

Truth: Always compare the Annual Percentage Rate (APR), not just the interest rate. APR includes fees and gives a clearer picture of total cost.

Myth #3: You Can’t Buy a Home With Student Loans

Many buyers assume student loans automatically disqualify them. That’s not true. Lenders evaluate debt-to-income ratio (DTI), not just the existence of debt.

Truth: With the right strategy, you can qualify even with student loans—especially if you’ve been making consistent payments.

Myth #4: Pre-Qualification Is the Same as Pre-Approval

These terms get used interchangeably, but they’re not the same.

- Pre-Qualification: A quick estimate based on unverified info.

- Pre-Approval: A verified review of your income, credit, and documents that gives you stronger buying power.

Truth: In a competitive market like Las Vegas, pre-approval is what sellers want to see.

Myth #5: Refinancing Isn’t Worth It Unless Rates Drop 2%

This old “rule of thumb” is outdated. Even a 0.5% drop can make refinancing worth it if you plan to stay in your home for several years.

Truth: What matters most is your breakeven point—how long it takes for savings to outweigh costs.

Myth #6: You Can’t Refinance With Bad Credit

While a higher credit score improves your options, some loan programs allow refinancing even with lower scores. Plus, if you’ve built up equity, that can offset credit challenges.

Truth: Don’t assume you’re stuck—talk to an expert before ruling it out.

Why These Myths Cost You Money

Believing myths can keep you from buying sooner, refinancing at the right time, or exploring better loan options. Over the life of a mortgage, these decisions can add up to tens of thousands of dollars.

Final Thoughts

The mortgage process doesn’t have to be intimidating, and you don’t have to navigate it alone. By separating fact from fiction, you can make smarter decisions, save money, and move forward with confidence.

If you’re ready to cut through the noise and learn what’s really possible, connect with The Derek Parent Team. We’ll help you understand your options and avoid costly mistakes.

Should You Wait for Lower Rates or Buy a Home Now

If you’ve been thinking about buying a home, you’ve probably asked yourself the big question: “Should I wait for lower interest rates, or should I buy now?”

It’s a tough decision, and with so much talk about rate cuts, inflation, and housing supply, it can feel overwhelming. The truth is, there’s no one-size-fits-all answer, because the right move depends on your financial goals, your timeline, and the local market.

Let’s break down the pros and cons so you can make the smartest decision for your situation.

Why Some Buyers Are Waiting

It’s no secret that interest rates are higher today than they were just a few years ago. Buyers who wait often hope that:

- Rates Will Drop Soon: If rates fall by even 1%, monthly payments can become significantly more affordable.

- Lower Payments Mean More Buying Power: A lower rate lets you qualify for a higher loan amount.

- Less Risk of Overpaying: If rates drop and home prices stabilize, some buyers feel they’ll avoid buying at the “peak.”

Waiting can pay off if rates fall quickly, but the risk is that no one can predict the market with certainty.

Why Buying Now Could Be Smarter

On the flip side, many experts argue that buying now can still be the better long-term move, because:

- You Can Always Refinance Later: As the saying goes, “Marry the house, date the rate.” If rates drop, you can refinance into a lower rate.

- Home Prices Are Rising: While rates have slowed the market, Las Vegas home values continue to trend upward. Waiting could mean paying more for the same property later.

- Build Equity Sooner: Buying now means you start building wealth through equity right away, instead of sitting on the sidelines.

- Less Competition (For Now): With some buyers waiting, the current market may give you more negotiating power than in a frenzy of lower rates.

The Las Vegas Market Factor

In Las Vegas, the decision feels even more important because of how competitive the market can get.

- Inventory is Tight: There aren’t enough homes for the demand, and when rates drop, more buyers will jump back in.

- Builders Are Offering Incentives: In places like Henderson and Summerlin, builders are helping with closing costs or even rate buy-downs.

- High-Rises and Investment Properties Are Attractive: Investors are waiting too, so buying before the rush could give you a better deal.

So while waiting for rates to drop sounds appealing, local conditions suggest buying sooner could position you ahead of the competition.

A Simple Example

Imagine you buy a $400,000 home today at a 6.5% interest rate. Your monthly payment might feel higher than you’d like, but you’ve locked in the price.

