Is Now the Best Time to Buy a High-Rise in Las Vegas?

Las Vegas is known for its luxury condos, Strip views, and vibrant real estate market—and high-rise living remains one of the most attractive lifestyle and investment choices in the city.

But with interest rates fluctuating, home prices adjusting, and inventory levels shifting, many buyers are asking: “Is now really the best time to buy a high-rise in Las Vegas?”

The answer depends on your goals, but let’s break it down.

Why High-Rises Are So Appealing in Las Vegas

High-rise living isn’t just about having floor-to-ceiling views of the Strip—it’s about lifestyle and long-term value. Buyers and investors are drawn to high-rises because:

- Location: You’re close to world-class dining, entertainment, and business centers.

- Amenities: Pools, gyms, valet, concierge, and 24-hour security make it turnkey living.

- Investment Potential: High-rises attract tourists, executives, and second-home buyers.

- Prestige: Towers like Waldorf Astoria, Veer, and Panorama offer exclusivity you won’t find in traditional neighborhoods.

So whether you’re buying for yourself or as an investment, the appeal is undeniable.

Current Market Conditions

The high-rise market in Las Vegas has its own rhythm compared to traditional single-family homes. Here’s what’s happening now:

- Moderating Prices: Prices have leveled after years of strong appreciation, which can mean opportunity for buyers.

- Stable Demand: Professionals, retirees, and investors still see value in condo living, especially in prime locations.

- Interest Rates: While mortgage rates remain higher than the lows of a few years ago, many experts predict modest declines in 2025 and beyond. That means buying now could let you refinance later.

- Inventory: There are more choices today than during peak demand cycles, giving buyers leverage to negotiate.

The Case for Buying Now

There are several reasons why buying a high-rise today could be a smart move:

- Lock in Today’s Price

If rates drop next year, buyer demand will spike again. More buyers = more competition = higher prices. Acting now can help you secure a unit before that rush. - Refinance Potential

You can always refinance if rates go down, but you can’t go back in time and buy the same condo at a lower price once appreciation kicks in. - Lifestyle Benefits Immediately

Beyond numbers, buying now means you get to enjoy the lifestyle right away—Strip views, concierge service, and lock-and-leave convenience. - Negotiation Leverage

With more inventory, sellers may be more open to concessions like closing cost credits or furniture packages.

The Case for Waiting

To be fair, there are reasons some buyers choose to wait:

- Rates Could Improve: A 0.5–1% drop in interest rates could save you hundreds per month.

- Economic Uncertainty: If the broader economy slows, prices could soften further in some towers.

- HOA Considerations: Some buyers like to take extra time to research HOA reserves, rules, and fees before jumping in.

So if your timeline is flexible and you’re not in a rush, waiting to see how the market unfolds may be worth considering.

What Buyers Should Really Focus On

Instead of just asking “when,” the better question might be: “What am I buying for?”

- If it’s a lifestyle purchase: The sooner you buy, the sooner you enjoy it.

- If it’s an investment: Look at rental demand, HOA fees, and long-term appreciation potential more than short-term rate swings.

- If it’s about timing the market: Remember that perfect timing rarely exists. Most successful buyers focus on the long-term, not chasing the exact bottom.

Expert Tip: Financing High-Rises is Different

Not all lenders are comfortable with condo financing—especially in high-rise towers with stricter guidelines. That’s where experience matters.

At The Derek Parent Team, we’ve specialized in high-rise financing for decades. We were the in-house lender at Veer Towers, and we’ve helped buyers close loans in nearly every luxury tower in Las Vegas. We know which properties qualify for conventional loans, which require jumbo financing, and how to navigate complex HOA requirements.

Final Thoughts

So, is now the best time to buy a high-rise in Las Vegas?

- Yes, if: You want to secure today’s prices, enjoy the lifestyle now, and take advantage of future refinancing opportunities.

- Maybe wait, if: You’re strictly focused on rates and are comfortable delaying your purchase for potential savings.

The truth is, high-rise living in Las Vegas has long-term appeal no matter what rates do in the short term. The key is aligning your purchase with your personal goals, lifestyle, and budget.

If you’re considering a high-rise purchase, let’s talk. The Derek Parent Team can walk you through financing options, tower comparisons, and strategies to make your investment as strong as possible.

First-Time Homebuyer Guide: Buying a Home in Las Vegas

Buying your first home is one of the biggest milestones of your life, and in a city like Las Vegas—where the real estate market moves quickly, neighborhoods each offer a unique lifestyle, and financing options can feel overwhelming—it’s important to have the right guidance.

This guide will walk you through everything you need to know as a first-time homebuyer in Las Vegas. From preparing your finances to choosing the right neighborhood, you’ll see the steps that make your purchase smoother and more successful.

Why Las Vegas is a Great Place for First-Time Buyers

Las Vegas isn’t just the “Entertainment Capital of the World.” Over the last decade, it has grown into a thriving city with family-friendly communities, expanding job opportunities, and a strong real estate market. Here’s why first-time buyers are drawn to Vegas:

- Affordability Compared to Other Major Cities: Prices have risen, but Las Vegas is still more affordable than many coastal markets like Los Angeles or San Francisco.

- No State Income Tax: Nevada has one of the most tax-friendly environments, so homeowners keep more of their income.

- Variety of Communities: You can choose a modern condo on the Strip, a new build in Summerlin, or a quiet neighborhood in Henderson—because the city has something for everyone.

- Strong Job Market: With tourism, technology, and logistics industries growing, the local economy provides stability for homeownership.

Step 1: Prepare Your Finances

Before you start shopping for homes, it’s important to take an honest look at your finances, because being prepared will make the process less stressful.

Check Your Credit Score

Your credit score plays a big role in determining what kind of mortgage you qualify for and the interest rate you’ll receive. Aim for a score of 620 or higher, but some loan programs can work with lower scores.

Save for a Down Payment

Traditionally, buyers put down 20%, but in today’s market, first-time homebuyers have more flexible options:

- FHA loans can require as little as 3.5% down.

- VA loans (for veterans and military families) often require no down payment.

- Conventional loans may allow for 3–5% down.

Get Pre-Approved for a Mortgage

Pre-approval not only shows sellers you’re serious, but it also gives you a clear picture of your budget. A local lender like The Derek Parent Team can walk you through the process and help you choose the right loan for your situation.

