Rising Debt, Slowing Jobs: Why Now Might Be the Smartest Time to Buy

If you’ve been feeling the squeeze—higher prices at the store, more on the credit card, headlines about layoffs—you’re not imagining it. The latest Applied Analysis: Las Vegas Labor Market & Economic Outlook (October 2025) shows a clear picture: debt is rising, savings are thin, and job growth in Nevada has cooled off.

On the surface, that sounds like a reason to wait. But when you look deeper, this environment may actually be one of the smartest times to get out of high-interest debt and into an asset that can build wealth: a home.

Let’s break down why.

Slowing Job Growth, But a Stable Las Vegas

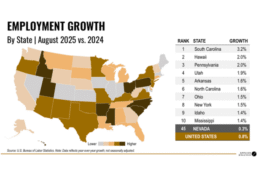

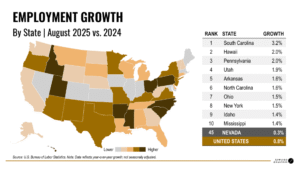

Nevada’s employment growth has slipped to about 0.3% year-over-year, ranking the state near the bottom nationally. At the same time, Southern Nevada’s unemployment rate sits above the U.S. average, signaling that the red-hot hiring boom we saw post-COVID has cooled.

That might feel scary, but in real estate terms it means something important:

- Less frenzied demand

- Fewer bidding wars

- More sellers willing to negotiate

In other words, when the job market cools, the housing market often shifts from “panic mode” to “negotiation mode.” That’s where smart buyers win.

Household Debt Is Up—Especially the Bad Kind

The national data in the report shows a clear trend: household debt continues to climb, and a growing share of that is credit card balances and short-term consumer debt.

We’re seeing:

- Rising credit card liabilities compared to prior decades

- Personal savings rates well below the 50-year average of 7.4%

- More families relying on debt to keep up with cost of living

Here’s the key problem: credit card and consumer debt compound against you. Every month you’re paying 18–25% interest, and at the end of the year you own nothing more than you started with.

A fixed mortgage, on the other hand, often comes with a much lower interest rate and is tied to a tangible asset that can appreciate over time.

Why Buying Now Can Be a Smart Debt Strategy

When people think “buy a house,” they usually think about lifestyle—more space, a yard, a garage. That matters. But in this environment, owning a home is also a strategic financial move:

- Trade Bad Debt for Better Debt

If you’re carrying high-interest balances, a purchase or future cash-out refinance can be part of a plan to consolidate debt into lower-rate, fixed housing payments. You’re not just shifting debt—you’re tying it to an asset that can grow. - Lock In Today’s Prices Before the Next Run-Up

The report still shows strong fundamentals in Las Vegas: billions in visitor spending, healthy gaming revenue, and long-term population growth. When rates eventually come down, demand is likely to spike again and prices can move fast. Buying now positions you ahead of that. - Use the Market Softness to Your Advantage

In a slower job and housing market, buyers are seeing things we almost never saw in 2021–2022:- Seller credits toward closing costs

- Rate buydowns paid by the seller

- Room to negotiate on price and repairs

- Refinance When the Rate Cycle Shifts

Rates move in cycles. If you buy now, you:- Lock in the price

- Start building equity

- Keep the option to refinance later into a lower payment when rates ease

You can’t go back in time and buy at yesterday’s prices. But you can buy today and improve the cost of money later.

Supporting Graph: Debt & Savings Pressure

You (or your marketing team) can turn this snapshot into a simple line or bar graph for the blog:

Household Financial Snapshot – U.S. (Selected Trends)

(Source: Applied Analysis, Oct 2025 – Federal Reserve & BEA data)

| Indicator | Long-Term / Prior Level | Most Recent Level | What It Signals |

| Personal Savings Rate | 50-year avg: 7.4% | Well below avg | Households saving less, leaning on credit |

| Credit Card Liabilities | Much lower in 1990s–2000s | Near record highs | More high-interest consumer debt |

| Total Household Wealth | Concentrated, Top 10% dominate | Still very skewed | Many families feel “behind” financially |

| Nevada Job Growth (YoY) | Higher in past expansions | 0.3% | Cooling, but not collapsing |

Takeaway: People are saving less, carrying more expensive debt, and feel pressure—yet homeownership remains one of the most reliable ways to get on the right side of that equation.

What This Means for Las Vegas Buyers

If you’re in Las Vegas and you’re feeling the weight of rising debt and an uncertain job market, you’re not alone. But this is also a moment where a well-structured mortgage can help you:

- Swap unsecured, high-interest debt for a more stable, potentially lower-rate housing payment

- Lock in a home in a market that still has long-term growth drivers (tourism, entertainment, sports, tech, and inbound migration)

- Use seller contributions and smart product selection to get in the door with less upfront cash than you might think

This isn’t about stretching yourself thin. It’s about using the tools that exist—strategy, structure, and timing—to move from surviving to building.

The Bottom Line

Rising debt and slowing jobs are real. But they don’t just create risk—they create opportunity for buyers who move with a plan instead of fear.

The Parent Team, we specialize in looking at the whole picture—your income, your debt, your goals—and building a mortgage strategy that helps you move out of high-interest debt and into long-term stability and wealth through real estate.

If you’re carrying balances, renting, and wondering how to get ahead, this may be the perfect time to sit down, run the numbers, and see what’s possible.

