Gifting a Home

Are you planning on gifting a home to someone this holiday season? For most people, a gift this generous is probably out of the question. But maybe you had a good year financially, and a family member needs the help. Whatever the case is, here are some guidelines when it comes to giving the gift of real estate.

Buying a new home outright

Instead of buying a new home outright, it may be wise to gift the cash for the home, NOT the home itself. Everyone has their own preferences when it comes to what they want in a home, so allowing the recipient of your generous gift to choose their home is probably a much safer idea.

We highly recommend running this by your accountant, as you may also need to file a gift tax return.

Gifting the down payment

Gifting money for a down payment works in pretty much the same way—except when it comes to the mortgage. If there’s even the slightest hint that the money is a loan rather than a gift, it can hinder the recipient’s ability to get a mortgage.

You’ll want to work closely with the recipient’s lender to file the appropriate paperwork, which will include a verified gift letter certifying the funds are a gift, not a loan. The lender will also likely need to examine your finances to determine if you’re able to gift. And remember, most lenders won’t permit gifts from nonfamily members.

Gifting an existing home

Would your children love to own the home they grew up in? Unfortunately this is a poor option, especially if both parents are still living.

One of the tricky struggles with gifting a home you own is the differential between the cost basis (what you first paid for the house) and the current fair market value—which could be hundreds of thousands of dollars, depending on how long you’ve owned it and the appreciation in the area.

This might not matter if your children plan to live in the home forever: The gift will be subject to your gift tax limit, and they’ll only pay capital gains tax if they sell. But if (and, likely, when) they sell, they’ll be stuck paying taxes on the difference.

If you’re determined to gift someone a home this holiday season, remember to keep these guidelines in mind. It IS possible, but of course it’s extremely important to consult your accountant and/or financial advisors to ensure it’s done in the right way.

Why The Holidays are a Great Time to Refinance Your Mortgage

If you're a homeowner in Las Vegas and you want to lower your mortgage payment and/or consolidate your debt, then refinancing might be the right option for you!

So how does it Work?

Well, its not always that simple. There are many factors that determine if refinancing is right for you, such as interest rates and your current equity in your home. It also depends on what your current needs are. Do you want to lower your monthly payments and interest rate? Or do you want to cash out to consolidate your debt in time for the holiday season? There are different types of refinancing options to choose from.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The traditional refinance option allows you to get a new mortgage with a different interest rate and terms. This could help you lower your monthly payment and start saving! Interest rates fluctuate, meaning they go up and down. So, there's a chance that you can get a lower rate on your mortgage and start saving money every month! Note that when you refinance your mortgage you are starting from the beginning of the set terms. For example, if you are 5 years into a 30 year mortgage and you choose to refinance to get a lower rate or payment, you will start at the beginning of the term of the new loan. So, your total finance charges may be higher over the life of the loan.

The other option is a cash-out refinance - This is where you refinance your mortgage for more than you currently owe, then pocket the difference. Sounds great, right? Well, there are many factors that go into the process of cash-out refinancing. For example, you will need to apply and submit various documents, get an appraisal on your home, and have a good standing with your current mortgage for the past 12 months. However, if you qualify, cashing out is a great way to consolidate your debt and put more money in your pocket during the holiday season! Please note that when you do a cash out refinance, you are not eliminating your debt. You are consolidating it through your mortgage and will pay it off through your monthly loan payment.

The good news is that the Las Vegas real estate market is booming! Interest rates are competitive, and home values are increasing. That means that the majority of home owners have equity in their homes. You could take advantage of the our refinance options and lower your monthly payments, in addition to "cashing out" the difference.

If you are a homeowner in Las Vegas and you would like to take advantage of our refinance opportunities this holiday season, give us a call at 702-331-8185!

Tips For First Time Home Buyers

There’s probably hundreds of articles on the internet that are full of useful tips for first-time home buyers. Since our team has been exposed to thousands of loan transactions, we want to give you our expertise and personal advice. The more prepared you are, the smoother the process will be. We love helping our clients achieve their dreams of homeownership!

Check Your Credit Not only does your credit score matter, but your credit history is just as important. It’s not impossible to purchase a home with less-than-perfect credit, but it will be more expensive. In most cases, the lower your credit score is, the higher your mortgage interest rate will be. You also want to be mindful of your debt-to-income ratio, which is your total monthly debts divided by your gross monthly income. If you have substantial credit card debt, your debt-to-income ratio will likely be too high to qualify for a mortgage. Try to keep your debt-to-income ratio equal to or less than 43%.