Step 2: Understand the Las Vegas Market

The Las Vegas housing market can be competitive, and prices vary depending on location, amenities, and demand.

- Entry-Level Homes: Many first-time buyers start with townhomes or smaller single-family houses.

- New Construction: Builders in Summerlin, North Las Vegas, and Henderson often offer incentives like closing cost assistance, so these can be a great option.

- High-Rise Condos: If you love city living, high-rises near the Strip offer luxury amenities but often come with HOA fees.

Because the market changes quickly, it’s smart to work with a professional who can help you set realistic expectations. You might face multiple-offer situations, so being prepared will give you an advantage.

Step 3: Choose the Right Neighborhood

Las Vegas is made up of diverse communities, and each has its own lifestyle. Here are a few popular areas for first-time buyers:

- Summerlin: Known for its master-planned communities, great schools, and parks. It’s perfect for families and professionals.

- Henderson: Offers a suburban feel with access to Lake Mead, shopping, and family-friendly neighborhoods.

- North Las Vegas: More affordable options with newer builds and expanding amenities, so it’s ideal if you’re looking for value.

- Southwest Las Vegas: Up-and-coming with plenty of new construction and easy access to the Strip.

Think about your lifestyle and priorities. Do you want to be close to work, or do you prefer quiet streets? Do you need great schools, or are amenities more important? Your answers will help narrow your search.

Step 4: Work with the Right Real Estate and Mortgage Professionals

Buying your first home can feel overwhelming, but you don’t have to do it alone. Having a trusted team by your side makes all the difference.

- Realtor: Helps you find properties, negotiate offers, and guide you through closing.

- Mortgage Lender: Assists with financing options, pre-approvals, and making sure your loan closes smoothly.

- Home Inspector: Ensures your home is in good condition before you buy.

At The Derek Parent Team, we specialize in helping first-time buyers navigate financing options in the Las Vegas market. Because we’ve been in the industry for decades, we know how to make the process simple and stress-free.

Step 5: Make an Offer

Once you’ve found the right home, it’s time to make an offer—and strategy is everything.

- Be Competitive: In a hot market, lowball offers often get rejected.

- Include a Strong Pre-Approval Letter: This reassures the seller you’re financially ready.

- Consider Seller Incentives: Builders and sellers sometimes offer credits toward closing costs, so ask your agent to negotiate these for you.

Step 6: Closing the Deal

The closing process typically takes 30–45 days. During this time, you’ll:

- Finalize your mortgage paperwork

- Complete inspections and appraisals

- Sign your closing documents

It can feel like a lot, but once you’re done, you’ll officially get the keys to your new home.

Tips for First-Time Homebuyers in Las Vegas

- Don’t Skip the Inspection: Even if the home looks perfect, inspections can reveal costly issues.

- Know Your Budget Beyond the Mortgage: Property taxes, HOA fees, and utilities all add up, so plan ahead.

- Think Long-Term: Buy a home you can grow into, not just one that works for right now.

- Stay Flexible: The right home might not check every single box, but it should meet your most important needs.

- Leverage First-Time Buyer Programs: Nevada offers down payment assistance and other incentives, so take advantage if you qualify.

Final Thoughts

Buying your first home in Las Vegas is an exciting step, and with the right preparation, it doesn’t have to feel overwhelming. The city has a strong economy, a wide range of neighborhoods, and flexible financing options—so there’s truly something for every type of buyer.

The key is preparation: understanding your finances, working with trusted professionals, and knowing what to expect in the market.

If you’re ready to take the next step, connect with The Derek Parent Team. We’ll guide you through the process, answer your questions, and help you secure the right loan for your first home in Las Vegas.

7 Smart Steps to Prepare for Homeownership in Today’s Market

Ready to buy a home? DerekParentTeam.com shares 7 essential steps to prepare for homeownership, improve your credit, and secure the best mortgage rates in today’s competitive market.

Buying a home is one of the most exciting—and financially significant—decisions you’ll ever make. Whether you're a first-time buyer or re-entering the market, preparation is key to success.

At DerekParentTeam.com, we guide individuals and families through every step of the home loan process—from improving your credit score to locking in the best rate possible. In this post, we're breaking down 7 smart steps to prepare for homeownership in today’s real estate market.

Let’s make your dream home a reality.

1. Check & Improve Your Credit Score

Your credit score directly impacts your mortgage eligibility and interest rates. Review your credit report early and look for:

-

Errors or outdated accounts

-

High credit card balances

-

Missed payments

Pro Tip: Aim for a score of 680+ to access better loan terms, though FHA loans may be available with lower scores.

2. Calculate Your Budget Before You Shop

Before house hunting, know what you can actually afford. This includes:

-

Monthly mortgage payments

-

Property taxes

-

Homeowners insurance

-

HOA fees (if applicable)

Use our Mortgage Calculator to get started.

3. Get Pre-Approved, Not Just Pre-Qualified

Pre-approval shows sellers you're a serious buyer and gives you a clearer picture of your loan amount. At Derek Parent Team, we offer fast, personalized pre-approvals so you can shop with confidence.

4. Avoid Major Financial Changes

Once you’re planning to buy, try not to:

-

Open new credit lines

-

Make large purchases (like a car)

-

Switch jobs

Lenders want to see financial stability before approving your mortgage.

5. Start Saving for the Down Payment & Closing Costs

While some loans allow as little as 3% down, a larger down payment can lower your monthly payments and eliminate PMI (Private Mortgage Insurance).

Don't forget to save for:

-

Closing costs (2–5% of home price)

-

Home inspections

-

Moving expenses

6. Understand Your Loan Options

There’s no one-size-fits-all loan. Common types include:

-

Conventional Loans

-

FHA Loans

-

VA Loans (for veterans)

-

Jumbo Loans

We’ll help you compare options to find the best fit for your budget and goals.

7. Partner With a Trusted Mortgage Team

Your mortgage lender is your financial partner through this journey. With over 20 years of experience, Derek Parent and his team offer:

-

Personalized mortgage strategies

-

Competitive rates

-

A smooth, transparent process from application to closing

Get Started Today with a free consultation!

Final Thoughts:

The housing market may change, but preparation will always give you the edge. By taking these 7 steps, you’ll be in a stronger position to buy a home you love—with a mortgage you can afford.

When you're ready, The Derek Parent Team is here to help you navigate your home loan with clarity and confidence.