Book your free mortgage strategy call today and let’s turn today’s uncertainty into tomorrow’s opportunity.

Is a Recession Coming—or a Buying Window? A Look at the 33% Recession Probability

With economists giving the U.S. a 33% chance of recession, Las Vegas buyers are asking: should I wait or move now? Here’s what the latest data says—and why opportunity may be hiding in plain sight.

Every few months, the headlines start sounding the same: “Recession fears rise.” “Markets brace for slowdown.” “Consumers tighten budgets.”

But here’s the truth: not every slowdown is a crash. Sometimes, it’s a reset—one that smart buyers can turn into their biggest advantage.

The Applied Analysis Labor Market Report (October 2025) puts the probability of a U.S. recession at 33% within the next 12 months. That sounds intimidating, but in context, it’s actually part of a healthy market correction after years of inflation, rate hikes, and overextended growth.

So let’s break down what that number means—and what it could mean for your next real estate move.

33% Recession Probability: What It Really Means

A one-in-three chance of recession doesn’t guarantee economic pain. It means forecasters are seeing signs of slowing—lower job growth, steady inflation, and cautious spending—but not collapse.

In fact, the same report shows:

- U.S. employment is stable at around 159 million jobs.

- Corporate profits remain near record highs at $3.6 trillion.

- Average wages are holding at $1,249 per week.

- Inflation has cooled to 3%.

That’s not recession territory. That’s a market catching its breath.

When growth slows, the Federal Reserve often steps in to ease rates. And for homebuyers, that’s where opportunity begins.

History Favors the Bold

If you look back over the past 50 years, some of the best times to buy real estate were when uncertainty was highest:

- After the early 1990s recession, home prices climbed 30% within five years.

- Buyers who purchased during the 2008–2009 downturn built life-changing equity once recovery began.

- Even after the 2020 pandemic shock, values in Las Vegas surged more than 35% in two years.

Recessions are temporary. Homeownership and equity growth are long-term.

And while timing the economy is impossible, positioning yourself before the recovery always beats trying to chase it.

How a Slower Economy Impacts Mortgage Rates

Here’s the connection many people miss:

- When growth slows, inflation eases.

- When inflation eases, bond yields drop.

- When bond yields drop, mortgage rates usually follow.

That’s why slower job growth and cautious consumer spending can actually benefit future homeowners.

Today’s rates may feel high compared to 2021—but they’re already showing signs of softening as inflation cools and the Fed hints at possible cuts heading into 2026.

And once rates fall, buyer demand will come roaring back. That’s why waiting until “the coast is clear” could cost you more in both price and competition.

Why This Could Be a Buying Window

Let’s put this into practical perspective for Las Vegas buyers.

According to Applied Analysis, Nevada’s employment growth has slowed to 0.3% year-over-year, ranking 45th nationwide.

That means fewer bidding wars and more motivated sellers. Pair that with stable incomes and strong tourism spending—over $55 billion in 2025—and the fundamentals for long-term housing demand are still solid.

So what we’re really seeing is a rare moment of balance:

- Sellers are negotiating again.

- Buyers can use credits and rate buydowns.

- Prices are steady, not surging.

- Future rate drops could make today’s purchases even more valuable.

In other words: this isn’t a warning light—it’s a window.

Supporting Graph: Recession Probability Trend

(Source: Wall Street Journal Economic Forecasting Survey, Oct 2025)

| Year | Recession Probability (Next 12 Months) |

| 2023 | 61% |

| 2024 | 46% |

| 2025 | 33% |

Takeaway: As economic confidence stabilizes, the risk of recession falls—and so do borrowing costs.

How to Prepare (Not Panic)

If you’re a renter, investor, or move-up buyer, this is the time to build strategy—not fear.

Here’s what to focus on:

- Get Pre-Approved Early – Lock in your qualification before rates shift again.

- Negotiate Like It’s 2019 – Ask for seller credits or rate buydowns to lower your payment.

- Think Two Steps Ahead – Buy now, refinance later when rates drop.

- Build Equity While Others Wait – Each month of ownership builds wealth, while waiting builds rent receipts.

The Bottom Line

A 33% chance of recession isn’t a red flag—it’s a yellow light telling us to slow down, evaluate, and make smart, informed moves.

Las Vegas remains resilient, and buyers who act strategically in these moments often end up years ahead.

The Parent Team, we’re helping clients turn uncertainty into opportunity—by structuring flexible loan options, seller-funded rate buydowns, and refinance strategies built for tomorrow’s lower-rate market.

You can’t control the headlines, but you can control your timing, your strategy, and your future equity.

Book your free mortgage strategy call today to see how this market could work for you.

Thinking About Selling? Here’s How to Stop Your Deal From Falling Apart After You Get an Offer

If you’re thinking about selling your home, you’ve probably spent a lot of time worrying about pricing, marketing, and timing.

But here’s the part most sellers never see coming:

Getting an offer is the easy part.

Getting all the way to closing is where deals fall apart.

Right now, roughly 15% of pending home sales are failing, and the #1 deal-killer isn’t usually the buyer’s loan.

It’s repairs and inspection surprises.

In other words: what happens after you accept the offer can make or break your sale.

The Silent Deal-Killer: Inspection & Repair Issues

Once your home is under contract, the buyer will usually order a home inspection. This is where hidden issues, deferred maintenance, and “I’ve been meaning to fix that” items all show up in writing.