Now imagine waiting a year. Rates drop to 5.5%, but demand skyrockets and that same home costs $440,000. Even with the lower rate, your payment could be similar—or higher—because prices increased.

This is why timing the market is tricky.

Questions to Ask Yourself

Before you decide whether to wait or buy, ask:

- How long do I plan to live in the home? If it’s long-term, short-term rate fluctuations matter less.

- Am I financially prepared? Do you have savings for a down payment, closing costs, and emergency funds?

- What’s more important right now—stability or savings? If stability is the goal, buying sooner may be better.

- Can I afford the payment today? Never stretch beyond your comfort zone just for the sake of timing.

Final Thoughts

There’s no perfect time to buy a home—but there’s a right time for you.

If you wait for lower rates, you could end up competing with more buyers and paying higher prices. If you buy now, you can secure a home, start building equity, and refinance later if rates drop.

At the end of the day, the best decision comes down to your personal goals, not just headlines.

If you’re ready to explore your options, connect with The Derek Parent Team. We’ll review your situation, run the numbers, and help you decide whether it makes more sense to buy now or wait.

Will Mortgage Rates Drop in 2025? What Experts Predict

With economic uncertainty and inflation concerns dominating headlines, many prospective homebuyers—and even current owners—are asking: “Will mortgage rates drop in 2025?” It’s a smart question, and while nobody can predict the future with complete accuracy, expert forecasts can offer useful direction.

Here’s a clear, accessible look at what leading authorities expect — and how you can prepare, whether rates fall or stay steady.

What Are the Experts Forecasting for Mortgage Rates?

Fannie Mae

Fannie Mae adjusted its outlook recently. It now expects the average 30‑year fixed mortgage rate to finish 2025 at about 6.5%, a slight upward revision from the previous 6.4%, before easing to 6.1% in 2026. MPA Magazine+1

Mortgage Bankers Association & Other Trade Groups

Industry groups like the MBA and others anticipate rates holding mostly steady through the year. For instance, MBA projects rates will average around 6.8% in Q3 2025 and end the year near 6.7%. Forbes

Broader Trend from Multiple Forecasters

Analysts including Fannie Mae, Freddie Mac, the National Association of Realtors, and others forecast that mortgage rates will linger in the mid‑6% range through 2025—declining incrementally but not dramatically. MarketWatch+5Investopedia+5Norada Real Estate+5

Recent Market Data

As of August 2025, the average 30‑year mortgage rate sits at 6.58%, its lowest in nearly ten months. Even so, experts stress that affordability remains a challenge and any rate improvement is expected to be modest. Investopedia+3AP News+3Reuters+3

Why Rates Likely Won’t Fall Sharply — Yet

Fed Rate Cuts ≠ Instant Mortgage Relief

Even if the Federal Reserve lowers benchmark interest rates (which many expect in September), mortgage rates don’t automatically follow. Trends in Treasury yields and bond markets, which mortgage pricing depends on, may not shift quickly enough to trigger dramatic declines. midflorida.com+15Investopedia+15Coosa Valley Credit Union+15

Inflation & the Fed’s Balancing Act

The Fed faces a tightrope: it needs to weigh inflation, jobs, and growth. While markets are hoping for a move in September, sticky inflation may delay or temper rate reductions. PoliticoKiplinger

Bond Market Volatility

Ultimately, mortgage rates track bond yields. Investor reactions to inflation, tariffs, or geopolitical instability can swing those yields—and thus mortgage rates—without direct policy changes. CBS NewsThe Mortgage Reports

What Buyers Can Take Away from These Forecasts

1. Expect Modest Declines Only

If rates do fall, we’re likely looking at a gradual easing into maybe the low‑6% range, rather than a return to the 3–4% era. MarketWatchNorada Real Estate

2. Opportunity to Refinance Later

If you’re buying now, you can always refinance if rates dip meaningfully down the road. In other words: buy the house today, date the rate. Investopedia+2MarketWatch+2

3. Don’t Let Timing Rule You

If you find a home you love and you’re financially prepped, waiting solely for rates may cost you more later—especially if prices keep rising. Investopedia

Final Thoughts

Here's what we can say with some confidence:

| Scenario | Likely Outcome |

| Rates will drop swiftly | Unlikely—experts see only modest movement. |

| Rates will stay in mid-6% range | Most probable—some forecasts expect 6.4–6.5% by year-end. |

| A sharp drop into low-6s or 5s | Possible down the road if inflation cools, but not expected soon. |

If you're ready to explore your options or need help projecting how mortgage rates may affect your buying power, the Derek Parent Team is here for you. We specialize in guiding Las Vegas buyers through uncertain markets, helping you lock in smart financing today with the flexibility to refinance later if needed.