Why The Holidays are a Great Time to Refinance Your Mortgage

If you're a homeowner in Las Vegas and you want to lower your mortgage payment and/or consolidate your debt, then refinancing might be the right option for you!

So how does it Work?

Well, its not always that simple. There are many factors that determine if refinancing is right for you, such as interest rates and your current equity in your home. It also depends on what your current needs are. Do you want to lower your monthly payments and interest rate? Or do you want to cash out to consolidate your debt in time for the holiday season? There are different types of refinancing options to choose from.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The other option is a cash-out refinance - This is where you refinance your mortgage for more than you currently owe, then pocket the difference. Sounds great, right? Well, there are many factors that go into the process of cash-out refinancing. For example, you will need to apply and submit various documents, get an appraisal on your home, and have a good standing with your current mortgage for the past 12 months. However, if you qualify, cashing out is a great way to consolidate your debt and put more money in your pocket during the holiday season! Please note that when you do a cash out refinance, you are not eliminating your debt. You are consolidating it through your mortgage and will pay it off through your monthly loan payment.

The good news is that the Las Vegas real estate market is booming! Interest rates are competitive, and home values are increasing. That means that the majority of home owners have equity in their homes. You could take advantage of the our refinance options and lower your monthly payments, in addition to "cashing out" the difference.

If you are a homeowner in Las Vegas and you would like to take advantage of our refinance opportunities this holiday season, give us a call at 702-331-8185!

Why it is Good to Buy Now in Las Vegas

Are you wondering if now is the right time to buy in Las Vegas? Still on the fence or a bit unsure? Want

some more information before diving in? Here is some information to know before moving forward.

If you want to get in on the fun, now is a better time than ever. With today's shift towards a buyer's

market, buyers have more options to choose from and negotiate leverage. Because of this, you can find

your dream home without paying over market value, even less! Compared to previous situations of

bidding wars and over-asking, the moment is now to get in. Not to mention the constant increases in

value, you can find yourself making a substantial profit in the coming years.

Unlike renting, mortgage inflation doesn't go up, rent goes up, and the rent gets competitive. So, with less

competition than ever, you have a prime opportunity in your hands. The only question left is, to buy or

not to buy?

Derek Parent Q&A: High Rise Life

- Can you tell us a little bit about your background and how you got involved in the mortgage industry? I stepped into the mortgage industry in 1999 after running into an old friend at a boat show in Rhode Island. It had been a little while since I had seen him last, and there was just something about him that seemed different. We got to talking, and I found out that he was doing quite well for himself as a loan officer in the mortgage industry. I was so inspired, that every day for the following four weeks, I called into his office asking for an interview. I got the job, and just about a year later, I won a trip to Las Vegas based on my efforts. I was stunned. I went back home, grabbed my stuff, bought a one-way ticket back to Vegas and never looked back.

- What do you think has contributed to your success as an expert high-rise lender? Honestly, one of the reasons I became so intrigued with the high rise market was because of my own experience. When I purchased a condo for myself on the Las Vegas strip, I realized just how difficult it was to finance the high rise units. It was a nightmare, so when I closed, I made it my mission to solve the problem. It should not have been that difficult, and I wanted to make sure that I used every resource at my disposal to ensure that no one else had to go through the same thing.

- What do you love most about what you do? The one thing--beyond anything else--that has motivated me to be great at what I do is the satisfaction I get from helping my clients purchase their homes. Yes, there are other rewards in this business, but there is nothing that affects the way I sleep like knowing that I have a small hand in such a large part of my clients’ lives.

- What are some of the core values that the Parent Team carries? No business is sustainable without a strong foundation, and our core values are insanely important to the way we run our business and the way we treat our people. Specifically, we the core values that we live by: honesty, integrity, communication, client-focus and consistency. These qualities are what keep us motivated and grounded as we deal with our success and our frustrations, and they are the reason we have been able to maintain our quality of business over the years.

- You have a growing list of over 125 condo projects available for financing. Can you elaborate on this? The reason that growing list is so important is because our definition of ‘approval’ is so much deeper than most other sources. We do our due diligence in advance rather than during the transaction, which negates a lot of frustration and fall out with the client. One measure that we really look at is having a completed questionnaire and analysis of the condo project before we list it as ‘approved’. In the lending world, the condo questionnaire is a vital piece to knowing whether or not a condo can be financed, and because we do it in advance, the client is able to have full confidence in their purchase.

- What are some of the great promotional offers you currently have for those looking to purchase a high-rise condominium? The most important thing we have right now is that the buyer does not have to pay for their condo questionnaire, which is anywhere from about $200 to $500. Generally, it’s a cost that lenders require the buyer to pay for just to obtain information about the project for the lender. If for some reason the questionnaire details information that does not allow the lender to lend on the property, the buyer loses that money. We take that responsibility off of the buyer because we have already obtained the information from the condo project. Another great offer is that we allow buyers to purchase with only 5% down payment for their principal residence, and for second homes, we only require 10% down. We also provide an option for 10% down payment on jumbo loans.

- What are some essential points homebuyers should address when shopping for a loan? In the high-rise market, the number one thing that buyers should be aware of is if the lender requires them to pay for a condo questionnaire. If the lender is not confident enough to pay for it, there is a large possibility that they cannot finance the condo, and again, if that’s the case, the client will not be refunded and absorbs the cost. Other than that, I would say communication from your loan officer is the second most important factor. It not only makes the process easy, but it ensures your ability to get an offer accepted on the home you want because it gives the real estate agents confidence that the transaction will be smooth and close on time.

- Any exciting new developments with the Parent Team that you would like to share with us? For us, it really starts with our people; we bring on team members that not only bring a lot of value but also add amazing energy. Just recently, we brought on a business development specialist who is dedicated to growing our footprint and building new professional relationships, and we are extremely excited to see what it does for our growth. It has the potential to really extend our reach and allow us the opportunity to help more people accomplish the goal of home ownership.

How Does Divorce Affect Mortgage Borrowing

Let’s face it: getting a mortgage can be a royal pain in the ass regardless of whether or not you’re recently divorced. Unfortunately, adding a divorce to the picture makes it even more difficult, although not impossible. Here are some things to consider:

What to plan for: By providing your mortgage company with the most accurate and true picture of your circumstances — starting with the loan application — you’re helping them to find the best way to structure your loan for a favorable credit decision. The lender will also look at your divorce decree for any other undisclosed/non-credit report financial obligations such as child support, alimony/spousal support paid or received.