When that inspection report lands, one of three things often happens:

- The buyer gets nervous and walks away

Big issues or long repair lists can scare buyers—especially in a cautious or shifting market. - They demand heavy credits or price cuts

Suddenly you’re giving back thousands at the closing table you thought you were keeping. - They try to renegotiate everything

You lose leverage, the timeline gets messy, and stress levels skyrocket.

The good news? You don’t have to be at the mercy of the inspection report.

You can get ahead of it.

The Smartest Move: Get a Pre-Listing Inspection

One of the most powerful tools you have as a seller is something most people never do:

A pre-listing inspection.

Instead of waiting for the buyer to hire an inspector and surprise you, you hire your own inspector before your home goes on the market.

A pre-listing inspection helps you:

- Know exactly what buyers will find

No guessing. No surprises. You see the report first. - Handle repairs on your terms

You decide what to fix, when to fix it, and who does the work—without a ticking clock. - Reduce renegotiations

When you’ve already addressed major issues or disclosed them upfront, buyers have less room to re-open negotiations. - Boost buyer confidence

A home that’s been inspected, repaired, and transparently presented feels safer and more trustworthy. - Dramatically lower the chances of a canceled contract

Fewer surprises = fewer freak-outs = fewer fallout deals.

In a market where buyers are cautious and picky, transparency is power.

Prepared homes make it to the closing table. Unprepared homes often don’t.

“But What If I Can’t Afford Repairs Right Now?”

This is one of the biggest fears sellers have:

“What if the house needs work, but I don’t have thousands of dollars to throw at repairs before I sell?”

If that’s you, you’re not alone—and you’re not stuck.

Many sellers today are using programs like RealVitalize (offered through select brokerages) or similar pay-at-closing improvement programs that allow you to:

- Do repairs, updates, or staging before you list

- Pay nothing upfront

- Repay the costs at closing

That means you can potentially:

- Refresh paint and flooring

- Update lighting or fixtures

- Do necessary repairs flagged in a pre-listing inspection

- Improve curb appeal, kitchens, or baths…all without writing a big check before your home ever hits the market.

These updates don’t just help you sell your home—they can help you:

- Attract more buyers

- Reduce lowball offers

- Improve your chances of getting top dollar

- Protect your deal once you’re under contract

In a world where buyers scroll through thousands of listing photos and expect homes to be “move-in ready,” this kind of program can be a game-changer.

Your Game Plan for a Smooth, Stress-Free Sale

If you’re even thinking about selling in the next 3–12 months, here’s a smart sequence to follow:

- Talk with a trusted real estate professional

Discuss your goals, timing, and rough pricing strategy. - Schedule a pre-listing inspection

Get clear on what’s really going on with your home behind the walls, under the roof, and in the systems. - Review the report together

Decide what must be fixed, what’s nice to fix, and what simply needs to be disclosed. - Explore pay-at-closing improvement options (like RealVitalize, if available)

See if you qualify to make impactful updates with no upfront payment. - Complete key repairs and cosmetic updates

Focus on items that will matter most to buyers and to an inspector. - List your home with confidence

You’re not guessing—you’ve already done the hard work upfront.

This approach keeps you in control—from the moment you list to the moment you sign at the closing table.

Thinking About Selling? Protect Your Deal Before It Starts.

If you’re planning to sell—or even just considering it—the best time to create a strategy is before you put the sign in the yard.

A strong pre-listing plan can:

- Help you avoid last-minute drama

- Prevent needless price cuts

- Reduce buyer cancellations

- Put more money in your pocket at closing

If you’d like to talk through:

- Whether a pre-listing inspection makes sense for your situation

- Which repairs or upgrades will give you the most return

- How a program like RealVitalize (or similar) could help you do improvements with no upfront cost

…reach out and let’s set up a time to talk.

Ready to Sell With Confidence?

If you’re thinking about selling your home, don’t leave it to chance.

Get ahead of the inspection.

Protect your leverage.

Create a clear path from listing to closing.

Click here to schedule a no-pressure strategy session and learn how to prepare your home the right way—so you don’t just get an offer… You get to the finish line.

Las Vegas 2025: What Slower Job Growth Means for Mortgage Rates

If you’ve been watching the market this year, you’ve probably noticed a strange mix of signals—steady paychecks, cooling inflation, but headlines hinting at slower job growth in Nevada.

The latest Applied Analysis Labor Market Report (October 2025) puts it plainly: Las Vegas is growing, just not as fast.

And that slowdown might be exactly what the housing market—and mortgage rates—need.

Nevada’s Job Growth Is Cooling

For the first time in years, Nevada’s employment growth has slipped to just 0.3% year-over-year, ranking it near the bottom nationally. Compare that to post-pandemic years when local job growth surged over 5%, and you’ll see why the tone feels different in 2025.

But slowing job growth isn’t always bad. It often signals that the economy is stabilizing after a period of overheating—and that’s when inflation begins to ease.

And when inflation cools, mortgage rates usually follow.

The Economic Balancing Act

Let’s put the numbers in perspective:

- Unemployment rate: 5.3% in Nevada (slightly above the national average)

- Average weekly earnings: $1,249—holding steady

- Inflation: Down from 9% highs in 2022 to around 3% today

- Personal savings rate: Below the 50-year average, but stable

So what does that mean for homebuyers?

It means we’ve entered a “cool but steady” economy—the kind that gives the Federal Reserve room to start cutting rates once they’re confident inflation is under control.