Apply Now Before House Hunting Many hopeful buyers skip out on this crucial step and find themselves disappointed that they can’t qualify for a home that they fell in love with. Not to mention, you may qualify for more house than you think. You may be shopping for a house in the mid $200Ks range, when you can qualify for a home in the upper $300Ks.

Save Your Money! This seems like an obvious tip, but becoming a homeowner can get expensive. Don’t be discouraged! Just be sure to budget yourself and set enough money aside for your down payment, closing costs, and of course, furnishing your new home. Down payment options start as low as 3.5%, so you no longer have to make a 20% down payment to buy a house.

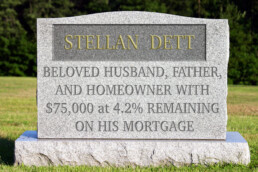

What Happens if You Inherit a Mortgage?

Most homeowners have mortgages, and the sad reality is all homeowners die eventually. And, if a homeowner dies with an outstanding mortgage loan, the mortgage company still expects to be paid. Whether the balance owed will be due all at once or can be paid off over time depends on who inherits the home and the state where thedeceased’s estate is being administered.

What Happens When a Homeowner Passes Away?

If someone dies owing money on a conventional mortgage, the mortgage company must usually be formally notified of the death as part of the probate process. However, if the deceasedtransferred his or her home to a living trust, such notice may be optional. (Sometimes the loan documents require it.)

If the home is owned by spouses and one of them dies, the mortgage company may allow the surviving spouse to make payments without interference since the loan had been extended to both parties.

If, however, the property is inherited by someone else, such as the deceased’s children, or if the home was just in the name of the deceased, the mortgage company may require the new owner to refinance the mortgage or pay the entire loan balance owed within a fairly short period of time. If the new owner is unable to meet its demand, the lender can foreclose on the home. (If the home was ultimately lost to foreclosure, that should not affect the credit of the “heir” because the heir was never personally obligated to pay the mortgage.) Flexibility on the part of the mortgage company in these circumstances is difficult to predict.

What should I do if I can’t pay?

Sometimes, people do not notify the mortgage company of a mortgage holder’s death and simply continue paying the loan. This scenario might happen, for example, if the heir to the home has bad credit, cannot afford to refinance or, alternately, pay the entire balance due, and yet wants to hold on to the house.

This strategy, however, could blow-up in the heir’s face should the mortgage company discover the ruse because the mortgage documents themselves will allow a foreclosure if the company is not notified of the death within a specific period of time.

All 50 states have laws that regulate mortgages at death. The very best option is to consult with an experienced estate attorney in the state where the home is located. That way, you can learn what specific options you may have.

This article was written by Brad Wiewel and originally published on Credit.com.

Trick Your Brain into Saving a Down Payment

Follow these 5 strategies to ensure you meet your long-term goals.

Why is it so difficult to stick with a long-term savings plan even when we truly consider our future goals to be just as important as — if not more than — our current desires? Chalk it up to our hardwiring: The rational side of the brain is often drowned out by the emotional side. Good news: It’s possible to outsmart those (very persuasive) instincts that encourage us to spend even when we know we should be saving.

Here’s how to save money for a down payment — or any other long-term savings goal — without letting those instincts get in the way.

Make it hard to spend

If your money is hard to get to, those impulse buys won’t be as easy to make. Put up some roadblocks by moving your savings from your checking account into a separate account that doesn’t have a debit card attached. Better yet, if you’ve got a separate emergency fund and you’re comfortable with not being able to access it immediately, move it into a money market account or other account with a higher interest rate and forget about it (unless you’re adding to the bottom line, of course).

Automate your savings

Take the task of saving out of your control and set up an automated account that diverts a certain amount of your income each month into a savings account. Because it removes the rationalization factor (“Should I save this month or skip it?”), it also removes the emotional act of negotiating with yourself.

Create specific goals and set reminders

Avoid settling for immediate gratification by forcing yourself to acknowledge your long-term goal regularly. Try posting a picture of your dream home in a highly visible area, pinning some money-saving quotes on your Pinterest board, or creating a clear savings timeline with specific number-based savings goals and saving it to your desktop to update with your daily progress.

Match impulse buys with an equal amount into your savings

Computers and smartphones make spending an ever-present option. Spending shouldn’t be forbidden. Instead, skew the act of spending to your favor. So you really want those new boots? Match that spending with an equal contribution to your down payment.

Sometimes the pain of doubling a cost is enough to deter a purchase. In the case you still choose to spend, the matched contribution ensures that at the very least you’re still taking measures to save.