If you receive income in the form of child support or alimony: This income can be used for qualifying for the mortgage, so long as there is a six-month history and the income will continue for the next three years, determined by child support or an alimony agreement detailing the terms of the obligation for the party paying the debt.

If you pay alimony or child support: This reduce your borrowing ability as debts reduce income, and income is needed to offset a mortgage payment.

If you are divorced even as long as 20 years ago: Unfortunately, there is no statute of limitations on mortgage loan underwriting. The full divorce decree will be required no matter how many years you have been divorced.

If you own a house and are on a mortgage with an ex-spouse: As long as the divorce decree awards the other party with the home, and the other party is willing to provide supporting evidence that they make the mortgage payments on that home — by providing 12 months of bank statements and/or canceled checks — the total mortgage payment on that home can be omitted from the decision-making process on your new mortgage, which can improve your ability to qualify.

If you and your ex make the mortgage payment from the same joint bank account and the divorce decree awarded the other party with the property: You are both 50-50 responsible because the money is “co-mingled” funds from the same place to pay the obligation. There is no way to support your position that one person is responsible for making the payment because it’s coming from a joint account.

If the ex-spouse is responsible for making the mortgage that you are also on: Explore the possibility of having the ex-spouse refinance you off the mortgage obligation.

If your ex-spouse is refinancing you off a mortgage loan: A final closing statement called an HUD could be required by the lender you’re working with for procuring your loan to omit the payment from the other house.

If you have a joint consumer credit such as credit cards, installment loans, auto loans or even student loans: Unless you can prove the other party is for responsible for the credit obligation (with 12 months of canceled checks or bank statements), those liabilities will be factored into your ability to qualify.

Tips If You’re Not Yet Divorced

It’s so important to create a marital settlement agreement prior to being divorced. This is a precursor to getting a divorce that could be a great asset in helping you qualify for home financing. Navigating the financial questions that inevitably come up during the separation or divorce can easily be taken care of by having a clear delineation in writing on whose property is whose.

Consumers planning a divorce in the future would also benefit by separating their finances. This means having separate bank accounts, and paying any obligations from these separate accounts. If you are trying to get a mortgage, or will be trying to get a mortgage, consider having a conversation with mortgage professional upfront, who can guide you through the complexities in the underwriting process during a divorce.

Tips For First Time Home Buyers

There’s probably hundreds of articles on the internet that are full of useful tips for first-time home buyers. Since our team has been exposed to thousands of loan transactions, we want to give you our expertise and personal advice. The more prepared you are, the smoother the process will be. We love helping our clients achieve their dreams of homeownership!

Check Your Credit Not only does your credit score matter, but your credit history is just as important. It’s not impossible to purchase a home with less-than-perfect credit, but it will be more expensive. In most cases, the lower your credit score is, the higher your mortgage interest rate will be. You also want to be mindful of your debt-to-income ratio, which is your total monthly debts divided by your gross monthly income. If you have substantial credit card debt, your debt-to-income ratio will likely be too high to qualify for a mortgage. Try to keep your debt-to-income ratio equal to or less than 43%.

Apply Now Before House Hunting Many hopeful buyers skip out on this crucial step and find themselves disappointed that they can’t qualify for a home that they fell in love with. Not to mention, you may qualify for more house than you think. You may be shopping for a house in the mid $200Ks range, when you can qualify for a home in the upper $300Ks.

Save Your Money! This seems like an obvious tip, but becoming a homeowner can get expensive. Don’t be discouraged! Just be sure to budget yourself and set enough money aside for your down payment, closing costs, and of course, furnishing your new home. Down payment options start as low as 3.5%, so you no longer have to make a 20% down payment to buy a house.

Corporate Benefits: Helping Employees Manage Their Financial Challenges

Reduce turnover and Boost Culture

The cost of employee turnover is exorbitant, and with statistics looming around every corner, taking a look at what employees are saying is no longer just a suggestion; it’s imperative to creating a culture that clearly represents its company.

HOW TO AVOID TURNOVER BY UNDERSTANDING THE JOURNEY

The decision to join a new organization is often accompanied by leaving another, and new hires are placing bets that their new role will be better than the last, fulfilling a need the previous employer was not. People ask for opinions from friends and family, search online for ratings and reviews and do what they can to find out if a company can help in achieving their personal goals. It is a decision that starts with rational considerations but is ultimately decided based on emotions and the connection that they feel with their new employer, and from the point they make the decision, all interactions build their perception about what it means to be an integral part of the organization. This is why on-boarding needs to be a refined process, offering employees the opportunity to truly feel at home. From a company’s perspective, it is a perfect opportunity to deliver on its value proposition and any other promises made during the hiring process—not only to meet expectations, but to exceed them. Our Corporate Benefits Program is designed to help Organization Name do that without having to subtract anything from its bottom line. There are not many things in life that have more of a correlation than work and home. Being able to play a role in helping employees—brand new or seasoned—establish themselves in their local communities is a crucial factor in earning their trust and giving them confidence in their employer.

“The benefits and perks that employees truly care about are those that offer them greater flexibility, autonomy and the ability to lead a better life… In general, employees are most likely to say they would change jobs for benefits and perks closely related to their quality of life. They are quite interested in jobs that offer them a way to balance work and home better, gain a deeper sense of autonomy and secure their financial future. (Gallup)”

In today’s uncertain economic climate, more businesses are seeking to create workplace environments that offer employees improved value and benefits.

That includes helping to manage personal finances and to prepare for retirement. In fact, two-thirds of North American employers now offer their workers financial education, according to a new report from the Wisconsin-based International Foundation of Employee Benefit Plans. Not only does this addition to employee benefits programs lead to happier and healthier workers, but it also can boost productivity as well as a company’s bottom line.

According to the recent survey Finding the Links Between Retirement, Stress and Health, financial stress can lead to decreased productivity

One-in-five workers reported feeling extremely stressed, mostly because of their job or finances. Those reporting high levels of stress were more than four times as likely to suffer from symptoms of fatigue, headaches, depression or other ailments. They also were twice as likely to report poor health overall, leading to more sick days, increased absenteeism and decreased productivity. Four-out-of-five employers reported that their employees’ personal financial issues were impacting their job performance somewhat, very much or to an extreme degree. This resulted in an increase in stress among employees (reported by 76 percent of employers); workers’ inability to focus at work (60 percent); and absenteeism and tardiness (34 percent). More than a quarter of employers also reported that a significant portion of their workers were challenged by both supporting their children (sometimes grown) and aiding elderly parents.