When job growth softens, wage pressure eases, spending slows, and inflation stabilizes. That’s the chain reaction that brings borrowing costs down.

Slower Growth = Rate Relief

Mortgage rates are heavily influenced by inflation expectations and job data. When job reports show strength, rates tend to rise. When job growth slows, rates ease—because investors anticipate a softer economy and lower inflation ahead.

According to most 2025 forecasts, rates could begin trending downward into 2026 as the Fed gradually shifts toward supporting growth again.

That means buyers who purchase now—while competition is still low—could see an ideal setup:

1️⃣ Lock in today’s home prices before they rise again.

2️⃣ Refinance later when rates drop, lowering monthly payments.

3️⃣ Use the market’s temporary slowdown to negotiate better terms.

Las Vegas Still Has Strength Beneath the Surface

Even with slower job growth, Las Vegas remains one of the country’s most resilient regional economies.

The Applied Analysis report highlights:

- $55 billion in annual visitor spending

- $13.7 billion in gaming revenue

- Strong investment in new projects, tourism, and tech infrastructure

These aren’t signs of weakness—they’re signs of sustainability.

Vegas has learned to balance its tourism-driven foundation with diversification in healthcare, logistics, and construction.

And that balanced growth helps keep local housing demand steady, even when national numbers cool.

What This Means for Homebuyers

If you’re a first-time buyer or planning to make a move in 2025, here’s what to take away from this shift:

✅ You Have Negotiating Power Again

Slower job growth and reduced demand mean sellers are more flexible on price, closing costs, and concessions.

✅ Rates Could Soften Ahead

Mortgage rates often lag behind the economy. As inflation cools and job growth steadies, rate cuts could follow within the next 6–12 months.

✅ The Window Before the Wave

When rates fall, demand surges. Acting before that rebound means less competition and better deals.

✅ Refinancing Is Your Safety Net

Buying now doesn’t mean you’re stuck with today’s rate forever. You can refinance when rates drop—and most buyers do.

Supporting Graph: Nevada Job Growth vs. Mortgage Rates

(Source: Applied Analysis, Oct 2025; Freddie Mac; U.S. Bureau of Labor Statistics)

| Year | Nevada Job Growth | 30-Year Fixed Mortgage Avg. | Inflation (CPI) |

| 2022 | +5.1% | 6.6% | 9.0% |

| 2023 | +2.7% | 7.1% | 6.5% |

| 2024 | +1.2% | 7.3% | 4.0% |

| 2025 | +0.3% | 7.0% | 3.0% |

Notice the trend: as job growth cools and inflation declines, mortgage rates tend to follow the same direction—with a short lag.

The Bottom Line

Las Vegas isn’t slowing down—it’s leveling up. The frenzy has cooled, the data is stabilizing, and opportunities are quietly shifting back toward buyers.

Slower job growth might sound concerning, but for mortgage rates—and for anyone ready to own—it could be exactly the break the market needed.

The Parent Team, we’re helping buyers use this moment strategically—locking in fair prices today and planning for refinancing opportunities tomorrow.

When rates drop, competition will return. The smartest move you can make is to prepare now while the market is calm.

Book your free mortgage strategy call today to explore your options and see what your buying power looks like in 2025.

From Paychecks to Property: Turning Las Vegas Job Stability into Homeownership

In a city that thrives on energy, opportunity, and reinvention, 2025 is shaping up to be a year of quiet strength for the Las Vegas workforce.

While headlines talk about slowing national job growth, the latest Applied Analysis Labor Market Report (October 2025) reveals something encouraging for Southern Nevada: stability.

Wages are holding steady. Employers are adapting. And for many residents, that steady paycheck might finally be the foundation to build something bigger—a home of their own.

The Power of Job Stability in a Changing Market

Nevada’s employment growth has cooled to around 0.3% year-over-year, ranking 45th nationwide. But behind that modest figure lies a more meaningful trend: employers are holding the line.

Instead of massive layoffs, most companies are restructuring and rebalancing—focusing on retention and steady operations.

For homebuyers, that’s critical. Why? Because lenders love stability.

A consistent job history, predictable income, and manageable debt-to-income ratio are the backbone of every strong mortgage approval.

If you’ve been in your job for two years or more, that track record puts you in a powerful position—especially in a market where sellers are finally negotiating again.

Steady Pay, Predictable Payments

The report shows that average weekly earnings in Nevada are holding at about $1,249, while inflation has cooled to roughly 3%. That combination gives buyers something they haven’t had in years: breathing room.

Let’s simplify it:

- Your paycheck is holding strong.

- Prices aren’t spiking like they were in 2022–2023.

- Mortgage rates, while higher than pandemic lows, are expected to ease through 2026.

That means 2025 could be the year where a steady income actually stretches far enough to make homeownership work.

And when you lock into a fixed-rate mortgage, you’re effectively converting part of your paycheck into a predictable, wealth-building payment—instead of a rent check that keeps rising.

Why the Smart Money Is Moving Now

Las Vegas has always been a city of cycles—and those who move early in a shift tend to win big.

Consider this:

- Tourism spending hit $55 billion last year, proving the economy is still strong.

- Average room rates and gaming revenue remain near record highs, sustaining local jobs.

- And while new construction is slowing (down 35% from peak), population growth hasn’t.