Let’s chat about your situation and run the numbers—because the best decision is always the informed one.

Relocating to Las Vegas: Complete Guide for New Homebuyers

Las Vegas is famous for its nightlife, entertainment, and energy, but it’s also one of the fastest-growing cities in the country for new residents. Every year, thousands of people relocate here for job opportunities, affordable living, and sunshine nearly 300 days a year.

If you’re considering a move to Las Vegas, you’re not alone—and having the right plan will make the transition smoother. In this guide, we’ll cover everything you need to know about relocating to Las Vegas as a new homebuyer.

Why Move to Las Vegas?

People relocate to Las Vegas for many reasons, and it’s not just about the Strip. Here’s why the city has become such a hot spot:

- No State Income Tax: Nevada is one of the most tax-friendly states in the U.S.

- Affordable Housing (Compared to Other Major Cities): While prices have risen, homes in Las Vegas are still more affordable than in Los Angeles, San Francisco, or Phoenix.

- Diverse Job Market: Beyond hospitality, industries like healthcare, tech, and logistics are growing.

- Year-Round Sunshine: With warm weather and outdoor activities, the quality of life is high.

- Variety of Communities: From suburban family-friendly neighborhoods to luxury high-rises on the Strip, there’s something for everyone.

Step 1: Decide Where to Live

Las Vegas isn’t one-size-fits-all. Choosing the right neighborhood will depend on your lifestyle, commute, and budget.

Popular Areas for New Homebuyers

- Summerlin: Master-planned luxury, great schools, and access to Red Rock Canyon.

- Henderson: Family-friendly with parks, schools, and Lake Mead nearby.

- North Las Vegas: Affordable homes and lots of new development.

- Downtown & Arts District: Perfect for professionals and those who love an urban vibe.

- High-Rises on the Strip: Great for investors or buyers seeking resort-style living.

Because each area has its own personality, it’s worth exploring different neighborhoods before deciding where to buy.

Step 2: Understand the Las Vegas Housing Market

The Las Vegas market can move quickly, so being prepared is essential.

- Median Home Prices: They are generally lower than coastal cities, but prices have been rising steadily.

- New Construction: Builders are offering incentives like closing cost credits, especially in Henderson and North Las Vegas.

- High-Rise Condos: These remain popular among investors and second-home buyers.

So whether you’re looking for a starter home, new build, or luxury property, there are options for every budget.

Step 3: Get Pre-Approved Before You Shop

If you’re relocating, one of the smartest moves you can make is getting pre-approved for a mortgage before you start house hunting.

- Why It Matters: Pre-approval shows sellers you’re serious, and it helps you understand your budget.

- Local Expertise: Working with a Las Vegas-based lender like The Derek Parent Team ensures you have someone who understands local market conditions.

- Loan Options: First-time buyers, veterans, and even investors can qualify for loan programs with low down payments or special benefits.

Because the market is competitive, pre-approval can give you an edge when making an offer.

Step 4: Plan for Moving Logistics

Relocating isn’t just about finding the right house—it’s also about making the move smooth.

- Hiring Movers: Decide whether you want a full-service mover or a DIY truck rental.

- Timing Your Move: Avoid peak summer heat if possible; spring and fall are easier months to relocate.

- Utilities and Services: Set up water, power, internet, and trash collection ahead of time so your home is ready when you arrive.

- Driver’s License & Registration: Nevada requires new residents to update their license and car registration within 30 days.

Step 5: Adjusting to Life in Las Vegas

Las Vegas offers more than just nightlife. Here’s what new residents quickly learn:

- Entertainment & Dining: From world-class shows to local food scenes, you’ll never run out of options.

- Outdoor Adventures: Red Rock Canyon, Lake Mead, and Mount Charleston are all within driving distance.

- Community Life: Many neighborhoods host farmers markets, festivals, and fitness events, making it easy to meet people.