More companies are realizing that offering health-care and retirement plans is no longer enough and are beginning to look for ways to also help their employees with personal monetary challenges such as housing, home ownership and financial planning.

To help with this process, USA Mortgage is proud to offer its Corporate Benefits Program, a workplace-sponsored Financial Education & Resource Program for employers and organizations throughout Organization name.

PROVIDE YOUR EMPLOYEES WITH EVEN MORE ADDED VALUE

Including special home financing benefits—through the Corporate Mortgage Benefit Program. The program is quick and easy to set up, and once it’s ready to go, there’s nothing more you need to do. You’ll receive uncomplicated communication to share with your employees. Then, we’ll work directly with them to help them understand their home financing options and provide ongoing support every step of the way.

- Personalized support, education and tools your employees need to confidently plan for and move through the home financing process

- Competitive rates and fees on various home financing products and programs

- Employees interact with us where and how they like— in person, over the phone or on-the-go

BUYING OR REFINANCING A HOME

Through our Corporate Benefits Program, you’ll be able to easily locate financing that meets your needs and supports your homeownership goals. You’ll find competitive rates and fees on an array of loans and programs, with special options also available for those who are planning to build a new home or undergo home improvements. As an experienced home mortgage consultant, I can offer you personal guidance throughout the entire home financing process.

CONVENIENT TOOLS AND RESOURCES

Online educational videos on my website can help you prepare to buy a home and learn about the home financing process.

- Find the ideal mortgage using our home loan shopping tools and calculators.

- Once you’ve applied, check your loans’ progress via a computer, smartphone or tablet with your LoanTracker.

- Manage your mortgage and other PERL accounts online.

REALIZE YOUR HOMEOWNERSHIP GOALS

You might be eligible to make a down payment as low as 3 percent on a fixed-rate loan for a single-family home with your first mortgage. You’ll have a chance to lower your interest rate through homebuyer education. To ensure eligibility, ask me about the loan amount, type of loan and type of property.

Benefits for Everyone

BENEFITS TO COMPANIES:

- Increased employee loyalty

- Reduced absenteeism.

- Improved financial well-being.

- Since buying a home is one of the top three stressful endeavors, less stress = more productive employees!

- Minimal administration required by your company; we do most of the work.

- Exclusive co-branded benefits website accessible to your employees and their families!

- No cost to your company or organization.

BENEFITS TO EMPLOYEES:

- All employees are eligible, and it’s completely voluntary.

- Educational materials are accessible through the co-branded benefits website.

- “Lunch & Learn” seminars are available.

- An exceptional team of real estate and financial experts are hand-picked and pre-screened for the benefit of participating members.

- A one-on-one relationship and a concierge experience working with a Mortgage Advisor and team.

- Professional advice and customized mortgage solutions for each borrower.

- Discounts on real estate commissions, home inspections, closing costs, moving expenses and more!

- Valuable savings when buying, selling and refinancing a home.

- Discounts on products and services in your area.

Homeownership for Future Employees

PROJECTED INCOME MORTGAGES

With a job offer letter mortgage, your future employees may qualify to buy a home with a non-contingent offer letter. A job offer letter must clearly outline employment terms – namely salary and start date. If that info is present and the income isn’t variable or commission-based, PERL may be able to approve and fund a loan with nothing more than the offer letter for income documentation for your future employees.

Subject to terms and conditions and credit qualification; not a commitment to lend, and not all borrowers may qualify.

PROGRAM REQUIREMENTS

- Income must begin within 90 Days of Closing (60 days for VA/FHA/USDA)

- Is non-contingent or provide documentation, such as a letter or e-mails from the future employer verifying all contingencies have been cleared, and

- Includes the terms of employment, including employment start date, position, and annual income based on salary (e.g., hourly earnings are not permitted)

- For a salary increase, documentation must indicate that the increase is fully approved and is explicitly granted to the employee

- Reserves are required covering 6 months principal, interest, taxes, and insurance

Open Doors, Unlock Opportunities: VA Home Loans

Program History

The VA program was created with the signing of the GI Bill by President Franklin D. Roosevelt on June 22, 1944. This law provided veterans with federally guaranteed home loans with no down payment.

This benefit was intended to stimulate jobs in the housing industry, as well as providing assistance for veterans and their families. The maximum loan amount at the time was $2,000, 50% of that guaranteed by the government.

VA Loans — Veteran’s Best Friend

- No down payment required up to county limits: http://www.loanlimits.org/va/

- No monthly Mortgage Insurance – helps to qualify for larger loan

- Seller contributions allowed up to 4% of value…above and beyond payment of standard closing costs

- Fees that can be paid by the veteran are limited

- 100% gift funds allowed

- No minimum reserve requirements (conforming limits)

- Make sense underwriting

- Veteran can use entitlement multiple times

- Fixed rate assumable loan (as approved by VA/servicer)

- Assistance/counseling to veterans in default due to temporary financial difficulty

- Vets qualify for home loan benefits after 2 years of service (less if served prior to 1980), or 90 days active duty during the Persian Gulf era; Reservists and National Guard eligible after 6 years (or 90 days active duty in Gulf)

- Unmarried surviving spouse of a veteran who died while in service or from a service connected disability may use benefits

To Recap...

- No Monthly Mortgage Insurance

- 100% LTV Purchase or Refinance

VA Financing is on the rise, but still under-utilized.

- Only an estimated 5% of U.S. Veterans and qualified military

personnel have used their home loan benefits.

What does this mean to you? Home financing made simple!