Put away any unexpected savings

Can’t turn down a great sale? To piggyback a good habit onto any impulse purchase, take the sum that was discounted on your sale item and add it to your down payment savings account.

5 Financial Perks of Being a First Time Homebuyer

A number of tax benefits come with being a homeowner — but you’ve got some work to do if you want to take full advantage.

All of those forms you filled out to buy your house were just the beginning. First-time homeowners have years of mortgage and insurance paperwork to look forward to, and, of course, taxes.

To sort through that pile of paperwork and make sure you’re saving as much money as possible, here are six tax benefits for new homeowners.

1. You can deduct the interest you pay on your mortgage

The home mortgage interest deduction is probably the best-known tax benefit for homeowners. It lets you deduct all the interest you pay toward your home mortgage with a few exceptions, including these big ones:

Your mortgage can’t be more than $1 million.

Your mortgage must be secured by your home (unsecured loans don’t count).

Your mortgage must be on a qualified home, meaning your main or second home (vacation homes count too).

Don’t assume that if you are married and file a joint tax return, you have to own your home together to claim the interest: For purposes of the deduction, the home can be owned by you, your spouse, or jointly. The deduction counts the same either way.

And don’t worry about keeping track of how much you’re paying in interest versus principal each month. At the end of the year, your lender should issue you a form 1098, which reports the amount of interest you’ve paid during the year.

Warning: Since, as a first-time homeowner, you pay more interest than principal in the first few years, that number can be fairly sobering.

2. You may be able to deduct points

Points are essentially prepaid interest that you offer upfront at closing to improve the rate on your mortgage. The more points you pay, the better deal you get.

You can deduct points in the year you pay them if you meet certain criteria. Included in the list (and it’s a long one): Points must be paid on a loan secured by your main home, and that loan must be to purchase or build your main home.

3. For 2015, you can deduct PMI

Private mortgage insurance, or PMI, protects the bank in the event you default. PMI may be required as a condition of a mortgage for first-time homebuyers, especially if they can’t afford a large down payment.

For most years, PMI is not generally deductible. However, for 2015, qualifying homeowners who itemize may claim a tax deduction for the cost of PMI for both their primary home and any vacation homes.

4. Real estate taxes are deductible

Real estate taxes are imposed by state or local governments on the value of your property. Most banks or other mortgage lenders will factor the cost of your real estate taxes into your mortgage and put those amounts into an escrow account.

You can’t deduct the amounts paid into the escrow, but you can deduct the amounts paid out of it to cover the taxes (you’ll see this amount on a form 1098 issued by your lender at the end of the year).

If you don’t escrow for real estate taxes, you’ll deduct what you pay out of pocket directly to the tax authority.

And don’t forget about those taxes you paid at settlement. If you reimburse the seller for taxes already paid for the year, you get to deduct those too.

5. You’ll get capital gains tax relief down the road

Resale value is something you considered when you chose your home. And different from other investments for which you’re taxed on the full value of any gain, you can exclude some of the gain attributable to your home when you sell.

Under current law, you can avoid paying tax on up to $250,000 of gain ($500,000 for married filing jointly) so long as you have owned and lived in the property for two of the last five years (those years of owning and inhabiting don’t have to be consecutive).

Gain over that amount is taxed at capital gains rates, which are generally more favorable than ordinary income tax rates.

Why the Parent Team Made the Move to USA Mortgage

As a seasoned mortgage professional, it is extremely important to me that I leave a lasting impression on my community. My mindset is that every day is an opportunity to grow—not only in my career, but also in my own development. It has always been my honor to be a stepping stone in others’ lives on the road to accomplishing their goals, and my career has enabled me to do that in a big way. With almost twenty years of experience, I have had the opportunity to work with an array of clients, including first-time homebuyers, high net-worth individuals and local heroes such as: our beloved veterans, police, firefighters, teachers and medical workers. Being that no one transaction is the same, the exposure to such a vast assortment of scenarios has given me a level expertise that allows me to handle any situation.

In such a dynamic industry, it is an obvious understanding that an open and creative mind will generally succeed; so personally, I believe that my duty is to always keep an adaptive perspective. Because of that, I have made it a point to work with some of the greatest minds in the industry, including David Silverman, Rick Ruby, Todd Scrima and Josh Sigma. Influences such as theirs’ have helped pave my career path and push me to create one of the top mortgage origination teams in the country.