- Weather: Summers are hot, but the dry climate and mild winters balance it out.

Because Las Vegas blends city living with outdoor beauty, it’s a place where you can shape the lifestyle you want.

Tips for New Homebuyers Relocating to Las Vegas

- Visit Before You Buy: If possible, spend time exploring neighborhoods to see where you feel most comfortable.

- Work With Local Experts: Realtors and lenders who know the market can save you time and money.

- Think About the Commute: Traffic is lighter than in many cities, but location still matters if you work near the Strip or Downtown.

- Budget for HOAs: Many communities in Las Vegas have homeowners’ associations, so factor those fees into your monthly costs.

- Stay Flexible: The perfect home may not check every box, but focus on your top priorities.

Final Thoughts

Relocating to Las Vegas is exciting because the city offers a mix of affordability, opportunity, and lifestyle you won’t find anywhere else. From Henderson’s family-friendly communities to Summerlin’s master-planned luxury, there’s a neighborhood that will feel like home.

The key is preparation: understanding the market, securing financing, and working with local experts who can guide you every step of the way.

If you’re ready to make Las Vegas your new home, reach out to The Derek Parent Team. With decades of experience in the local mortgage industry, we’ll help you secure the right loan and make your relocation as smooth as possible.

Reverse Mortgages Explained: A Retirement Strategy for Homeowners 62+

For many homeowners, their house is their biggest asset. But when retirement comes around, savings may not stretch as far as expected, and fixed incomes can feel tight. That’s why more and more seniors are exploring reverse mortgages as a retirement strategy.

If you’re 62 or older, a reverse mortgage can allow you to tap into your home equity without selling your home or making monthly mortgage payments. Here’s how it works—and why it could be the financial solution you’ve been looking for.

What Is a Reverse Mortgage?

A reverse mortgage is a special type of loan available to homeowners 62 and older. Instead of you making payments to the lender, the lender pays you.

You can receive funds as:

- A lump sum

- Monthly payments

- A line of credit you draw from when needed

The most common reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is federally insured.

How It Works

With a reverse mortgage:

- You must continue to live in the home as your primary residence.

- You’re still responsible for property taxes, insurance, and maintenance.

- The loan balance grows over time, and is repaid when you sell, move out, or pass away.

Because no monthly mortgage payments are required, it frees up cash flow during retirement.

Benefits of a Reverse Mortgage

- Supplement Retirement Income

Use your home equity to cover living expenses, medical costs, or even travel. - Stay in Your Home

You don’t need to sell or downsize to access your equity—you can stay right where you are. - Flexibility

Choose how you receive the funds—lump sum, line of credit, or monthly income. - Non-Recourse Protection

You or your heirs will never owe more than the home’s value, even if the loan balance grows larger. - No Monthly Mortgage Payments

This can dramatically reduce financial stress in retirement.

Things to Consider

A reverse mortgage isn’t the right fit for everyone. Here are a few important considerations:

- Home Equity Requirements: The more equity you have, the more you can access.

- Costs & Fees: Like any loan, reverse mortgages have upfront costs.

- Impact on Inheritance: Since the loan is repaid when the home is sold, heirs may receive less.

- Staying in the Home: If you plan to move soon, a reverse mortgage may not make sense.

Who Can Benefit Most?

Reverse mortgages work best for:

- Seniors on fixed incomes who want extra financial flexibility

- Homeowners who plan to stay in their home long-term

- Retirees who want to eliminate existing mortgage payments

- Families who want to preserve other retirement assets by leveraging home equity first

Reverse Mortgage in Las Vegas

In Las Vegas, where home values have appreciated significantly, many retirees have built up substantial equity. Instead of selling, a reverse mortgage lets you enjoy the lifestyle you’ve worked hard for—whether that means helping family, traveling, or simply covering monthly expenses comfortably.

Final Thoughts

A reverse mortgage can be a powerful retirement strategy for homeowners 62 and older. It allows you to convert home equity into usable income while staying in your home and eliminating monthly mortgage payments.

Like any financial decision, it’s important to weigh the pros and cons and talk with a trusted advisor.

If you’d like to explore whether a reverse mortgage is right for you, connect with The Derek Parent Team. We’ll walk you through your options and help you decide if this strategy fits your retirement goals.