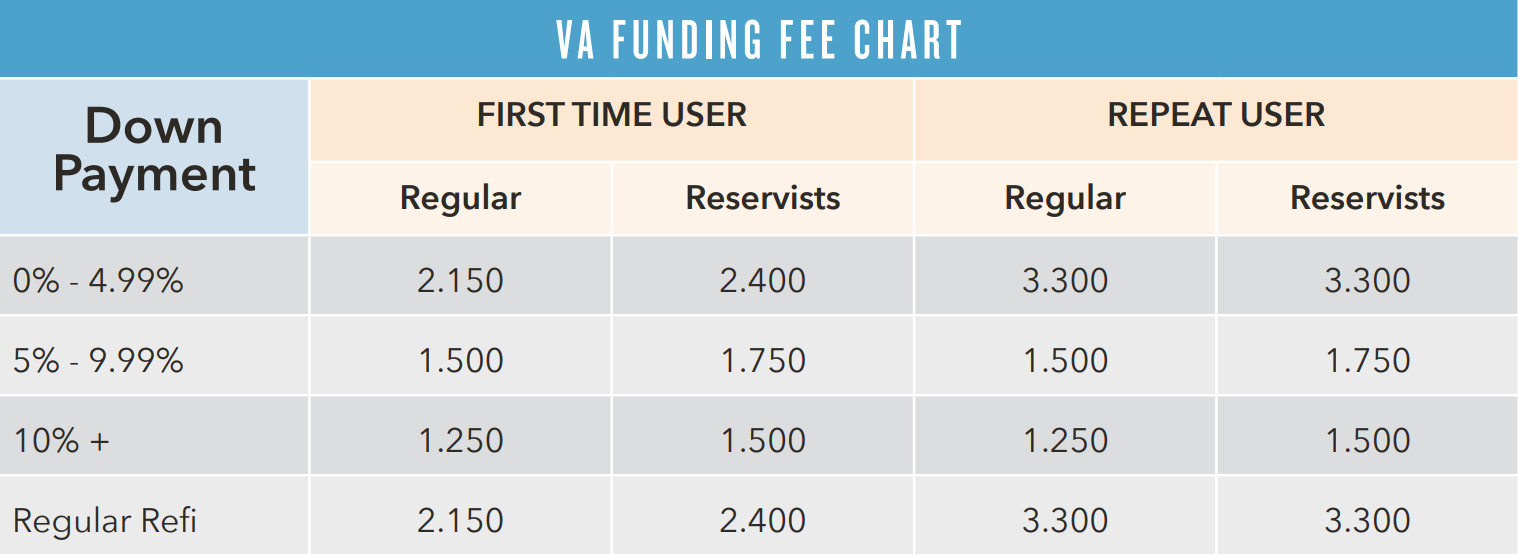

VA Funding Fee

- Although there is no monthly mortgage insurance on a VA loan, the veteran does have a onetime Funding Fee. On loans below county limit, this can be financed into the loan over and above the appraised value/sales price, or can be paid in cash (or a combination of both).

- The Funding Fee may be waived in the following instances (as evidenced on the “Certificate of Eligibility”):

- Veterans receiving VA compensation for service-connected disabilities

- Vets who would be entitled to receive compensation if not receiving military retirement pay

- Loans for surviving spouses of vets who died in service or from service-connected disabilities

- Funding Fee is calculated as a percentage of the loan amount. For example, on a $400,000 loan with a 2.15% VAFF = $8,600. Total loan amount = $408,600

TIP: Ask the Vet to put down 5% to reduce the Funding Fee!

Down Payments & Loan Amounts

Loan Programs: 30, 25 & 20 Yr. Fixed (PERL – conforming); High Bal, 15 Yr. & 5/1

The VA will guarantee 25% of the loan up to the county limit. Because of this, there is no down payment at or below the county limit: http://www.loanlimits.org/va/

Above county limits, the borrower is required to make a minimal down payment in the amount of 25% of the difference between the sales price and county limit (see example below).

Example

$458,850 - VA Loan Limit for Chesapeake County

$550,000 - Sales Price

$550,000 Sales Price - $458,850 County Limit = $91,150 difference

$91,150 difference x 25% required down = $22,787 down payment

$550,000 Sales Price - $22,787 down = $527,213 max VA loan (a 95.8% LTV in this case!)Hint: If the borrower has 5% to put down, the Funding Fee will be reduced to 1.5%!

The Advantage - Selling the Seller

Overcome the seller’s objections about dealing with a VA buyer! With PERL Residential Lending, the seller does not need to pay all the “non-allowable” fees!

- VA allows the non-allowable fees to be paid by the borrower up to 1% if an origination fee is not charged.

- These fees include lender fees (processing, underwriting etc.), escrow fee, termite inspection (depending on state), notary fee, messenger fee and any other non-allowable fee.

- It generally costs the borrower less than the one percent so all parties benefit.

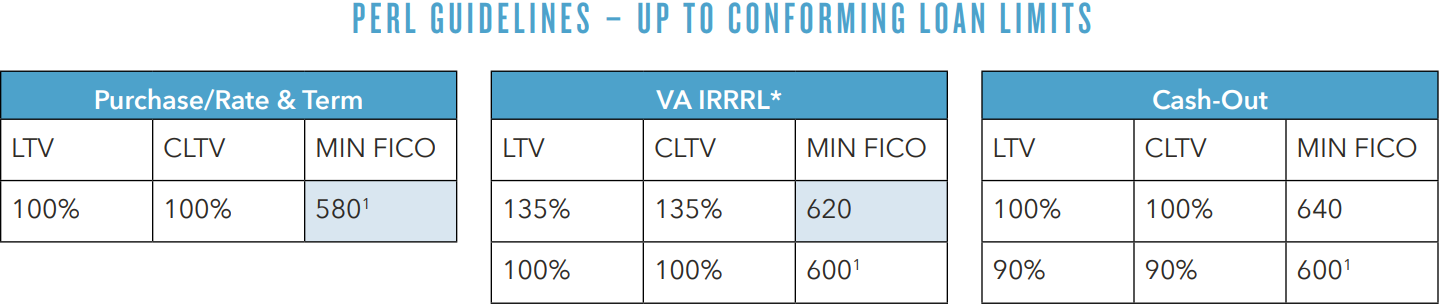

LTV/Credit

NOTE: The LTV/CLTV is exclusive of Financed VA Guaranty Funding Fees (Except for IRRRL)

1Minimum credit score for manufactured housing is 620

Underwriting — IRRRLs

A VA Interest Rate Reduction Refinance Loan (IRRRL) is a refi of an existing VA loan only. Rate and P&I must both be reduced, unless the existing loan is an ARM or the term is decreasing.

The new loan amount may include:

- Unpaid principal balance

- Prepaid expenses

- VA Funding Fee of .50%

- Allowable closing costs

- Max. 2 discount points

Perl IRRRL Guidelines

- Max 135% LTV w/ 620 credit; Max 100% LTV w/ 600 credit (based on total loan amount

- AVM from DataVerify determines LTV; if AVM not adequate, order conventional appraisal

- NEVER order a VA appraisal on a streamline!