With that being said, I personally have made it my goal to pay it forward by serving my clients and helping them realize their dreams. So less than a month ago, the Parent Team made a ground-breaking decision to relocate to USA Mortgage. To say the least, it was not an easy choice. Personally, I grew to admire and truly respect NFM Lending’s CEO Mr. David Silverman and his humble approach to leadership. In the amount of time that I was there, I can honestly say that I not only became a better loan originator, but I also grew as a leader. Coincidentally, that is the reason that my team and I made the decision to start fresh with USA Mortgage.

My career has always been about creating lifelong relationships with my clients and referral partners. However, I quickly realized how unique the Las Vegas market was when I began having to turn away clients to other industry professionals. Not only was that not good for business, it prevented me from doing what I love. It is evident that my number one motivation is to help others, and that is exactly what this company allows me to do. Each region of the country demands very different things when it comes to real estate, and based on location, demographic and the overall demand of the community, specific companies have the ability to be very impactful in targeted areas. Las Vegas, Nevada—as a whole—is somewhat of a niche market, and it requires mortgage options that are tailored to its residents. As a nationwide top twenty-five company, it is obvious that USA Mortgage understands this. They are built on a foundation that boasts remarkable leadership and innovation, and they are able to provide the loan products that my team and I need to be able to serve our community to the fullest extent.

I am lucky enough to say that I have had many great experiences throughout my career, and each step has helped me grow immensely. So personally, it is difficult to express the full level of my excitement to start this new venture.

P.S. We are moving offices, too. Come check out our new location at: 5598 Fort Apache, Las Vegas, Nevada, 89148.

Derek Parent

2 Ways to Build Passive Income Streams in Different Markets

It's wise to build passive income streams in the young adult years and allow them to grow. Before long, you'll be earning significant money from your previous work.

Two Easy Ways to Build Significant Passive Income

Passive income is great because it's a way to earn income without putting in a lot of work on a consistent basis. Technically, passive income works because a person does an amount of work in the beginning, but the cash flow is reoccurring and provides financial health. This is especially beneficial for the older generations as they continue to age and desire to preserve their energy.

Invest in Real Estate: Condos, High Rises, Homes

For some people, the thought of owning multiple properties may sound daunting and almost impossible. However, there are many ways to earn money as a real estate investor. One of these ways involves rentals. You can purchase a home, condo, or high rise by researching various investment property financing options. Don't be deterred by the idea just because of the finances. When you prepare a house to put on the market as a rental, you'll be able to earn a lot of money on a monthly basis. A few years of rental income can easily pay off an entire mortgage without your help and the rest becomes profit.

Books, Music and Other Copyrighted Material

Books are great forms of passive income for building wealth. An author spends a significant amount of time writing a book. Once it's published and available for sale, the book will sell over and over. The same concept applies to music. The percentage that's paid to the creator is called a royalty. With the right marketing plan and a wide audience, anyone can experience royalty checks in the hundreds of thousands of dollars. There are also many celebrities who make a lot of money from their book tours and book signings. If you don't consider yourself a good writer, but you have a story to tell, hire a ghostwriter. They'll create the content and you'll be able to eloquently share the story with the world.

Finances and the Future

Passive income streams eliminate the process of exchanging time for money. When you free up your time and can still earn lots of money, this is a dream that most people long to experience. In the meantime, be intentional about creating passive income streams and you'll experience financial freedom in no time.

The Top 5 Most Common Refinancing Misconceptions

When it comes to refinancing your home, there are a few misconceptions that many people have. Before you rule out the possibility of refinancing your home, you might want to learn why it may be easier than you think.

Some of the most common refinance misconceptions are not having enough equity, not being able to afford the refinance, or that it simply doesn’t make sense because of high interest rates.

Regardless of why you think you wont qualify to refinance your home, don’t let what someone told you stop you from taking advantage of some of the great benefits it can provide such as lowering your monthly payment, cashing out to consolidate debt, or getting a lower interest rate.

Here are the most common myths when it comes to mortgage refinance:

- I don't have enough equity in my home

Most refinancing programs require you to have at least 20 percent equity in your home to qualify. However, new federally chartered programs make it possible for homeowners with little or no equity to refinance their home and take advantage of the benefits that comes along with refinancing. The federal program is called Home Affordable Refinance Program, or HARP, and it has helped many homeowners with low equity reap the benefits of refinancing. Just like any mortgage program, you must meet certain requirements before you can qualify, but if this sounds like your situation, a federally chartered program, such as HARP, may be able to help.

- I can't afford it

Just like any mortgage or refinance program, there are lending fees involved for processing the loan. The fees vary based on the lender, but the average cost is about 1.5 % of your total loan value. For example, if you have an estimated loan balance of $300,000, you will be required to pay $4,500 in fees. That may seem expensive, but don’t worry, most lenders will let you add those fees to the total loan balance and let you pay over time through your monthly mortgage payment.