That means the city’s fundamentals remain solid—but competition hasn’t yet come roaring back. Buyers with stable jobs have an edge right now to:

✅ Negotiate seller credits or rate buydowns

✅ Get approved with flexible income verification programs

✅ Buy before prices rise again when rates fall

Turning Stability into Strategy

You don’t need a massive down payment or perfect credit to make your paycheck work for you.

What you need is a plan—and the right guidance to use today’s lending tools strategically.

Here’s how we’re helping Las Vegas buyers turn income into ownership:

- Customized Pre-Approval Plans

We review your job history, income, and goals to create a clear roadmap for your ideal purchase price and payment. - Low Down Payment Options

FHA, VA, and even some conventional programs allow as little as 3% down, especially with strong employment history. - Debt Restructure Through Homeownership

If you’re paying high-interest credit cards or personal loans, a mortgage can consolidate that debt into a lower, tax-advantaged payment. - Rate Strategy, Not Rate Panic

We build plans around what’s available now—then help you refinance later when rates drop, so you keep today’s price and lower tomorrow’s payment.

Supporting Graph: Job Stability & Wage Growth

(Source: Applied Analysis, Oct 2025 | U.S. Bureau of Labor Statistics)

| Indicator | 2024 | 2025 | Change |

| Employment (Nevada) | 158.9M | 159.4M | +0.3% |

| Avg. Weekly Earnings | $1,208 | $1,249 | +3.4% |

| Inflation (CPI) | 3.2% | 3.0% | -0.2% |

| Unemployment Rate | 4.2% | 4.3% | +0.1% |

Takeaway: Paychecks are stable, inflation is easing, and lenders value consistency more than ever.

The Bottom Line

In 2025, Las Vegas doesn’t need explosive job growth to create opportunity—it needs consistent earners with a plan. And that’s exactly who’s winning right now.

If your income is steady and you’re ready to stop renting, the path from paycheck to property is closer than you think.

The Parent Team, we specialize in helping Las Vegas professionals turn steady income into smart mortgage solutions—whether you’re buying your first home, upgrading, or planning long-term wealth through real estate.

Your paycheck is powerful. Let’s make it work for you.

Book your free mortgage strategy call today to see how far your income can take you.

How Inflation, Wages, and Debt Shape Your Homebuying Power in 2025

The economic headlines can feel like a blur: inflation cooling, wages flat, debt rising. But what do those trends actually mean if you’re thinking about buying a home this year?

The latest Applied Analysis Las Vegas Labor Market Report (October 2025) shows that while the national economy is slowing, the fundamentals for homeownership are quietly improving. Prices are steady, incomes are stable, and—believe it or not—these mixed signals might actually work in your favor.

Let’s unpack how inflation, wages, and debt are shaping what you can afford—and how to build a strategy that works in today’s market.

Inflation: The Silent Rate Mover

After years of painful price increases, inflation has finally cooled to around 3%, down sharply from the highs of 2022.

That’s not just good news for groceries—it’s good news for mortgage rates.

When inflation drops, the Federal Reserve has room to pause or even lower rates. Mortgage rates tend to follow that same downward trend.

While we’re not back to the ultra-low rates of the pandemic years, the direction is finally shifting.

Here’s what this means for you:

- Your buying power increases as inflation cools.

- Fixed-rate mortgages protect you from future inflation spikes.

- Locking in before demand rebounds gives you an early equity advantage.

So, if inflation is cooling and you’re waiting for rates to drop “just a little more,” remember—so is everyone else. When they finally do, you’ll be competing against a flood of buyers who waited too long.

Wages: Steady and Reliable

In Nevada, the average weekly wage has held at $1,249, according to the report—flat, but stable. Job growth may have slowed, but paychecks are still coming in strong.

That stability is powerful in lending terms.

Mortgage approvals don’t depend on whether the economy is booming—they depend on your income consistency. Lenders want to see:

✅ A steady job or verifiable self-employment income

✅ Manageable debt-to-income ratios

✅ A clear paper trail for savings or down payment funds

So while job growth across the state has cooled to 0.3%, that’s not necessarily a bad thing for homebuyers. It’s keeping prices from overheating and giving serious buyers space to move without bidding wars.

Debt: The Double-Edged Sword

The report also highlights a growing concern—household debt.

Credit card balances are climbing, and personal savings rates are well below the 50-year average of 7.4%. More families are using credit to cover higher costs, and those interest rates can eat into your long-term financial flexibility.

But here’s the key insight: a mortgage is debt that works for you, not against you.

While credit card debt compounds at 18–25% with no lasting value, mortgage debt is tied to a tangible, appreciating asset—your home. Each payment builds equity, not just expense.

That’s why more buyers are using homeownership as a way to stabilize their financial picture, even during economic uncertainty.

How to Protect—and Increase—Your Buying Power

Here’s how you can make these trends work for you:

- Consolidate High-Interest Debt Strategically

If you’re carrying credit card or personal loan balances, consider consolidating them through a mortgage refinance or purchase plan. It can dramatically lower your monthly obligations. - Use Seller Credits to Offset Costs

With slower job growth and cooling demand, sellers are offering concessions again. You can use those credits for closing costs or temporary rate buydowns to lower your monthly payment. - Think Long-Term, Not Short-Term

The perfect rate is temporary; the right property and strategy are lasting. Lock in your price now and refinance later when rates fall. - Stay Employment-Ready

Keep your financial profile strong: stable income, consistent savings, and low credit utilization. That’s what lenders value most in any market.