- DTI is not calculated – no AUS

- The P&I on the IRRRL must be less than the loan being refinanced (unless going from fixed to ARM or reducing term)

- 0x30x12 on all mortgages

- Max $500 incidental cash back

Underwriting Basics - Credit

Bankruptcy:

- Chapter 7 – generally 2+ years is acceptable; possibly 1-2 years with extenuating circumstances

- Chapter 13 – all payments satisfied OK; possibly OK after 12 months of satisfactory payments with court approval

- VA Jumbos – no BK within past 7 years

Foreclosures:

- Follow same rules as Chapter 7 BK (VA Jumbos – no history of foreclosure within past 7 years)

- Ensure that borrower’s entitlement has been restored (or determine if there’s bonus entitlement)

- Develop complete information on the facts and circumstances of the foreclosure

Other Adverse Credit Items:

- Collections - Aggregate balance of $1,000 or greater must be paid (excluding medical)

- Judgments – Must be paid in full at or prior to closing

Underwriting Basics - Property

Conversion of primary Residence to Rental

- If the veteran is converting a current principal residence to an investment property:

- Evidences of cash reserves totaling 3 months PITI for each rental property must be provided.

- The borrower may qualify using 75% of the gross rental income to offset the mortgage payment.

- Borrower may use entitlement multiple times – Veteran must occupy the property as his/her primary residence

when purchased. - Income from existing rental properties claimed on the borrower’s Schedule E may be used. With 2 years, positive

net rents may be used as income. Less than 2 years, can be used to offset mortgage. - Unlike FHA, the VA has no “flip” rule or restrictions. Sales price appreciation simply must make sense.

Underwriting Basics - Liabilities

Need a boost? VA Underwriting makes sense!

VA Recommended Compensating Factors include (but are not limited to):

- Excellent Credit History

- Conservative use of consumer credit

- Minimal consumer debt

- Long-term employment

- Significant liquid assets

- Sizeable down payment (purchases)

- Significant equity (refi’s)

- Little or no payment shock

- High residual income (more info on next slide)

- Low DTI

- Tax benefits for home ownership

Compensating factors can be used to justify expanded DTI or payment shock, but CANNOT be

used to offset unsatisfactory credit.

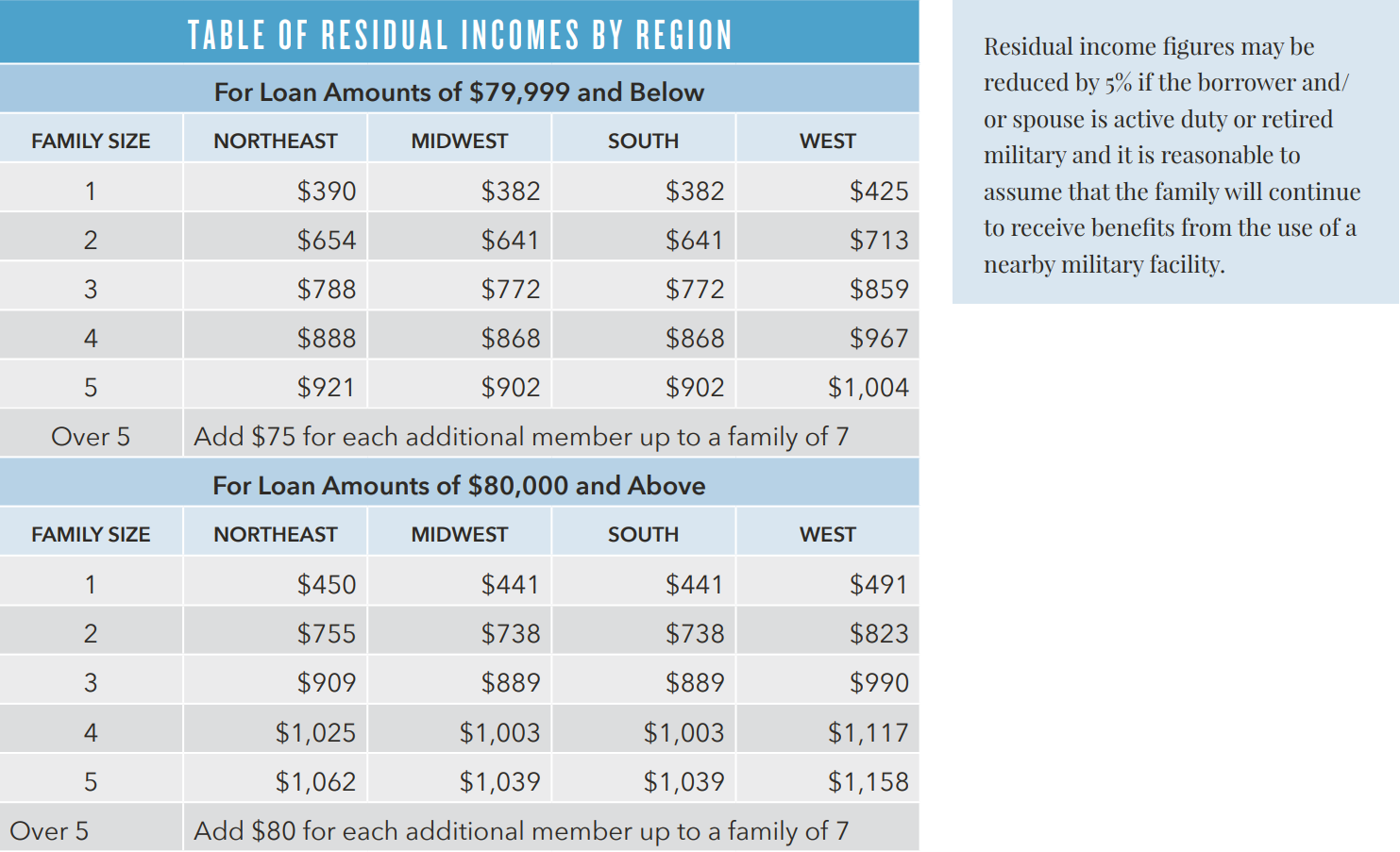

Underwriting — Residual Income

Residual income is the amount of net income remaining to cover family living expenses (food, health care, clothing, etc.). All household members are included in family size, with the exception of: a) a non-borrowing spouse who has a stable, reliable income sufficient to support expenses, or b) a child for whom sufficient foster care or child support payments are received regularly.