- I was turned down before, so there's no reason to try again

Were you recently rejected for a mortgage application? Don’t give up just yet. Just because you were rejected in the past, doesn’t mean that you won’t ever qualify. If your financial situation has changed since you last applied, then there’s a chance you could qualify. Most applicants get rejected because of low credit, low income, or too much debt. However, if your financial situation changed, then you may be able to qualify. For example, maybe you got a raise at your job, raised your credit score, or paid off a good amount of debt. A change in any of these factors could get you one step closer to qualifying for a refinance program.

- It's easier to refinance with your existing lender

Many people think that refinancing with the lender that did your original loan is the best option. However, this is not always true. Lenders have different fees, interest rates, and programs that could be better for your situation. Even though you gave your financial documentation to your original lender when you did your first loan, you will still be required to resubmit new documentation that represents your current financial situation such as job status, income verification, bank statements, and credit score. So, the process to refinance your home won’t necessarily be easier with your original lender because you worked with them in the past. You are free to work with any lender you choose and there are many lenders in any given community, so it is smart to shop around and find the one that works best for you

- Interest rates are too high to make refinancing worthwhile

With talks about the rise in interest rates, you might think it is not a good time to refinance. However, in the mortgage industry, things are constantly changing. Regulations, loan limits, and interest rates can be different on any given day so it is smart to talk to a lender and find out what the current state of the industry is. When you secured your first loan you were locked into the interest rate that was available at that time. It might not seem like a significant change, but if you are able to lower your interest rate a full percentage point, it could save you a significant amount of money on your monthly payment when you refinance. There are also benefits of refinancing your mortgage to a shorter term so you can save more money long term on interest and pay your loan off faster. For example, if you refinance from a 30 year fixed rate mortgage to a 15 year fixed rate loan, you could reduce the amount of interest on the loan by $100,000 or more. Your monthly payment will be higher, but your interest rate and total interest owed over the life of your loan will go down.

If you are a homeowner and you're interested in refinancing your home, give us a call and we will guide you through the process!702-331-8185

Should You Combine Finances with Your Partner?

Depending on who you ask, combining finances with your significant other is either a positive step towards establishing a life together OR the worst idea ever. If you're considering it, here are some pros and cons to weigh.

Pros

Teamwork

If you’re on the same page and your financial priorities are fully aligned, you're likely looking beyond your own personal needs and wants and putting the needs of the relationship first. By combining all your assets and liabilities, you’re ultimately making the commitment to succeed or fail together, as a unit.

Simplicity

One of the benefits of joining accounts is that it makes bill paying and record keeping a whole lot easier (particularly if you’ve established a budget).

Furthermore, combining your loan accounts, such as credit cards, could help you get additional loans in the future.

And if you’re making consistent, timely payments, both of your credit scores will improve. If you had kept that credit account separate, only one of you would have the benefit of a higher score, which could hurt you down the road when you apply for additional credit.

Taxes

Sure, filing separate returns may be beneficial in some instances. (For example, if one spouse has large medical bills and can meet the deduction threshold by considering only his or her income.)

But joint filing saves time, and possibly money, too — particularly if you both work and one of you makes considerably more than the other. Combining incomes could bring the higher earnings into a lower tax bracket.

Also, some tax credits are only available to a married couple when they file jointly. Talk to your accountant for additional information about minimizing the tax bite.

Cons

Attitudes

Some couples may not agree on certain issues, like creating a spending/saving plan, setting retirement goals, or even how much debt they should carry. After all, opposites do attract, and in many relationships, there is, in fact, a spender and a saver.

If your financial philosophies don’t align, and you’re combining your financial life with someone who has vastly different expectations, goals, systems, ideals and habits, this could bring challenges and unwelcome relationship conflict.

Dependence

If you’ve been managing your money on your own for years, and have been relatively successful in doing so (from choosing your 401K funds to setting a budget to planning a vacation), you may not want to relinquish your financial autonomy.

Sure, there may be more bookkeeping for you to do if you keep your finances separate, and opt for more of a yours/mine/ours account type arrangement (commonly referred to as the “three pot system”), but it may ultimately provide you with the independence and comfort you desire.

Disentangling

You may be in la la land now, but what happens if the relationship doesn’t work out in the long run? Joint mortgages, credit cards, and bank accounts can be very difficult to separate, even with a formal court-ordered divorce decree.