Supporting Graph: How the 3 Forces Interact

(Source: Applied Analysis, Oct 2025 | U.S. Bureau of Labor Statistics & Federal Reserve)

| Factor | 2024 | 2025 | Trend | Impact on Buyers |

| Inflation (CPI) | 4.2% | 3.0% | ⬇️ Cooling | Improves rate outlook |

| Avg. Weekly Wages (NV) | $1,208 | $1,249 | ⬆️ Steady | Strengthens approval potential |

| Household Debt | $17.3T | $18.0T | ⬆️ Rising | Reduces flexibility |

Takeaway: Inflation easing and wage stability can boost buying power—if debt is managed smartly.

The Bottom Line

The economy may be slowing, but for homebuyers, that’s not a setback—it’s a reset.

Cooling inflation, steady wages, and flexible lending tools have created one of the most balanced markets we’ve seen in years.

If you’ve been waiting for the “right time,” this may be it: a moment when the economy rewards preparation, not hesitation.

The Parent Team, we specialize in helping Las Vegas buyers turn income stability into long-term wealth through smart mortgage planning. From rate buydowns to debt restructuring and refinance strategies, we help you see the full picture—so your money works harder for you.

Book your free mortgage strategy call today to see how far your 2025 buying power can go.

Rising Debt, Slowing Jobs: Why Now Might Be the Smartest Time to Buy

If you’ve been feeling the squeeze—higher prices at the store, more on the credit card, headlines about layoffs—you’re not imagining it. The latest Applied Analysis: Las Vegas Labor Market & Economic Outlook (October 2025) shows a clear picture: debt is rising, savings are thin, and job growth in Nevada has cooled off.

On the surface, that sounds like a reason to wait. But when you look deeper, this environment may actually be one of the smartest times to get out of high-interest debt and into an asset that can build wealth: a home.

Let’s break down why.

Slowing Job Growth, But a Stable Las Vegas

Nevada’s employment growth has slipped to about 0.3% year-over-year, ranking the state near the bottom nationally. At the same time, Southern Nevada’s unemployment rate sits above the U.S. average, signaling that the red-hot hiring boom we saw post-COVID has cooled.

That might feel scary, but in real estate terms it means something important:

- Less frenzied demand

- Fewer bidding wars

- More sellers willing to negotiate

In other words, when the job market cools, the housing market often shifts from “panic mode” to “negotiation mode.” That’s where smart buyers win.

Household Debt Is Up—Especially the Bad Kind

The national data in the report shows a clear trend: household debt continues to climb, and a growing share of that is credit card balances and short-term consumer debt.

We’re seeing:

- Rising credit card liabilities compared to prior decades

- Personal savings rates well below the 50-year average of 7.4%

- More families relying on debt to keep up with cost of living

Here’s the key problem: credit card and consumer debt compound against you. Every month you’re paying 18–25% interest, and at the end of the year you own nothing more than you started with.

A fixed mortgage, on the other hand, often comes with a much lower interest rate and is tied to a tangible asset that can appreciate over time.

Why Buying Now Can Be a Smart Debt Strategy

When people think “buy a house,” they usually think about lifestyle—more space, a yard, a garage. That matters. But in this environment, owning a home is also a strategic financial move:

- Trade Bad Debt for Better Debt

If you’re carrying high-interest balances, a purchase or future cash-out refinance can be part of a plan to consolidate debt into lower-rate, fixed housing payments. You’re not just shifting debt—you’re tying it to an asset that can grow. - Lock In Today’s Prices Before the Next Run-Up

The report still shows strong fundamentals in Las Vegas: billions in visitor spending, healthy gaming revenue, and long-term population growth. When rates eventually come down, demand is likely to spike again and prices can move fast. Buying now positions you ahead of that. - Use the Market Softness to Your Advantage

In a slower job and housing market, buyers are seeing things we almost never saw in 2021–2022:- Seller credits toward closing costs

- Rate buydowns paid by the seller

- Room to negotiate on price and repairs

- Refinance When the Rate Cycle Shifts

Rates move in cycles. If you buy now, you:- Lock in the price

- Start building equity

- Keep the option to refinance later into a lower payment when rates ease

You can’t go back in time and buy at yesterday’s prices. But you can buy today and improve the cost of money later.

Supporting Graph: Debt & Savings Pressure

You (or your marketing team) can turn this snapshot into a simple line or bar graph for the blog:

Household Financial Snapshot – U.S. (Selected Trends)

(Source: Applied Analysis, Oct 2025 – Federal Reserve & BEA data)

| Indicator | Long-Term / Prior Level | Most Recent Level | What It Signals |

| Personal Savings Rate | 50-year avg: 7.4% | Well below avg | Households saving less, leaning on credit |

| Credit Card Liabilities | Much lower in 1990s–2000s | Near record highs | More high-interest consumer debt |

| Total Household Wealth | Concentrated, Top 10% dominate | Still very skewed | Many families feel “behind” financially |

| Nevada Job Growth (YoY) | Higher in past expansions | 0.3% | Cooling, but not collapsing |

Takeaway: People are saving less, carrying more expensive debt, and feel pressure—yet homeownership remains one of the most reliable ways to get on the right side of that equation.