Appraisals & Collateral

- Appraisals are ordered through the Veteran’s Information Portal and assigned by the VA.

- The subject property must meet VA Minimum Property Requirements prior to loan funding. This will affect properties being sold “as is.” Repairs noted on the appraisal must inspect the repairs and issue a clear inspection report prior to funding.

- All VA Purchases requires a clear termite report, excluding condos on the 2nd story or higher.

- Any required repair items or deficiencies will be noted on the appraisal report.

Most VA appraisals do not require repair work!

What Else Do I Need To Know?

- Borrowers must occupy the property. No Investment or 2nd Home purchases allowed (IRRRL OK).

- VA borrowers may own other property, as long as the subject property will be owner occupied.

- Non-occupant co-borrowers are not permitted to help qualify.

- Non-traditional credit is allowed on a case by case basis.

- Condos must be on the VA approved condo list. There are no “spot approvals.”

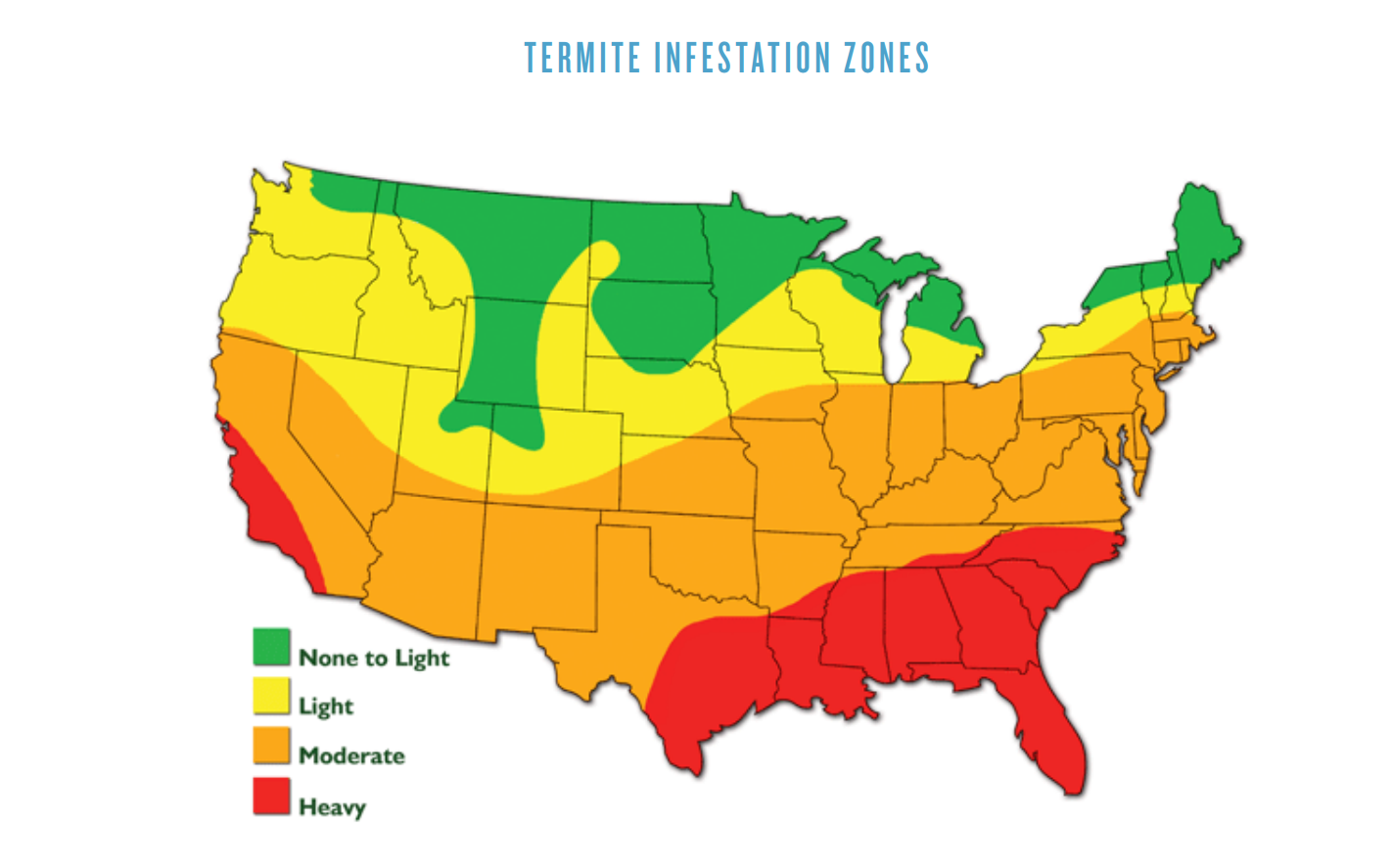

- Termite report and clearance is required (except IRRRL’s) on existing properties in areas where the probability of infestation has been defined as “very heavy” or “moderate to heavy” by the IRC. Check with VA Regional Loan Center for final determination.

- Clear CAIVRS is required for all borrowers.

- VA is often confused as a “First Time Homebuyer” program, but this is not the case.

- This program is open to all Veterans, active duty military, qualified reservists/National Guard, and un-remarried surviving spouses of service-connected death.

Summary of VA Advantages

- No down payment required. See County List for limits.

- Maximum seller contributions 4%+

- 100% gift funds allowed

- No minimum reserve requirements

- Make sense underwriting

- Citizenship is not required

- Veteran can use entitlement many times

- Not limited to First Time Homebuyers

- Fixed rate assumable loan

- Reservists/National Guard qualify for VA benefits

- Manufactured homes OK

- Quick closings

- Underwritten at PERL

Why PERL?

Experienced Realtors and Veterans trust and choose PERL!

- Purchase and Refinance specialists in VA, FHA and Conventional loans.

- We understand the demands and pressures of a Realtor driven purchase market.

- We know the importance of closing on time to the buyer, seller, and Realtor.

- Experienced, quality Mortgage Loan Originators who provide individual service.

- Dedicated Government Lending department and senior management team with decades of experience.

Resources

- VA Loan Guaranty Homepage

- General Rules for Eligibility

- Lender’s Handbook

- 2016 County Limits

- Appraisal Fee Schedules

- VA Regional Loan Centers

- VA Condo Search

- VIP (Veterans Information Portal)

- VA Forms

- Veterans Association of Real Estate Professionals