What This Means for Las Vegas Buyers

If you’re in Las Vegas and you’re feeling the weight of rising debt and an uncertain job market, you’re not alone. But this is also a moment where a well-structured mortgage can help you:

- Swap unsecured, high-interest debt for a more stable, potentially lower-rate housing payment

- Lock in a home in a market that still has long-term growth drivers (tourism, entertainment, sports, tech, and inbound migration)

- Use seller contributions and smart product selection to get in the door with less upfront cash than you might think

This isn’t about stretching yourself thin. It’s about using the tools that exist—strategy, structure, and timing—to move from surviving to building.

The Bottom Line

Rising debt and slowing jobs are real. But they don’t just create risk—they create opportunity for buyers who move with a plan instead of fear.

The Parent Team, we specialize in looking at the whole picture—your income, your debt, your goals—and building a mortgage strategy that helps you move out of high-interest debt and into long-term stability and wealth through real estate.

If you’re carrying balances, renting, and wondering how to get ahead, this may be the perfect time to sit down, run the numbers, and see what’s possible.

How the 2025 Las Vegas Economy Is Shaping Opportunities for Homebuyers

If you’ve been watching the Las Vegas market, you’ve probably felt the tension — steady demand, high prices, and interest rates that just won’t seem to budge. But according to the latest Applied Analysis: Las Vegas Labor Market & Economic Outlook (October 2025) report, the tides may be turning.

Beneath the flashy Strip lights, the local economy is showing signs of cooling. And for homebuyers, that shift could actually be a major opportunity.

Job Growth Has Slowed — But That’s Not All Bad

Nevada’s job growth has dropped to just 0.3% year-over-year, ranking 45th in the nation. That’s a big slowdown from the post-pandemic hiring surge we saw in 2022 and 2023.

At first glance, this might sound concerning. But here’s the silver lining: when employment growth eases, it often takes some heat off the housing market. Fewer bidding wars, fewer cash investors driving up prices, and more room for real buyers to negotiate.

For context, Southern Nevada’s unemployment rate sits around 5.3%, slightly higher than the national average. It’s not a sign of crisis — it’s a return to balance.

Wages Are Holding Steady, Inflation Is Cooling

While job creation has slowed, paychecks have not. The average weekly wage in Nevada remains around $1,249, and inflation has cooled to roughly 3%. That means your purchasing power is finally stabilizing after several years of runaway prices.

Even better, corporate profits and consumer spending are holding strong, which helps prevent a deep downturn. Retail sales are up nearly 4% year-over-year, and visitors are still spending over $55 billion annually in Las Vegas.

This mix — stable income, controlled inflation, and slower job growth — creates a sweet spot for mortgage planning. Buyers can take their time, shop strategically, and use temporary rate buydowns or seller credits to make their payment more manageable.

Builders Are Adjusting, Not Retreating

After years of nonstop construction, homebuilders in Southern Nevada are showing a little restraint. New housing starts and building permits are down more than 35% from their peak. That’s not a collapse — it’s a recalibration.

When builders pause, inventory tightens in the short term, but it also means fewer speculative projects flooding the market later. For today’s buyers, that’s a chance to find real value before demand ticks back up.

Remember: Las Vegas is still adding new residents every month — especially from states like California and Arizona. Slower growth now doesn’t mean contraction; it means the market is catching its breath.

What This Means for You as a Homebuyer

The 2025 economy may not feel “perfect,” but it’s quietly working in favor of those ready to act. Here’s how you can use this moment to your advantage:

- Leverage Softened Competition – With job growth slowing and rates holding, fewer people are buying. That gives you more negotiating power and more time to find the right property.

- Ask for Seller Concessions – In 2021–2022, sellers wouldn’t budge. In 2025, they’re more willing to offer credits for closing costs, rate buydowns, or repairs.

- Focus on Payment, Not Rate – With creative mortgage tools like 2-1 buydowns or adjustable programs, your first-year payment can look dramatically better than expected.

- Plan to Refinance Later – Mortgage rates are cyclical. If you buy now and refinance when rates drop, you keep the lower purchase price and reduce your future payment.

- Think Long-Term – Despite short-term slowdowns, Las Vegas remains a high-growth metro area. Between population migration, tourism, and tech expansion, long-term appreciation is still in play.

Supporting Data: Employment Growth Snapshot

Source: U.S. Bureau of Labor Statistics (Applied Analysis, Oct 2025)

Nevada’s slower job growth signals moderation — a healthier, more balanced real estate environment.

While national headlines debate a possible slowdown, Las Vegas is quietly moving toward balance — and that’s exactly where smart homeowners win. Steady wages, easing inflation, and builder adjustments are creating rare breathing room for those ready to act.

The Parent Team, we’re helping buyers lock in opportunities while everyone else is waiting. From flexible loan programs to strategic rate buydowns and future refinance plans, our team helps you turn this uncertain market into an advantage.

Because the truth is simple: when rates drop, prices and competition rise. Don’t wait to be ready — be positioned now.

Book your free mortgage strategy call today and find out what your buying power really looks like.

7 Creative Ways to Save for Your Down Payment

Saving for a down payment can feel like one of the biggest obstacles to buying a home. In a city like Las Vegas—where the market is competitive and prices continue to climb—having enough cash on hand matters. The good news? You don’t need to rely only on traditional savings. With a little creativity and discipline, you can reach your goal faster than you think.

Here are seven creative ways to save for your down payment.

1. Automate Your Savings

One of the simplest yet most effective strategies is to set up automatic transfers. Every payday, move a set amount into a separate “down payment” savings account. Because the money is tucked away before you see it, you won’t be tempted to spend it.

2. Cut Out Hidden Subscriptions

Streaming services, unused gym memberships, and auto-renewing apps add up. Review your bank statements and cancel what you don’t use. Even if you save $100 a month, that’s $1,200 a year toward your down payment.

3. Leverage Side Hustles

From rideshare driving to freelance work, side hustles can generate extra income dedicated exclusively to your savings goal. In Las Vegas, opportunities like event staffing or part-time hospitality jobs can be lucrative and flexible.

4. Bank Your Windfalls

Tax refunds, work bonuses, or even casino winnings (if you’re lucky!) should go straight into your down payment fund. These one-time boosts can shave months—or even years—off your timeline.

5. Sell Unused Items

Chances are, you’ve got valuable items collecting dust. Furniture, electronics, or collectibles can all be sold online. Not only does this free up space, but it also moves you closer to your down payment target.

6. Use Employer Programs or Grants

Some employers offer homebuyer assistance programs as part of their benefits package. In Nevada, state and local down payment assistance grants are also available. Working with a local lender like The Derek Parent Team can help you uncover programs you may qualify for.

7. Downsize Temporarily

If possible, consider downsizing your living situation for a short period—whether it’s moving in with family or finding a cheaper rental. The money you save on rent can go directly into your home savings account.

Bonus Tip: Know How Much You Really Need

You might not need as much as you think. Some loan programs require as little as 3% down (conventional), or even 0% down (VA loans for eligible veterans). Understanding your options with a trusted mortgage advisor can give you a clear and realistic target.

Final Thoughts

Saving for a down payment takes discipline, but it doesn’t have to feel impossible. By automating savings, cutting hidden expenses, taking on side hustles, and exploring assistance programs, you can reach your goal sooner than you think.

When you’re ready, the Derek Parent Team can guide you through loan options, down payment assistance, and strategies to make homeownership in Las Vegas a reality.

Why Waiting for Lower Rates Could Cost You More in Las Vegas

Every homebuyer dreams of locking in the perfect rate—but waiting for that “just right” moment can be risky. Across Las Vegas, many would-be buyers are sitting on the sidelines, hoping interest rates will drop before they make a move.

But here’s the truth: waiting for rates to fall could actually cost you more—both in the short term and long term. Let’s break down why.

1. Prices Keep Moving Up

While rates have gone up, Las Vegas home prices haven’t fallen as much as many predicted. Why?

Because the supply of homes remains tight. Many homeowners with low mortgage rates aren’t selling, which means fewer listings and steady demand from buyers relocating from California, Arizona, and other high-cost states.

Even modest appreciation adds up. If home prices rise just 5% next year, that $450,000 house you’re eyeing could cost nearly $475,000—and you’ll still be paying interest, just on a higher price.

2. You Can Always Refinance Later

Mortgage rates move in cycles. Historically, when rates rise quickly, they tend to settle back down over time.

If you buy now, you can refinance later when rates drop—especially if you work with a lender who offers programs like “refi protection” or discounted refinance fees.

The phrase holds true: “Marry the home, date the rate.”

You can’t rewind to buy the same home at today’s price once appreciation kicks in—but you can refinance when the time is right.

3. Waiting Means Missing Out on Equity Growth

Every month you wait to buy, you’re delaying equity growth. Homeownership is one of the most effective long-term wealth builders—especially in a market like Las Vegas, where population and job growth continue to fuel demand.

If a $450,000 home appreciates by 4% annually, that’s $18,000 in potential equity in just one year. Renters don’t get that benefit—every payment goes to someone else’s mortgage.

4. Competition Will Surge When Rates Drop

Here’s the part many buyers overlook: when rates finally fall, everyone else will jump back in.

That means:

- More buyers in the market

- More bidding wars

- Fewer seller concessions

- Faster price increases

In other words, you might get a slightly lower rate—but you’ll likely pay a higher price for the same home.

Buying before that wave hits gives you the advantage of less competition, more negotiating room, and seller incentives that might disappear once demand spikes.

5. You Can Use Today’s Market to Your Advantage

Right now, smart buyers are using this slower market to score deals. Here’s how:

- Ask for seller credits to cover closing costs or buy down your rate.

- Negotiate repairs or upgrades that would’ve been impossible during a bidding war.

- Get creative financing—some programs offer 2-1 buydowns or temporary rate reductions that make early payments more affordable.

Las Vegas sellers are far more flexible today than they were a year ago. Taking advantage of that now could save you thousands.

6. Real Estate Is About Time in the Market, Not Timing the Market

Trying to “time” real estate perfectly is like predicting when to buy the winning lottery ticket. The most successful homeowners don’t wait for perfect conditions—they buy when it makes sense for their budget, lifestyle, and goals.

The longer you own, the more time you give your investment to appreciate and compound. Historically, Las Vegas home values have doubled roughly every 10–12 years—proof that time in the market beats timing the market every single time.

Final Thoughts

Yes, higher mortgage rates can make buying feel intimidating—but waiting for perfect conditions could cost you more in price, equity, and opportunity.

The key is to buy smart, not scared. Lock in your home today, use creative strategies to lower your rate, and refinance when the market shifts.

If you’re ready to run the numbers and see what’s truly possible, connect with The Derek Parent Team. We’ll help you compare scenarios, explore programs that fit your goals, and make an informed decision about when to buy—because the right move is often sooner than you think.